Deep Dive

Adding More Fuel to the “Why You Should Have a Crypto Allocation” Fire

In last week’s Deep Dive: Bitcoin isn’t an Inflation Hedge, it’s a Hedge Against Hyperinflation & Currency Debasement… and a Beta Risk Bet, we looked at Bitcoin as a hyperinflation & currency debasement hedge and beta risk bet. Also, we examined why the current tight money policies will flip sooner rather than later due to global economic turmoil. This week we take a closer look at the EU & ECB’s financial issues and BTC as fiat insurance to add more fuel to the “why you should have a crypto allocation” fire.

The Eurozone has been in economic disarray since the Great Financial Crisis (GFC), but truly sealed its economic fate when the European Union (EU) was formed in 1993. While one can argue the positives and negatives of many aspects of the EU, the development of the European Central Bank (ECB) and its monetary union has led and will continue to lead to economic turmoil in times of financial stress and inflation.

The EU is doomed to fail because it is solely a monetary union, and it does not have federal powers to collect taxes and force economic harmony between its country members. Because every country in the EU pursues different policies, each one faces different economic outcomes. Some are more prosperous than others, and there’s no way for the centre to move resources between its member states. But at the same time, all states share the same currency and monetary policy — which is not always suitable for their specific economic circumstances.

As a result, some countries are perceived as safer or more worthwhile sovereign credit risks than others. The member states can issue their own Euro-denominated country bonds but cannot print Euros. Therefore, these bonds are not risk-free in Euro terms. They would only be risk-free if the European Central Bank (ECB) fully commits to printing Euros to pay back member states’ government debts in any and all circumstances. The ECB could have been set up with such a proviso; however, the ECB’s sole legal mandate is stabilising the general price level of the EU, and that’s it. All other policies are subordinated to that mandate.

The problem is that, when faced with inflation, the ECB’s mandate technically requires it to tighten monetary policy to keep prices down. This means that if a country cannot afford its national debt load during an inflationary period, the ECB cannot legally ride to the rescue and print Euros when doing so would push up the general price level.

But what the law prescribes as the ECB’s mandate and what the ECB views as its mandate are two different things. The ECB is really only concerned about maintaining the EU as a monetary and political entity — even if that means eschewing its legal mandate and stoking the fires of inflation. Leaving a member state to struggle helplessly under its Euro-denominated debt load can drive that member state to leave the Euro and redenominate all of its debts in a new national currency, which its central bank can print freely (much to the chagrin of its investors, who then get paid back in the weaker new national currency, rather than the Euro). This is called a technical default. An EU member entering technical default and leaving the EU to resolve its debt problems is the ECB’s worst nightmare — and it will do pretty much anything in its power to prevent that outcome.

-Arthur Hayes: Excalibur

The ECB needs to balance stabilizing the Euro, which entails aggressively raising rates to fight inflation, while also creating an environment for its member-states to manage increasing debt service. With elevated amounts of debt across the EU, it’s virtually impossible for all members to afford interest payments at higher rates. Here is the issue:

The current yields don’t compensate for inflation and redenomination risk. The amount of debt issuance is set to increase dramatically, both to fund large and increasing government deficits and to repay old debt. Even worse, the EU as a trade bloc now owes the world money, rather than the other way around. -Arthur Hayes: Excalibur

How do you find investors to buy new debt at artificially low yields to repay old debts and increasing deficits?

The ECB concocted a new alphabet soup program aimed at printing more money to support the weakest member states. It’s called the Transmission Protection Instrument (TPI). Basically, it gives the ECB the sole discretion to determine whether the market value of a member state’s bonds is unwarranted given certain macroeconomic fundamentals. If such a situation occurs, then the ECB is empowered to purchase any member state’s bonds in an unlimited amount.

Explicit Yield Curve Control (YCC) — whereby the ECB targets a general absolute level of government bond yields and then purchases member state bonds to achieve that target — is the only way it can coax investors into taking the inflation and redenomination risk associated with buying the weaker member states’ bonds. Anything short of YCC, and investors will shun those bonds. -Arthur Hayes: Excalibur

I don’t get it.

Capital goes to where it’s best treated. If investors can sell negative real-yielding bonds to a buyer who must buy for political rather than economic reasons, then they will do so. -Arthur Hayes: Excalibur

So that can solve for investors, but more ECB money printing? Won’t that worsen inflation? Yes, and that exacerbates the original problem… but without printing more money, the EU and ECB will fold.

Printing more Euros will cause the exchange rate to fall, and energy costs — and most importantly, the cost of natural gas — will rise.

Without ECB support, EU governments will be unable to finance themselves affordably. Then the bankrupt governments must either enact crushing austerity measures, such as raising taxes and cutting healthcare spending, or leave the Euro and redenominate all their debt into new national currencies which they can print. And if they decide to do the latter, the ECB and most of the large Too-Big-To-Fail European banks will become insolvent, as they owe Euros to their depositors, but their debt assets will be redenominated into weaker currencies.

The unfortunate reality is that European countries must import a substantial portion of their energy needs, and the countries selling it to them won’t be interested in a newly created Euro-trash currency. Trading partners will demand “hard” currency, and when a nation runs out of EUR, USD, or gold, no one will trade with them. -Arthur Hayes: Excalibur

And in steps the Fed. A quick review of last week and how Hayes’ thesis has it all playing out.

The Fed’s policy is extremely aggressive compared to the monetary policy of Japan and the EU. When a country (or group of countries) engages in YCC, it must print money and buy back its own bonds in order to cap yields below the observed rate of inflation. Therefore, the BOJ and the ECB cannot run an aggressive monetary tightening program like the Fed. Interest rate parity thus dictates that the Yen and the Euro must depreciate vs. the Dollar due to the divergence in monetary policies.

The Fed can do one of two things to weaken the dollar so that its allies can continue to afford to import the goods they need while also engaging in YCC:

1. Buy JGBs and EU member state bonds by printing dollars.

2. Stop reducing the size of its balance sheet and cut its policy rate.Of the two options, I believe the first is politically an easier sell than the second.

The following is a direct quote from a report written in March 2021 from Office of Inspector General, Department of Treasury, which describes what the Exchange Stabilisation Fund (ESF) is authorised to do.

The Gold Reserve Act of 1934 established a fund to be operated by the Secretary of the Treasury (the Secretary), with the approval of the U.S. President. Section 10 of the Act provided that “For the purpose of stabilizing the exchange value of the dollar, the Secretary, with the approval of the President, directly or through such agencies as he may designate, is authorized, for the account of the fund established in this section, to deal in gold and foreign exchange and such other instruments of credit and securities as he may deem necessary to carry out the purpose of this section.”

The aggregate Fed balance sheet rises — but the portion of the balance sheet that is targeted for reduction under the bank’s Quantitative Tightening (QT) program remains unchanged. This is extremely important.

The Fed telegraphed to the world — and most importantly, to the American public — that it is tightening domestic credit conditions by allowing its hoard of US Treasury and MBS to decline. This raises the effective borrowing rate for all financial assets for American individuals and businesses. They hope this will reduce borrowing demand, as America’s economy will contract if less credit is supplied to it — cooling inflation in the process.

A rise in the size of the ESF and a fall in the size of the holdings of Treasuries and MBS securities can happen concurrently. Therefore, the Fed can supply the dollars its allies require, and reduce domestic inflation. At least, in theory. -Arthur Hayes: Excalibur

