Deep Dive

Bitcoin isn’t an Inflation Hedge, it’s a Hedge Against Hyperinflation & Currency Debasement… and a Beta Risk Bet.

**Intermediate**

TLDR: A dive into Bitcoin (and other crypto) as a hyperinflation & currency debasement hedge and beta risk bet versus an inflation hedge. Despite aggressive rate hikes and QT posturing by Fed, we are going to see more money printing sooner rather than later… our global allies are inching ever-closer to the inevitable need for a US-sponsored bailout. We could ignore the economic pain of our allies, but even the mighty US economy isn’t insulated enough to continue aggressive tightening for much longer. Even if you hate crypto, but see the easing/stimulus writing on the wall, why not scale into the currency debasement x high beta risk? After all, you can’t brag about a market-perform portfolio laden with devalued currency.

“Bitcoin is an inflation hedge” was very popular narrative over the last decade, but it was never put to the test until recently.

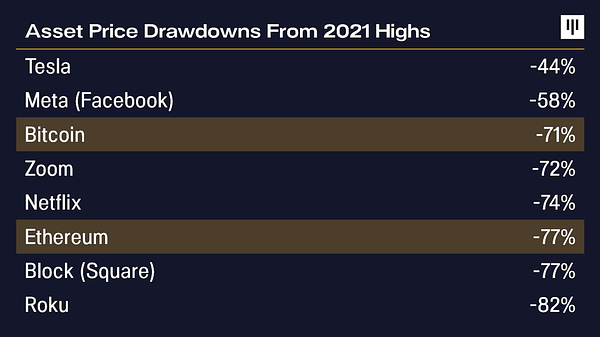

As global inflation has increased, BTC has proven to not be an inflation hedge, but rather a hedge against hyperinflation and currency debasement.

We explained that consumer price inflation and currency debasement are two sides of a similar coin, but their impact on asset prices can differ. At a certain point, price inflation can have an adverse impact on markets as rising consumer prices start to curb spending, eat into savings, and slow demand. Higher CPI prints didn’t equate to higher asset prices. Today, we’re seeing this exact dynamic play out. -Delphi Digital: Bitcoin Is Not An Inflation Hedge

We bought bitcoin after the pandemic to protect against the inflation that would inevitably follow the government’s money printing response.

Inflation is up a lot and, yet, bitcoin is down a lot.

Were we wrong to think bitcoin is a hedge against inflation?

Yes … but let's call it a technicality: Bitcoin is not a hedge against inflation; it’s a hedge against hyperinflation.

In the case of garden-variety inflation, like we’re experiencing now, it hasn’t been much use at all.

Why hasn't Bitcoin been a hedge against inflation? Because this inflation is transitory.

We've been laughing at the Fed for telling us that, but Bitcoin has been telling us the same thing. And it's almost certainly right.

Bitcoin's definition of transitory is different from yours, however. The OG crypto is a big thinker: It knows a year or three of inflation doesn't really matter.

A one-time demand shock and a once-a-century supply shock are not the stuff of which hyperinflation is made.

What does make for hyperinflation is sustained, out-of-control money printing coupled with skyrocketing velocity.

There is currently no sign of either: Rising tax receipts and lower spending has slowed the money printer to a crawl. And the velocity of money is at multi-decade lows.

(Reminder: It’s federal deficit spending that prints money. But if you think Fed bank reserves are money, too, that printer has gone in reverse with the Fed now unprinting $95 billion a month via quantitative tightening.)

Bitcoin has been telling us the money printing would stop. And it has.

