Deep Dive

Tornado Cash Crackdown

After reading/listening to what seems like ~100 takes on the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) sanctions on crypto mixer, Tornado Cash, I thought it would be helpful to run through:

What is Tornado Cash?

What is OFAC?

Why was Tornado Cash sanctioned?

How big of an issue are illicit crypto transactions?

What are the implications?

What is next?

What is Tornado Cash?

Tornado Cash is a cryptocurrency mixer that lets users make transactions privately with zk-SNARK technology. Here’s how it works:

I want to send you ETH privately

I connect my wallet to Tornado Cash, and the platform standardizes all deposit transaction amounts for anonymity (e.g. 1, 10, or 100 ETH)

I decide to deposit 10 ETH which goes into Tornado’s shared pool

Upon deposit, Tornado gives me a key with a secret hash (called a “private note”) for later withdrawal

I send you my private note

You wait a day, then withdraw the 10 ETH with the private note to your wallet address

A “relayer” charges you a small fee to send the 10 ETH to your wallet, then initiates the withdrawal pays the gas fee on your behalf

You receive 10 ETH from me, and there is no on-chain link between both our wallets. Our transaction is completely private.

Tornado Cash is really useful if you value your privacy… or if you’re trying to conduct illegal (but not necessarily immoral) transactions.

For the latter reason, the US Treasury is slapping sanctions on Tornado Cash this week. -Bankless: US Treasury Sanctions Tornado Cash

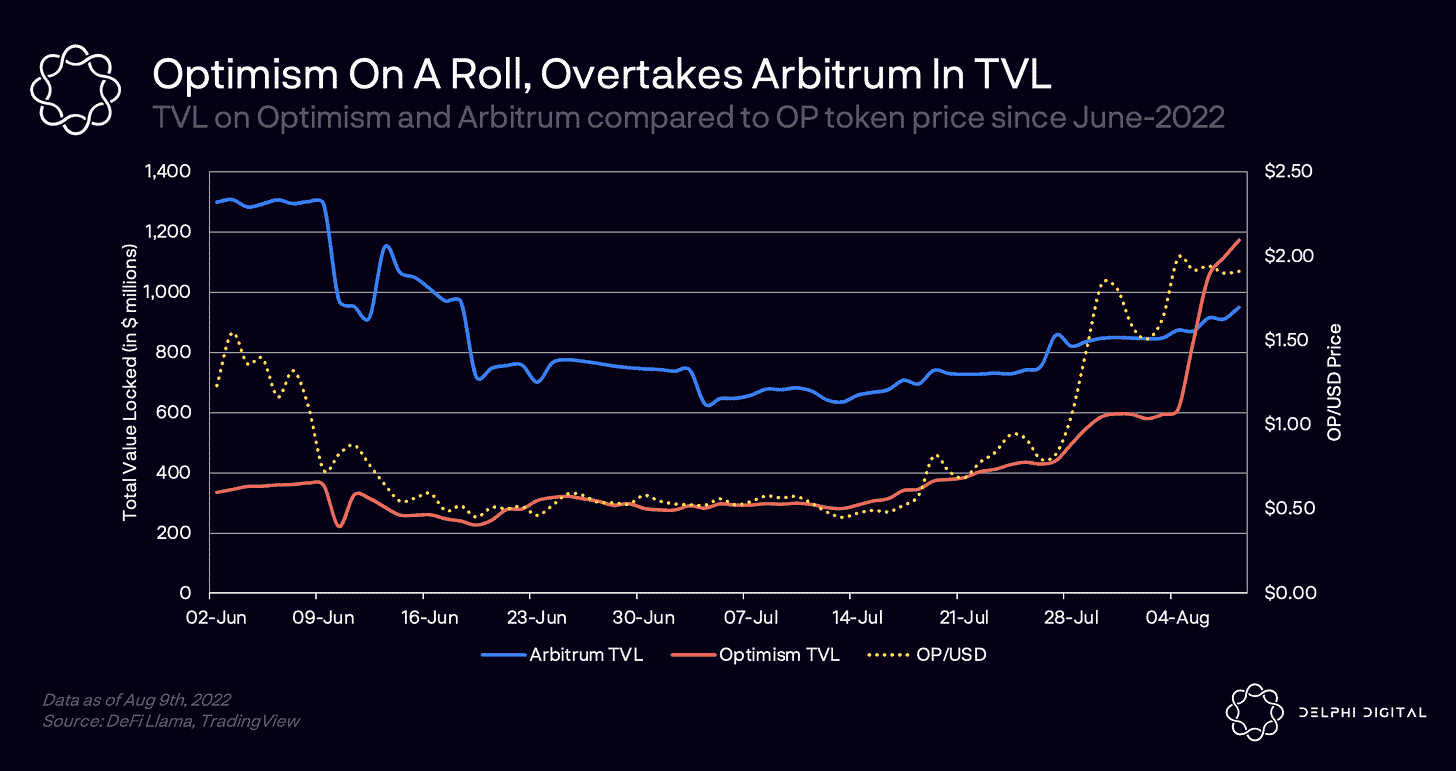

Tornado Cash exists concurrently on Ethereum and 6 other L1 and L2 blockchain platforms: BNB Chain, Arbitrum, Polygon, Avalanche, xDAI, and Optimism. Historically, Tornado Cash has supported $7.6bn in cumulative volume. At the time of sanction by OFAC, Tornado Cash had approximately $450m of total value locked, with 92% of that TVL on Ethereum mainnet. Of Tornado Cash’s total TVL on Monday, 84% was WETH ($375m). -Galaxy Digital: 🌪️ Tornado Cash Sanctioned by OFAC

What is U.S. Treasury Department’s Office of Foreign Assets Control (OFAC)?

OFAC has the power to designate on the Specially Designated Nationals (SDN) list foreign individuals or entities who pose a threat to the national security or foreign policy of the United States, and levy fines or criminal charges on U.S. persons who interact with them following their designation. These are the standards OFAC uses, not enforcement of the Bank Secrecy Act, i.e., KYC/AML (FinCEN), U.S. federal law (DOJ), or securities or commodities regulations (SEC & CFTC). -Galaxy Digital: 🌪️ Tornado Cash Sanctioned by OFAC

Why would OFAC sanction Tornado Cash?

Some people use Tornado to keep their transactions private. But of course, there are bad actors.

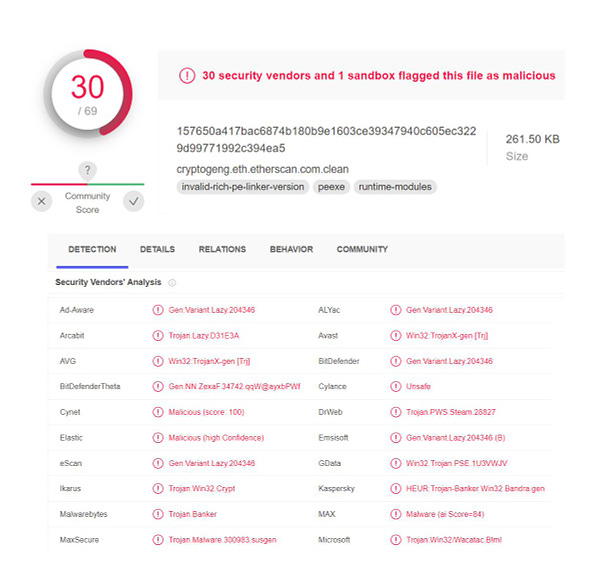

In fact, according to Chainanalysis, every single North Korean-linked hack used Tornado to launder funds. -The Milk Road: TORNADO CASH GETS BANNED IN THE U.S

While OFAC has sanctioned crypto addresses or companies operating in the cryptocurrency ecosystem on at least 13 prior occasions, this was the first time that OFAC sanctioned contracts associated with a decentralized application. Indeed, the SDN entries list no individuals or legal entities. OFAC specifically cited the Lazarus Group, the state-sponsored hacking group affiliated with the Democratic People’s Republic of Korea, which itself was sanctioned in 2019 for a large crypto heist and is believed to be responsible for hacking Axie Infinity’s Ronin Bridge, as having used Tornado Cash for laundering $455m. OFAC also said Tornado Cash was used to launder $96m from the hack of the Harmony Bridge and $7.8m from the hack of the Nomad bridge. -Galaxy Digital: 🌪️ Tornado Cash Sanctioned by OFAC

How big of an issue are illicit transactions in crypto broadly?

Chainalysis research shows that a minuscule 0.15% of total cryptocurrency volumes in the whole of 2021 (a boom market nonetheless) were tagged to “illicit” transactions. That’s how little crypto is used in criminal activity.

And that is a drop in the ocean compared to the amount of fiat that is laundered annually, which according to the UN, ranges between $800B-$2T. -Bankless: US Treasury Sanctions Tornado Cash

What about illicit transactions specific to Tornado Cash?

When we zoom in on Tornado’s activity since its launch in 2019, only a minority 10.5% of all its transactional volumes were tied to stolen funds. -Bankless: US Treasury Sanctions Tornado Cash

Sidenote: Bankless talking their book a bit here. While a minority, 10.5% is still a large amount. So there is a problem here, but is this the best fix?

“Tornado Cash” is merely a bunch of open-source smart contracts running on a public blockchain. So the logic of sanctioning a smart contract is akin to sanctioning, say, a pool of water. -Bankless: US Treasury Sanctions Tornado Cash

In order of importance, how does OFAC enforce sanctions an open-source decentralized application?

Centralized Entities Don’t Want to be Implicated

In response, a swathe of platforms are quickly insulating themselves politically:

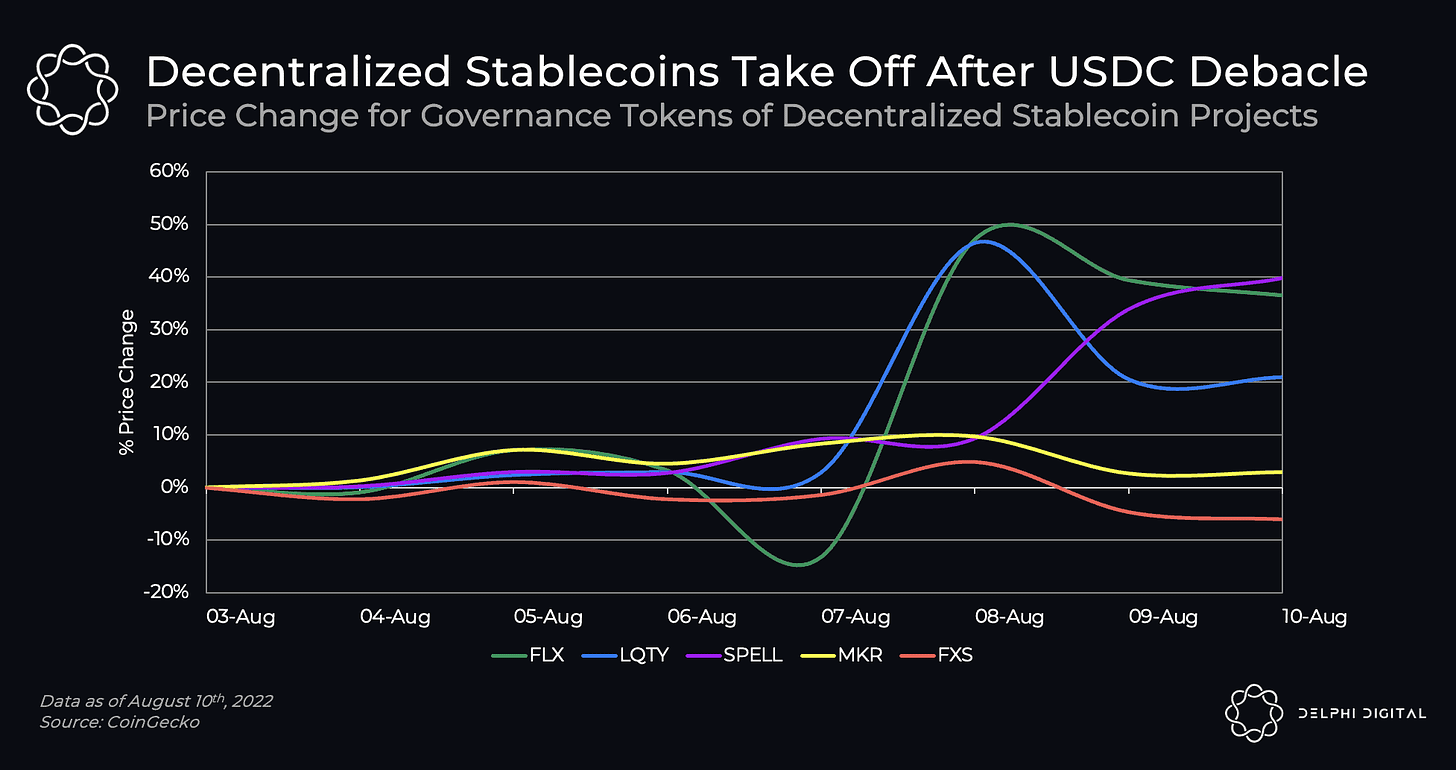

Circle, the issuer of USDC, has moved to blacklist wallet addresses that interacted with the Tornado Cash contract. This is prompting discussions in the Maker community to reduce DAI’s reliance on USDC, and depeg the stablecoin altogether from the dollar.

Github has removed Tornado Cash’s source code and banned source contributors (hence the need for decentralized alternatives like Radicle).

Infura and Alchemy, centralized service providers that provide access to on-chain data, have blocked RPC requests to Tornado’s frontend. Even its decentralized alternative Pocket Network has similarly blocked the sanctioned list of wallet addresses from accessing its frontend Portal.

dYdX are also blocking users whose wallet funds have directly interacted with Tornado. -Bankless: US Treasury Sanctions Tornado Cash

This is why the OFAC list was perhaps the most powerful financial weapon used against Russia after its invasion of Ukraine: Banks over-comply with OFAC rules, so the Treasury did not need a comprehensive list of Russian financial entities to do the job — adding just the most high-profile banks meant that the whole of Russia was immediately barred access to the US financial system.

I suspect crypto exchanges will do the same: There’s a reasonable chance that any address ever connected with Tornado Cash will effectively be blacklisted.

That’s already evident with the actions taken at Circle, which has been dragged into this because they have the ability to immediately block the addresses cited by OFAC.

CEXes have presumably done the same, and it may even be that DEXes will outsource some of their compliance work by auto-blacklisting any address that it sees Circle has blacklisted.

CEXes may also over-comply by blacklisting any address that has interacted with one of those addresses.

That could go on, ad infinitum, which would be bad.

It gets worse, though.

Circle could, in theory, blacklist the smart contract addresses of DeFi primitives such as Curve, Uniswap and AAVE.

That, I think, would more or less be the end of DeFi. Or, at the very least, the end of DeFi as we know it.

That’s an extremely unlikely scenario, but is it an unthinkable one?

If the Treasury Department adds a smart contract address to its OFAC list, it’s not a judgment call for Circle: They can’t stall by filing a lawsuit. They can’t ring the Treasury Secretary and try to talk some sense into him. They just have to comply.

Fortunately, I don’t think the Treasury Department has it in for DeFi.

Unfortunately, this is the department that initially labeled Tornado Cash a “DPRK state-sponsored hacking group” — which suggests to me they are too disinterested in DeFi to bother learning much about it.

Why is that a risk?

It was reported just today that the government of Iran made its “first official import order” using cryptocurrency.

So, what happens if it turns out that Iran is avoiding US sanctions by accepting payment for oil exports in, say, DAI?

Would you be totally shocked if Maker’s smart contract addresses were subsequently added to OFAC?

As said, it’s not likely.