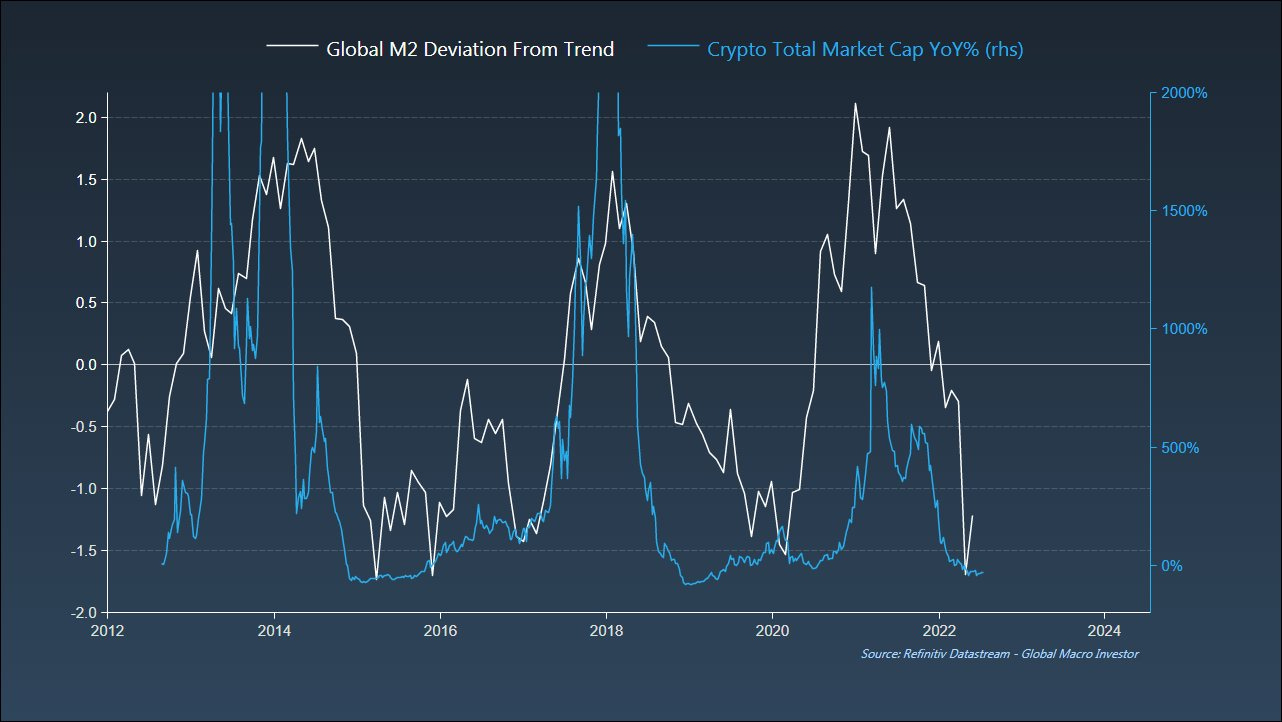

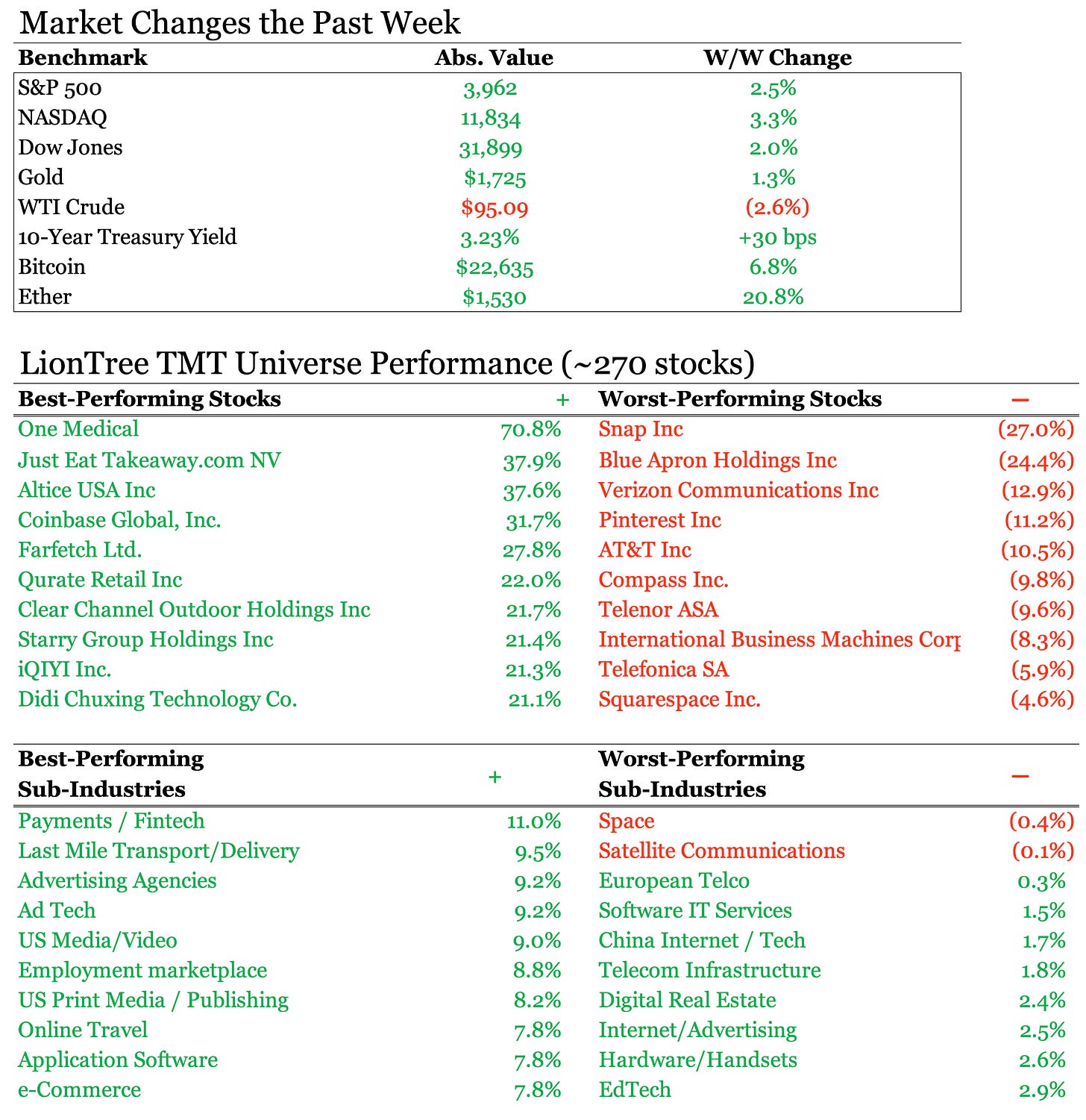

Hayes’ piece goes a lot more in-depth into the political justifications and ramifications of this, but the main point is while concurrently “tightening” conditions domestically to “fight” inflation, the Fed is buying JGB and EU bonds. This, plus the BOJ and ECB doing some buying of their own increases the global money supply. And when the money supply goes up, so do risk assets, particularly and aggressively in the crypto realm.

And if you are still critical of all of this crypto business, think of it this way Credit Default Swaps (CDS) are to bonds as Crypto (particularly BTC) is to fiat currency. As Byron Gilliam puts it: BTC is fiat insurance… and exceptionally cheap fiat insurance at that.

If you’re concerned that fiat-issuing governments are on a slippery slope to default, sovereign CDS is however not much help to you: It’s only available to institutions big enough to sign ISDA agreements with investment banks.

Fortunately, there’s a better form of insurance available to hedge the risk of sovereign default: Bitcoin.

Insuring a Bit of Your Coin

What’s better about bitcoin?

For thing one, it’s available to all: no ISDAs required.

For thing two, there’s no carry cost to pay… — and it never expires.

And for thing three, there’s no counterparty risk.

If you’re buying insurance on sovereign debt, you’re betting on a scenario where every counterparty will be highly suspect — even the US government.

I, personally, am not losing any sleep over it. I don’t think the fiat currency house is on fire.

But hedges are for when you’re wrong. You don’t buy fire insurance because you think your house is going to burn down, but because you know there’s some probability it might.

Bitcoin is a hedge against the probability that I’m wrong about fiat currencies.

And, like Lehman and subprime CDS in 2007, it’s cheap.

Tangible Valuation

Crypto is mostly narratives still. There’s not much valuation support to go on.

The bull cases you hear for bitcoin are mostly things like Michael Saylor’s thesis that it’s the “purest form of monetary energy.”

I find that formulation inspiring, except for the fact that I don’t know what it means.

In reading Greg Foss’s work, however, I’ve learned that thinking about bitcoin in CDS terms can make things more tangible.

Foss uses CDS prices to calculate what the market is currently paying to hedge sovereign debt credit risk and argues that bitcoin is similarly valuable.

Bitcoin, he argues, should be worth at least $110,000 on that basis. (And presumably more now, as the stock of government debt is ever rising).

So, at today’s bitcoin price of $22,000, you are being offered insurance on your fiat exposure at a bargain rate.

That does not mean you’ll be able to sell your BTC at $110,000 any time soon. There’s no reason why it can’t trade at a big discount more or less forever.

But as with all insurance, you don’t actually want it to pay out: The world will be a better place if the doomsday scenarios on fiat currencies don’t come to pass.

What Are the Odds

It’s easy to dismiss Bitcoin at the moment because it hasn’t been a hedge against 9% inflation.

That’s a fair criticism: If Bitcoin is only going to be a higher-beta version of Nasdaq, then it’s not particularly useful. The financial world doesn’t need another levered bet on interest rates; we have plenty of those.

And, as discussed yesterday, as long as M2 money supply stays within normal bounds, Bitcoin may not be much more than that.

But the real value in Bitcoin is for the eventuality that M2 gets out of normal bounds.

BTC is a put option on USD with asymmetric upside.

Judging by the low cost of CDS on US government debt, there may only be a 1-in-500 chance of that put option paying out.

But the odds of your house burning down are even longer, and you wouldn’t go without fire insurance, would you? -Blockworks: 🟪 Fiat insurance by Byron Gilliam

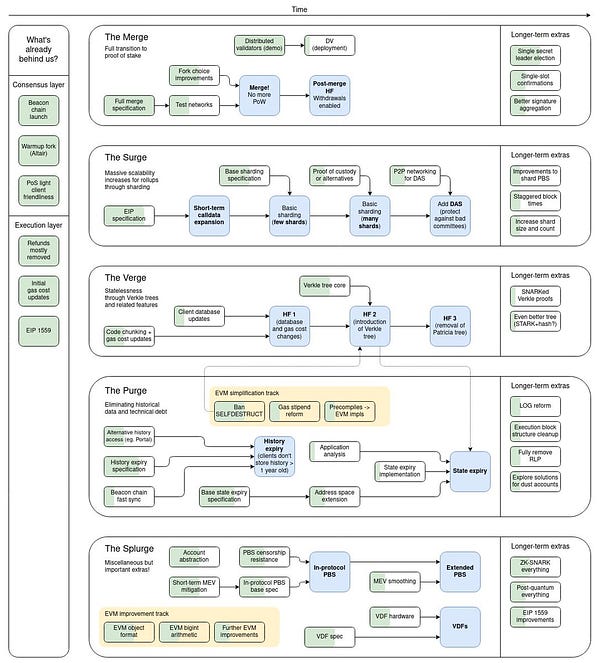

Blockchain, Cryptocurrencies & Digital Assets

Some Insights on Layer 2s & Recent Developments

**Advanced**

Messari: The Big Three zkEVM Announcements: What You Need to Know And Potential Implications

Each zkEVM plans to operate as a Layer-2 (L2) rollup. A L2 rollup batches user transactions together for cheaper gas costs and faster local processing while preserving the security guarantees of L1. The two main types of rollups are optimistic rollups and zero-knowledge (zk) rollups.

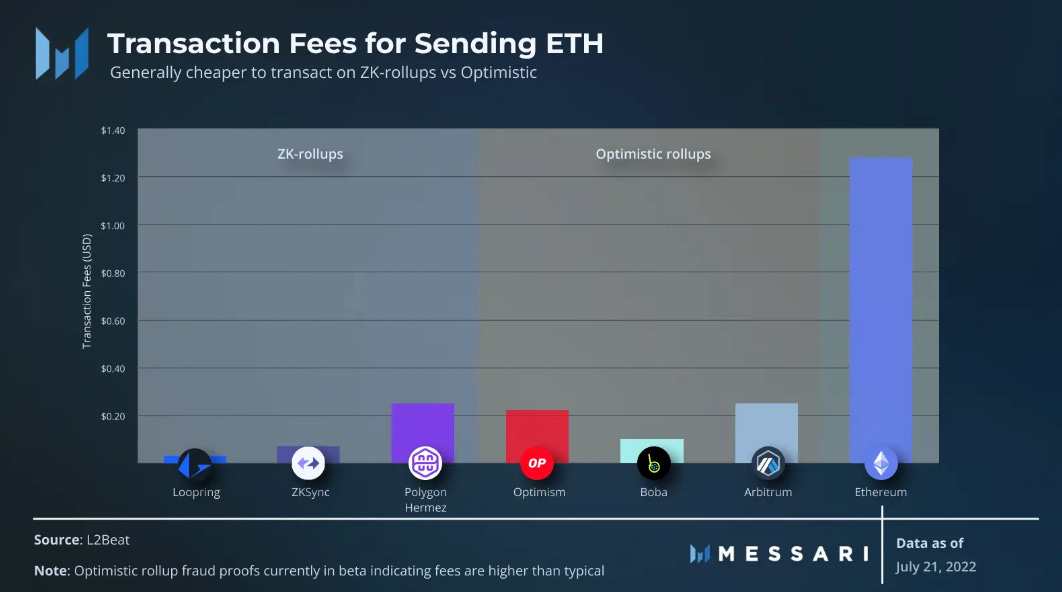

It is generally cheaper and faster to use zk-rollups to transact. Between the zk-rollups, Loopring is the cheapest for sending ETH, while Polygon Hermez costs 10x as much. Though, fees should be much lower according to Vitalik.

The EVM runtime is well-established, with powerful features and tooling for developers to build upon. However, it was not built to support zero-knowledge proofs (ZKPs), which is the gap that zkEVM projects are working diligently to close. Today’s zk-rollups can only process certain types of smart contracts, severely limiting their potential use cases. Loopring can only do token transfers and DEX trades, while StarkNet is not compatible with existing EVM code. A zkEVM would support the same smart contract capabilities as Ethereum. Developers could move any contract from Ethereum L1 directly to a zkEVM with minimal or ideally no changes.