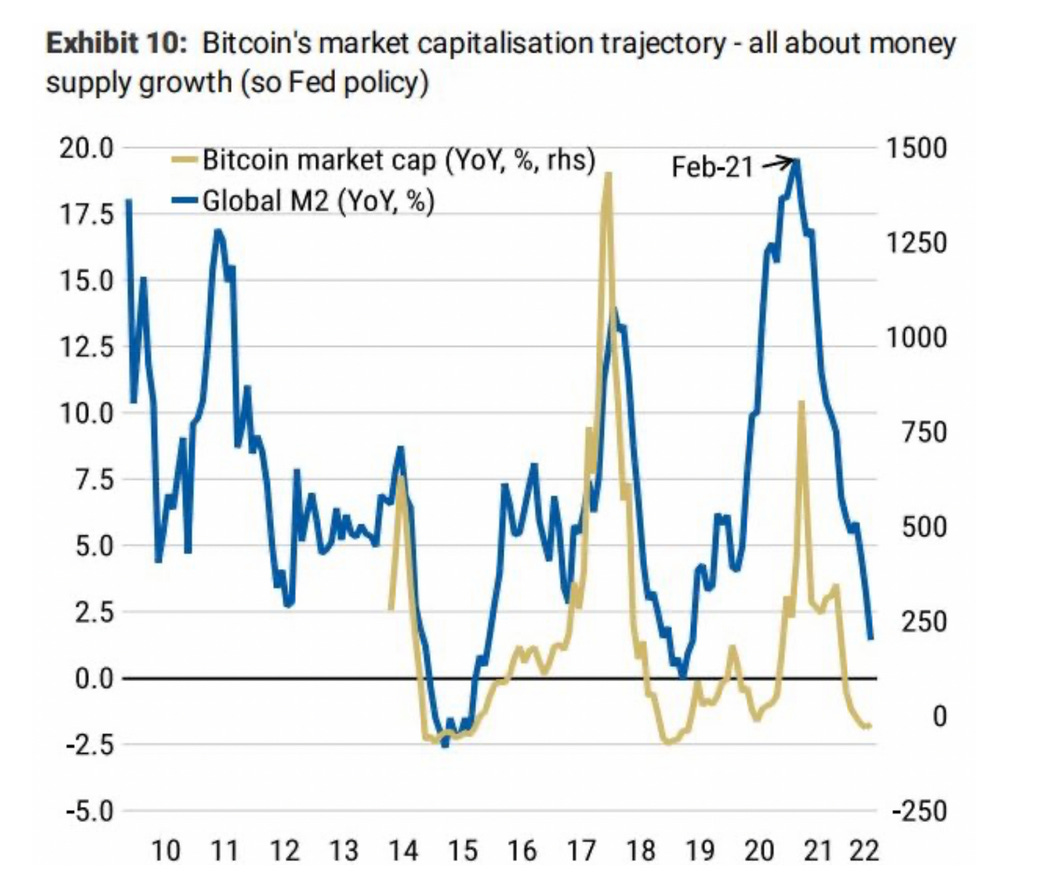

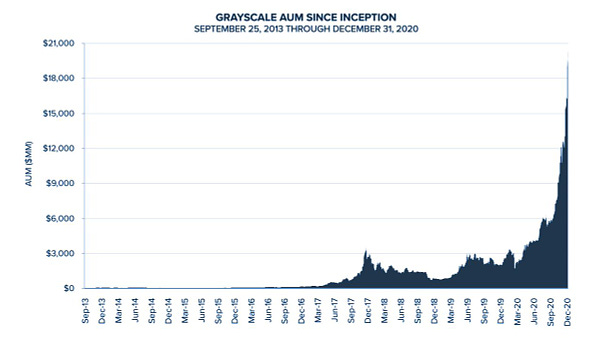

Bitcoin has been highly correlated to the M2 measure of money supply, which I think is a good-enough proxy for money printing.

It shows, tactically, if you think the money printer will be turned back on, you should be long Bitcoin.

With the US Dollar as the Global Reserve Currency, a majority of global assets priced in terms of USD. The US Treasury and Federal Reserve, by extension of their policies, play a large part in global asset prices, including BTC and broader cryptocurrrencies.

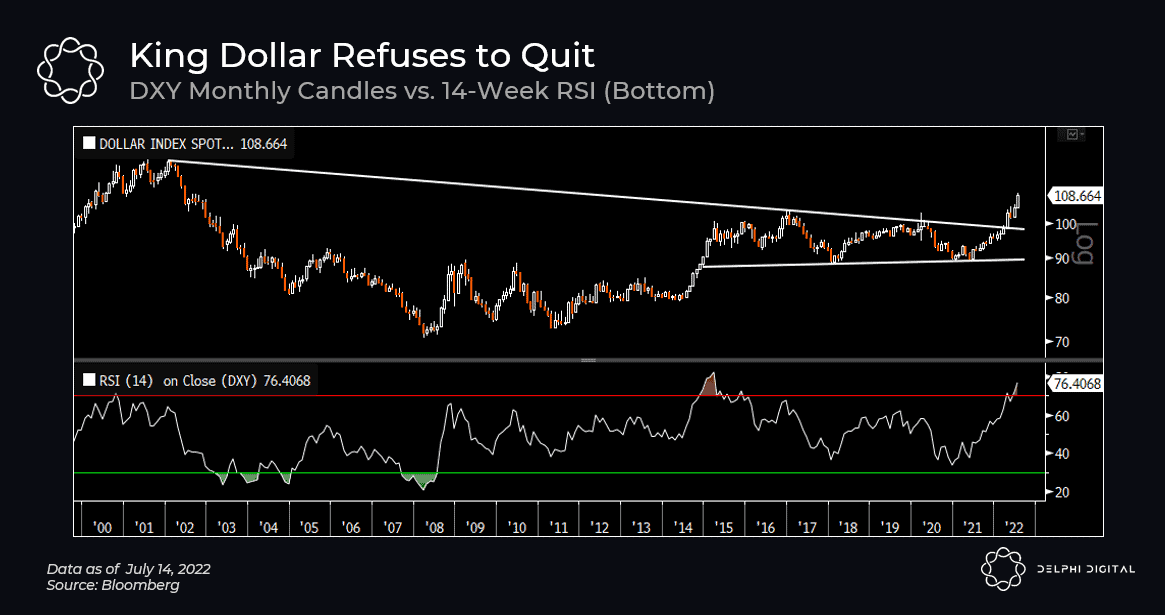

Those banking on the currency debasement narrative are also hurting as the dollar has only gotten stronger – not weaker – over the last 12 months.

The almighty dollar continues to throw cold water on markets, which we know does not bode well for BTC and crypto either.

We noted the dollar’s latest rally has come at the expense of the EUR and JPY, both of which are seeing material long-term technical breakdowns. EURUSD is trading at its lowest level in 20 years as the outlook for the euro area continues to weaken relative to its cross-Atlantic trading partner.

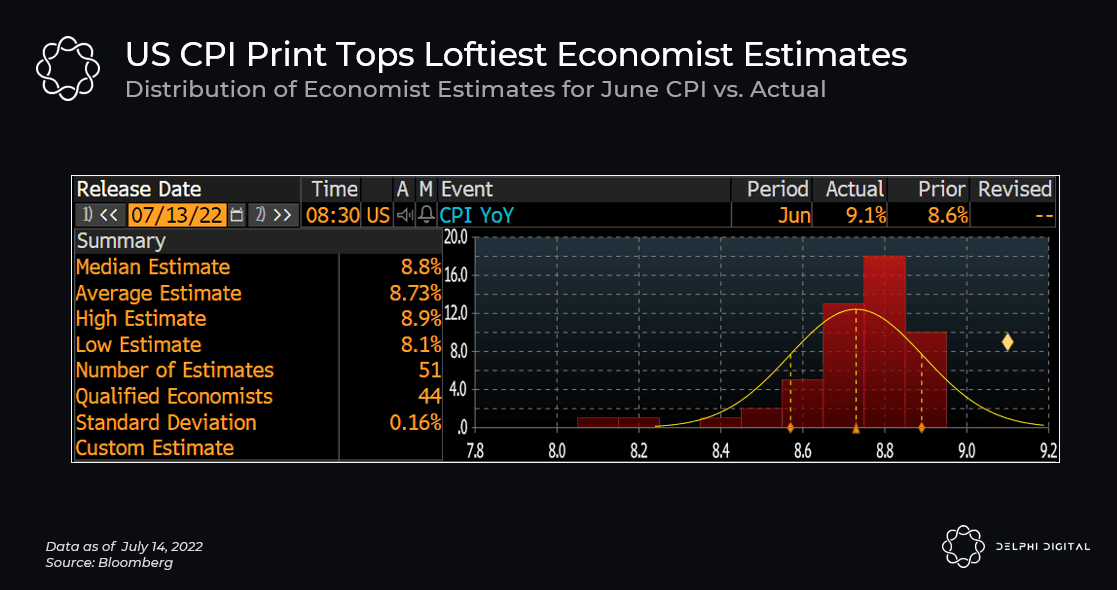

The aggressive hawkish stance taken by the Fed has also given the greenback a boost and the hotter-than-expected CPI print increased the likelihood of an even bigger rate hike at the July FOMC meeting in just two weeks. At one point yesterday the market was pricing in an 80% chance of a 100bps hike. The odds have since dropped back down to ~25%, which is still higher than the low-single-digit probability a week ago. -Delphi Digital: Bitcoin Is Not An Inflation Hedge

But… what happens when the balance of global economic growth and inflation gets out of whack?