But here’s where the OFAC news should make us rethink some things: DeFi is immutable, but it’s not censorship resistant. -Blockworks’ Byron Gilliam: Oh FACK

User’s Don’t Want to be Implicated

Our language obscures where the prohibitive burden of the sanction is falling on - it is individuals that are being forbidden from interacting with Tornado Cash, namely privacy-seeking Americans. If you mess with that smart contract, if you dip your toes in that water, you violate our political sanctions and go to jail, says the US Treasury. -Bankless: US Treasury Sanctions Tornado Cash

Anon Tornado user: Haha, government, you have no idea where my crypto is from!

Government: OK, fine. We’ll just assume it’s from North Korea then.

This is a problem.

Receiving crypto from an account on the OFAC list can now put you in the same legal jeopardy as if you had sold a vintage Dennis Rodman jersey to Kim Jong Un.

That’s because OFAC is a means to deny access to the US financial system to foreign persons or entities that are otherwise beyond the reach of law enforcement.

They do that by making it illegal for any US person or entity to transact with those slippery foreigners.

Crypto protocols are similarly beyond the reach of US law enforcement: A core tenet of DeFi is that its protocols are self-running software living in a decentralized cloud — Tornado Cash (or Uniswap or AAVE or whatever) will run forever, no matter what anyone does to try to stop it.

Well, this is how the government stops it.

They stop it by imposing legal liability on the user.

Does that mean the FBI will send a swat team to your house if, as crypto Twitter has been speculating, your archenemy maliciously sends you a dusting of ETH from Tornado Cash?

No, it does not.

(Not legal advice, though: The maximum sentence for violating sanctions law is 30 years, so maybe don’t risk it.)

What it does mean is that you could lose real-world access to “your” crypto.

That may occur because the US Treasury doesn’t need to pursue every account that has interacted with Tornado Cash: They leave that to the banking system to police.

No bank is going to mess with any counterparty that might be even related to a person or entity on OFAC: They start with a presumption of guilt, because it’s not worth the hassle or risk to prove a counterparty’s innocence. -Blockworks’ Byron Gilliam: Oh FACK

Dutch Developer Arrested

Things got personal on Wednesday when Dutch authorities arrested a Tornado Cash developer in Amsterdam. The Block’s Yogita Khatri then confirmed the developer’s identity: Alexey Pertsev. After the arrest, Tornado Cash’s Discord server and governance forum went dark. -The Block: Suspected Tornado Cash developer arrested in Amsterdam

Obviously, Tornado Cash’s Website is Shutdown

Some other interest tidbits:

It’s been 24 hours since Tornado Cash was added to the U.S Specially Designated Nationals (SDN) list.

Here are 3 things that have happened since:

Vitalik admitted he’s used Tornado Cash. No, he isn’t laundering money.

He used it to make donations to Ukraine. This protected the recipients from the Russian Government if they tried to track the donations.

Celebrities got sent Tornado’d ETH, which is now illegal. Once the news was announced, someone started using Tornado to send money to people like Shaq, Randi Zuckerburg, Jimmy Fallon, Brian Armstrong, and more.

Why? Someone saw that the government was labeling users of Tornado Cash as “bad guys”, so they started using Tornado to send cash to all kinds of famous people to muddy the waters and make everyone equally guilty.

Tornado Cash hit new yearly highs for usage… after being sanctioned.

What’s the difference between Blender.io’s sanctions in May and Tornado Cash’s recent sanctions? There is a lot to read through, but the TDLR: Blender is an organization made up of person(s), which own the sanctioned BTC addresses and are able to protest these sanctions. The Tornado Cash Application is a piece of software that is unable to protest sanctions, and does not/cannot own the sanctioned ETH addresses.

To understand the legal issues at stake in OFAC’s addition of the Tornado Cash smart contracts to the SDN List, it helps to first understand OFAC’s addition of Blender.io to the same list in May. The press release announcing those sanctions stated:

WASHINGTON – Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned virtual currency mixer Blender.io (Blender), which is used by the Democratic People’s Republic of Korea (DPRK) to support its malicious cyber activities and money-laundering of stolen virtual currency.

This announcement drew no objection from the cryptocurrency community. That’s because it makes sense that OFAC would sanction Blender since it is a company or some like entity. That is, Blender is a person or group of persons (whether legally incorporated or not) that provides Bitcoin mixing services. Executive Order 13694, under whose authority the designation was made, defines “persons” subject to listing as “an individual or entity,” and it defines “entity” as “a partnership, association, trust, joint venture, corporation, group, subgroup, or other organization,” and Blender certainly qualifies. When you send funds to an address provided by Blender, the persons who run Blender take control of those coins. They then mix your coins with those of other customers and send an equivalent amount back to you minus a fee.

What’s important to note here is that this entity is ultimately under the control of natural persons, whether they are identified or not. That is, there are human beings with agency who control what Blender the entity does. They can decide to continue to pursue the business or not, or change how they do business. When they receive coins, they can decide to send back mixed coins or not. They can choose to serve some customers and not others, etc.

This also means that when Blender is added to the SDN list, the individuals who run the mixer—who indeed are the Blender entity—can file a petition for removal from the SDN list. As OFAC notes on its petition web page,

The power and integrity of the Office of Foreign Assets Control (OFAC) sanctions derive not only from its ability to designate and add persons to the Specially Designated Nationals and Blocked Persons List (SDN List), but also from its willingness to remove persons from the SDN List consistent with the law.

Blender, because it is an entity that is ultimately under the control of certain individuals, has the ability to bring to OFAC’s attention any number of facts or arguments that could cause the agency to remove it from the list, such as:

It is actually a U.S. person and therefore not properly the subject of sanctions without due process

It has changed its behavior and no longer engages in the sanctioned activity

The designation was made in error for some reason

The designation exceeds Treasury’s statutory or constitutional authority for some reason

And if OFAC denies or does not respond to the petition, Blender can hire lawyers to represent it and challenge the designation in court. The bottom line is that Blender is a legal person, and these are all things a person can do.

With all that in mind, we can now consider Tornado Cash. The press release announcing its addition to the SDN List uses essentially identical language to that employed for Blender:

WASHINGTON – Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned virtual currency mixer Tornado Cash, which has been used to launder more than $7 billion worth of virtual currency since its creation in 2019.

In this case, however, the statement does not make sense, is unexpected, and the crypto community has been outraged by the designation. The reason is that Tornado Cash is not equivalent to Blender the way the press release implies because, unlike Blender, it can’t be said that Tornado Cash is a person subject to sanctions.

The Tornado Cash designation notice also mirrors the Blender notice, again implying that there’s no difference between the two. It first lists the entity (“TORNADO CASH (a.k.a. TORNADO CASH CLASSIC; a.k.a. TORNADO CASH NOVA)”), second it lists “Website tornado.cash”, and finally it lists several dozen Ethereum addresses.

It may be the case that there is an entity that is a “a partnership, association, trust, joint venture, corporation, group, subgroup, or other organization” called Tornado Cash that is under the control of natural persons and that can properly be the subject of sanctions. It may be the entity that owned and operated the tornado.cash website, and it may be the entity that raised funds for the development of the mixer software. Funds raised via Gitcoin were sent to an Ethereum address under the control of the entity that is among those listed in the designation notice. So there is potentially an entity called Tornado Cash that is controlled by certain individuals, and the web address and some of the Ethereum addresses in the notice can be thought of as either pseudonyms for that entity or, alternatively, as its property. At this point, we’re not offering an opinion on whether it was appropriate to sanction that entity—we do not know all the facts that have led to this action—but we would agree that there may be an entity behind those donation addresses and that said entity may be legally eligible for listing. If those people have done nothing beyond author mixing software now found on the Ethereum blockchain then they may have a strong First Amendment defense; we just don’t know all the facts yet.

That said, there are several Ethereum addresses listed that cannot be said to be either pseudonyms for, or the property of, the Tornado Cash entity. These are Ethereum addresses for the mixer smart contract. They are the addresses at which a user can find the software logic that, given the proper inputs, will execute and mix coins for users. This is the mixer itself, but it is something wholly separate from the entity identified as Tornado Cash, even though the name “Tornado Cash” is also often used to refer to it. For the sake of clarity, we’ll call them the Tornado Cash Entity and the Tornado Cash Application.

This is sometimes difficult for persons unfamiliar with decentralized blockchain technology to understand, but an application (also known as a smart contract) can be installed on the Ethereum network in such a way that, once installed, the person who installed it no longer has any control whatsoever over it. After that point it will automatically execute when called on by any user in the world giving it the appropriate inputs. In the case of the Tornado Cash Application, anyone in the world can send ETH to it directly and it will mix coins according to the instructions of its code. It will continue to operate as long as the Ethereum network continues to operate.

The Tornado Cash Entity, which presumably deployed the Tornado Cash Application, has zero control over the Application today. Unlike Blender, the Tornado Cash Entity can’t choose whether the Tornado Cash Application engages in mixing or not, and it can’t choose which “customers” to take and which to reject. In the case of Blender, the entity and the application are one and the same, but in the case of Tornado Cash they are two completely distinct things. This is the subtle but important difference that OFAC is not recognizing by treating both as one and the same (like in Blender) and adding both to the SDN List as one.

What we are saying here should not be controversial. Indeed, other divisions of the Treasury Department explicitly recognize such a distinction.

In its May 2019 guidance document on virtual currency business models, the Financial Crimes Enforcement Network (FinCEN) draws a distinction between “providers of anonymizing services” (including “mixers”) and “anonymizing software providers”. They make it clear that service providers are subject to Bank Secrecy Act Obligations while software providers are not. Regarding service providers, FinCEN explains:

[A] person (acting by itself, through employees or agents, or by using mechanical or software agencies) who provides anonymizing services by accepting value from a customer and transmitting the same or another type of value to the recipient, in a way designed to mask the identity of the transmittor, is a money transmitter under FinCEN regulations.

The guidance goes on to explain that, in contrast to an anonymizing service provider,

An anonymizing software provider is not a money transmitter. … This is because suppliers of tools (communications, hardware, or software) that may be utilized in money transmission, like anonymizing software, are engaged in trade and not money transmission.

FinCEN also distinguishes between (on the one hand) service providers who employ anonymizing software to serve customers and who are thus subject to BSA obligations, and (on the other hand) individual persons who employ anonymizing software on their own behalf. They call this latter category of persons “users”.

We recognize that OFAC is not bound by FinCEN’s regulations or interpretations. Nevertheless, the fact is that another division of the Treasury Department, and one that is similarly tasked with money laundering and national security concerns, has developed a sensible definition of “mixer” that recognizes that there exists both (1) mixers that are persons and (2) mixers that are not persons but merely software, and further that individual “users” can employ mixer software by themselves and on their own behalf without the participation of any third party. FinCEN’s guidance goes to show that what we are suggesting here is not novel or strange.

With this nuanced distinction between persons and software in mind, the uproar from the cryptocurrency community should now make eminent sense. How can it be proper to add to the sanctions list not a person, or a person’s property, but instead an automated protocol not under anyone’s control? On its petition for removal web page and elsewhere, OFAC states:

The ultimate goal of sanctions is not to punish, but to bring about a positive change in behavior. Each year, OFAC removes hundreds of individuals and entities from the SDN List. Each removal is based on a thorough review by OFAC.

If the purpose of sanctions is not to punish, but to change behavior, then it makes no sense to add to the SDN List an immutable smart contract that cannot change its behavior because it has no agency. It is not a person nor is it under the control of any person. By conflating the Tornado Cash Entity and the Tornado Cash Application and adding both to the SDN List, the government has essentially accomplished a ban on Americans using a particular internet tool without any clear prospect that the restriction will ever be lifted.

The Tornado Cash Entity, because it is a person, can file a petition to be removed from the list, and it can hire lawyers and sue in federal court if it believes its rights have been violated. The Tornado Cash Application cannot because it is not a person. And because the regulations that govern delisting only provide for persons to petition for themselves or their property, third parties cannot petition for it. The fact that OFAC included the Entity and the Application in the same update notice does not change the fact that they are different things.

This distinction between the Tornado Cash Entity, which is a person and can be properly the subject of sanctions, and the Tornado Cash Application, which is neither a person nor the property of a person, is important not just because it shows that what OFAC did in this case is contrary to its own stated goal of bringing about change in behavior, but because it has implications for OFAC’s statutory authority to do what it has done, as well as the Constitutionality of its actions.

The fallout: crypto fights back & legal ramifications

As we suspected, we believe that OFAC has overstepped its legal authority by adding certain Tornado Cash smart contract addresses to the SDN List, that this action potentially violates constitutional rights to due process and free speech, and that OFAC has not adequately acted to mitigate the foreseeable impact its action would have on innocent Americans. We intend to work with other digital rights advocates to pursue administrative relief. We are also now exploring bringing a challenge to this action in court. -CoinCenter: Analysis: What is and what is not a sanctionable entity in the Tornado Cash case

Sidenote: There is a ton more information on CoinCenter’s opinion and potential case on the link provided.

Given all this, what are our next steps?

First, we will seek to engage OFAC, share our views, and hopefully hear theirs. We have also had inquiries from members of Congress about the situation and we will continue to brief interested parties there.

Second, there are innocent Americans who have funds trapped at listed Tornado Cash addresses. We will do our best to help them apply for a license to withdraw those funds. In addition, the DeFi Education Fund has announced that it will be petitioning OFAC to issue a “general license” that would cover all affected persons without each having to file individually and we will support that effort.

Finally, we will begin exploring with counsel a court challenge to this action. Stay tuned. -CoinCenter: Analysis: What is and what is not a sanctionable entity in the Tornado Cash case

Cinneamhain Ventures Partner: Adam Cochran

Coinbase CEO: Brian Armstrong

Circle CEO: Jeremy Allaire

Ledger Head of Policy: Seth Hertlein

CoinCenter Director of Research: Peter Van Valkenburgh

Concluding thoughts

This is an example of ready, shoot, aim regulation… not well thought-out. There will be immense privacy pushback, and lawsuits questioning the constitutionality of these sanctions as they pertain to the first amendment. Additionally, Tornado Cash is open-source, meaning anyone can recreate Tornado Cash under a different name. The question is: after the arrest of Tornado Cash Developer, Alexey Pertsev, who is going risk it?

Beyond Tornado Cash and crypto mixers, sanctioning software, and by extension it’s users, and centralized entities (stablecoins, infrastructure, etc) creates enormous problems for DeFi and the crypto industry as a whole. It will certainly light a fire under the centralized vs decentralized anything/everything debate in crypto. This particularly case is, likely, going to be a long and intense legal battle that will either enforce the previous precedents, or create new ones that have massive ramifications for the future of the crypto industry.

Blockchain, Cryptocurrencies & Digital Assets

30,000 Feet: Issue #75: Hey...Do You Know Who I Am!?