The optimal zkEVM solution would be a bytecode (compiled Solidity code) compatible zkEVM, making the transition for developers seamless. A less ideal solution would be a language-level compatible EVM. These solutions transpile Solidity into code that a non-EVM virtual machine can read. They are essentially another level up from bytecode level solutions, meaning less functionality.

Given the spectrum of EVM compatibility and journey to mainnet, the zkEVM big three have made several differing tech decisions on how they’ve built their rollups.

Bankless: Under The Radar Layer 2s

To date, much of the discourse surrounding L2s has largely focused on “The Big Four” generalized rollups. These include optimistic rollups (ORUs) in Optimism and Arbitrum, which are live and boast a rapidly growing user and developer base.

The Big Four also includes zk-rollups (ZKRs) in zkSync and StarkNet. While highly performant, neither has seen level of traction as ORU counterparts (more on that later).

However, there are a number of L2s which — while currently lesser known — are waiting in the wings to disrupt incumbents. These networks bring unique design choices and functionality to the table, while some are highly specialized for certain, individual use cases.

Fuel is an optimistic rollup.

Fuel is unique in that it uses its own custom virtual machine — the Fuel VM — with smart contracts written in Sway. This means that unlike most L2s, Fuel is not EVM-compatible, a factor that may hinder its adoption.

Fuel also differentiates itself through the use of a UTXO model — the same as Bitcoin — instead of the traditional accounts based model utilized by Ethereum and L2s. These unique design choices have allowed Fuel to be highly performant, as the network is capable of validating multiple transactions in parallel, rather than serially (one at a time).

Fuel also boasts improved user experience relative to other L2s. Rather than a 7-day withdrawal time like traditional optimistic rollups, users on Fuel can bridge back to Ethereum mainnet in minutes using atomic swaps. Furthemore, transactors can pay gas fees in any token — rather than just ETH. Though like any L2, the network must still purchase Ethereum blockspace to verify proofs.

Scroll is a zk-rollup (ZKR) developing a zkEVM.

A zkEVM has the potential to radically change the L2 and entire blockchain scaling landscape.

Along with the difficulties of implementing ZKRs in production, a major obstacle hindering adoption of the tech is its lack of EVM-compatibility. While ZKRs are more performant in regards to throughput and gas fees, the inability to easily integrate the EVM into zk-tech has led to each ZKR having to build out unique developer tooling and infrastructure from the ground up.

This is why a zkEVM is considered by many to be the “endgame” of L2 scaling, as it allows ZKR’s to inherit the network effects of the EVM while maintaining the same, high-level of performance.

While other competitors such as zkSync and Polygon (more on that below) are developing zkEVM’s, a factor that may allow Scroll to be competitive with these projects is that it aims to be EVM-equivalent. This means that contracts deployed on Ethereum mainnet can be ported over to Scroll without needing to make any material changes to the codebase. This should help catalyze adoption of Scroll, because it greatly increases the ease at which projects can migrate over to the network.

Aztec is a privacy-focused zkRollup.

Aztec provides users with privacy through its unique transaction architecture. While complex, at a high-level this architecture functions similar to a UTXO-model and uses zk-proofs to transfer ownership of assets, while simultaneously protecting the identities of any parties involved.

A primary use case for Aztec thus far has been private DeFi through Aztec Connect.

Aztec Connect provides users with the ability to directly interact with smart-contracts that are deployed on L1 from within the L2. This means that users can inherit Aztec’s privacy while also accessing the liquidity and composability of dapps on Ethereum. Further, Aztec users also pay minimal gas fees despite the direct interaction with L1 because, like with any rollup, gas fees are still batched and amortized across all transactors. Per L2 Beat, Aztec Connect currently has $3.12M in TVL.

The most popular individual application which has been built to leverage Aztec’s technology is zkmoney, a transaction shielding service. zkMoney enables users to privately transact with an assortment of prominent L1 protocols such as Uniswap, Aave, Compound, Lido

Immutable X is a validium built using StarkEx.

Immutable X is considered to be a validum because transaction data is stored via an off-chain solution known as a data availability committee rather than entirely on-chain. While this means that Immutable X has increased trust assumptions relative to other rollups that settle to Ethereum, it allows the network to significantly reduce transaction costs, with the network entirely subsidizing them for end users.

Immutable X is governed by the IMX token. Along with these rights, IMX holders can stake their tokens to earn 20% of transaction fees, as well as protocol fees that include 2% of all secondary NFT trades made on the L2.

Immutable X is focused on gaming, with numerous high profile projects building on the network, such as Gods Unchained, a NFT based trading card game, and Illuvium, an auto-battler with Triple-A quality graphics that is currently in private beta.

Polygon is developing a suite of ZKRs, with the most prominent of these being the Polygon zkEVM.

Similar to Scroll, Polygon’s zkEVM, which was revealed the day before publication, has the potential to radically shake up the L2 landscape.

Like its competitor, the Polygon rollup will be EVM-equivalent, enabling developers to near-seamlessly deploy their L1 contracts onto L2. The zkEVM will also utilize the Plonky2 prover system developed by Polygon Zero, another ZKR which was brought into the Polygon ecosystem following the $400M acquisition of Mir. Plonky2 enables proofs to be validated at incredibly fast rates, which decreases the time it takes for L2 transactions to reach finality.

The zkEVM is scheduled to launch its testnet sometime in the summer of 2022, with a mainnet deployment slated for early 2023.

The Milk Road: POLYGON INTRODUCES ZKEVM

Yesterday Polygon dropped a huge announcement - the release of zkEVM.

zkEVM stands for "Zero-Knowledge Ethereum Virtual Machine"

Let's make it stupidly simple with a "Driver's License" analogy...

You need a driver's license. If you're American, that means you need to go to the DMV.

Ethereum is like the DMV.

It's SLOW (~15 transactions per second) & EXPENSIVE ($10-$100 gas fees)

Polygon's new thing is gonna make it 2-3X faster and ~10X cheaper to use Ethereum.

The key details:

It's compatible with ANY solidity smart contract (devs don't need to change their code)

It uses ETH as the gas token (no new token required)

Code is open source, and available now— test net in a few weeks. Full launch early next year.

This is big because people have been excited about "zero knowledge" methods, but most people thought it was still ~1-3 years away.

Updates: Recent Crypto Market Insolvencies & Subsequent Fallout

3AC (Three Arrows Capital)

The Block: Three Arrows founders tell Bloomberg 'the whole situation is regrettable'

Three Arrows Capital had positioned itself for a market that “didn’t end up happening” and “the whole situation is regrettable,” co-founders Zhu Su and Kyle Davies tell Bloomberg. The pair is heading for Dubai to avoid the “crazy people in crypto that kind of made death threats.”

Coinbase

Good news for Coinbase (COIN): The crypto exchange had no financial exposure to Three Arrows and the contagion that spread to Celsius and Voyager. Brandy Betz reported on the issue, but noted that the exchange did make non-material investments in Terraform Labs and has been hurt by the overall crypto decline. -CoinDesk

SkyBridge

CoinCodeCap: Scaramucci’s SkyBridge Capital Halts Withdrawals in Funds with Crypto Exposure

The TerraUST/Luna implosion in May has destructed the crypto market like never before. The crash affected crypto lending platforms, hedge funds, institutional traders, and investment management firms alike.

Terra/LUNA

CoinCodeCap: Authorities Raid South Korean Crypto Exchanges in Terraform Labs Probe

Authorities inspected local cryptocurrency exchanges on Wednesday as part of a fraud probe into the demise of Terraform Labs’ digital currencies, TerraUSD and Luna, according to police. Around 5 o’clock in the evening, a team of detectives from the Seoul Southern District Prosecutors Office reportedly began obtaining transaction information and other materials from Upbit and other local exchanges as per reports from a Korean agency.

Voyager

CoinCodeCap: Voyager Declines Alameda-FTX Proposal to buy its Assets, Calls it a Low-ball bid

Battered crypto lender Voyager Digital has rejected the buyout offer of Sam Bankman Fried’s FTX and its investment firm Alameda Ventures. The crypto lender has described the offer as “not value-maximizing” and called it a low-ball bid.

It seems FTX CEO Sam Bankman-Fried isn't happy about Voyager's rejection. In a Twitter thread, he criticized the company's handling of its bankruptcy process. He claims Voyager still has most customer funds left — and they should be distributed to users now while they wait for the rest to be recovered from Three Arrows Capital. SBF went on to warn that a bankruptcy can take years — pointing to Mt. Gox, which went bust in 2014 — as an example. The billionaire suggested his plan could get Voyager users up to 75% of their funds back immediately, adding: "In the end, we think Voyager's customers should have the right to quickly claim their remaining assets if they want, without rent seeking in the middle. They've been through enough already." -CoinMarketCap

Blockworks: 🟪 Regulation anarchy

**Beginner**

Byron Gilliam reviews the SEC’s arbitrary crypto regulation.

The SEC is regulating crypto by enforcement. And it feels arbitrary.

Instead of writing a new set of rules as to what makes a digital asset a security, we have to parse every complaint they file to see how the 76-year-old Howey Test is being applied.

The good news is that we have a lot of new information to go on: In last week’s complaint against three Coinbase employees accused of insider trading, the SEC spells out its case for why each of nine crypto tokens the employees traded are securities under Howey.

The bad news is that their reasoning is so broad that almost anything could be considered a security.

And maybe that’s right; maybe every digital asset outside of BTC and ETH really is a security.

But their method of letting us know that still feels arbitrary:

Unlucky: You’re a security because someone happened to front run your Coinbase listing.

Lucky: You’re already listed on Coinbase, so not a security!

Regulation should have less to do with luck and more to do with logic.

But this is where we are, so let’s see what we’ve learned from the latest SEC complaint. (I’ve already used half my word count on that silly trading-desk story, so I’ll be brief!)

Reading the Tea Leaves

Below, in italics [bulleted], are some lowlights from the SEC’s complaint, followed by my personal takeaways.

Note that everything I know about the law I learned from TV, so this is the furthest thing imaginable from legal advice. But I’m hoping my take will give you a flavor for the current state of crypto regulation without having to read any SEC docs yourself.

On October 20, 2021, the same day as a Coinbase listing announcement, Nikhil messaged Ishan’s foreign phone a dollar sign and the eyes emoji: “$ 👀👀.

Takeaway: Emojis can and will be used against you in a court of law.

Each of the nine companies invited people to invest on the promise that it would expend future efforts to improve the value of their investment.

Takeaway: Protocols are companies? The Howey Test is meant to determine whether an offering is an investment contract. But if protocols are companies, what do we need Howey for? Everything’s a security.

Investors in RLY had a reasonable expectation of profits based on the efforts of others…Rally stated: “Tokenomics play a fundamentally important role in the success or failure of a crypto project.”

Takeaway: Anything with tokenomics (i.e., everything) is well on its way to being a security.

Purchasers of Flexacoin/Amp tokens invested in a common enterprise. In its November 2020 Amp white paper, Flexa explained that “participants stake Amp into pools that secure the network.”

Takeaway: Staking is not a loophole through which protocols can return earnings to token holders.

Amp investors also share a common interest with Flexa’s management team. Flexa explained…that 20% of the total percentage of Flexacoin was reserved for the Founding Team.