When the largest economic powerhouse is able to push back for against inflation with rate hikes and QT

for a little while…While another global player can’t afford to fight inflation due to a combination of a historic central bank intervention, and negative demographic trends…

What about when you add a geopolitical conflict causing disproportionate pain in a different major economic region (which also has similar central bank and demographic issues)?

This confluence of complex global economic factors is made even more complicated when the economies in pain are not only your economic partners, but political and stratgic allies as well. Arthur Hayes’ piece, A Samurai, a Knight, and a Yankee, explores this, what it leads to, and the immense ramifications. Here is his thesis:

Japan and the European Union (EU) are both engaging in Yield Curve Control (YCC), either explicitly or implicitly. YCC is when a central bank engages in the price fixing — more commonly known as “manipulation” to us non- central bankers — of government bond yields. The central bank prints fiat currency, and then purchases its own bonds to artificially cap yields where they wish. Remember — when the price of the bond goes up, the yield goes down. This intervention weakens the domestic currency, ceteris paribus.

YCC -> Currency Weakness Playbook:

The central bank caps the yield on one or more government bond maturities.

The central bank stands ready to print money, which expands the money supply, so that it may purchase bonds in a quantity sufficient to reduce yields to below the cap.

If the market believes that the yield should be higher than the YCC cap, then the central bank starts printing money until it either purchases all bonds outstanding, or the market stops demanding a yield above the cap.

This process expands the money supply and thereby weakens the fiat currency, due to the increased supply vs. real goods / services and other currencies.

Usually, Japan and the EU are happy to have a weak Yen or Euro vs. the rest of the developed world. It allows their export industries to gain market share, as their goods are cheaper vs. other countries. However, due to the food and fuel inflation experienced post-COVID and the cancelling of Russian commodity exports, their plebes are now facing the harsh downsides of having a weak currency. It is becoming more and more expensive for them to eat, move around, and heat/cool their dwellings.

The ruling bureaucrats of Japan and the EU have very strong political — and by political, I mean self-serving — reasons to continue YCC in the face of rising inflation that hurts 90% of their population. I will explore those motivations in greater detail later in this essay, but suffice to say that refusing to trade with Russia is a political choice, and one that Japan and the EU feel pressured to make in order to remain aligned with America. The combination of YCC and a boycott of Russian energy is a toxic cocktail, and if YCC is to continue, Japan and the EU will need a helping hand from their baby daddy, the US.

How can the US help? Let’s listen to former Fed Chairman Ben Bernanke in a 2002 speech he gave before the National Economic Club.

“The Fed can inject money into the economy in still other ways. For example, the Fed has the authority to buy foreign government debt, as well as domestic government debt. Potentially, this class of assets offers huge scope for Fed operations, as the quantity of foreign assets eligible for purchase by the Fed is several times the stock of U.S. government debt.

I need to tread carefully here. Because the economy is a complex and interconnected system, Fed purchases of the liabilities of foreign governments have the potential to affect a number of financial markets, including the market for foreign exchange. In the United States, the Department of the Treasury, not the Federal Reserve, is the lead agency for making international economic policy, including policy toward the dollar; and the Secretary of the Treasury has expressed the view that the determination of the value of the U.S. dollar should be left to free market forces. Moreover, since the United States is a large, relatively closed economy, manipulating the exchange value of the dollar would not be a particularly desirable way to fight domestic deflation, particularly given the range of other options available. Thus, I want to be absolutely clear that I am today neither forecasting nor recommending any attempt by U.S. policymakers to target the international value of the dollar.”

At the direction of the US Treasury, the Federal Reserve Bank of New York trading desk could print USD, buy JPY/EUR, and purchase Japanese Government Bonds (JGB) or government bonds of EU members, parking them in the Exchange Stabilization Fund (ESF) on its balance sheet. This has two positive effects. Firstly, this policy directly weakens the Dollar vs. the Yen and the Euro, which helps Japan and the EU import USD-priced commodities at cheaper prices. Secondly, this policy helps reduce government bond yields, but does not result in the growth of the balance sheets of either the Bank of Japan (BOJ) or the European Central Bank (ECB).

But, the Fed has also expressed interest in engaging in quantitative tightening (QT) to curtail domestic inflation and defend the wallets of the American people. QT (as defined by the Fed), is an activity whereby the central bank sells its holdings of US Treasury and Mortgage-backed Securities (MBS) for USD in order to tighten domestic credit conditions. If it’s more expensive for the government to borrow money, then it’s more expensive for American individuals and businesses as well. So the obvious question is, how can the Fed effectively engage in QT (i.e., tightening domestic USD credit conditions) while also loosening USD credit conditions globally by purchasing foreign government bonds?

Remember — politics is about accounting misdirection, not economic reality. In reality, engaging in the purchase of these foreign bonds will expand the USD money supply and the Fed balance sheet, and might nullify any impact its QT operations has upon domestic conditions. But that’s not how the Fed will spin it. Instead, the Fed can simultaneously sell its holdings of treasuries and MBS, while at the same time printing money to buy foreign bonds. And with a straight face, Powell can proclaim he is tightening US domestic monetary conditions to fight domestic inflation, while also helping America’s allies stay strong in the fight against Russia.