**Beginner**

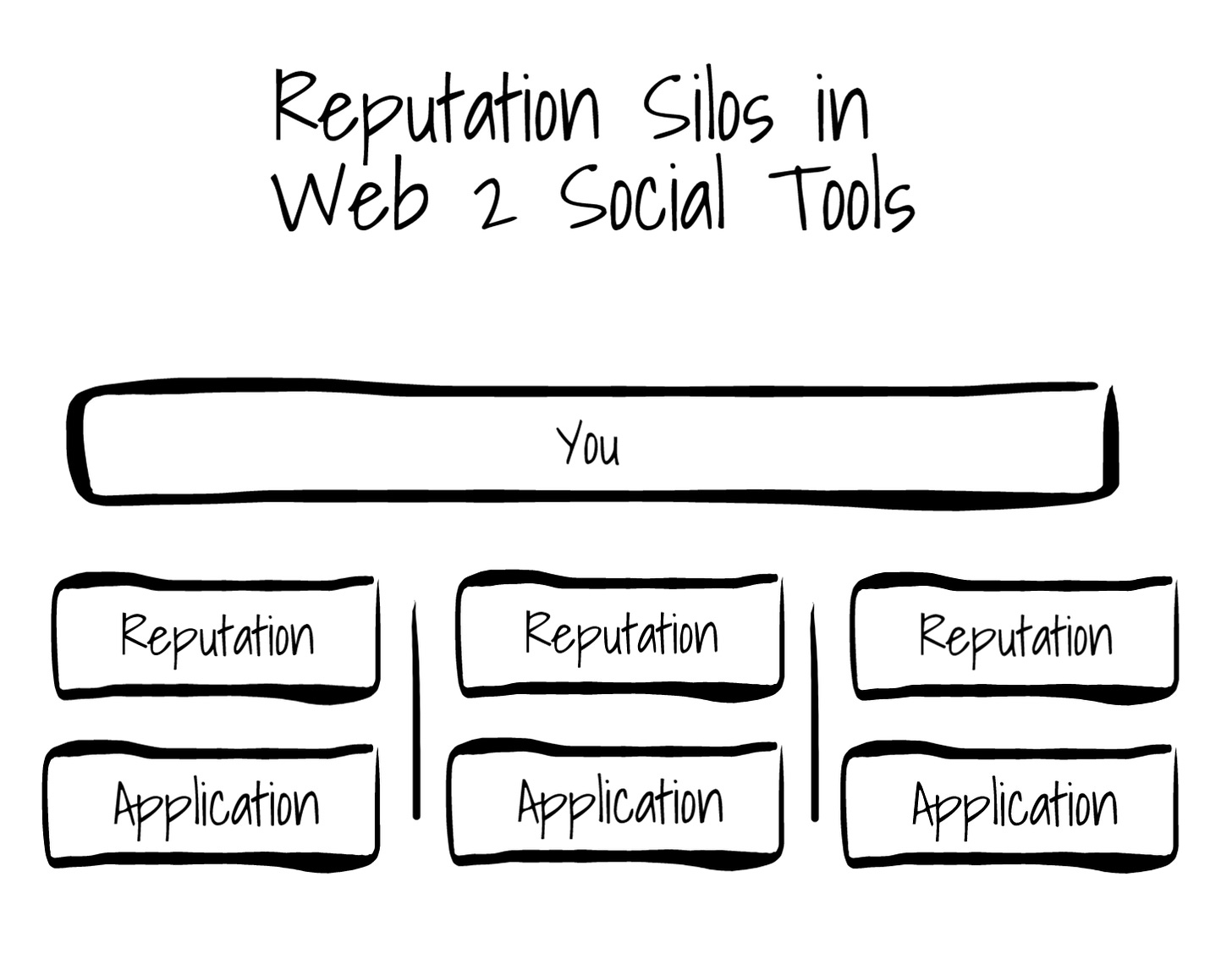

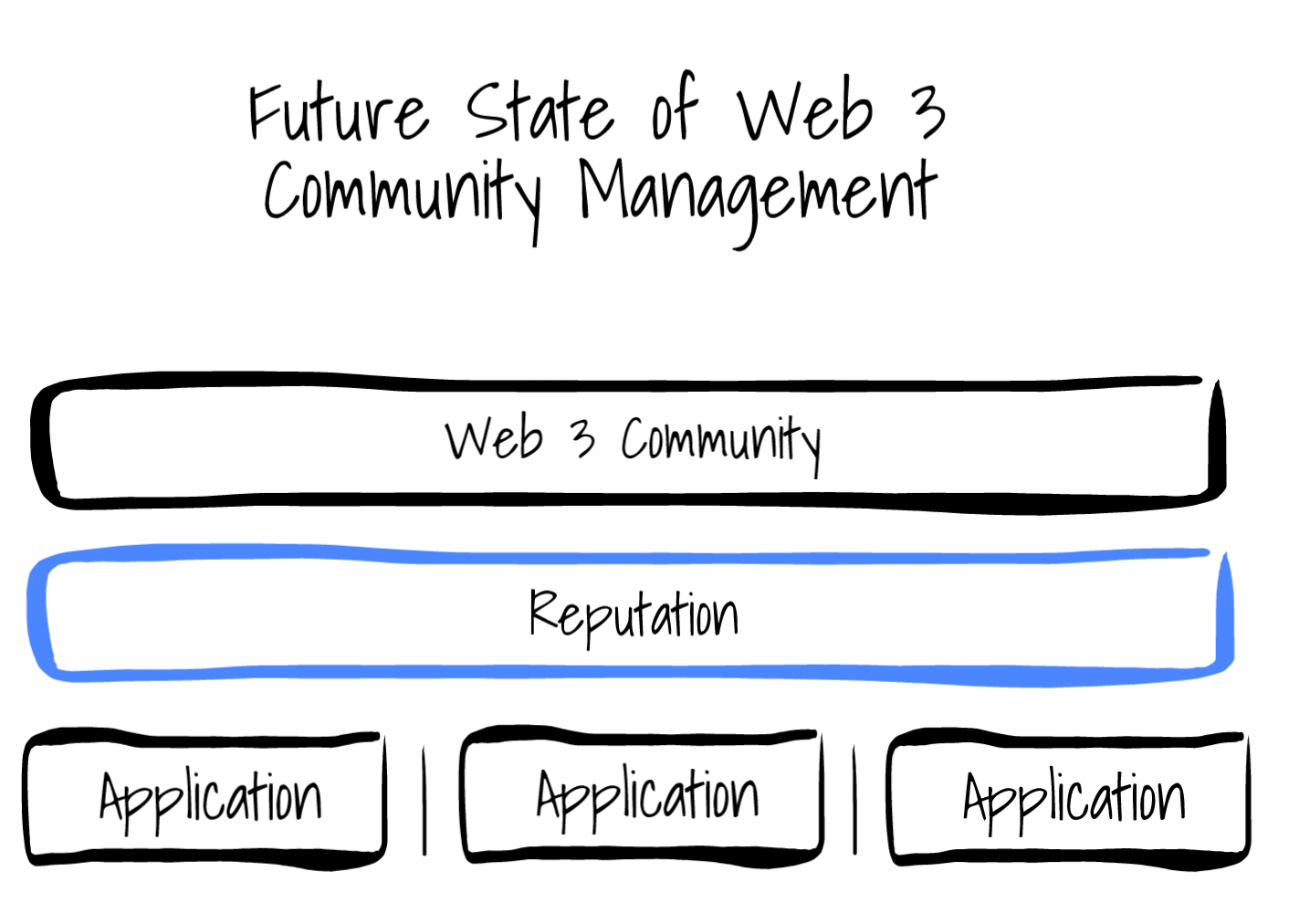

Quick and thoughtful read on why Web2 social is backward in siloing users’ reputation across applications. One of the big pushes in Web3 is to have user reputation as a base layer that can be plugged into different applications/protocols, so users and their reputations are recognized across platforms.

As Andrew notes:

One of the biggest shifts in Web 3 is the extraction of your identity/reputation out of the application layer into the user layer.

I re-read the last sentence and it struck me just how backwards social reputation is online today. Of course our online reputations should live at the user layer! That’s how it is in real life.

The Future is Token Gated

A by-product of this shift is the Internet becomes increasingly token-gated, and we’re seeing this play out in every corner of Web 3.

To mint an NFT, you need a ticket

To gain early access to Gallery.so, you needed an NFT pass

To access the Nouns discord channel, you need to hold a Noun

You need to hold a minimum number of tokens before you can submit a governance proposal

To access your newsletter, I need at least 500 tokens

To comment on this thread, I need to have a certain status in the community

From a pure community management and governance standpoint, I’m a fan. Token-gating, if elegantly implemented, can minimize noise, elevate the conversation and dramatically improve efficiency.

Sorry, but not all voices have equal weight.

Now, in a hyper-financialized Internet where every NFT has a market price, one unintended side effect of pervasive token-gating is it disproportionately rewards those with more capital. The more capital you have, the more reputation you can acquire. Put this trend on a long enough timeline and you have just recreated the online equivalence of the class systems and wealth gap that plague our real-world societies.

This is why it’s so important to scale the earned reputation component of your communities. If merit replaces capital as the gating item to reputation, Web 3 communities will thrive.

Arthur Hayes: Max Bidding

**Intermediate**

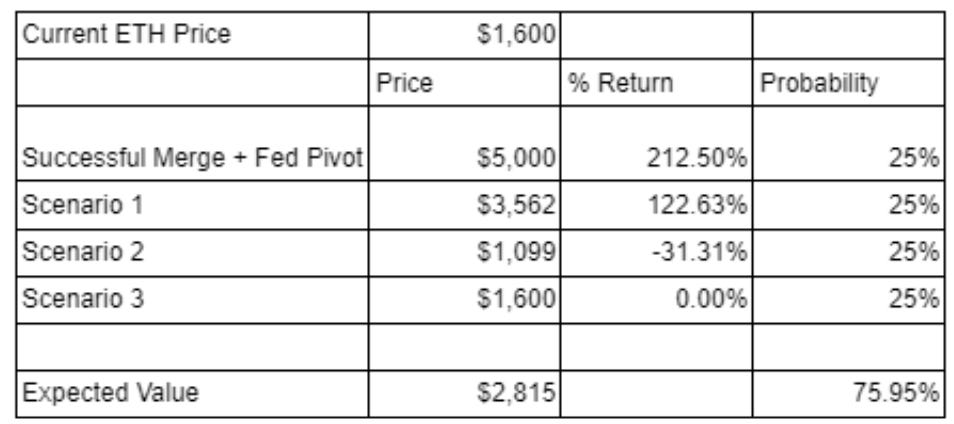

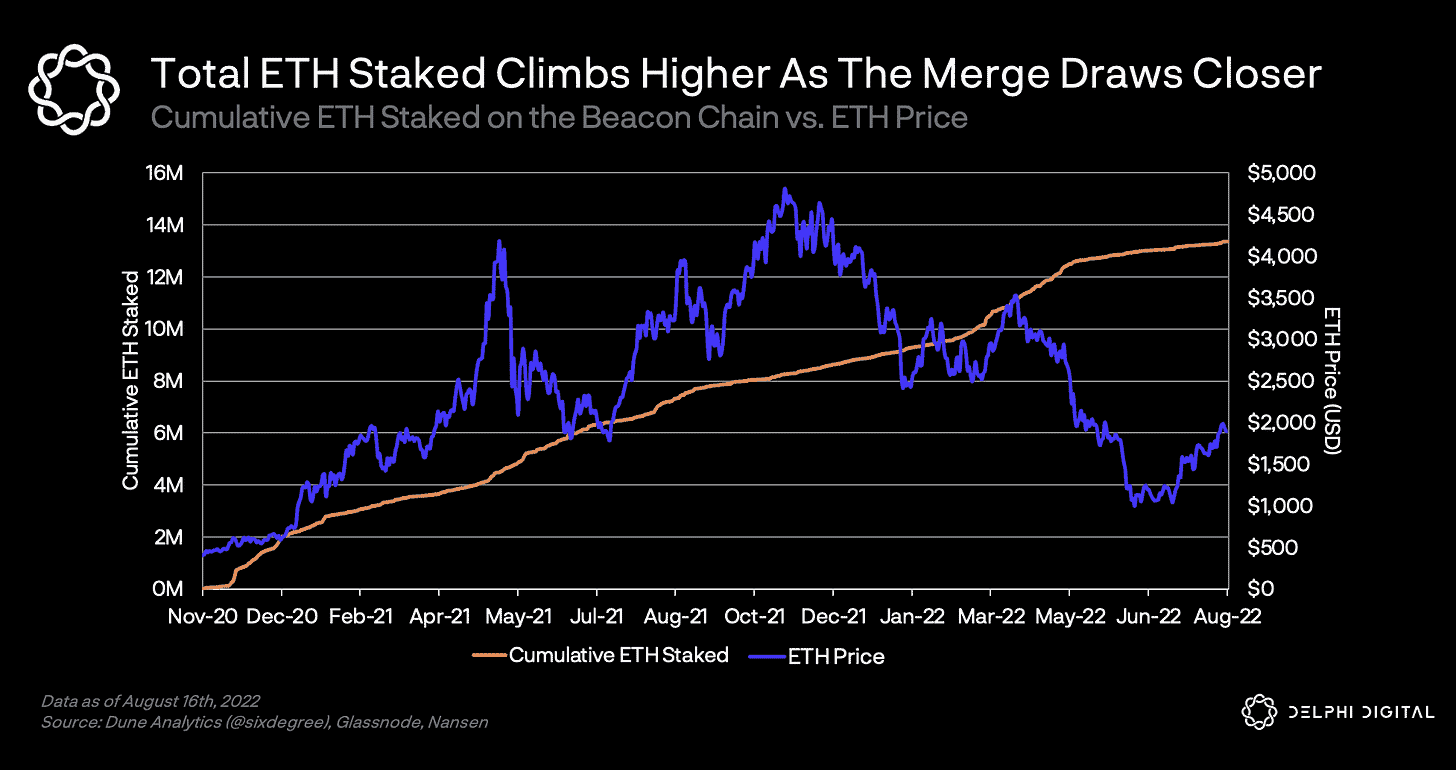

Expecting a successful ETH merge and Fed Pivot, Arthur Hayes is betting big on ETH over the next ~6 months. He layes out an expected value matrix for his four scenarios and why he thinks ETH is the best bet. Here are a few important segments, but my highlighted PDF is below.

Let’s run through my hypothesis once more before we move on.

I am confident the merge will happen by the end of the year due to the increased noise made by Ethereum miners, who will likely lose a significant chunk — if not all — of their income in a PoS world.

The recent market rout broke the souls of the “Zhu-percycle” bulls who were big on Ethereum and DeFi this cycle, turning them into a horde of indiscriminate sellers.

The “buy the rumour, sell the news” phenomenon post-merge will not occur. Anyone who might sell has likely already sold due to the intense downward price movement over the past month.

The merge means that Ether becomes a deflationary currency, and usage is forecasted to continue growing as DeFi gains popularity– increasing the rate of deflation.

Although there are other Layer-1 smart contract network competitors, many of them already feature some version of a PoS consensus algorithm. Ether is the only major cryptocurrency currently transitioning from PoW to a PoS.

The last point is extremely important. This change is a one-time event. There will never be another investing setup like what we’re seeing today. That is why my shot shall ring true, powered by Ether.

The market’s expectations of the policy rate change at the September meeting is baked in. However, between now and then, the Fed will have two additional CPI data points (July CPI, released August 10th, and August CPI, released September 13th). I’m no data sleuth, but it is entirely likely that the rate of price rises slows by the second reading. That would give Powell the justification he needs to backslide into easing monetary conditions.

Given that the November meeting is mere days away from an election, it would be quite bad form for the Fed to dramatically alter its policy stance. Instead, the Fed will likely attempt to be as bland as possible so as not to distract from the ongoing poli-tainment.

Given the data, we are almost assured a 0.5% to 0.75% rate hike at the September meeting. Of course, the economic data could disappoint so badly that the Fed pauses in September, but I’m not of that view. This leaves the December meeting as THE defining meeting for the remainder of 2022. We are trading that meeting. I fully expect the steadily climbing fed funds rate to wreak absolute carnage upon the average American from now until the December meeting. The economic trainwreck will be so obvious that even the spin doctors employed by the ruling party will have to admit the damage is real.

With the election concluded, the Fed will have a free political hand to get back to business — the business of reducing Americans’ monthly payments by loosening monetary policy. While the top 10% disproportionately benefit from a rise in financial asset prices, given that every facet of American life is financed, the plebes also need cheap rates to afford their lifestyles. Everyone is hooked on cheap money provided by the Federal Reserve.