Takeaway: Any distribution to team members fulfills the common-enterprise clause of Howey.

The May 2019 Flexacoin white paper devoted an entire section to “Our team.”

Takeaway: If you still have a “team,” you’re probably a security.

Flexa stated [in a Medium post] that “we take our responsibility to the Flexa community very seriously”…Flexa stated in a YouTube video, “we built this network from the ground up” and “we’ve created an open network.”

Takeaway: The SEC will scour YouTube, Medium and Twitter for mentions of “we.”

DerivaDEX claims on its website that the DDX token is a so-called “governance” token for DDX.

Takeaway: The use of quotation marks here suggests the SEC thinks governance tokens are about as real as the Loch Ness monster. You’re either a utility token or a security.

DerivaDEX has posted an audio recording featuring the CEO and the product lead discussing development plans that have no firm timeline.

Takeaway: The complaint refers to the CEO of DEX Labs (the development company) as if he’s the CEO of DerivaDex (the protocol). If labs CEOs are conflated with protocol CEOs, probably everything is a security.

All of the development plans that DerivaDEX has described depend entirely on the efforts of its management team and the affiliated entities.

Takeaway: Everything short of voting on pre-written code will be considered “efforts of others.”

XY noted: “Some folks just want to buy XYO Tokens to see if they can make a profit from trading.” XY claimed that was “not the intended purpose of an XYO token.”

Takeaway: Don’t acknowledge that a token could ever go up for any reason. Or even just accidentally.

Shortly before the ICO, XY provided a “Roadmap” with target dates for XY’s plans to develop the business.

Takeaway: Your protocol had better be fully functional, in no need of a roadmap, before a token is tradeable.

XY has obtained listings for XYO on multiple trading platforms and publicized those listings via social media channels.

Takeaway: Don’t even acknowledge your token is tradeable!

Rari has continued to use funds raised by selling RGT to pay Rari’s management team and developers.

Takeaway: All contributors should be volunteers, I guess?

Rari explained that 70% of Rari’s profits would be used to “burn” and buyback RGT tokens.

Takeaway: Buybacks are a form of capital return. (Same as TradFi.)

The Rari CEO stated that the goal … is to “provide exponential returns to RGT holders … Rari stated on their homepage: “The more money you make, the more money we make” … Rari has often referred to participation in the RGT buying programs as an “investment” … and RGT holders as “shareholders.”

Takeaway: Ok, fine. That one’s definitely a security!

The SEC has some legitimate gripes here. Some things really are securities by any reasonable definition.

But applying 76-year-old case law, originally meant for orange groves, on an ad-hoc basis? That’s not the way to regulate a whole new asset class.

Let’s do better before crypto’s lightly regulated free market turns into an unregulated black market.

The Milk Road: ONE MAN, TWO ROBOT DOGS, AND 8,000 LOST BTC

**Beginner**

A quick and fun read about James Howell’s attempt to find his lost hard wallet with ~175mm of BTC on it.

This is the story of one man, two robot dogs, and a mission to find 8,000 lost BTC.

James Howells has been in crypto for a while. Mining Bitcoin as early as 2009. But one day he was doing some cleaning and accidentally threw away his hard drive with 8,000 BTC on it…. (which would be ~$175m today)

Now James has a plan to find it and he’s raising $11m to do it.

The plan includes a combo of human sorters, robot dogs, and an A.I-powered machine trained to look for hard drives. Here’s the masterplan:

Two Robot Dogs will be sweeping the landfill for anything that looks like a hard drive during the day. At night they function as mobile CCTV patrols to make sure no one tries to search for his hard drive

Human Sorters consist of a team of 8 experts that specialize in everything from landfill excavation to waste management. One of them even helped find the famous black box from the crashed Columbia space shuttle

A.I-Powered Machines have been trained to spot hard drives that look like the one James lost. Then a mechanical arm will pick out any contenders for the humans to sort through

What will James do with the money if it's found?

30% stays with him

30% goes to the recovery team

30% back to investors

The rest will go to locals. James wants to give all 150,000 people in his city of Newport, Wales some Bitcoin

James is taking dumpster diving to a whole new level.

The Milk Road: A NEW STORE: SOLANA SPACES

**Beginner**

Self-explanatory.

The Apple Store is one of the slickest stores ever designed.

Now, Web3 is getting its own version - Solana Spaces. That’s right, Solana is opening up an IRL store in New York.

The goal? Onboard new users into the Solana ecosystem.

At the store you can:

Learn how Solana works

Get your first wallet set up

Buy your first NFT

Make your first crypto transactions

Like the genius bar, for crypto.

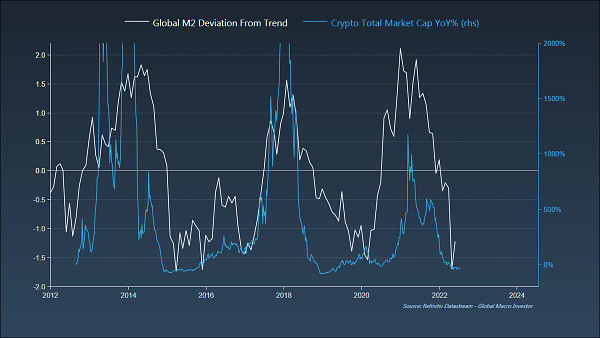

The Milk Road: VITALIK TALKS ABOUT THE FUTURE OF ETHEREUM

**Intermediate**

Vitalik’s insights on the future of ETH at ETHCC conference.

Yesterday [7/21] was the final day of the ETHCC conference.

The Merge is just the first major upgrade. Ethereum will move from proof-of-work → proof-of-stake during this phase.

But Vitalik says the roadmap is only 55% done after the Merge. There are 4 more stages… The surge, the verge, the purge, and the splurge are next.

Once those are done - Ethereum will be 100% complete with the roadmap. Making it faster, cheaper, more secure, and more scalable.

Let's break down each stage:

The Surge - increasing scalability through "sharding" - where the network gets split into pieces called shards to create smaller, faster, more manageable parts.

The Verge - optimize storage through Verkle Trees. This will reduce node sizes and help Ethereum become more scalable.

The Purge - reducing excess historical data. The goal is to decrease the hard drive space needed for validators and reduce network congestion.

The Splurge - making smaller updates to ensure everything runs smoothly from previous updates. Vitalik calls this "the fun stuff" since all the hard work is done by this stage.

“By the end of its roadmap, Ethereum will be able to process 100,000 transactions per second”.

More Details:

Actions:

I removed a majority of my crypto assets from centralized platforms as insolvency dominoes play out in the market.

Airdrops

Galaxy Digital: 🌟 Starknet Token Confirmed

StarkWare outlines decentralization path with new token & formation of StarkNet Foundation. As background, StarkWare is building a L2 on top of Ethereum in the form of a STARK-powered ZK rollup. StarkWare built StarkEx and StarkNet, which together are home to popular applications including dYdX, ImmutableX, DeversiFi, and Sorare.

StarkWare’s announcement outlines the roadmap towards the decentralization of StarkNet, which includes the creation of the StarkNet Foundation to oversee the development of the protocol and a new token to be used for governance and to pay for gas fees. The Foundation will be responsible for developing the community decision-making process around protocol upgrades, working on the protocol upgrades, creating a system for dispute resolution, and funding public goods on StarkNet.

Buying Liquidations

Liquity (Disclaimer: I lend & stake on Liquity)

Borrowing: Borrow against ETH to get Liquity’s stablecoin (LUSD), which you can swap to USDC and convert USD. The collateralization ratio minimum is 110%, meaning if you borrow against $11k worth of ETH, you can receive up to 10k worth of LUSD. If ETH’s price increases, your collateralization ratio increases (good). If ETH’s price decreases and your collateralization ratio drops below 110% (bad), your ETH will be liquidated and bought by stability pool lenders, but you keep your LUSD.

Lending: Lend Liquity’s stablecoin (LUSD) to the stability pool to earn an APY in Liquity’s native token (LQTY). Lending to the stability pool requires lenders to absorb and cancel debts that drop below 110% collateralization (ETH). This means your LUSD loan, will be converted into ETH on a pro rata basis.

Delphi Digital on Liquity

Liquity is a decentralized borrowing protocol that allows users to draw interest-free loans against Ether used as collateral. Loans are paid out in LUSD (a USD pegged stablecoin) and need to maintain a minimum collateral ratio of 110%. In addition to the collateral, the loans are secured by a Stability Pool containing LUSD and by fellow borrowers collectively acting as guarantors of last resort. Liquity as a protocol is non-custodial, immutable and governance-free. Learn more about it here

Stability Pool:

The Stability Pool absorbs and cancels debt from liquidated Troves – similar to collateral auctions in MakerDAO

The Stability Pool replaces these auctions by allowing LUSD holders to commit capital upfront in order to “buy” liquidated ETH and offset the bad debt

In general, Stability Providers will receive more ETH (in $ terms) than LUSD burned which gives them discounted ETH

LQTY rewards are distributed pro rate to Stability Providers for the duration of their deposit:

The more LUSD a user has in the pool and the longer they keep it deposited, the more LQTY rewards they receive

Risks:

By committing capital upfront to “buy” liquidated ETH, users are also committing to buying ETH during price drops:

This means that it’s possible for the ETH that users receive to be worth less shortly after receiving it due to a quick price drop.

DeFi

Governance

Resources

Security

Staking

Acala (ACA) Staking, if you participated in the Polkadot (DOT) crowdloan

Moonbeam (GLMR) Staking, if you participated in the Polkadot (DOT) crowdloan

Adoption (or Not):

ELON SELLS: Tesla sold most of its bitcoin holdings in the second quarter to boost its cash position, given the uncertainty around COVID-19 lockdowns in China. But CEO Elon Musk said Tesla is open to increasing its bitcoin holdings again in the future.

The numbers: Tesla offloaded $936 million worth of bitcoin, or 75% of its holdings. It didn’t sell any of its dogecoin holdings.

Meanwhile, SkyBridge Capital, run by bitcoin supporter and former Donald Trump official Anthony Scaramucci, is planning a Web3 fund. Earlier this week, SkyBridge suspended withdrawals from another fund because of steep losses. -CoinDesk

Saylor attacks Tesla for Bitcoin sale 👀

Michael Saylor has lashed out at Tesla for selling 75% of its Bitcoin. The MicroStrategy CEO has long been one of the most bullish voices in the crypto space. Indicating he's pretty exasperated about Elon Musk's decision to unlock liquidity for Tesla by offloading its crypto investment, Saylor wrote: "If you sell 75% of your Bitcoin, you will only have 25% of your Bitcoin left." It's fair to say that MicroStrategy has taken a very different approach to Tesla when it comes to acquiring Bitcoin. The business intelligence firm has actively taken on additional levels of debt to ensure it can get its hands on even more cryptocurrency. -CoinMarketCap

HQLAᵡ, the distributed ledger-based tokenization platform, has executed its first agency securities lending transaction between BNY Mellon and Goldman Sachs, both investors in the company. The 35-day term transaction was for hundreds of millions of dollars.