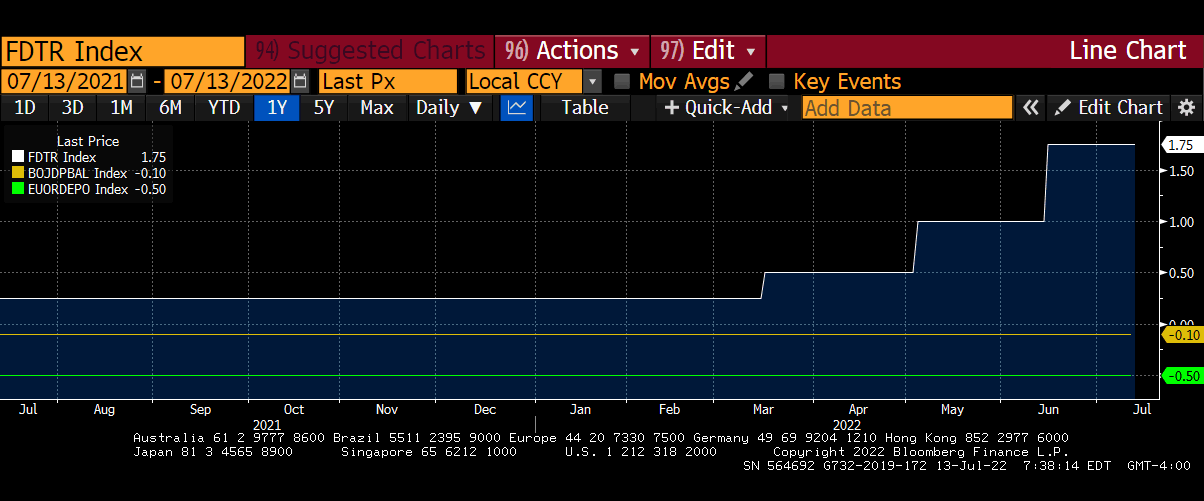

Fed Policy Rate (white); BOJ Policy Rate (yellow); ECB Policy Rate (green)

All three amigos — Japan, the EU, and the US — are experiencing record high inflation. However, only the Fed has increased policy rates to a meaningful degree thus far. Interest rate parity dictates that the currencies of countries that run the loosest relative monetary policies should weaken vs. those that run the strongest. Given that global commodities are priced in USD, the US’s tight monetary policies have created a situation wherein the US currently has the strongest fiat currency of the bunch. If the Fed stops raising and starts cutting its policy rates, this will weaken the USD vs. the JPY and EUR and reduce commodity prices for them.

The Fed can justify ending its tightening cycle by pointing to a looming economic recession in the US. If the Fed can credibly claim that inflation has peaked — i.e., the inflation rate slows enough that, even if prices continue to rise, they can say the worst is behind us — then they can switch to recession prevention mode without drawing too much ire from the public. “Recession prevention mode” is code for printing money — as the only way the Fed knows how to prevent a recession is to loosen monetary policy by turning on the printing press.

One or both of these setups is necessary for the Fed to be able to provide the allies of America with the liquidity they need to continue YCC. And if the Fed fails to do either, the discontent created in the EU and Japan by rising food and fuel prices (especially as fall and winter bring colder temperatures) might cause political difficulties for their respective ruling technocrats.

And so it begins… this is the first step to a US-sponsored global ally bailout…adding more credence to Hayes’ thesis:

Janet Yellen called for closer trade ties between US allies. The treasury secretary advocated the practice of friendshoring to protect against supply chain disruptions.

-Quartz

Side Note: Here are more insights on deglobalization, (discussed in WW 3/23, WW 4/27), and the pertinent, yet neglected conversation on the global demographic collapse (~40 min mark).

In this episode of the podcast, Sam Harris speaks with Peter Zeihan and Ian Bremmer about Peter's new book, The End of the World is Just the Beginning. They discuss a wide range of issues related to the deglobalization and demographic collapse, the differing fates of China and America, climate change, the war in Ukraine, and other topics.

-Making Sense Podcast

So what does this have to do with Bitcoin, and crypto broadly?

To recap:

Bitcoin is a hyperinflation, and currency debasement hedge

When global money supply goes up, so does BTC and crypto

The US Dollar as the Global Reserve Currency, so US Treasury and Fed policies greatly influence the price of global assets, especially high beta ones like BTC and crypto

The combination of complex global economic factors, such as inflation, geopolitical conflict, consistent & immense central bank intervention, and negative demographic trends, is leading to a US-sponsored global ally bailout.

A US-sponsored bailout —> USD money printing —> Lower USD value & increase in the global money supply = Increased value of USD denominated assets, particularly high beta risk assets.

As crypto holders, the reason we care about YCC is that if/when either of these policy shifts is announced by the US Treasury, or we notice a rising ESF-reported balance, we can then assume that the Fed is actively engaging in printing money to aid the YCC efforts of Japan and the EU. Such activity would be highly inflationary and completely change the global fiat liquidity regime. With more fiat liquidity sloshing through the system, risk assets — which include cryptocurrencies — will find their bottom and quickly begin to recover as investors discover the central bank financial asset market put has been activated.

The following must be true for this hypothesis to be valid:

America is committed to defeating Russia primarily using economic sanctions, which means its allies must refrain from purchasing Russian food and energy.

Japan and the EU must pursue YCC to save their banking and political systems.

The inflation driven by YCC is exacerbated by Russian food and energy sanctions.

To keep their plebes from revolting, Japan and the EU need help from their ally, the US, to reduce their domestic inflation.

Therefore, if America is to do right by her allies, she must find a way to print USD and purchase Japanese and EU bonds, or reduce the divergence in policy rates by starting to cut the Federal Funds rate.

Printing USD to buy Japanese and EU bonds and/or cutting the Federal Funds rate weakens the dollar, and will add trillions worth of liquidity to the financial system. This fiat money will find its way into all-risk assets. PARTY TIME!