Scenario 1: Fed Pivot + Successful Ethereum Merge (i.e., what I am speculating will happen, and the best case scenario for ETH)

In November 2021, the Fed was printing money, shitcoins were surging, and attention started shifting to the bullish narrative surrounding an upcoming 2022 Ethereum merge. Therefore, I will use $5,000, the psychological barrier Ether fell just short of at that time, as my price target for this scenario. I believe this is a conservative estimate, because the structural changes to the demand/supply dynamic will never be fully priced in a priori– just like how the Bitcoin halvings continuously produce positive returns, even though we know well in advance when they will occur.

Scenario 2: No Fed Pivot + Successful Ethereum Merge

From the deepest, darkest depths of the Three Arrows-initiated forced liquidation of many of the preeminent crypto lending institutions and hedge funds, Ether has rallied from a low of around $1,081 to $1,380 — a close to 30% return in a matter of weeks. From the July 27 Fed meeting to the July 29 Friday close, Ether was +25% in absolute terms, and +9% vs. Bitcoin…

ETH’s value increased increased 25.46% vs. BTC from June 17 to July 26 — so if the Fed pivot gets taken off the table, we can assume that the price would drop to $1,081 (the June 17 low) * 1.2546, which comes out to $1,356.

Now, we need to add on the expected price impact of a successful merge. As I mentioned earlier, the merge is expected to drive a “triple-halving” event due to the structural impact it will have on the Ethereum network. To predict how this might affect Ether’s price, we can look at how Bitcoin has performed between its halving dates. The below table shows the price appreciation that has occurred between each Bitcoin halving date.

Bitcoin is decentralised money. Ethereum is decentralised computing power. If Bitcoin has always gone up post-halving, it is reasonable to assume Ether will as well. Therefore, if we take the least significant post-halving price rise of 163%, and apply that to $1,356, then we arrive at an expected value of $3,562…

Scenario 3: No Fed Pivot + Unsuccessful Ethereum Merge

No free money and no assistance from Archangel Vitalik takes us back to the dark ages. That would be the recent low of $1,081 — which is my price prediction for this scenario.

Scenario 4: Fed Pivot + Unsuccessful Ethereum Merge

If the merge fails or is postponed, the Ethereum network will still work just as it does today. Many might be severely disappointed, but the value of Ether won’t drop to zero. Solana, the 9th largest shitcoin — with a market cap of $13.5 billion — has ceased working for many hours multiple times over the past 12 months, and it is still worth a lot more than zero. Ethereum will be just fine if the merge doesn’t happen on schedule…

From June 17 to July 26, BTC increased 1.72% against USD. So, we can estimate that the price of ETH would have also increased by 1.72% over that time frame in the absence of merge-related excitement — because again, we’re assuming the merge is the only factor driving ETH’s outperformance vs. BTC. A failed or postponed merge would thus take us back to $1,081 (the July 17 ETH low) * Liquidity Beta (1.0172), or $1,099. But in this scenario, we also get to experience the euphoria of more printed money. DeFi will continue to gain ground on TradFi. And if the past is any indicator, Ether will suck filthy fiat into its orbit as the Fed expands the money supply once more. Ethereum rose almost 10x from the March 2020 lows when the Fed expanded USD global liquidity by 25% in the span of one year. To be conservative, I’ll predict that Ether only rallies back to the current levels of $1,600.

The Expected Value Matrix

With an expected future value that is 76% higher than today, our March 31 ETH/USD forward price is $1,600 (current spot price) * 1.7595, or $2,815.

I believe I’m being extremely cautious with the outcome of Scenario 3, so this is a highly conservative estimate. And given the expected return is significantly above 0%, I can confidently deploy fiat into Ether.

Blockworks’ Byron Gilliam: Escape Pod

**Intermediate**

As we near the ETH merge, Gilliam examines the what, why, and how of Ethereum proof-of-work. I’ll look into this more as we approach the mid-September merge.

Q: What’s an Ethereum proof-of-work?It’s just what the existing Ethereum blockchain will be called after the Merge, currently scheduled for September 15/16.

After that, “Ethereum” will refer to the proof-of-stake version of the blockchain, so the proof-of-work one will need a new name.

Some will probably insist on calling them ETH1 and ETH2 — like Thing 1 and Thing 2 in Dr. Suess, except they won’t get along: The first argument will be, which is 1 and which is 2?

Q: Which chain will my Bored Ape be on?

Both, I guess?

Your 1-of-1 Bored Ape will become a 2-of-2 Bored Ape. But they’ll both be yours.

Q: I only care about the original. Which one is that?

I’d say the one on ETH PoW will be the original.

But, if, like me, you mostly care about money, that’s not the one you’ll want: Social consensus will make the one on ETH PoS more valuable. (Because what is crypto but social consensus?)

Which is kind of weird because art NFTs are pretty much just a proof-of-purchase for the original version of a digital artwork — but it’s the non-original version that will retain its value.

I’d bet, though, that the NFT that lives on ETH1 (proof-of-work) will have some value, too.

There has to at least be some bragging rights to owning an original Bored Ape on the original Ethereum chain.

Stolen art is said to be worth something like 5% or 10% of its non-stolen market value.

So that’s my highly scientific prediction for NFT prices on ETH PoW: 5%-10% of what it’s worth on ETH PoS.

Whatever the price, I’d recommend keeping them both: You don’t really want to get in an argument about which is the real NFT.

If you’re arguing, you're losing.

Q: Will the ETH PoW token have any value?

If enough “state” retains value, then the underlying chain should have value, too.

(“State” refers to the entire history of a blockchain — or the things that live on a blockchain, such as NFTs and dapps.)

People appear to think that will be the case: The ETH PoW token is already trading at $80 on Poloniex.

And ETH Classic, which has no state (because NFTs and dapps weren’t a thing yet in 2016), is valued by the market at $6 billion.

$6 billion!

There’s nothing happening on ETH Classic, so I’d ascribe that rich valuation to “meme value.”

ETH PoW should have the same meme value as ETH Classic, plus some upside for potential utility from all of the NFTs and dapps that will still be on there.

Q: Is this just a scam for miners to eke out a last little bit of profit from their ASICs?

That could be, in which case, it won’t be particularly interesting.

Stablecoins like USDC should immediately go to zero.

But all of the smart contracts currently on Ethereum will still work on ETH PoW, so it may be that the tokens are worth something.

They presumably won’t be worth much, but if they retain even a few percent of their value, people will want to trade them.

And if people trade them, the ETH PoW versions of things such as Uniswap and Curve will have value.

The logic is a bit circular — tokens will have value because people want to trade tokens — but that’s pretty much all DeFi is at this early point in its development.

If the circular logic gets some early momentum, an alternative, slightly bizarro version of DeFi could develop.

Q: What do we want with a bizarro version of DeFi?

It’s not really wanting or not wanting. If miners think it can be profitable, they will mine the blocks to keep ETH PoW alive.

And why wouldn’t they? They’ve got nothing else to do with all the mining equipment that will otherwise be idle after the Merge.

And if it’s not profitable to mine ETH PoW, they can just change the rules: Cancel the difficulty bomb. Or double the miner rewards. Or triple the miner rewards.

Or all of the above — in which case we’d have ETH3, ETH4, ETH5, etc. A regular multiverse of Ethereum chains to choose from.

More Insights:

VeradiVerdict - Issue #209: Margin

**Intermediate**

Pantera Capital Partner, Paul Veradittakit, explores the capital inefficiency of margin trading across multiple different protocols and how margin unifying interface, marginfi, is changing that by developing a platform that supports margin trading across multiple protocols, moves capital to the protocol where it is needed, and allows margin lending/borrowing to increase capital efficiency.

How does marginfi work?

marginfi itself is a DeFi-native global clearing house protocol. From the user’s perspective, marginfi is simply a holistic trading platform: USDC is deposited into their margin account and users can start trading from that account with different DeFi protocols within the Solana ecosystem. They also need to maintain sufficient margin depending on their open positions.

However, under the hood, users’ margins are in fact not isolated. They are pooled together such that deposits into accounts with currently positive net balances can be used to offset margin loans to other accounts. The mechanism used to shift balances to and from different accounts within marginfi is, in fact, a lending pool. Users with excess margin can lend their margin to others for an interest, leaving no margin unused. Those who borrow to take leverage collateralize their positions with their own pool of assets purchased on margin and any excess capital held in their global margin account. Importantly, the lending does not happen directly, but rather through the pool itself as in other DeFi lending protocols, which leads to a seamless user experience.

In general, marginfi’s mechanism allows users to trade more safely with higher leverage. marginfi’s platform can also be used to more effectively hedge user’s positions in various derivatives protocols that marginfi supports to produce more customized risk-return profiles.

Actions:

Airdrops

Buying Liquidations

Liquity (Disclaimer: I lend & stake on Liquity)

TLDR

Borrowing: Borrow against ETH to get Liquity’s stablecoin (LUSD), which you can swap to USDC and convert USD. The collateralization ratio minimum is 110%, meaning if you borrow against $11k worth of ETH, you can receive up to 10k worth of LUSD. If ETH’s price increases, your collateralization ratio increases (good). If ETH’s price decreases and your collateralization ratio drops below 110% (bad), your ETH will be liquidated and bought by stability pool lenders, but you keep your LUSD.

Lending: Lend Liquity’s stablecoin (LUSD) to the stability pool to earn an APY in Liquity’s native token (LQTY). Lending to the stability pool requires lenders to absorb and cancel debts that drop below 110% collateralization (ETH). This means your LUSD loan, will be converted into ETH on a pro rata basis.

DeFi

Governance

Resources

Security

Staking

Acala (ACA) Staking, if you participated in the Polkadot (DOT) crowdloan

Moonbeam (GLMR) Staking, if you participated in the Polkadot (DOT) crowdloan

Adoption (or Not):

The Milk Road: BLACKROCK LAUNCHES A BITCOIN TRUST

This week they launched a new Bitcoin trust. Institutional clients will now have direct exposure to Bitcoin for the first time ever.

BlackRock is the largest asset manager in the world. They have some of the biggest institutional clients in the world and ~$10b in AUM. Including a handful of central banks that can now get involved with Bitcoin directly. Gamechanger.

The clients have been asking for it, so BlackRock is delivering:

“Despite the steep downturn in the digital asset market, we are still seeing substantial interest from some institutional clients in how to efficiently and cost-effectively access these assets using our technology and product capabilities”

The Milk Road: MERCADO LIBRE IS EXPANDING CRYPTO FEATURES ACROSS LATIN AMERICA

Mercado Libre is one of the largest e-commerce businesses in Latin America. They have over 38m users and processed over $30b in transactions in Q2.

Now they’re expanding their crypto features across Latin America. Here’s the TLDR:

Mercado Libre launched a crypto wallet earlier this year in Brazil. They offered trading for BTC, ETH, and USDP (a stablecoin)

Within 2 months, they reached over 1m users

Now they want to expand to Argentina, Chile, Colombia, Peru, and more.

Mercado Libre sees two trends that are getting people in Latin America to use stablecoins:

About half the population is unbanked and uses cash for retail transactions

Inflation and interest rates are at all-time highs. If you think stuff is bad in the U.S, think again. Argentina’s inflation rate was 64% for June (9.1% in the US).

Mercado Libre (Milk Road Translate to English: free market) is manifesting its name. This move could be big for the next million users to get onboarded into crypto.

Steve Cohen, the Billionaire behind Point72, is Quietly Setting up Crypto-only Asset Manager

The move to create a separate entity reflects Cohen’s increasing bullishness on digital assets. Reportedly, the new entity plans to trade spot cryptocurrencies and digital asset derivatives, as well as look to write checks to outside digital asset-focused hedge fund managers, including possible seed deals. -The Scenius Sync

Buenos Aires plans to deploy Ethereum validation nodes in 2023.

TAKEAWAY: Diego Fernández, the city’s secretary of innovation and digital transformation, said the effort “has exploratory and regulatory purposes” and will help the capital of Argentina, which has 3 million residents, “develop adaptable regulation” for crypto. Buenos Aires would be one of the first cities in the world where a government deploys Ethereum nodes. -CoinDesk

CLOSE, CANCEL & HALT: Chinese tech giant Tencent will stop releasing digital collectibles on its non-fungible token (NFT) platform in light of scrutiny from regulators. The company's Huanhe NFT platform, which started up last August, will no longer sell NFTs starting on Tuesday.

Meanwhile, blockchain services firm Eqonex will close its crypto exchange, citing volatility and dwindling volume.

Also, cryptocurrency exchange Huobi Global will stop offering derivatives trading services to users in New Zealand starting next week, just a couple of months after expanding operations to the country. -CoinDesk

Centralized Entities:

The S&P Global said that the outlook for Coinbase is “negative.”

TAKEAWAY: S&P Global dropped Coinbase’s long-term issuer credit rating and senior unsecured debt ratings to BB from BB+. “Competitive risk has intensified in the crypto exchange sector, with the company’s market share decreasing this year,” S&P Global wrote. “We believe that as a result of market share erosion and a higher risk of margin compression, cyclical variations (peak-to-trough changes in revenue, EBITDA, and EBITDA margin) for Coinbase have exceeded our previous expectations, leading us to revise our assessment of financial risk.” -CoinDesk

BIGGEST DEAL? Leon Li, founder of crypto empire Huobi Global, is reportedly in talks with Justin Sun and FTX to sell a majority stake in the company. This transaction would value Huobi at upward of $3 billion and could be completed this month.

Different reactions: FTX has made a slew of offers to acquire crypto companies during the recent market downturn, including Japanese exchange Liquid, Canadian trading platform Bitvo and lending platform BlockFi. For his part, Sun has denied any involvement in the deal, on Twitter.

Zooming out: Seychelles-based Huobi is one of the world's largest crypto exchanges, with a daily trading volume of over $1 billion. The deal would be one of the biggest ever in the crypto industry. -CoinDesk

Celsius has $2.8 billion hole to plug by the end of October

Celsius, the CeFi lender that had to halt its network to get liquidated by its customer, has a little less than three months to plug a massive hole in its balance sheet. According to the information from its law firm, the company owes $2.8 billion more than it owns. Its balance sheet will turn negative by the end of October. This far exceeds previous expectations and is mostly due to bigger-than-expected crypto liabilities in BTC and ETH. -CoinMarketCap

CoinMarketCap Dips into Social: How to Use CMC-Community

It looks like a Twitter-esque model focused on digital assets

Crypto Markets:

Research firm FSInsight says ETH might eclipse BTC’s market capitalization in the next year.

WHY IT MATTERS: Ether (ETH) has a good chance of surpassing bitcoin (BTC) in market cap over the next 12 months because the Ethereum blockchain’s switch to proof-of-stake (PoS) mechanism will reduce both the production of the tokens and selling pressure from miners, research firm FSInsight said. Bitcoin has a market cap of about $461 billion, CoinDesk data shows, compared with Ethereum’s $226 billion -CoinDesk

Deals/Raises:

The Milk Road: FTX AND REDDIT TEAM UP

1 Big crypto exchange ($30b+ valuation) + 1 Big social media platform ($10b+ valuation)

Why’d they team up? Reddit has been playing with a new feature called Community Points. Basically, tokens you earn inside a subreddit.

More points = more street cred in your subreddit.

In theory, users can use these Community Points to vote on key decisions in their community (like an HOA gone wild). But just like anything on the blockchain, there are fees.

That's where FTX Pay comes in...it lets users pay Ethereum gas fees using fiat currency. Right now, Community Points are only live in 2 subreddits r/cryptocurrency and r/fortnite. But more are coming soon.

One cool thing is now developers can create their own dApps that use Reddits' Community Points - i.e someone can launch a new game and make it the in-game currency.

This week we saw ~$250M get invested into crypto companies. Here’s who got the money:

CreatorDAO got $20M to invest in content creators in exchange for future cuts of their revenue. A chance to invest in the next Mr. Beast.