The primary purpose of HQLAᵡ is to save money for big banks that have to keep high quality liquid assets (HQLA) for Basel III balance sheet compliance. To date, the platform has allowed banks to swap HQLA between each other to get the right mix of assets on a delivery versus delivery basis. Today’s news is it is also enabling agency securities lending.

CoinCodeCap: French Banking Giant BNP Enters Crypto Custody Realm

Given the ongoing bear market in cryptocurrencies, BNP Paribas, a French multinational banking institution, is said to have partnered with Swiss company Metaco to provide crypto custody services.

Chipotle has announced that it's giving away $200,000 in free crypto through an online game called "Buy the Dip." The premise is fairly simple: Players are presented with a crypto trading chart, and watch as prices rise and fall. They need to hit stop whenever they believe the market is bottoming out. Bitcoin, Ether, Solana, Avalanche and Dogecoin prizes are on offer every day until July 31. Not everyone is a fan of Chipotle's latest promotion — including The Verge's Elizabeth Lopatto. She argues that this game is "irresponsible at best" because of how it's difficult to time the market, and this could result in everyday consumers losing money through crypto investments. -CoinMarketCap

Centralized Entities:

Blockchain.com downsized its workforce by 25%, equating to roughly 150 people.

TAKEAWAY: In the past 16 months, Blockchain.com grew from 150 employees to more than 600, but with recent brutal bear market conditions, Blockchain.com will close its Argentina-based offices, cancel team expansion plans in several countries and reduce salaries of its executives. The exchange recently revealed it was dealing with a $270 million shortfall from lending to beleaguered hedge fund Three Arrows Capital. Read more here. -CoinDesk

The Block: Coinbase stock opens down over 7% as the exchange faces SEC scrutiny

Coinbase was down 7.71% at the open on Tuesday following news on Monday that the Securities and Exchange Commission (SEC) is investigating the exchange.

According to a report from Bloomberg, the SEC is investigating Coinbase for improperly allowing trading of several tokens that should have been registered as securities.CoinCodeCap: The Trade Republic, Crypto.com Registered as Crypto Operator in Italy

The Trade Republic, a German investment platform, and Crypto.com, a Singapore-based digital currency exchange, both announced on Tuesday that they have registered as crypto operators in Italy. The move comes after other significant cryptocurrency companies, including leading U.S. trading platform Coinbase and the largest exchange in the world by trading volume, Binance, did the same previously.

Musk isn't the only one offloading Bitcoin right now. Finland's confirmed that it has sold off 1,900 BTC seized through drug-related crimes for $47 million. Two crypto brokers offered their assistance with the transaction. The funds are now going to be donated to Ukraine. While this is the single biggest contribution that the country has received, the value of Finland's Bitcoin has fallen substantially since its plans were announced earlier this year. Had it been sold when BTC hit all-time highs of $68,700 last November, the crypto stash would have been worth over $130 million. -CoinMarketCap

Crypto Markets:

Decentral Park Capital: Top 100 (7d %) as of 7/25:

Quant (+38.5%)

Aave (+33.3%)

Internet Computer (+27.7%)

Uniswap (+25.8%)

Polygon (+20.8%)

BEAR OVER? JPMorgan Chase said demand among retail investors for crypto is improving, and the "intense phase" of deleveraging appears to be over. Improved investor sentiment and increased demand ahead of the Ethereum Merge have sparked a market recovery.

An alternate view: Bank of America's monthly fund manager survey shows dire levels of investor pessimism and increased preference for cash. BofA's “Bull and Bear Indicator” remained "max bearish." -CoinDesk

CoinCodeCap: According to Grayscale, the Crypto Bear Market Might Continue for Another 8 Months

The $22k resistance mark was breached by Bitcoin once more, sparking suspicions that the currency has bottomed out. On the basis of prior market cycles, Grayscale has however predicted in a report that the bear cycle may continue for a further 250 days

Deals/Funding:

FTX is seeking a fresh round of funding, according to a report from Bloomberg. Can you blame them? The company and its majority owner Sam Bankman-Fried, who reportedly owns more than 50% of the company, have doled out commitments to spend approximately $1 billion in the past month to bail out bleeding lending companies. FTX could use some cash!

The most important detail: the company is reportedly targeting the same $32 billion valuation as its January funding round, even after the crypto rout. That would value it at twice the price that Coinbase is trading at in the public markets. And recall that FTX has somewhere between 200-300 employees and Coinbase has roughly 5,000 (it had a lot more until last month, when it laid off 18% of its workers). FTX seems to be doing a lot more with less.

Of course, there’s no guarantee FTX will get the valuation it’s looking for. That’s the risk of fundraising in the current environment. Though my sense is Bankman-Fried isn’t too worried. There’s plenty of dry power around to spare, what with crypto venture capitalists having raised many new mega funds as of late. FTX will likely be a hot commodity. -The Information

ANOTHER DIEM, ANOTHER DOLLAR: Layer 1 blockchain Aptos Labs, a project looking to resuscitate Facebook’s mothballed Libra project, raised $150 million in a Series A funding round led by FTX Ventures, the venture capital arm of crypto exchange FTX, and Jump Crypto. Aptos Labs has now raised $350 million this year, looking to bring the Diem blockchain back to life.

Separately, U.K. bank Barclays is expected to invest "millions of dollars" in cryptocurrency custody firm Copper. The funding round values the company at $2 billion and is expected to close in the coming days.

Also, investment bank Moelis & Co. has started a group to focus on venture deals in the blockchain and digital asset industry. -CoinDesk

DeFi:

Decentral Park Capital: DeFi Top 100 MCAPs (7d %) as of 7/25:

Convex Finance (+41.6%)

GMX (+36.2%)

Aave (+33.3%)

Neutrino System Base (+28.2%)

The Block: Lido DAO voting on proposed $14.5 million token sale to Dragonfly Capital

The Lido community is voting whether to approve a token sale to Dragonfly Capital.

Lido is planning to liquidate 2% of the total LDO token supply to diversify its treasury via the DAI stablecoin.

This token sale is half of Lido’s proposed treasury diversification proposal. The complete plan is to sell 20 million Lido DAO (LDO) tokens at a flat rate of $1.45. Half of this allocation will go to Dragonfly if the vote passes.

The Block: Lido DAO votes no to selling $14.5 million in LDO tokens to Dragonfly Capital

The vote ended with almost a two-thirds majority against the proposal. Lido was planning to sell 10 million LDO tokens at a flat rate of $1.45 per coin to Dragonfly Capital.

Hacks/Exploits:

AUDIUS HACK: About $1.1 million worth of Audius’ AUDIO tokens were stolen in a sophisticated attack that involved the project’s governance forums this weekend. The exploit involved attackers passing a malicious governance proposal by exploiting smart contracts. -CoinDesk

Layer 1s:

Mining:

The Block: Bitcoin network difficulty dips 5%, the largest drop in months

As the bitcoin network’s hash rate has fallen 8.9% since July 6, mining difficulty also went down by 5.01%. This was the biggest drop since July of last year when China’s crackdown on Bitcoin mining caused the network’s hash rate to plunge.

Regulation:

The Block: California ends ban on crypto campaign donations

California’s campaign regulator ended a years-long ban on crypto donations this week. Campaigns will soon be able to accept crypto through a payment processor, according to a regulation approved by the state’s Fair Political Practices Commission.

The Block: US ethics agency issues new rules for employees who own NFTs

The Office of Government Ethics, which oversees the executive branch, released new guidance for public financial disclosure filers who own NFTs.

Filers should report NFTs that are worth more than $1,000 or have generated over $200 in investment income, according to the legal advisory.

Ex-Coinbase employee charged… 😱

A former Coinbase employee has been charged with insider trading of cryptocurrencies. It's alleged Ishan Wahi was involved in the "highly confidential process" of deciding which coins would be listed on the exchange — and when. Prosecutors claim he shared secret information with his brother and a business associate, who ended up making $1.5 million in gains by trading 25 cryptocurrencies. All three men could face 20 years behind bars if convicted. U.S. Attorney General Damian Williams said this is the first insider trading case involving the crypto markets, adding: "Today's charges are a further reminder that Web3 is not a law-free zone." -CoinMarketCap

The Securities and Exchange Commission has also brought charges over this case. But there's a particular line in the court filing which has caused alarm bells. According to the SEC, at least nine digital assets listed on Coinbase are securities. They are AMP, DerivaDEX, DFX Finance, LCX, Kromatika, Powerledger, Rally, Rari Governance Token and XYO. The agency explained that these altcoins contain "the hallmarks of the definition of a security." Coinbase has shot back by saying none of the assets listed on its trading platform are securities. It added: "The SEC charges are an unfortunate distraction from today’s appropriate law enforcement action." -CoinMarketCap

According to an announcement shared with The Block, Senators Pat Toomey and Kyrsten Sinema have introduced the Virtual Currency Tax Fairness Act, which establishes a de minimis exemption from reporting taxes on purchases made in crypto.

The Block: Central African Republic begins public sale of Sango Coin

The Sango project has sold 5.25% of the tokens, as of the time of publishing. This means the project has raised a little over $1 million in the first 24 hours of the public sale. The project plans to raise more than $1 billion from the token sale that will last for one year.

CRYPTO ON CREDIT: Taiwan's Financial Supervisory Commission is looking to stop the use of credit cards for crypto purchases. In recent months regulators worldwide have been speeding up crypto rules amid the industry-wide devaluation. -CoinDesk

Paraguay’s legislature approved a crypto taxation and regulatory framework that would be a boon to Bitcoin mining in the country. -Nexo

South Korea has postponed the implementation of a new 20% tax on crypto until 2025. -Nexo

India’s central bank wants to ban cryptocurrencies, the govt told the parliament, raising more uncertainty about the future of the nascent virtual digital asset in the world's second largest internet market. The minister of finance in India said that the Reserve Bank of India has expressed concerns about the “destabilizing effect of cryptocurrencies on the monetary and fiscal stability of a country” and has recommended “for framing of legislation on this sector." (YAHOO) -LionTree

Security:

Stablecoins:

Web3/NFTs:

Emerging Technology & Venture Capital

EV Updates:

Gasoline company Shell is trying to diversify by making electric scooters / The Verge -Movements Substack

TIER's light electric vehicles will now be accessible to billions of super app users around the world thanks to a deal with Splyt / ZAGDaily -Movements Substack

Chinese automaker Xiaomi will unveil a prototype of its first electric vehicle at the end of August / FirstPost -Movements Substack

Macro & Markets

Blockworks’ Byron Gilliam: 🟪 Mission accomplished?