Let’s pump the breaks on the ally bailout thesis, and look at US economy more closely. Say the US sticks to the Under Armour strategy:

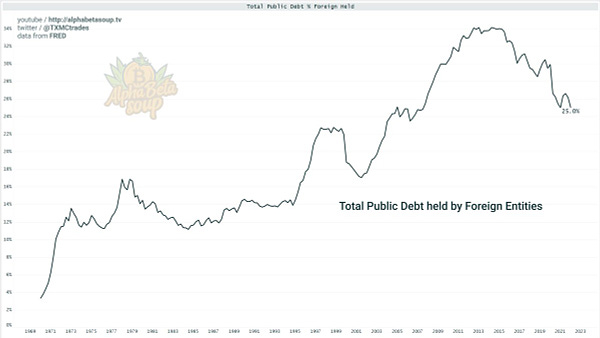

This thread by @TXMCtrades does the heavy lifting… while a different variety, the US isn’t far behind our Japanese & EU allies:

Byron Gilliam comes to a similar conclusion:

That means, though, Bitcoin will be inversely correlated to inflation — because the money printer is only coming back on if inflation falls.

It’s all a bit counterintuitive. You want to be long bitcoin, the hedge against hyperinflation, mostly when people are worried about deflation.

Unless you think we get inflation AND money printing. In which case you should be very long bitcoin.

As does Forest for the Trees (FFTT) founder and macro analyst, Luke Gromen. The whole segment is terffic, but the last 30 min are a must listen:

Any way you cut it, we are going to have another inevitable risk asset party due to money supply growth. If you believe in some combination of blockchain, metaverse, and/or web3 technologies, why wouldn’t you put a lot of chips in the currency debasement x high beta basket?

Even if you hate crypto, but see the easing/stimulus writing on the wall, why not scale into the currency debasement x high beta risk? After all, you can’t brag about a market-perform portfolio laden with devalued currency.

Blockchain, Cryptocurrencies & Digital Assets

Updates on Crypto Insolvency Dominoes & the Fallout

The latest on the fallout from Terra/LUNA, 3AC, Celsius, Voyager, etc…

3AC / Three Arrows Capital

The Milk Road: 3AC COURT FILINGS ARE LEAKED

The court filings came out today. It’s a 1,100-page PDF. Here are 5 ridiculous things we found:

They owe 27 lenders $3.5B

One founder’s WIFE says the company owes her $66M

They lost $700M in Luna’s collapse (they make my $1M loss look like a box of tic-tacs)

They spent $80M+ buying two bungalows (aka mansions) and a yacht. Because ya know, one bungalow is for chumps.

They would borrow money from one lender, and use it to pay off another. They had such a big reputation (and paid so much in interest to each lender) that nobody wanted to question them.

The cherry on top? Su Zhu (the founder) claims his own 3AC owes him $5m.

3AC Updates: Crypto hedge fund DeFiance Capital said it was "materially affected" by the liquidation of rival fund Three Arrows Capital. DeFiance's CEO has said he is committed to recovering all assets that may have been affected.

A number of crypto companies have been hit by the Three Arrows Capital fallout, with Genesis suffering "hundreds of millions" in losses and Voyager Digital filing for bankruptcy after the fund defaulted on $670 million of loans.

Three Arrows’ liquidators are working to get Singapore courts to recognize the British Virgin Islands’ liquidation order against it, in order to preserve the company's Singapore assets. -CoinDesk

Three Arrows Capital creditors lent bankrupt fund $3.5 billion, court documents show

A collection of affidavits show the extent to which nearly 30 crypto companies had lent billions of dollars to 3AC. Genesis is the biggest creditor of 3AC, with $2.3 billion lent to the now bankrupt crypto hedge fund. 3AC co-founder Zhu Su and the wife of another co-founder Kyle Davies are among creditors owed money from the fund. -The Block

DEBT OWED: Three Arrows Capital, which is known as 3AC, owes blockchain development lab Moonbeam Foundation over $17 million worth of stablecoins and $10 million worth of Moonbeam-issued tokens, according to agreement documents. This is the latest debt that has come to light as investors try to recover funds from the insolvent fund founded by Su Zhu and Kyle Davies.

In a twist of the knife, bankruptcy docs show that Zhu has filed to recover $5 million from 3AC, while Davies’ wife, Chen Kelly, says she is owed $65.7 million. -CoinDesk

Celsius

Not Just ‘Insolvent’: Celsius Network “is deeply insolvent,” alleged the U.S. state of Vermont’s Department of Financial Regulation, claiming the lender lacks the assets and liquidity to honor its obligations to account holders and other creditors. However, on-chain data suggests the firm may be digging itself out of the hole:

The troubled crypto lender fully paid off its debt on the decentralized finance lending protocol Aave, freeing $26 million in tokens through a maneuver almost identical to one it conducted last week on the rival protocol Maker.

Celsius fully paid off its remaining debt to the decentralized finance lending protocol Compound, freeing up nearly $200 million of pledged collateral.

Meanwhile, it moved $418 million in staked ether or stETH to an unknown wallet.

The discount on stETH, a derivative of ether, surged as the crypto lender reclaimed and then transferred almost 10% of the total supply of the token. -CoinDesk

Celsius has now paid off more than $800 million of debt to DeFi apps

Celsius has paid off all of its debt taken on decentralized finance applications. Over the last month, the firm has returned over $800 million to Aave, Maker and Compound. -The Block

Mysterious Debtor: Speaking of that beleaguered crypto lending firm, Celsius Network is owed $439 million by Indianapolis-based private lending platform EquitiesFirst. EquitiesFirst is currently repaying $5 million per month; the debt is made up of $361 million in cash and 3,765 bitcoin.

Details of the debt first emerged in Celsius' bankruptcy filing on Thursday, in which it revealed that it had liabilities of $5.5 billion and $4.3 billion of assets. -CoinDesk

DCG (Digital Currency Group)?

Genesis

The Block: Crypto lender Genesis lent $2.36 billion to Three Arrows Capital

Genesis lent $2.36 billion to Three Arrows Capital, the crypto hedge fund that recently filed for Chapter 15 bankruptcy in New York.

Its loans to 3AC had a margin requirement of over 80%, and it sold collateral when 3AC failed to maintain that, later seeking repayment of the outstanding debt through arbitration in New York.

Bankless: DeFi Will Never Die

**Beginner**

Another very pro-crypto take on DeFi’s resiliency during the market collapse of the last few months. It notes a lot of what what we covered over the last few weeks (WW 7/6 & WW 7/13) including the benefits on on-chain transparency and how DeFi mitigates counterparty risk that is wreaking havoc on centralized entities since 3AC collapsed. It glosses over the over-collateralization requirement instrumental to the success of DeFi (at least in this episode) and how that excludes DeFi from a majority of the use cases of debt in the broader economy. The most interesting points in this piece are in regards to DeFi’s self-governance… highlighted below.