Piñata got $18M as a Web3 media management company for creators & devs.

Merkle Science got $19M to build a predictive crypto risk & intelligence platform.

Gunzilla Games got $46M to build blockchain-based games.

Vespene Energy got $4.3M to use landfill methane to fuel Bitcoin mining. Renewable energy FTW!

If you wanna check out the full database of companies that have raised money in 2022, we got 'em for you right here.

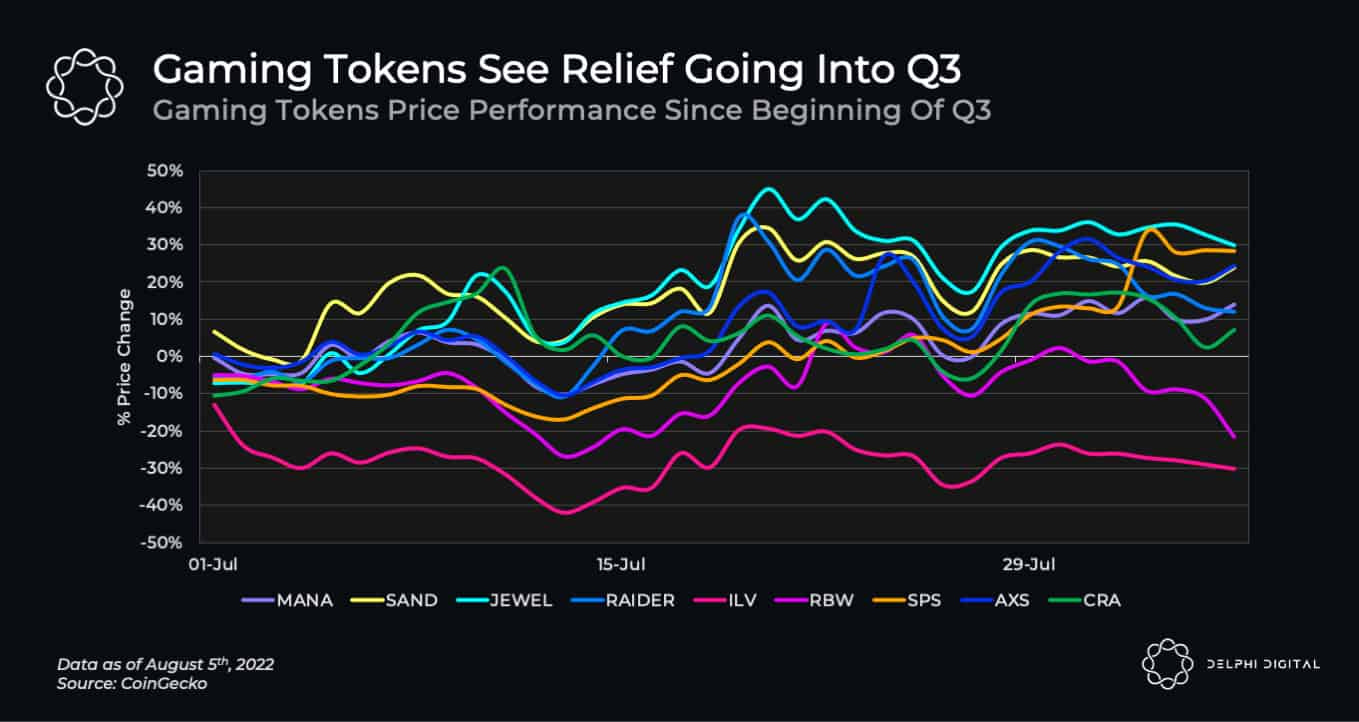

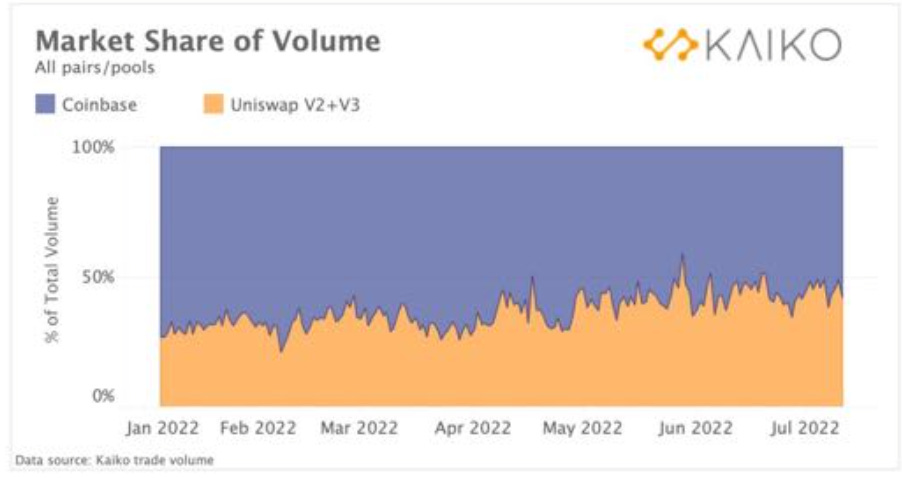

DeFi:

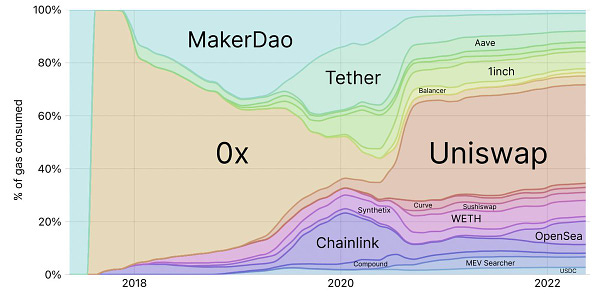

Coinbase (Centralized) v. Uniswap (Decentralized): Market Share Now “Neck and Neck”

~$2B

MakerDAO Co-founder Rune Christensen proposed a plan to trade a significant portion of the $2.26 billion USDC collateral for DAI into ETH.The effort would further decentralize DAI and de-risk it from centralized backing. It could also de-peg the asset, potentially even upward. -The Block

Hacks/Exploits:

Layer 0s:

Layer 1s:

MERGE SET: Ethereum developers said the long-awaited Merge will take place either September 15, 16 or 20th, assuming nothing goes wrong. The planned upgrade, the most significant in crypto history, will move Ethereum to the more efficient proof-of-stake consensus algorithm from the current energy-intensive proof-of-work.

It will be preceded by the so-called Bellatrix upgrade, slated for Sept. 6, 2022, which will kick off the process. There will be a 14-day period between the Bellatrix upgrade and the mainnet Merge.

Vitalik optimism: Vitalik Buterin, the co-founder of Ethereum, expressed his optimism about the move, although he noted it’s just the first in a series of developments to improve network scalability. -CoinDesk

REVAMPING CHAINS: Jump Crypto is trying to revamp a core part of Solana’s infrastructure, seeking to boost the throughput and reliability of a network that’s been plagued by frequent outages and slowdowns.

The current price of the ether derivative token stETH implies a close to 94% chance of the Merge succeeding without major hiccups or delays.

Surpass bitcoin? Ether (ETH) has a good chance of exceeding bitcoin (BTC) in market cap over the next 12 months because its transition to a proof-of-stake consensus mechanism will reduce both the production of the tokens and selling pressure from miners. -CoinDesk

Monero successfully completed a hard fork upgrade.

WHY IT MATTERS: The change to Monero’s privacy-focused protocol was implemented Saturday at block 2,688,888. The upgrade brings about new privacy-preserving features including fee changes that will minimize fee volatility, improvements to multisignature functionality and a better Bulletproofs algorithm that increases transaction speed. Overall performance is expected to improve by 5%-7%. -CoinDesk

ETH Governance Process: How Ethereum Improvement Proposals (EIP) Work

I wanted to highlight how the EIP flow chart works and that it is “off-chain” governance to prevent major holders from controlling the most power.

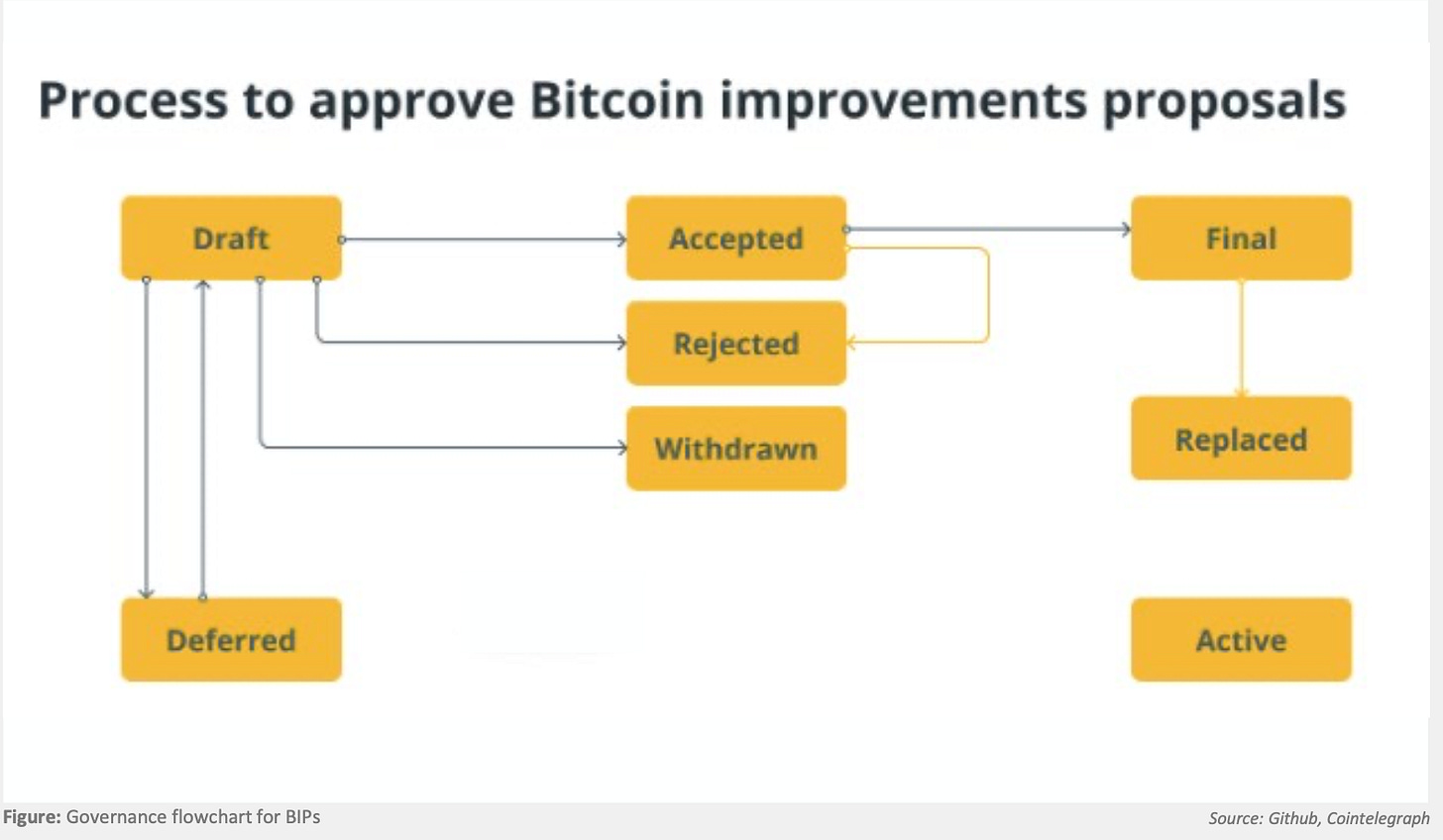

BTC Governance Process: How Bitcoin Improvement Proposals (BIP) Work

Very similar to EIPs (above)

Visualization of the ETH Merge

Layer 2s:

Polkadot has a decentralized version of “wrapped” bitcoin.

TAKEAWAY: Interlay, a decentralized stablecoin network, launched InterBTC (iBTC), a wrapped bitcoin token, on Polkadot. One iBTC can be redeemed directly on the Bitcoin blockchain for one BTC, which allows bitcoin to be used for decentralized finance applications on Polkadot. Interlay claims iBTC is built on a trustless model that borrows its security from the token’s target blockchain and uses decentralized vaults that hold collateral, instead of relying on third-party merchants and custodians like wBTC. -CoinDesk

Miscellaneous:

The Milk Road: DO KWON BREAKS HIS SILENCE

It's been over 3 months since the collapse of Luna, aka that time we lost it all, and the man behind the fall of a $40b+ empire finally spoke out in his most recent interview with Coinage.

Do doesn’t believe he committed any fraud. He thought Luna was the future and argued that everything was working perfectly before the attack that caused the depeg.

The attack on Luna was an insider job. Kwon says the only people that knew of Luna’s movements for that specific time were employees. It was the perfect window to attack and make profits along the way.

Many Terraform team members wanted to raise the 20% APR. Contrary to reports that the team advised Do to lower the yield, he says most were on board and some even suggested “several thousand % APR”.

Do says he isn’t like Elizabeth Holmes. He argues the comparisons are baseless. She straight up lied about a product working. He claims that Luna was working perfectly until it got attacked.

Do admits he developed an alter ego on Twitter. But claims it was only because he was trying to match the energy of the community he was engaging with.

So what’s next? He plans to keep building. “I think what I spend time doing over the next 20 years is going to be more meaningful than what happened with Luna”

Regulation:

FROZEN FUNDS: India's Enforcement Directorate has frozen assets worth 3.7 billion rupees ($46.4 million) at crypto-exchange Vauld. The crypto lender, which is backed by billionaire Peter Thiel, filed for bankruptcy protection from its Singaporean creditors in July.

More freezes: Indian authorities have already frozen assets of exchange WazirX, and raided the properties of one of its directors. Also, the regulator has probed at least 10 crypto exchanges for allegedly assisting international money-laundering.

In the states: U.S. regulators plan to ask large hedge funds to disclose their crypto exposure using something called Form PF that gets submitted confidentially to regulators. -CoinDesk

Stablecoins:

Polkadot-based stablecoin aUSD depegs after Acala Network breach. Acala Network, a protocol that underpins the decentralized stablecoin of blockchain networks Polkadot and Kusama, was subject to a misconfiguration issue that has resulted in error mints of its stablecoin aUSD. The protocol paused operations as its stablecoin depegged from the $1 mark. -The Block

DeFi platform Acala’s stablecoin came close to regaining its peg to the U.S. dollar.