**Beginner**

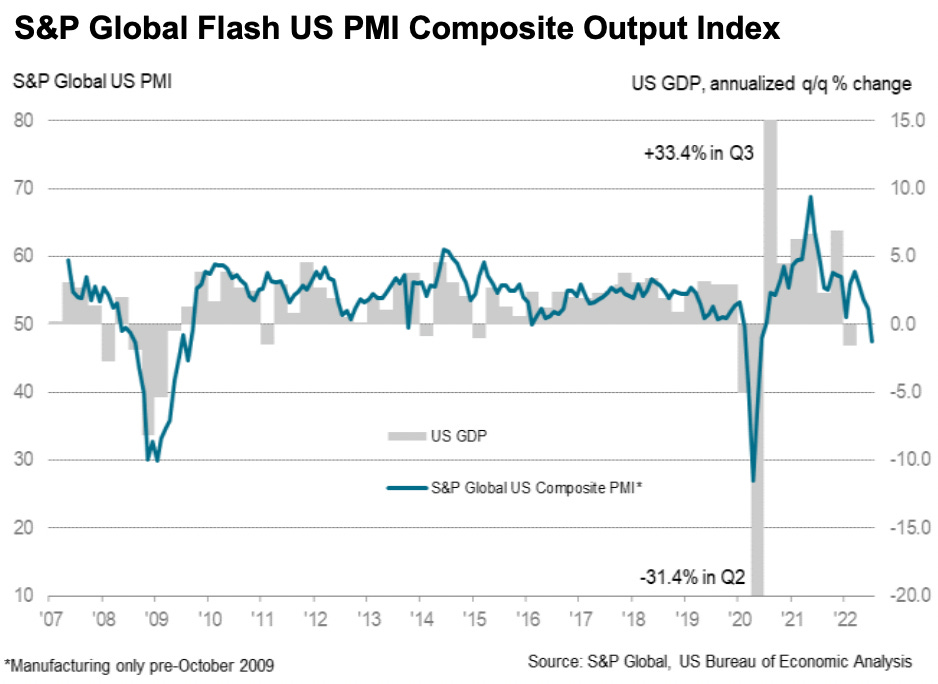

Some recent macro charts indicating inflation is turning lower.

Futures markets have been telling us for some time now inflation would turn lower sooner rather than later. Businesses are now saying the same.

This morning’s PMI survey data showed the first contraction in business activity since the pandemic, with respondents asserting that disinflation is already here: “The weakening demand environment has helped to alleviate inflationary pressures … the rate of inflation [is] still running high by historical standards but [is] now down to a 16-month low.”

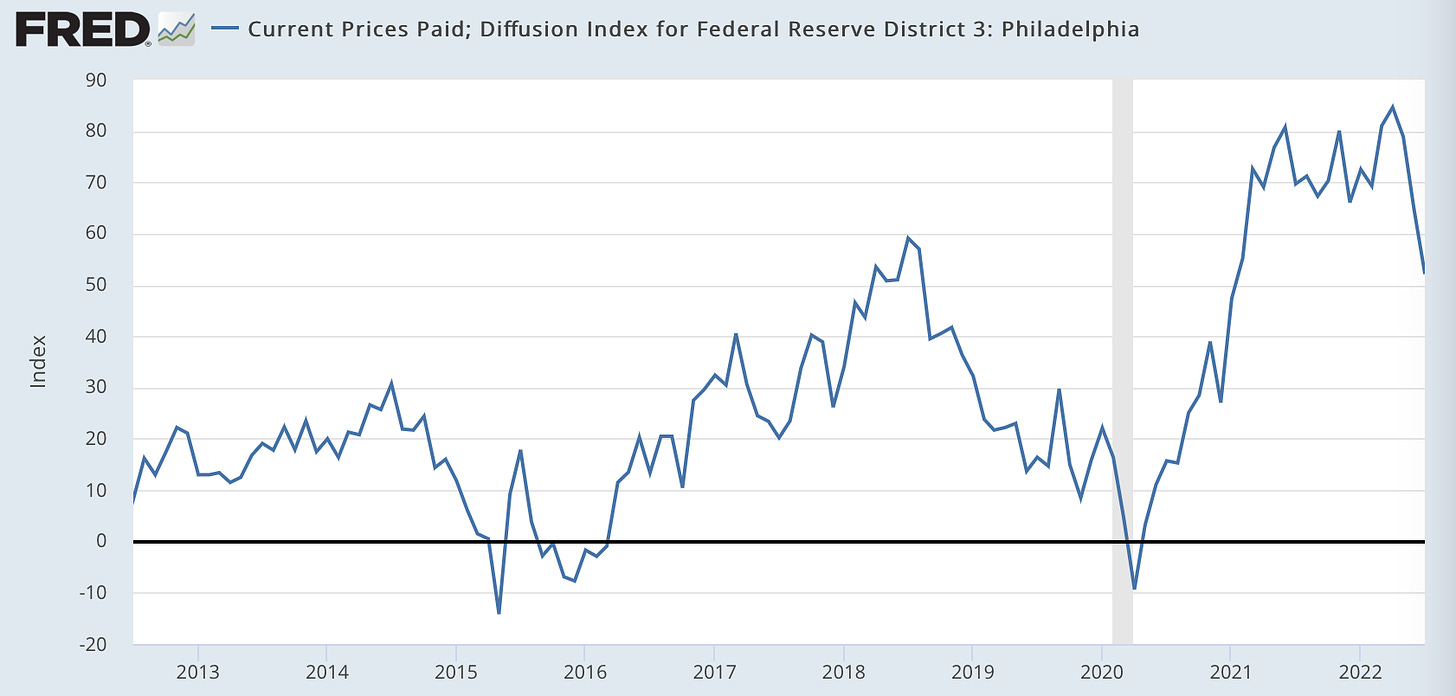

The Fed’s Prices Paid index for the Philadelphia region (the most recent data), suggests prices are already falling (from admittedly high levels).

The Fed’s Future Prices Received index shows businesses expect prices to fall further:

Prices received falling faster than prices paid does not bode well for corporate profitability — a reminder that in P/E terms, disinflation is good for the numerator (price), but bad for the denominator (earnings).

Business inventories rose 17.7% in May (and presumably more in June and July). Retailers won’t worry much about 9% CPI when they are having to cut prices to get you to buy anything.

If you do buy their inventory, they won’t have trouble getting more:

The cost of shipping freight from China to the US (blue line) has fallen 65% from September highs. And that’s despite all the ongoing Covid-related port closures.

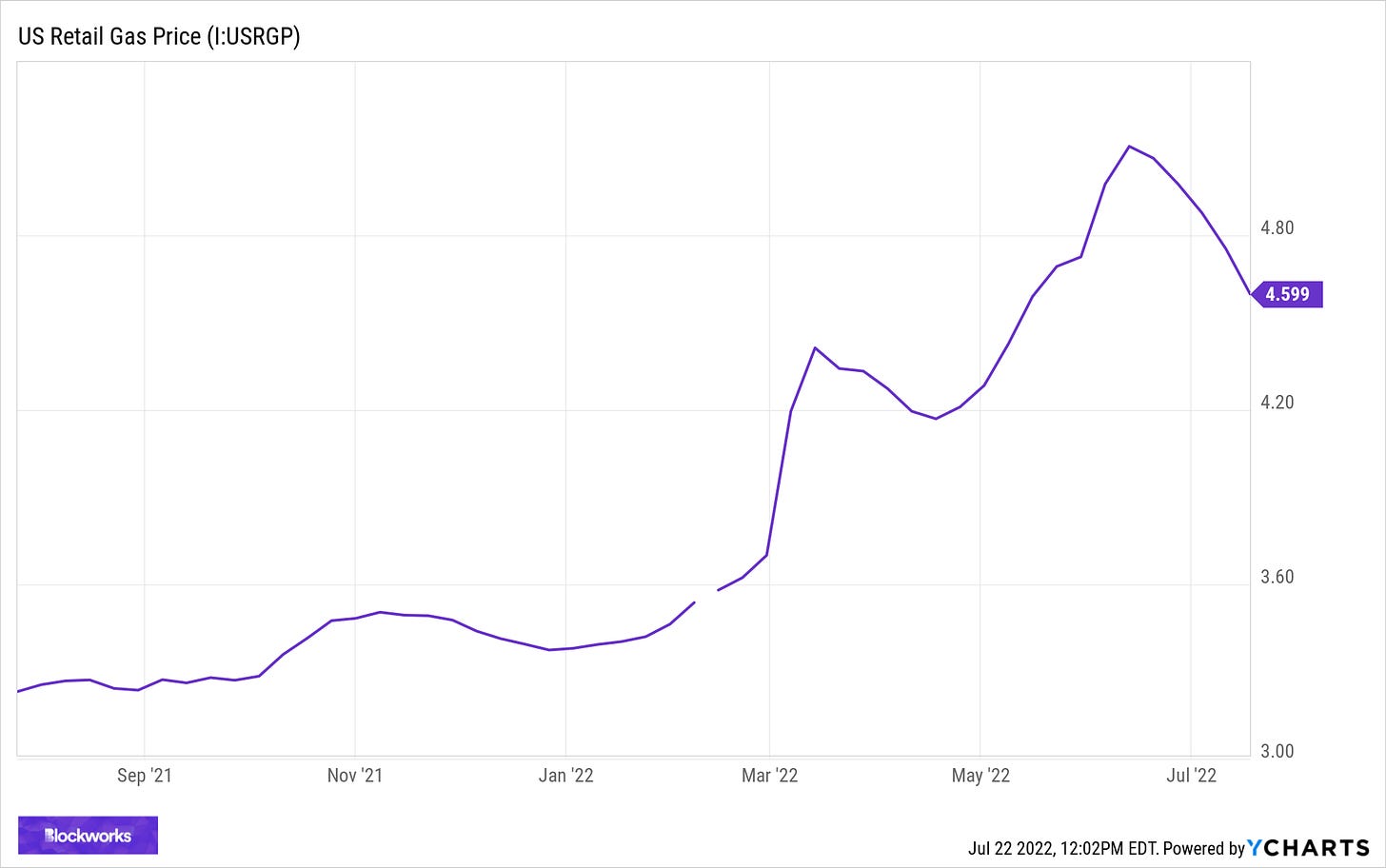

US gasoline prices have fallen for 39 straight days (39!) — from $5.10 on June 13 to $4.60 today. Inflation expectations — the Fed’s biggest worry — are sure to follow.

Our housing expectations have already followed:

The housing bubble is bursting, just like the Fed asked it to.

So, how long will we have to wait until the Fed changes its tune?

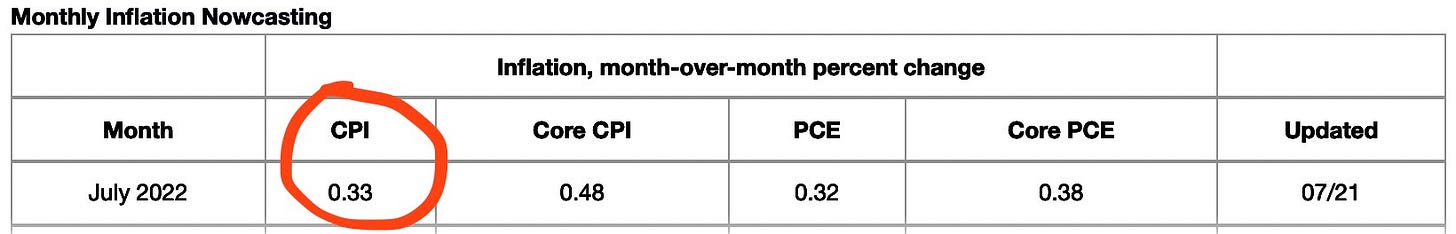

The Cleveland Fed’s Inflation Now model sees the upcoming CPI print at just 0.33% month-on-month, down nearly a full point from June's 1.3%.