Lido controls ~⅓ of ETH’s circulating supply. Its concentrated ETH holdings prompted researchers from the Ethereum foundation and Vitalik himself to sound the alarm bells of a possible centralization threat to Ethereum. What followed was a lot of debate, then a governance proposal to self-limit the amount of ETH deposits into the liquid staking protocol. That governance proposal failed, but a further decentralization of Lido’s validator set was installed by adding eight new validators.

Solend — Solana’s top lending protocol — faced a more imminent threat. It was discovered that one whale had a disproportionately large margin position ($170M) that might trigger a catastrophic liquidation event and impact the entire chain if SOL’s price continued to drop.

In response, Solend developers introduced a series of governance proposals to the community, first proposing to takeover the whale’s account and execute a safe liquidation, but eventually landed on a solution to introduce a new constitutional rule that capped borrow limits to $50M (the whale borrowed $108M).

It may well be that Lido and Solend are not out of the woods yet, but both episodes of governance illustrate something unique about DeFi.

Transparency over the rules of the blockchain network and on-chain activity enabled a community of internal and external stakeholders to rally over a common cause of concern and reach a solution collectively. Both cases saw stakeholders waving red flags and engaging each other in deeply technical discussions before—not after—it was too late.

People make stupid risks, systems are maliciously attacked and things go wrong. The question is what rules of the game best deal with that. TradFi’s answer to that is, “The government will pass a law”.

DeFi’s answer to that is, “We’ll let the code decide”.

Yes, let the code decide to a degree, but I think these examples better illustrate how a community with shared interests can work together to solve a problem without the need for nation-state driven intervention.

Crypto Pragmatist: How We Think About Layer One Blockchains

**Beginner**

Good overview of some of the biggest blockchain names, though they conflate layer 0s, 1s and 2s.

Bitcoin: The Doomsday-Proof Blockchain

Bitcoin is an apocalypse-proof blockchain. It’s designed to be a project that just works perfectly as intended: a censor-proof, permissionless ledger, nothing more. What are the features that keep it anti-fragile in a world that tends to overcomplicate things?

No smart contracts

Proof-of-work consensus algorithm

Nearly no developer activity

No hard forks

Bitcoin's beauty is, in large part, due to its antifragility. Those who desire for Bitcoin to become greater or different largely seem to miss the point.

Ethereum: The Best-Executing Blockchain (for now)

A healthy view on Ethereum is "the blockchain that’s managed to execute most successfully, so far." While some see it as the ‘most decentralized’ blockchain, which is probably fair, it hasn’t always been that way thanks to events like the DAO hack. Now, Ethereum maxis would make fun of a similar event on another chain.

Despite a lot of Ethereum users recently becoming outspoken Ethereum ‘maximalists,’ Ethereum has really historically been a moderate blockchain. They’ve never been slow to ship, as the first smart contract platform to come on line, but they’ve simultaneously never damaged their blockchain beyond repair.

More proof of their expert in managing execution is:

Their pending transition from proof-of-work to proof-of-stake

A strong scaling plan

Ability to progressively decentralize over time.

Their focus on bridge security before it was widely seen as a problem

Binance Smart Chain: The Centralized Blockchain

While other blockchains talk about decentralization as important, Binance, on purpose, runs a blockchain that is pretty much centralized. Their validator set is hyper-centralized, and Binance does this to create a network that is inexpensive to run and ultra-cheap and quick to transact on.

While other blockchains assume a hostile environment, Binance assumes a ‘benevolent operator’ environment, because they are the operators. The assumption for its users is that the company won’t screw them over. While some see see that logic as flawed, it’s a compromise that seems to work for millions of people and billions of dollars of Total Value Locked. It's definitely a unique compromise to make.

Solana: The Blockchain that Questions Assumptions

Solana is an interesting blockchain to me because they’ve thrown some of Ethereum’s pragmatic assumptions out the window. They’re the only chain to use the ‘proof-of-history’ consensus mechanism, and their security approach comes down to ‘we just need one copy of the ledger to survive.’ Their scaling goals are much more related to user and developer adoption than to scaling the blockchain itself.

I think this mental model is exemplified with Solana’s recent announcement around their Web3 native phone. This phone has a trustless hardware component that allows users to isolate their wallet private key from the operating system, which Solana sees as a vulnerable attack vector. The fact that Ethereum is worried about bridge security while Solana works on user-level security is a clear example of how these blockchains differ in outright assumptions.

Polygon: The Business Development Blockchain

There’s not a single performance metric that Polygon ‘wins’ at: not throughput, not finality, not security, not user experience. But they are really good at one thing: business development.

Polygon was phenomenally popular for its ability to come to market first, and now it’s been able to secure one business partnership after another: Draft Kings, Adobe, Disney, Meta, and the NFL have all announced collaborations on this Ethereum sidechain.