WHY IT MATTERS: Polkadot-based decentralized finance (DeFi) platform Acala’s native stablecoin, aUSD, depegged on Sunday, falling 99% after hackers exploited a bug in a newly deployed liquidity pool to issue 1.28 billion tokens. In response, the platform burned over 1.2 billion aUSD tokens. Even though the price of aUSD plunged from roughly $1.03 per token to $0.009 after the attack, the peg was nearly regained Tuesday following the token burns, reaching 93 cents. -CoinDesk

Web3/NFTs:

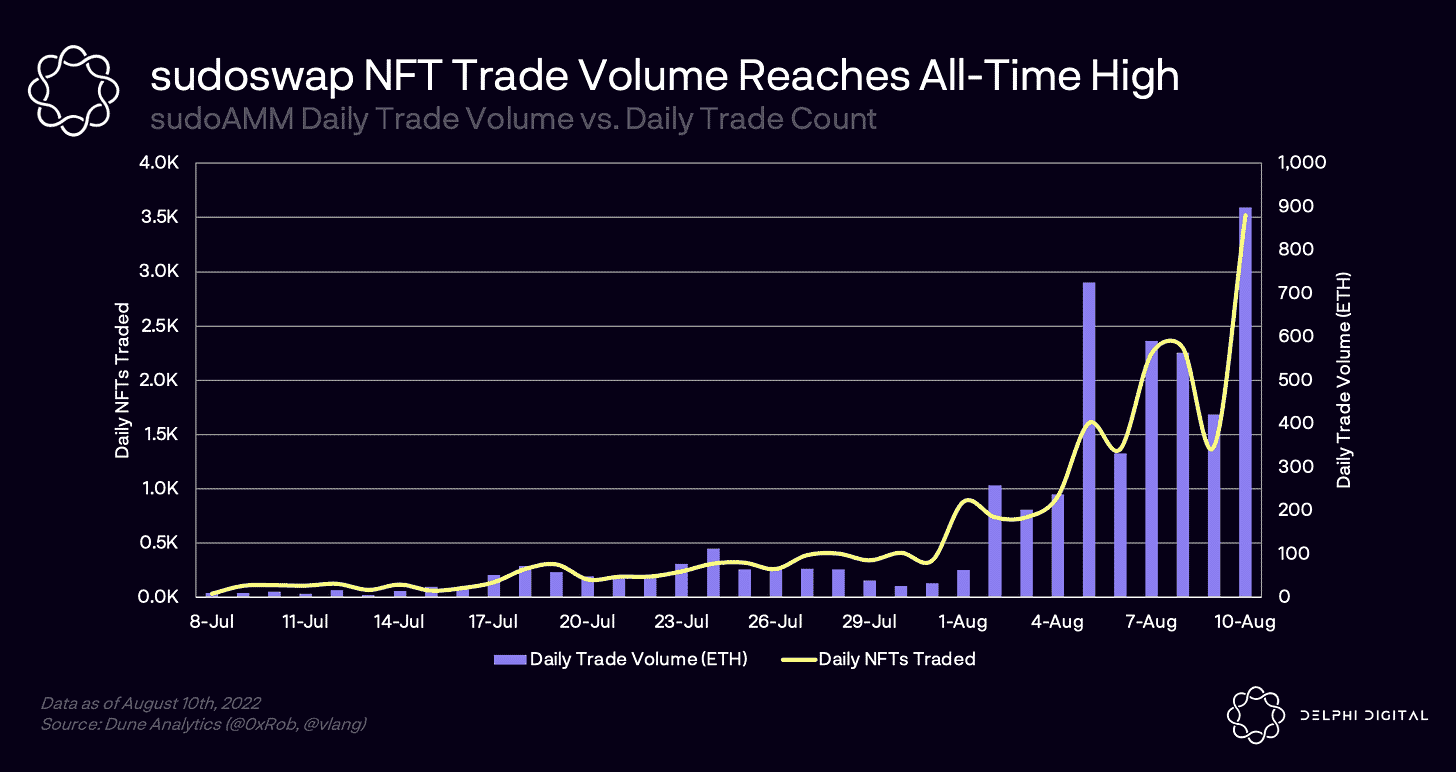

The Myth of Enforced Creator Royalties in NFTs & What Can Be Done

The NFT Marketplace that Ignores Creator Royalties is Gaining Steam

Moonbirds Just Made All Their NFTs Public Domain

In a major change for the popular NFT project, Kevin Rose, founder of Moonbirds, announced on Twitter that both Moonbirds and Oddities will move to a CC0 license. Otherwise known as Creative Commons, CC0 simply means “no rights reserved” on intellectual property. It’s a form of copyright that allows creators to waive legal interest in their work and move it, as far as possible, into the public domain. This means that anyone can now use Moonbirds NFT art freely without any copyright restrictions. -The Scenius Sync

Emerging Technology & Venture Capital

Net Interest: Family Fortunes

**Beginner**

Short and interesting read on the origins and growth of the family office. Though some semblance of family offices can be traced back to ancient Rome, family offices most closely related to the modern day seem to start with John D. Rockefeller and his right-hand man, Fredrick T. Gates.

Gates and his colleagues reflect the archetype of the modern family office: it started with the desire for an “entirely independent agent,” as Gates called it, and became a dedicated team of confidantes tasked with personal finances, philanthropic efforts, legal matters, and even the education of the next generation.

Deals/Raises:

Andreessen Horowitz, the prominent Silicon Valley venture capital firm, is investing ~$350M in Flow, a new business being started by WeWork's (WE) founder Adam Neumann.

This time Neumann's venture is focusing on residential rentals, a shift from the flexible office space model he pioneered. The amount that Andreessen Horowitz is investing is the largest it has ever made in a round of funding a company and values the firm that hasn't yet even started operations at more than $1B.

In a post on AH's website, Marc Andreessen explained why the firm is putting its money into the venture. "We think it is natural that for his first venture since WeWork, Adam returns to the theme of connecting people through transforming their physical spaces and building communities where people spend the most time: their homes. Residential real estate - the world’s largest asset class - is ready for exactly this change," Andreessen said.

Stats, Themes & Trends:

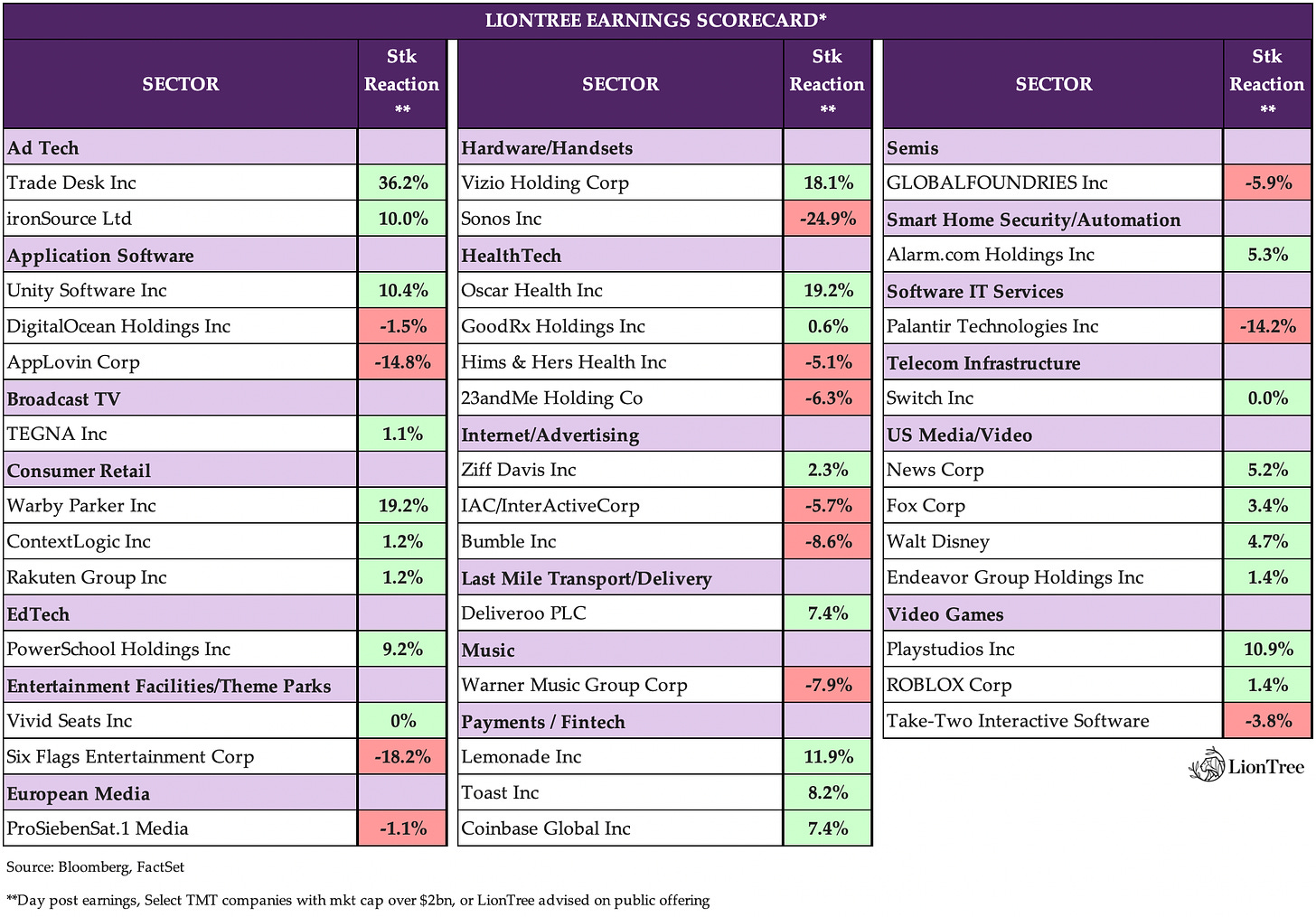

Masayoshi Son, founder and CEO of SoftBank Group, which reported a quarterly loss of over $23bn, is worried that the funding winter for startups may continue for longer. HThe 64-year-old executive, whose Vision Funds have backed over 470 startups globally in the past six years, said that some unicorn founders are unwilling to accept lower valuations in fresh funding deliberations, an assertion that has led him to believe that the “winter maybe longer” for unlisted companies. (TechCrunch) -LionTree

Macro & Markets

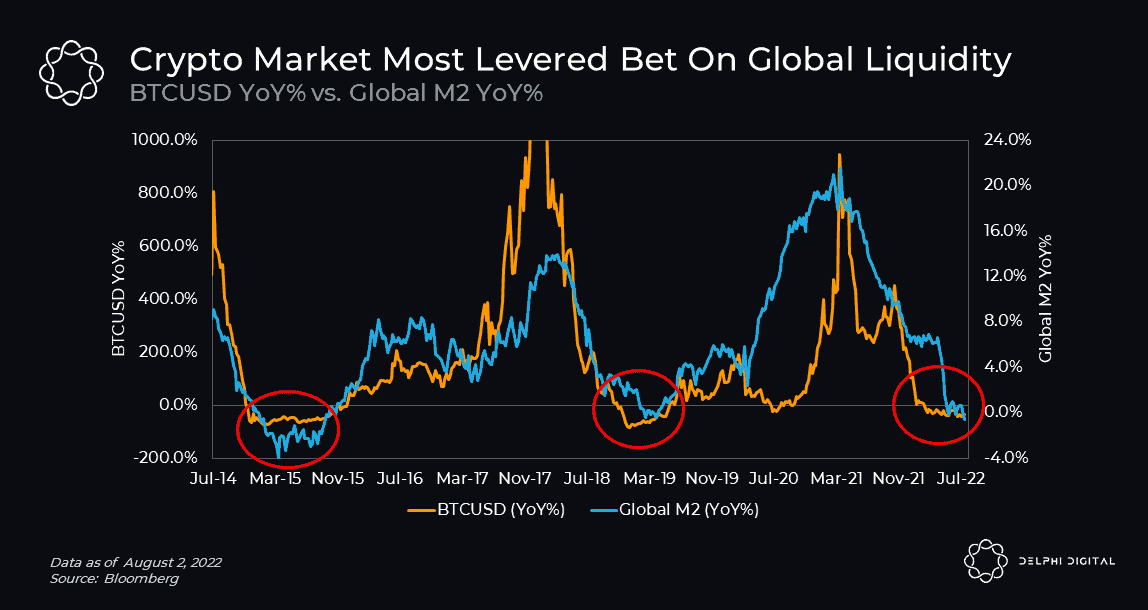

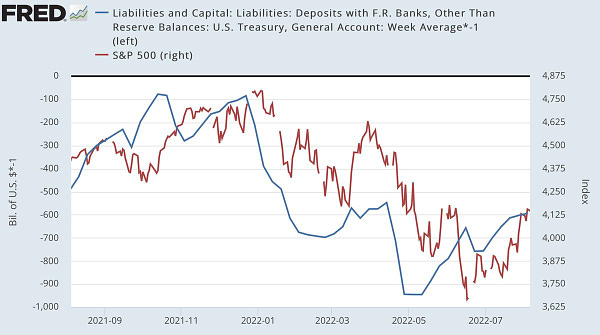

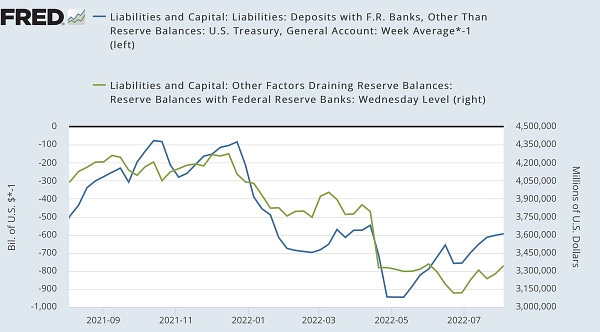

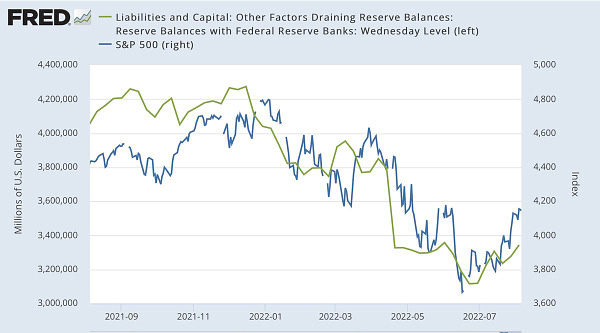

Macro Charts Explaining the End of July Market Pump is Liquidity Driven

The most recent (last week) bounce is due to the inflation drop

Stocks clinched their fourth straight winning week with strong gains Friday after the monthly report from the University of Michigan showed a surge in consumer confidence, marking the second consecutive gain for the index since its June low. The upbeat data, coupled with a better than expected reading of the consumer price index earlier in the week, had some traders feeling euphoric that the worst inflation had passed and that the Federal Reserve might raise its main interest rate by just half a percentage point in September, after two consecutive three-quarter-point increases. Meanwhile, the bond market continues to take a pessimistic view of the economic outlook, with the spread between the two-year and 10-year yields deeply inverted at negative 41 basis points. The S&P 500 and Nasdaq gained for the fourth week in a row, up 3.2% and 3.1% respectively, while the Dow jumped 2.9% for the week. -Seeing Alpha

Blockwork’s Byron Gilliam: Catch-22

**Beginner**

The recent Friday (8/12) chart-centric post from Byron Gilliam seems to be calling a bottom. Charts & data points are showing a lot of positives, and risk assets are moving up quickly. The market reacts to change, and a lot of what we have seen recently has been positive (earnings, inflation data, liquidity), but I think we have moved too far too fast. Gilliam highlights a market-centric concern:

The peak inflation narrative may have peaked:

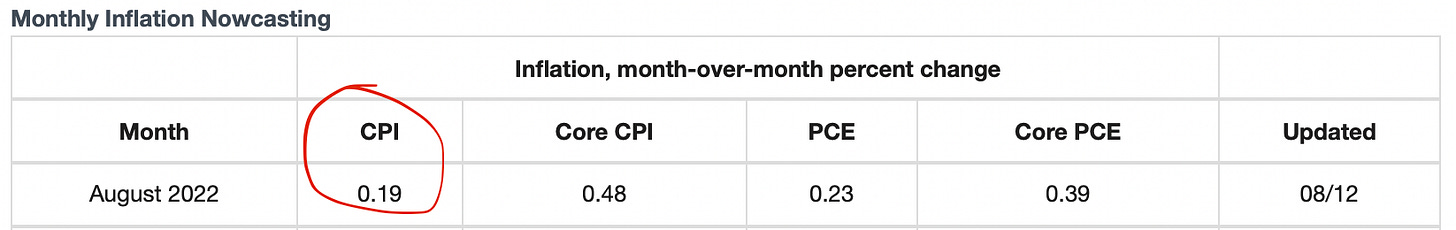

The downside of July’s 0% MoM CPI print is that the bar is set so low now it will be difficult for future prints to limbo under. The upside is that August’s forecast of 0.19% still annualizes to only 2.3%.