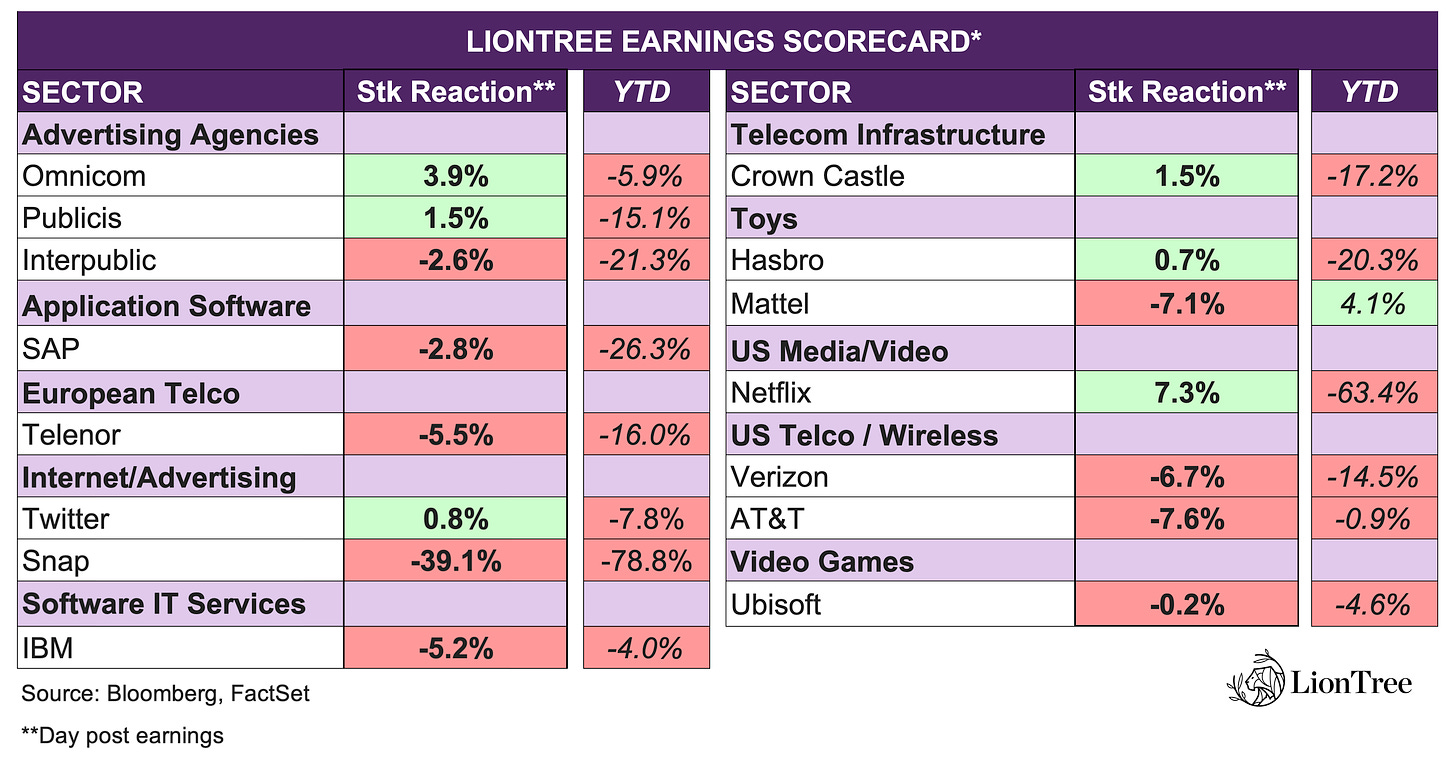

LionTree: Earnings Scorecard & Stock Market Check

Companies:

Seeking Alpha: Walmart makes waves

Retail stocks are under pressure premarket Tuesday after Walmart (WMT) laid out a dismal consumer landscape when it preannounced results late yesterday. The retail giant cut its Q2 and full-year profit outlook, noting that while it is attracting customers, their spending is eaten up by higher food and gas prices. That's forcing markdowns in other items like apparel, hitting Walmart's margins.

"The increasing levels of food and fuel inflation are affecting how customers spend, and while we’ve made good progress clearing hardline categories, apparel in Walmart U.S. is requiring more markdown dollars," CEO Doug McMillon said. "We’re now anticipating more pressure on general merchandise in the back half."

Walmart is down 10% before the bell. Major retailers followed, with Target (TGT) down 5% and Amazon (AMZN) off 4%. Grocery stocks like Kroger (KR), down 3%, are also under pressure after Walmart specifically cited high food prices. To put the move into perspective, while today would be the second time this year WMT has gapped down 7% or more at market open, that has only happened 10 times since 1985, according to Bespoke Investment Group.Seeking Alpha: Musk takes the mic

Tesla (TSLA) weaved in and out of traffic in after-hours trading on Wednesday, ultimately settling up 1.5% at $753/share. The electric vehicle maker posted stronger than expected financials, with adjusted EPS of $2.27 (+57% Y/Y) on revenue of $16.9B (+42% Y/Y). The strong bottom line figure appeared to put to rest some concerns about the "gigantic money furnace" gigafactories in Austin and Berlin, while free cash flow rose above estimates at $619M (vs. consensus forecasts of $500M).

Changing lanes: While prices for Tesla cars are up 25% to 30% from a year ago, the firm's automotive margins compressed to 27.9% in Q2. The margins also fell below the 32.9% number that impressed in the first quarter, and 28.4% notched in 2021. The EV maker previously reported a disappointing quarterly delivery figure of 254,695 vehicles and is facing headwinds that include higher raw material and logistics costs.Tesla secured a fast lane at the Mexico border. The border crossing in the state of Nuevo Leon has a lane exclusive for Tesla and its suppliers, according to Bloomberg. -Quartz

Seeking Alpha: Snap!

The tech sector rallied broadly on Thursday, with the Nasdaq ending the session up 1.4%, until Snap (SNAP) sharply dented sentiment with its quarterly results. The Snapchat owner posted its weakest-ever quarterly sales growth as a public company, with revenue that increased just 13% in Q2 (7 percentage points below the low end of its April forecast). Net losses swelled by 178% Y/Y to $422M, prompting shares to plunge 27% in extended trading, after losing nearly three-quarters of their value over the past year.Amazon announced a $3.9 billion deal to buy One Medical. If approved, the acquisition of the healthcare company would expand Amazon’s footprint in the industry. -Quartz

A drone delivery service from Amazon is coming to Texas / TechCrunch -Movements Substack

Amazon wants 100,000 delivery vans -- can Rivian deliver? (link). 'Amazon has said it doesn’t expect all 100,000 trucks to be delivered until the end of the decade. In a November securities filing, Rivian said it planned to deliver the 100,000 trucks by 2025.' -Trucks FoT

Apple plans to slow hiring and spending growth next yr in some units to cope w/ a potential economic downturn. The potential move would see Apple join a growing pool of American corporations, including Meta Platforms and Tesla, in slowing hiring. The changes would not affect all teams, and Apple is still planning an aggressive product launch schedule in 2023 that includes a mixed-reality headset, its first major new category since 2015. (Reuters) -LionTree

Apple is reportedly the frontrunner to secure rights for NFL Sunday Ticket. According to Dylan Byers at Puck News, Apple is now regarded as the "most likely winner" of the NFL Sunday Ticket package for out-of-market games after Disney dropped out. Byers also reported that w/ bidding approaching $3bn per yr, the race has come down to Apple and Amazon, as Fox, Comcast, and CBS are not in contention. (MacRumors) -LionTree

Mattel hopes the Barbie movie will boost doll sales. The toy maker saw a 20% rise in sales, but these were driven by Hot Wheels and other brands. -Quartz

A total of 550 women passengers across the United States are suing Uber, alleging that drivers assaulted them / TechCrunch -Movements Substack

DoorDash will require drivers to scan customer’s ID when delivering alcohol, a new policy intended to crack down on underage alcohol purchases / The Verge -Movements Substack

The Department of Energy handed GM its first green energy loan in a decade. The government program that benefited Tesla’s development has been resurrected. -Quartz

Ford discusses its battery supply plans, including a move to add lithium iron phosphate (LFP) from CATL in addition to its current nickel cobalt manganese (NCM) chemistry (link). 'By late 2023, Ford plans to have enough battery supply so that it can support the production of 270,000 Mustang Mach-Es, 150,000 Transit EVs, 150,000 F-150 Lightnings, and 30,000 units of a mystery all-new midsize SUV destined for release in Europe.' -Trucks FoT

GM, Ford seek U.S. OK to deploy AVs without steering wheels (link). 'Both automakers want to deploy up to 2,500 vehicles a year, the maximum allowed under the law, for ride sharing and delivery services. Neither seek approval to sell self-driving vehicles to consumers.' -Trucks FoT

Volkswagen Group CEO Herbert Diess departs (link). In a short run of just four years, the former BMW executive will be remembered for a host of changes -- from the reputational repair of the corporation in the wake of the diesel emissions scandal, to the pivoting to EVs, to a large joint venture with Ford for Argo, to many software projects and re-orgs. The new CEO will be ex-Porsche leader Oliver Blume. -Trucks FoT

Boeing defense workers in St. Louis decided to go on strike next month. Nearly 2,500 unionized workers at three facilities rejected a new contract. -Quartz

Virgin Atlantic to trial flying taxis in London. Virgin Atlantic Airways will carry out test flights using a flying taxi model from UK startup Vertical Aerospace, as the futuristic technology moves closer to becoming a reality. Virgin will operate one flight from the main airport in Bristol, England to an airfield elsewhere in the southwest. A second will link the carrier’s own London Heathrow hub and a so-called vertiport to be built by infrastructure specialist Skyports. (NEWS24) -LionTree

International:

Seeking Alpha: Grain export deal

An agreement to release 18M tons of wheat, corn and other crops from Ukraine is set to be signed today following the Russian invasion in February that blocked key ports in the Black Sea. It's a big deal for Ukraine, which has been traditionally referred to as the "Breadbasket of Europe," as well as many developing nations that rely on its grain across Africa, the Middle East and Southeast Asia. It also raises hopes that an international food emergency could be avoided, with prices spiraling in recent months and exacerbating an inflation crisis.

Snapshot: Officials from Russia, Ukraine and the United Nations all plan to be at the signing, which will take place around 8:30 a.m. ET. Substantial differences had remained in recent days over providing safe passage for cargo vessels, including how to demine ports and assure that private vessels aren't carrying military equipment. Enforcement will also be key, as well as how to prevent threats of further attacks.Russia resumed gas exports to Europe. As the EU urged member states to cut gas use by 15% until March, the Nord Stream pipeline restarted operations, but at 40% capacity. -Quartz

European Union Energy Crisis - The EU proposed a 15% energy cut as many countries in Europe begin to ration energy. Some even within the country suggest to utilize basketball courts as universal warming centers to save energy. -Closing Bell Gems Substack

CoinCodeCap: UK Inflation Hit 4 Decade High of 9.4% in June

Inflation rates worldwide are surging as geopolitical crises and market demands grip the economy. Recently, UK annual inflation surged to a fresh 40-year high in June of 9.4%. The consumer price index (CPI) rose 9.3% annually, up slightly from 9.1% in May.