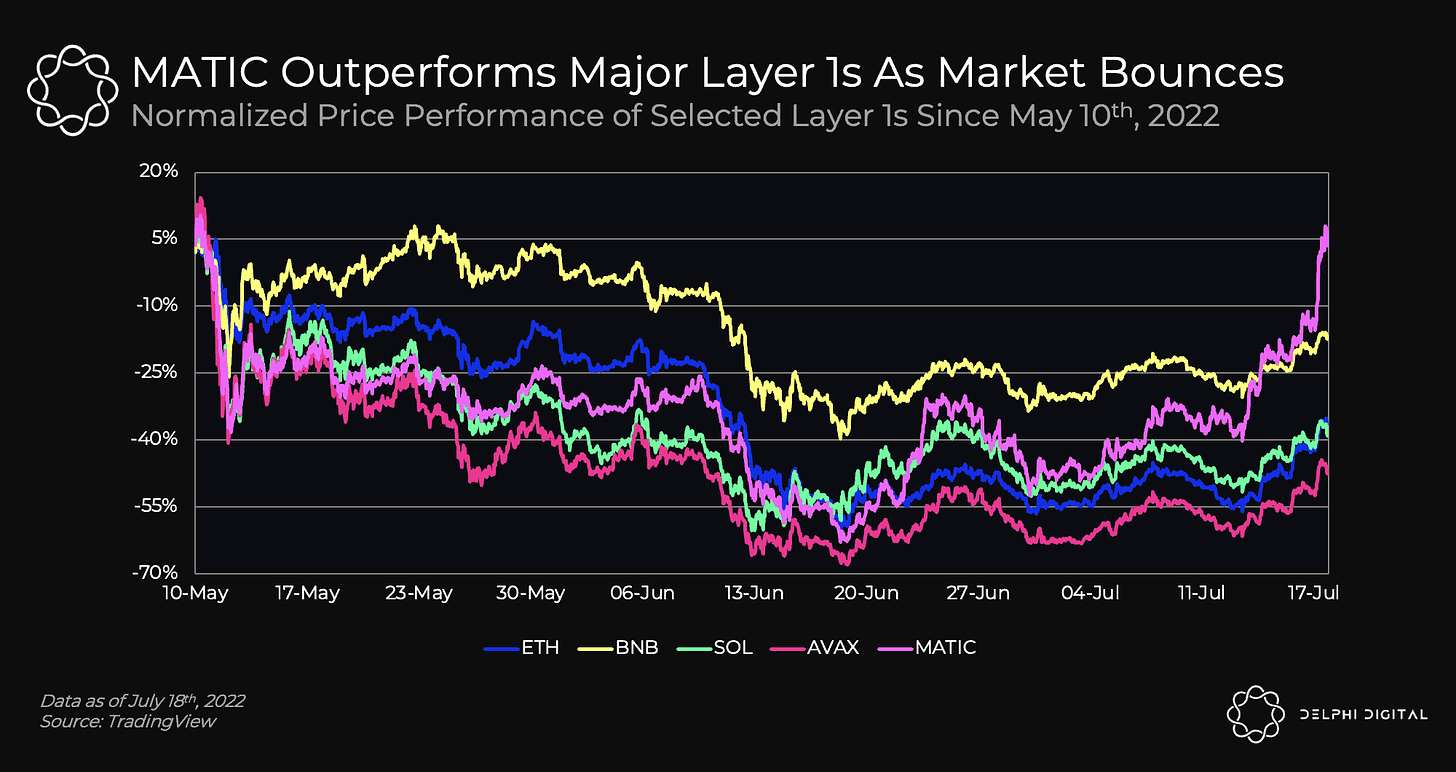

Polygon posits that this BizDev is more important than tech in the short term, and its speed-to-market has allowed it to acquire several Zero-Knowledge Rollup companies that will come in handy as the market requires better and better tech. Will it work? It seems to be convicing investors, with the chain being the best performer of the L1s mentioned in this newsletter.

Polkadot: A Federalist’s Blockchain

Polkadot uses a relay-chain/parachain model which allows independent blockchains to all communicate together and share a security model.

Polkadot has a unified governance structure that makes me think of it as a blockchain with a governance structure similar to the United States: each state (parachain) has its own sovereignty and rights, but must rely on the central organization for governance and security.

Cosmos: An Out-of-the-Box Blockchain

Cosmos is a project that makes it incredibly easy to set up a new blockchain. They create an open-source set of rules to operate these networks, but ultimately leave the governance of the blockchain up to its creators, leaving validation, voting, and architecture questions up in the air.

Another way to think about the Cosmos ecosystem is as a parallel ‘states rights’ blockchain to Polkadot's 'federalist' architecture–Cosmos gives you the framework to start your own blockchain (Terra Luna, Osmosis, Juno, and Evmos all being examples of this), then lets the chains communicate with each other, while staying out of the way.

This has some drawbacks, but it’s been an incredibly popular platform as it gives well-funded teams a way to simply and quickly roll out their own L1 networks. Lately it’s been touted as a solution for ‘app-chains,’ or applications that can be benefitted by having their own chains: dYdX will be launching shortly on Cosmos.

Cardano: The Castle-in-the-Sky

A lot of people give Cardano a lot of grief, but I don’t know if they entirely understand what Cardano is doing.

While Ethereum’s product is their blockchain, is it possible that Cardano’s product is its token, $ADA? I might take some heat for this, but perhaps the endgame for Cardano isn’t necessarily to become the premier smart contract platform, but to provide a product for speculation.

‘Castle-in-the-sky’ investments aren’t new–think about most biotech companies or cash-burning tech startups. They're use case is more speculative than based on any type of fundamental value, and with Cardano’s (relative) failure to create a successful crypto ecosystem over the last cycle, it’s sure they’ll have another bull run to create persistent memes and ideas around the future potential of the blockchain.

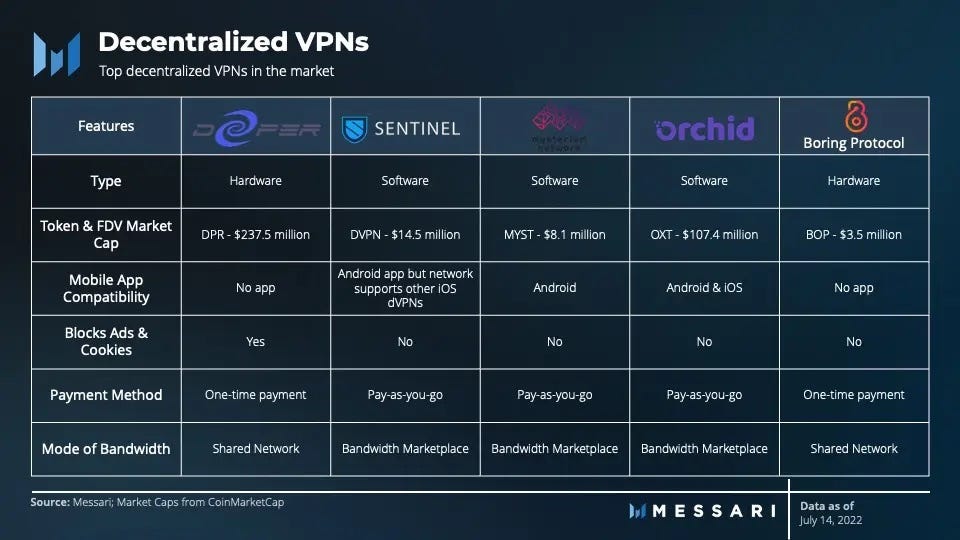

Messari’s Kaushik Guduru: Decentralized VPNs: Surfing a New Wave of Privacy

**Beginner**

A quick overview of Decentralized VPNs (dVPNs).