The bigger concerns I have are the liquidity-driven pump (highlighted above), and global economic woes, particularly among our allies (highlighted in July’s Deep Dives: WW 7/20 & WW 7/27).

Financial conditions are arguably easier now than when the Fed started hiking rates: Stocks are rising, mortgage rates are falling, credit spreads are tightening and banks are lending freely — it’s not exactly what the Fed had in mind.

July’s 0% MoM CPI print was an amazingly pleasant surprise. But even if we get another five more pleasant surprises between now and year-end (which we won’t), the YoY number would still be down to only about 6%.

The Fed is not going to cut with headline CPI at 6%.

Do we need them to? Does the market need the Fed’s permission to go higher?

Let’s see what the charts say.

Market expectations are changing:

This chart, from Nomura’s Charlie McElligott, is the difference between the March and December Fed funds futures. The increasingly inverted (i.e., negative) curve shows the market is pricing later and deeper rate cuts.

That’s because Fed members have been pushing back against the “pivot” narrative this week. They are not happy with our bullish behavior of late and will be doling out a few more rate hikes to teach us a lesson. That means higher rates than we hoped for in the first half of 2023 and, when the economy weakens as a result, lower rates in the second half.

The peak inflation narrative may have peaked:

The downside of July’s 0% MoM CPI print is that the bar is set so low now it will be difficult for future prints to limbo under. The upside is that August’s forecast of 0.19% still annualizes to only 2.3%.

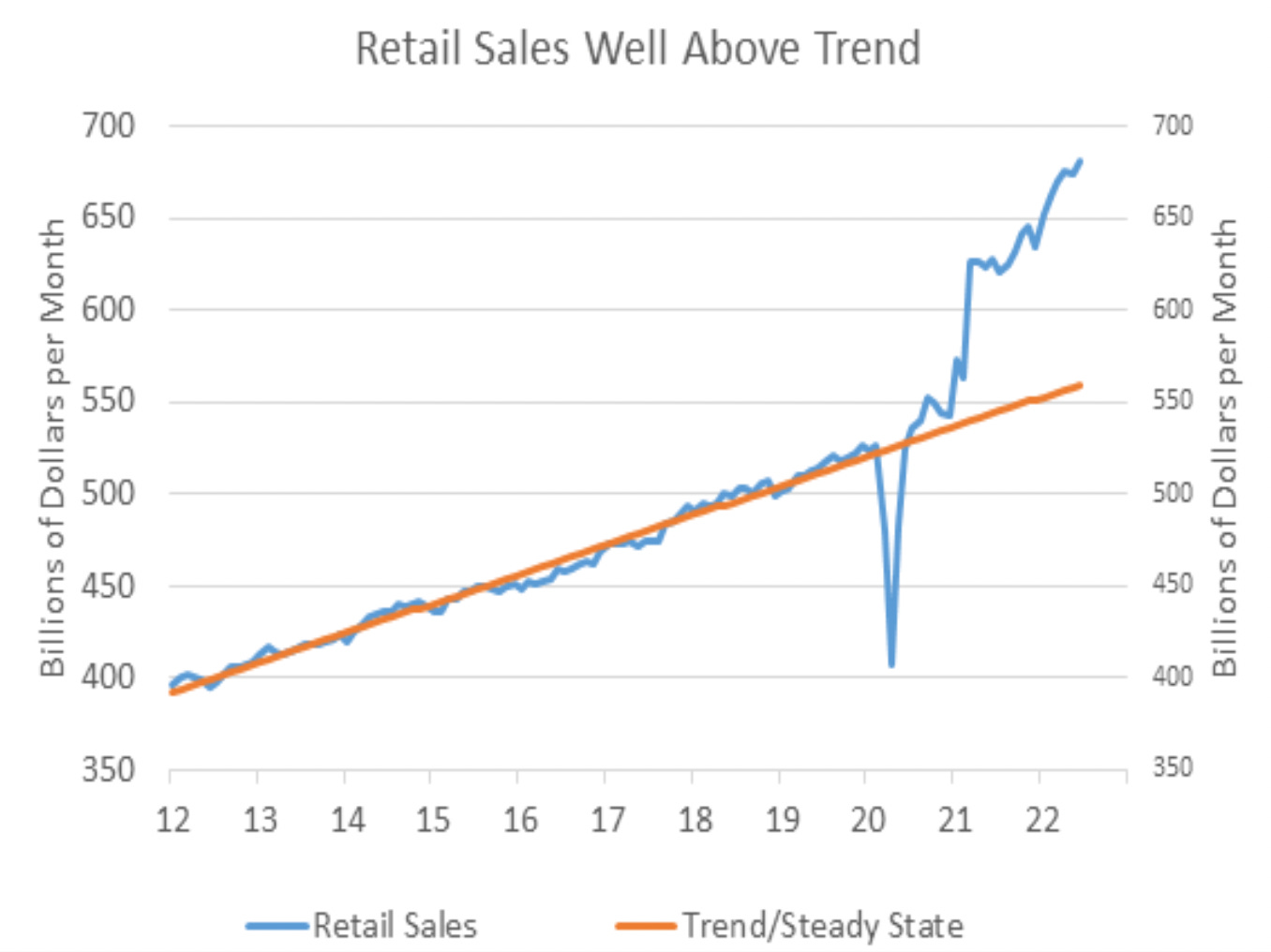

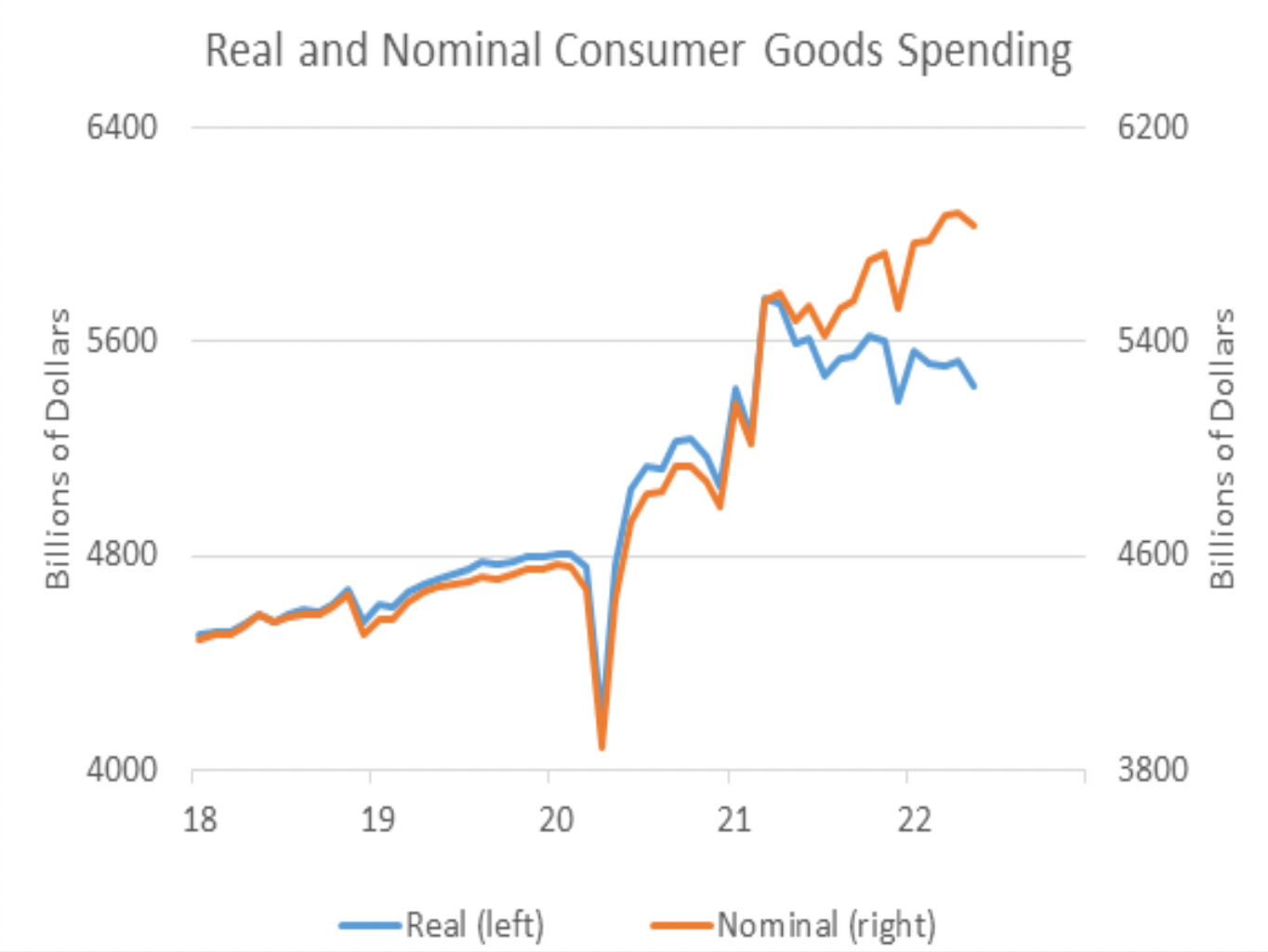

We’re trying to spend our way out of recession:

Retail sales are running $100 billion per month above trend. That’s more than the Fed would like, but no one ever asked their permission to go shopping, did they.

In real terms, though, spending is falling.

We're spending more to keep consumption constant. Our stimulus and pandemic savings are being spent down to offset inflation.

Can we keep it up?

With wage growth accelerating to 6.7%, we probably can. And if you feel like you can’t, now is an especially good time to be looking for a new job.

If you can’t find one, the bank will be happy to tide you over:

Banks are lending freely with loans up 16.3% YoY.

So things are pretty good. Too good?

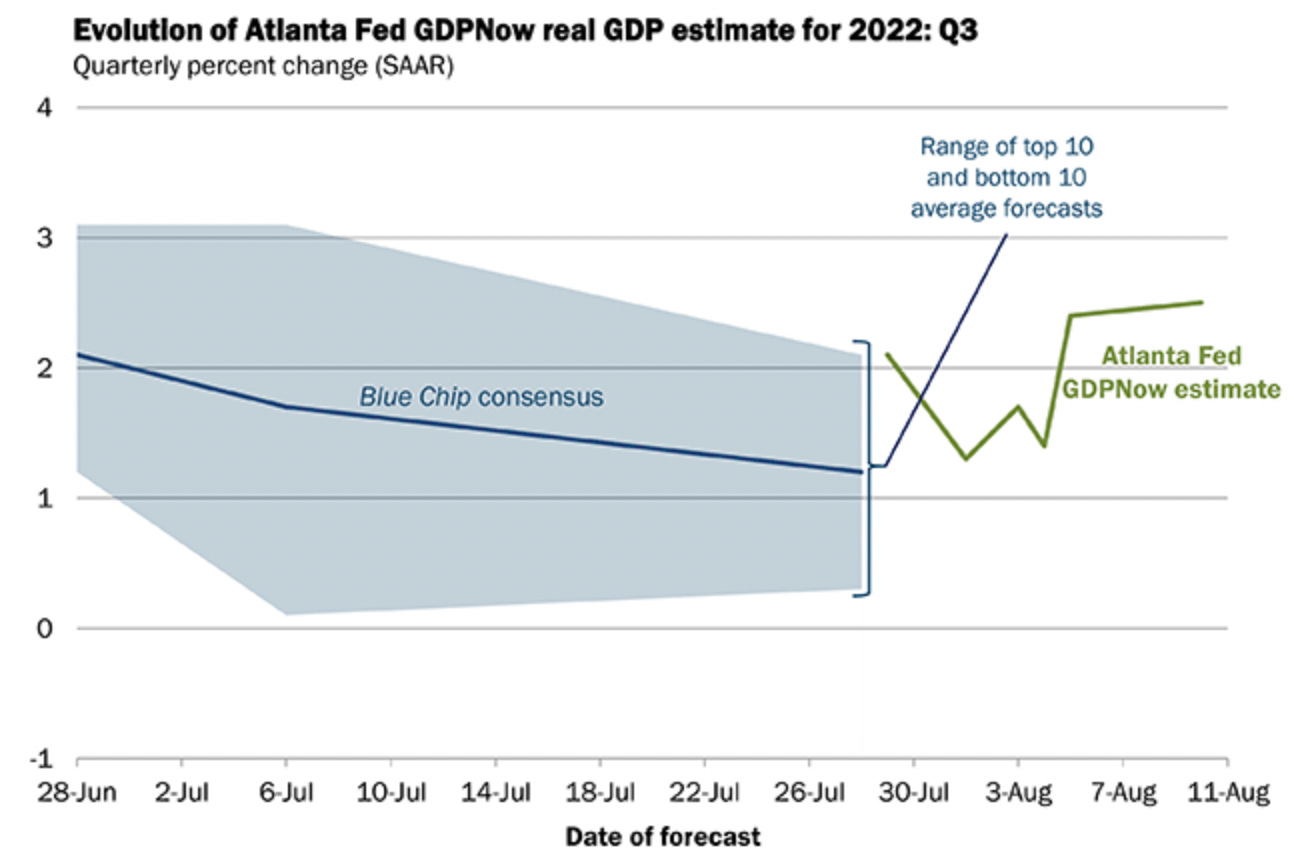

Q3 GDP growth is tracking at 2.5%.

With wages up, lending up, stocks up, and GDP up, expect the Fed to keep trying to talk us down.

But this isn’t the US Army, we don’t have to follow their commands.

We can rally if we want to.

Net Interest: The Most Important Sector in the Universe

**Intermediate**

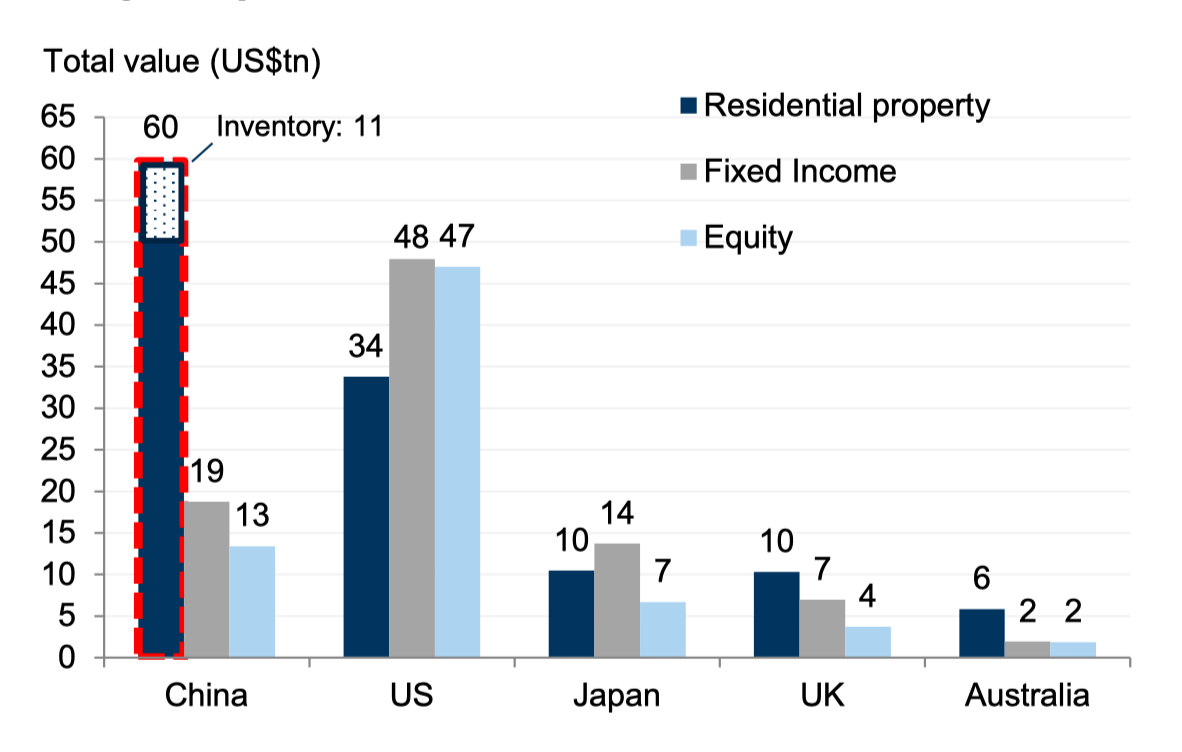

A deep dive into China’s residential real estate market. At ~60 trillion in value, any notable turmoil would have significant effects on the global economy. That started last summer when major property developer, Evergrande, began to buckle as a result of immense leverage. As they attempt to restructure, creditors have little faith in Evergrande bonds trading ~8cents on the dollar. The worst part is that Evergrande is one of many wobbly property developers in China, all of which contribute significantly to the Chinese economy, government finances, and the financial sector as a whole. While the Chinese government balked at an Evergrande bailout, their hands may be tied if the real estate degradation continues.