Trouble in China - President Xi Jinping of China has a new set of troubles on his plate with middle class homeowners boycotting paying their mortgages on unfinished properties. This boycott spans across 91 cities in China and amongst many other macroeconomic headwinds, threatens China’s 5.5% annual growth target. -Closing Bell Gems Substack

China records lowest Q2 GDP growth since pandemic. The Covid-19 lockdowns in two of China’s most significant cities, Beijing and Shanghai, has caused China’s economy to plunge dramatically in Q2. This sets the government’s annual economic goals further out of reach. According to official figures, China grew by 0.4% in the three months leading up to June compared to the same period last yr. Full-year GDP growth forecasts are now reduced to 4%. (Retail in Asia) -LionTree

Macro/Markets:

FT: Investors cut equity allocations to lowest level since Lehman collapse

Fund managers reach ‘dire level’ of pessimism over economic outlook, Bank of America survey shows

“Any rally is likely to be temporary. The catalyst for a sustained recovery will be a change in monetary policy from the Fed when it sees that Main Street is suffering along with Wall Street. We are still some distance from the kinds of levels on the [US S&P 500 stock index] that would cause policymakers to panic and change course,” he said.

Seeking Alpha: The rate hike club

A big central bank meeting is on tap in Europe as inflation roils the continent and the euro remains on the backfoot. The ECB has been hesitant to get too aggressive on the monetary policy front - especially in comparison to the Federal Reserve - fearing a looming recession that was exacerbated by Russia's invasion of Ukraine. That stance may be changing, however, as the bloc clearly sees Moscow in the driver's seat in terms of natural gas supplies and even higher energy prices that could put it further behind the inflation curve.

Bigger picture: While the Fed began its latest rate hike cycle back in March, the ECB has yet to raise rates as it sought to prioritize economic growth. In fact, the last time the central bank raised rates was in 2011, in the aftermath of the European debt crisis. Over the past few months, the ECB warmed to the idea by telegraphing a 25 basis point hike, though a bigger 50 bps move has not been ruled out (and would be seen as a very hawkish signal by the markets).

Unlike the U.S., which makes up one large jurisdiction, the ECB's decision today will reverberate through 27 different member states and their economies. That could expose more indebted countries like Italy to financial trouble and weigh on peripheral bond yields as a whole. The situation remains even more precarious on word that Italian Prime Minister Mario Draghi (a former ECB president) would resign, prompting Italy's 10-year government bond yield to jump above 3.5% and the iShares MSCI Italy ETF (NYSEARCA:EWI) to slide 4.2% during yesterday's session.

Anti-fragmentation tool: Seeking to limit the spreads between yields across the eurozone, the ECB is also poised to unveil a new stimulus plan during today's meeting. Investors will be paying close attention to the details of the new bond-purchase program, including what assets policymakers are considering buying and under what circumstances. "While ECB President [Christine] Lagarde is likely to stress the temporary nature of the instrument - owing to the exceptional circumstances the euro area finds itself in - she will also underline the ECB's determination to secure the integrity of the monetary union, thereby trying to evoke a 'whatever it takes' spirit," wrote Dirk Schumacher, head of European macro research at Natixis.Seeking Alpha: The housing story

The overheated U.S. housing market is starting to cool down in what some in the industry are calling a real estate shakeout. Sales of previously owned homes fell 5.4% M/M in June to 5.12M units, according to the National Association of Realtors, and were 14.2% lower when compared to the same month a year ago. At those levels, sales fell to their slowest pace since June 2020, when buying activity dropped briefly at the start of coronavirus pandemic.

Bigger picture: Surging inflation is hammering potential buyers' purchasing power and rising interest rates aren't helping the situation. In fact, mortgage applications fell to a 22-year low last week, with the 30-year mortgage rate rising to 5.82% (compared to 3% at the start of the year). At the same time, the median existing-home price of all housing types climbed to $416K in June, from $407K in May (and surging from $285K just two years ago).The US has become the world’s largest exporter of LNG. Shipments to Europe have even surpassed what president Joe Biden had promised. -Quartz

The US treasury secretary insisted a recession is avoidable. Janet Yellen pointed to healthy labor market figures to support her argument. Plus, wealthy Americans are still borrowing money. -Quartz

Housing Cool Down - United States housing sales are down 21% as mortgage applications hit their lowest point since 2000 according to the National Association of Realtors -Closing Bell Gems Substack

Long-awaited cannabis legislation has been finally introduced by a group of Senate Democrats, which would decriminalize weed at the federal level. Pot stocks soared over the past week on word of the imminent release of the bill, but have quickly turned sour in a common "buy the rumor, sell the news" trade. Others see slim odds of the legislation passing the Senate, though it will definitely shape the conversation around cannabis legalization and portions could make their way into other measures before the end of the year.

Hawaii will offer $500 or 20% of the cost of an e-bike, an incentive aimed at encouraging the purchase of e-bikes. There are, however, a few restrictions to this rebate: The buyer must be enrolled in school, be without a registered motor vehicle, or be eligible for low-income assistance / Hawaii News Now -Movements Substack

Stats, Themes & Trends:

One in five marketers have cut their spending in response to rising inflation, per new Advertiser Perceptions data. Budgets decreased by an avg of 16%. Upper-funnel campaigns have seen the biggest cuts, w/ 47% of marketers surveyed suspending CTV, 44% halting digital video, and 42% pausing linear TV. CTV is believed to be one of the ad channels most at risk, as the study that found that 17% of CTV ads air while TVs are off, costing advertisers $1bn. (Insider Intelligence) -LionTree

Instagram is the most popular news source among teenagers – used by nearly three in ten in 2022 (29%), while TikTok and YouTube follow closely behind, used by 28% of youngsters to follow news, according to Ofcom’s News Consumption in the UK 2021/22 report. BBC One and BBC Two – historically the most popular news sources among teens – are now down in fifth place. Around a quarter of teens (24%) use these channels for news in 2022, compared to nearly half (45%) just five years ago. (Broadband TV News) -LionTree

Some Fun

CADILLAC CELESTIQ SHOW CAR

Cadillac has fully revealed its upcoming flagship electric car, the Celestiq. Designed with the intention of rivaling the best Europe has to offer, the Celestiq will be built on GM's Ultium EV platform and will showcase Cadillac's entry into the ultra-luxury market. A rumored six-figure price tag is expected for the hand-build Celestiqs, producing around 500 cars per year at GM's Global Technical Center in Warren, Michigan, and utilizing manufacturing tech like 3D printing. The styling uses familiar Cadillac cues in a long, low fastback silhouette, with a pillar-to-pillar display and four-zone transparent roof that can be darkened individually. Performance and drivetrain details haven't been released as yet. -Uncrate

THE GODFATHER MANSION

Airbnb is opening the doors to the Corleone family home. During the month of August, fans can spend the end of summer in Vito Corleone's iconic Staten Island mansion, famously featured in the opening scene of Francis Ford Coppola's 1972 film The Godfather. The home is available for one 30-day stay and includes access to its five bedrooms and seven bathrooms. Guest can pass the time in the property's saltwater pool or inside in the pub and game room, but plan any big parties or gatherings, and you'll be sleeping with the fishes. The residence is situated in a quiet neighborhood, and additional guests are prohibited. Booking opens at 1 p.m. ET on Wednesday, July 27. -Uncrate

HAN SOLO'S BLASTER

"Hokey religions and ancient weapons are no match for a good blaster at your side, kid." Han Solo may have eventually learned to believe in the Force, but in the original trilogy, he believed in his blaster. This blaster, in fact. Used on screen by Harrison Ford in his iconic role — including the infamous cantina scene — it was fashioned from a Mauser C96 broom handle pistol, with a vintage German Hensoldt scope that had previously been used on-screen by none other than Frank Sinatra. Three were made for filming, but only this one is believed to have survived intact, making it a truly unique piece of cinema history. It, along with documentation and a signed photo of Harrison Ford as Han Solo, is going up for auction on August 27th. ~300k -Uncrate

Surprising Insights:

Texas and Oklahoma recorded temperatures of 115°F. They’re among 28 US states under extreme heat alerts and warnings. -Quartz

The James Webb Space Telescope made another awesome discovery. It found the oldest galaxy ever seen in the universe, dated to 300 million years after the big bang. -Quartz

A seized Russian oligarch’s superyacht was carrying precious cargo. A suspected Fabergé egg was recovered on board the Amadea. -Quartz

A cannabis facility turned the sky pink in an Australian town. Someone must have forgotten to put down the blinds, treating locals to a spellbinding glow. -Quartz

The world’s oldest, giant male panda has died. An An the panda had reached the ripe age of 35 years, equivalent to the age of 105 in human years. -Quartz

Bridesmaid rental services are a fast-growing industry in China. Height and other restrictions apply. -Quartz

Authorities found an illicit vodka pipeline on the Ukrainian border. In the Soviet era, smugglers used pipes like this to transport cheap vodka into neighboring Moldova. -Quartz

A new Homo sapiens population was uncovered. It may be the genetic link between East Asian and early American populations. -Quartz

Central Park’s famous boathouse is closing. The doors are shuttering in October to the dismay of romantics the world over and the 163 workers facing layoffs. -Quartz

Some fish fins were made for walking. Paleontologists discovered a fossil suggesting that ancient fish once walked on four limbs, but then decided they liked water instead. -Quartz

Cricket is lifting spirits in Sri Lanka. Amid a political and economic meltdown, the men’s national team is on a winning streak. -Quartz

The new global gray market for auto chips: buy them in Europe, then move them at steep prices to manufacturers in China -- from $23.80 each to $375 (link). -Trucks FoT

Nearly half of drivers use potentially impairing medications (link). Via AAA Foundation. 'Nearly 50% of respondents in AAA's study of drivers aged 16 and up admitted using one or more drugs with potentially impairing effects (antihistamines, cough medicines, antidepressants, prescription pain medications, muscle relaxers, sleep aids — including barbiturates and benzodiazapines — or amphetamines) in the past 30 days.' -Trucks FoT

Around 43% of US public roadways are in poor or mediocre condition (link). Via WSJ / American Society of Civil Engineers. -Trucks FoT

Nissan Terrible Drivers? “The worst drivers all prefer Nissan” Source

Polarity of Honor Students: “honor roll bumper stickers = mom or dad is going to blow twice the legal limit.” (Source)

Internal Clock and Wealth: “The most successful people I know always know what time it is Watch or no watch, clock or no clock Their internal clock is basically infallible Probably why they waste none of it” (Source)

Steel Watches? “The most reliable men wear steel wristwatches. The worst npcs wear apple watches “ (Source)

Quoting Experience = Unskilled? “The least productive employees are the most likely to quote their experience. "Trust me I've been doing this for 30 years." - So you've been incompetent for a long time?” (Source)

Sponsorship

If any interest in sponsoring this newsletter, email me here.