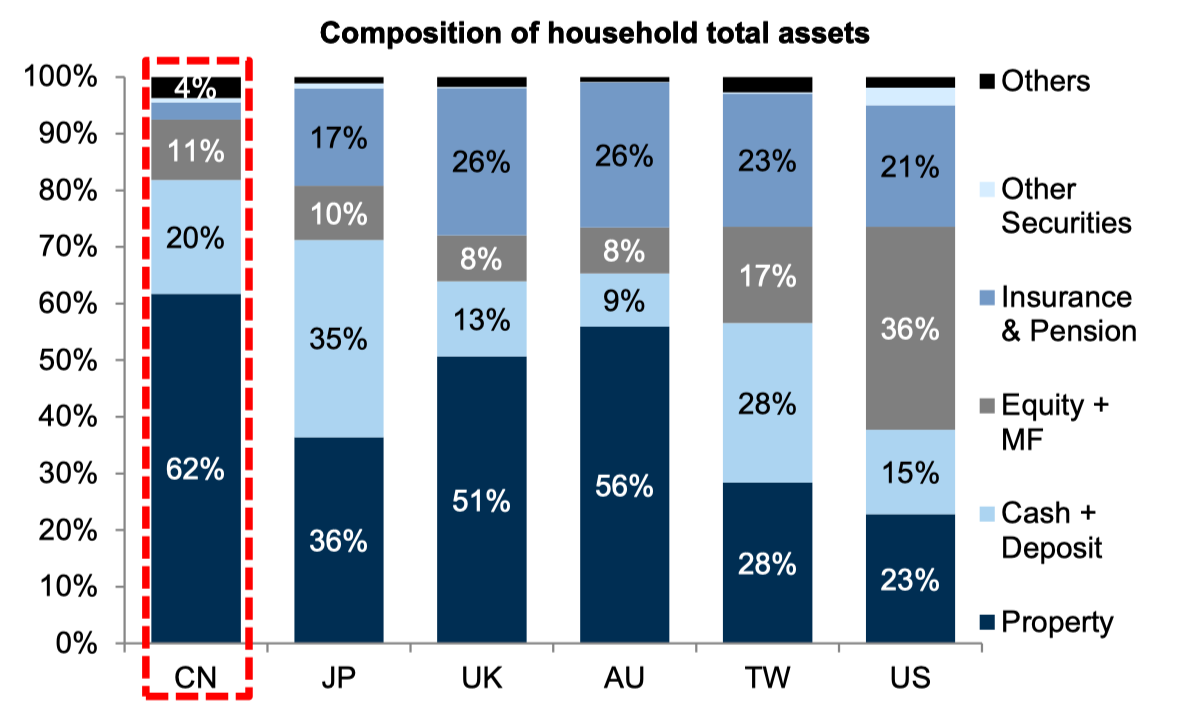

It’s also central to the economy. Real estate investment stood at over 13% of GDP in 2019, of which more than 70% was linked to residential building. Add in the contribution of the construction industry and the share jumps closer to 29%. Yet even this potentially understates the importance of property to the economy: Housing accounts for almost two-thirds of households’ overall assets – compared with around a third in Japan and a quarter in the US – so it has a major bearing on people’s spending decisions. 1

It’s central to government finances, too. Since changing its constitution to allow land-use rights to be bought and sold under long term leases, the Chinese state has relied on land sales to raise funds to meet its budget. Based on data from the IMF, revenues from land sales accounted for around 39% of local government revenues, equivalent to 7% of GDP, in 2017.

And it’s central to the financial system. Banks rely on real estate and land holdings as the main source of collateral to secure loans. Housing loans account for around a third of banks’ loan books and have grown more quickly than other loan categories. In the four years through to 2018, the average annual increase in real estate credit was 20%, versus 6% in manufacturing.

In the first half of 2022, property sales dropped by 29%, land sales plummeted by 50%, and average home selling prices fell by 5%. New home prices have now slid for 10 consecutive months and sales have fallen for 12 straight months, the longest slump since China created a private property market in the late 1990s.

Since the beginning of last year, 35 property companies have skipped bond payments. Shanghai-based Shimao Group is one of the latest to be added to the list, having failed to pay off a $1 billion offshore bond earlier this month. Currently, around three-quarters of Chinese property high yield bonds are priced below 35 cents on the dollar, signalling significant stress.

In 2015, hedge fund manager Kyle Bass, who had been early to the troubles of the US financial system in 2006, wrote to his investors: “Similar to the US banking system in its approach to the Global Financial Crisis (GFC), China’s banking system has increasingly pursued excessive leverage, regulatory arbitrage, and irresponsible risk taking. Banking system losses – which could exceed 400 percent of the US banking losses incurred during the subprime crisis – are starting to accelerate.”

In the US, property developer stress was the earliest sign of impending crisis: the sector peaked in 2005. The Chinese banking system is better capitalised today than the US system was back then, and the state has more tools available to contain losses. But it’s difficult to see how the most important sector in the universe can unwind without any collateral damage elsewhere. It’s a slow process, but it’s one that needs watching.

Companies:

The slide in US stock prices punished Berkshire Hathaway's bottom line in the Q2, as the conglomerate run by billionaire Warren Buffett reported a $43.8bn loss. Berkshire still generated nearly $9.3bn of operating profit, as gains from reinsurance and the BNSF railroad offset fresh losses at the Geico car insurer, where parts shortages and higher used vehicle prices boosted accident claims. (Business Insurance) -LionTree

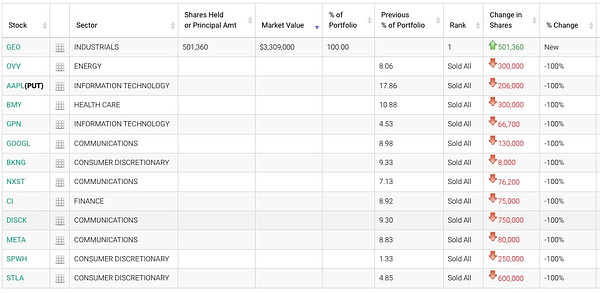

Seeking Alpha: Whale watch — Large HFs pick up beaten-down growth stocks in Q2

Growth stocks were among the favorites for hedge fund whales in the second quarter. Monday was the deadline for hedge funds with more than $100M in assets under management, as well as other institutional investors and endowments, to report certain stock holdings through 13F filings. The 13F season gives investors a glimpse into where the big players are betting, albeit with dated information.

A number of hedge funds and money managers looked to pick up beaten-down growth stocks, such as tech, in Q2. From April to June, the Nasdaq 100 (NDX) (QQQ) fell more than 22%, while the S&P 500 (SP500) (SPY) was down about 16.5%.

Who's buying what?: Among the big-name disclosures, Warren Buffett's Berkshire-Hathaway (BRK.A) (BRK.B) boosted its stake in Activision (ATVI) to ~68.4M shares from 64.3M. It also exited its stake in Verizon (VZ).

Soros Fund Management made a new investment in Tesla (TSLA) (~29.9K shares) and disposed of its stakes in MGM Resorts (MGM) and Solid Power (SLDP).

David Tepper's Appaloosa took new positions in Salesforce (CRM), buying 200K shares, Alibaba (BABA), acquiring 100K shares, and Netflix (NFLX), with 50K shares, during Q2.

In addition, Elliott Investment Management started a stake in Pinterest (PINS) and shed Twitter (TWTR), Ray Dalio's Bridgewater started positions in Rivian (RIVN) and Amazon (AMZN), the Gates Foundation turned to autos with Vroom (VRM) and Carvana (CVNA), and Carl Icahn eyed Bausch + Lomb (BLCO).

Dan Loeb takes aim at Disney: It wouldn't be 13F season without some hedge fund saber rattling. Dan Loeb's Third Point Capital revealed a new stake of 1M shares in Disney (DIS) in its filing, but added in a letter directly to the company that in recent weeks it had “repurchased a significant stake.”Saudi Arabia’s Public Investment Fund went on a US stock buying spree… Shares of Alphabet, Zoom, and Microsoft were among the top picks. -Quartz

…while Michael Burry’s firm sold almost all its holdings. The investor retained shares in just one company, Geo Group, which invests in prisons and mental health facilities. -Quartz

FinTech

SoftBank plans to sell its stake in digital personal finance company SoFi Technologies, according to a filing. On August 8th, SoftBank sold 6.7mn shares in SoFi at a weighted average price of $8.17/shr, three days after it sold 5.4mn shares at a price of $7.99. To raise cash, SoftBank has exited companies including Uber Technologies and home-selling platform Opendoor Technologies, for a total gain of $5.6bn. (REUTERS) -LionTree

Mobility

Baidu has secured permits to offer a fully driverless commercial robotaxi service, with no human driver present, in Chongqing and Wuhan via the company’s autonomous ride-hailing unit, Apollo Go. When Baidu launches in Wuhan and Chongqing, it’ll be the first time an autonomous vehicle company is able to offer a fully driverless ride-hailing service in China, Baidu claimed. (TechCrunch) -LionTree

Online consignment retailer CarLotz will merge with Shift for $120M in stock (link). -Trucks FoT

Ford is gearing up to start accepting new orders for its F-150 Lightning after pausing orders late last year, but the 2023 model will cost up to $8,500 more across trim levels, a Co said. The cheapest Lightning Pro truck, a basic work vehicle meant for contractors and the like, will now cost $46,974, up from just under $40,000 for the inaugural 2022 model. Ford chalked up the price hikes to "significant material cost increases and other factors." (Business Insider) -LionTree

Lyft goes further into media revenue with in-car ads (link). -Trucks FoT

Seeking Alpha: Rivian Automotive

Will Rivian (RIVN) eventually become a formidable competitor to Tesla (TSLA)? Investors are trying to size that up following the EV maker's Q2 results. Shares wobbled between gains and losses after-hours, though largely remained near the $40-level, in a similar story that has taken place since the company went public in November. IPO hype initially saw the stock hit as high as $180, before starting to gradually decline to a lower evaluation, even touching lows of under $20.

Mixed sentiment: First off, Rivian lost $1.7B during the quarter, which is a great deal of money even for a company that is in the early stages of production. That puts it in a place to conserve cash and hustling to fill customer purchases, with around 98,000 pre-orders on its books from customers in the U.S. and Canada. With regards to guidance, Rivian still expects to record a whopping $5.5B EBITDA loss in 2022, up from the $4.8B estimate it disclosed three months ago.

Tesla CEO Elon Musk sold 7.92mn shares of the electric vehicle manufacturer worth about $6.88bn between August 5 and August 9, according to a series of recent SEC filings. Musk says he needs the money in case he is forced to buy Twitter for $44bn. (The Verge) -LionTree

Tesla reportedly secures $5B worth of nickel in Indonesia (link). -Trucks FoT

Uber plans to close its free loyalty program this year (link). -Trucks FoT

United Airlines has put down a deposit for 200 four-passenger flying taxis from Archer Aviation, a San Francisco–based startup working on the aircraft/auto hybrid. Archer’s eVTOL (electric vertical takeoff and landing) aircraft have the ability to take off and land much like helicopters, meaning no runway is required. They’re designed to be quieter than cars or even air-conditioning units and have a range of 60 miles, traveling at speeds of up to 150 mph. Passengers will book rides via smartphone, the company says. (Fortune) -LionTree

Retail

A profit guidance lift from Walmart (WMT) helped the retail sector outperform in early trading on Tuesday.

While the retail giant issued a profit warning last month due to concerns over consumer spending, WMT execs said with its earnings report that it was seeing a trade-down effect with shoppers at the higher income levels buying more groceries from Walmart. Back-to-school sales were also noted to be off to a strong start and the early outlook for the holiday season was positive.

Morgan Stanley said the retail giant seemed to show that inventory and markdown issues were under control and sees more upside than downside for the near term.Bed Bath & Beyond (BBBY) shares soared nearly 30% on Tuesday amid an ongoing upswing in meme stocks. The sharp rise in shares adds to an over 300% run for the stock since the end of July.

At one point in the session, BBBY was up nearly 79% for the day. The furious activity also prompted a trading halt for volatility. The rally came as the stock continued to draw attention from short squeeze-eyeing meme traders following the disclosure of call-buying from GameStop (GME) chairman Ryan Cohen’s venture capital firm RC Ventures. Per the disclosure, the Chewy founder bought January 2023 calls on more than 1.6M shares with strike prices between $60 and $80, fueling a squeeze

Tech

Alibaba has reportedly let go of close to 10,000 employees in anticipation of an economic downturn, according to the South China Morning Post. Exactly 9,241 employees reportedly left the co during its latest financial quarter, from Apr. to Jun., leaving the co’s rolls at 245,700. (Retail TouchPoints) -LionTree

SoftBank that it plans to sell about 242mn American depository receipts of Alibaba, which will bring its stake in the company down to 14.6% from 23.7% as of the end of June. The group estimated a roughly 4.6 trillion yen ($34bn) pre-tax gain from the sale. (TechCrunch) -LionTree

Amazon's palm-reading payment technology will soon be available in many more Whole Foods stores. The co is rolling out Amazon One to more than 65 Whole Foods shops in California, starting w/ Malibu, Montana Avenue and Santa Monica locations in Los Angeles. More stores in LA, Orange County, Sacramento, the San Francisco Bay Area and Santa Cruz will come online in the "coming weeks." (Engadget) -LionTree

Apple plans to ship ~1.5mn units of its upcoming AR/VR headset in 2023, according to Apple analyst Ming-Chi Kuo. In a research note, Kuo reiterated that Apple plans to announce its long-rumored mixed-reality headset during an event in Jan. 2023. The headset will feature more than a dozen cameras for tracking hand movements, two ultra-high-resolution 8K displays and advanced eye-tracking technology. (MacRumors) -LionTree

Snap is in the early stages of planning layoffs, according to two people familiar w/ the plans. It’s currently unclear how many of Snap’s more than 6,000 employees will be laid off, as managers across the company are still planning the full scope of the cuts for their teams. (The Verge) -LionTree

Spotify’s testing a new website to sell concert tickets directly to fans, as first reported by Music Ally. The site, dubbed Spotify Tickets, currently has a limited selection of upcoming US-based concerts for participating artists like Limbeck, Tokimonsta, and Annie DiRusso. Spotify already partners with Ticketmaster, Eventbrite, and See Tickets to sell tickets through its new Live Events Feed, where you can browse nearby shows and purchase tickets through a third party. The new Spotify Tickets site, however, lets you buy tickets through Spotify itself. (The Verge) -LionTree

Seeking Alpha: Disney edges Netflix