The VPN market is expected to surpass $92 billion by 2027.

Traditional VPNs establish an encrypted connection to a centralized provider’s server, providing a private tunnel for all of the user activity on the network. VPNs mask a user's IP address and prevent any form of surveillance by outside parties.

But regardless of the advertised privacy and security, users are still required to trust in the centralized third parties behind commercial VPNs. The centralized third party could claim that they don’t track user activity on the network, but there’s no way to be sure if the VPN isn’t open sourced. Users run the risk of their data being logged and sold to third parties or exposed to a data breach.

Web3 infrastructure has been building away to solve some of the issues with current technologies, in many cases with an added emphasis on privacy and security. Decentralized VPNs (dVPNs) could replace commercial virtual private networks (VPNs) by eliminating the presence of a centralized party. Though they’re still a small subsector of Web3 infrastructure, the goal of dVPNs is to create a distributed, secure, and private network for users around the world. Both software and hardware versions of dVPNs play key roles in achieving this goal.

Diving into dVPNs

From a technology standpoint, dVPNs are pretty similar to VPNs, but they do have a few clear-cut differences:

Incentivization — Instead of a centralized server, node operators are incentivized to run nodes on the network and share their bandwidth in exchange for token rewards. The network speed is reliant on the number of users. The more users there are, the faster the network will be and the faster the network will grow.

Pay structures — dVPNs operate their pay structures very differently than commercial VPNs. Hardware dVPNs have a one-time payment when you purchase their product, and most software dVPNS utilize a pay-as-you-go service. Both of these options are more financially feasible than commercial VPNs.

Multi-routing — While VPNs only route via one tunnel at a time, dVPNs allow users to easily switch nodes and simultaneously use different routes and servers.

There are numerous dVPN projects all at different stages in the development process with different network architectures, services, features, and reward mechanisms. However, the biggest differentiator between dVPNs is the type: hardware or software.

Pantera’s Dan Morehead: A Thread on Crypto Decoupling

**Beginner**

Dan’s been pounding the table about crypto decoupling from tech equities for at least a few months. It’s starting to happen a bit, but I attribute that more to negative & idiosyncratic crypto events over the last few months that have led to forced selling.

SIMETRI: Swimming with Sharks

**Advanced**

A very helpful walk-through of how to track large wallets on Ethereum using Nansen. Obviously this can be very useful if you are day trading, but it also illustrates the transparency of the blockchain.

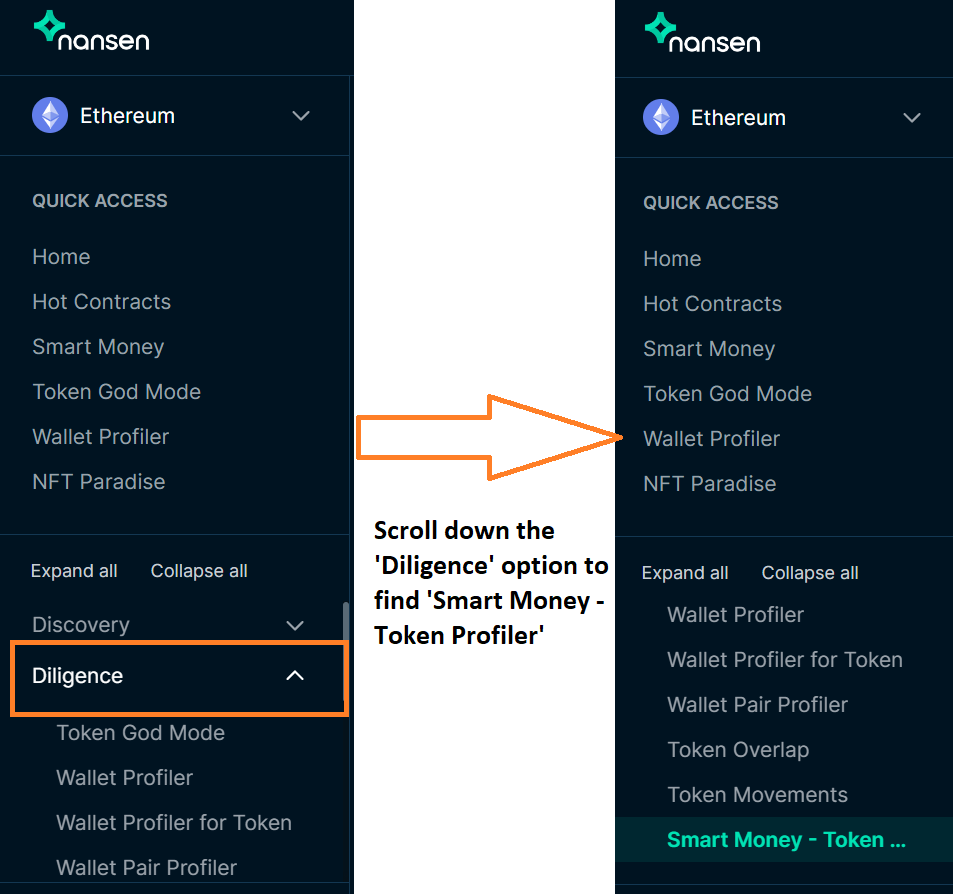

One of the easiest ways to track whales on Ethereum is Nansen. The data analytics platform tags large funds and profitable ETH wallets as “smart money.” You can identify these wallets on Nansen from the 🤓 emoji next to a wallet’s info.

Today, we will explore how to use Nansen to track token movements by large funds and gain valuable insights from it. The caveat is that Nansen standard subscriptions cost $400 per quarter, which you may account as your initial investment. You can also start with a one-week trial subscription for $9.

Tracking Large Funds

Go to the ‘Smart Money’ section of Nansen’s platform and then select ‘Segment.’ Filter only large funds.

First deselect the ‘All’ segment and then search for ‘Fund.’

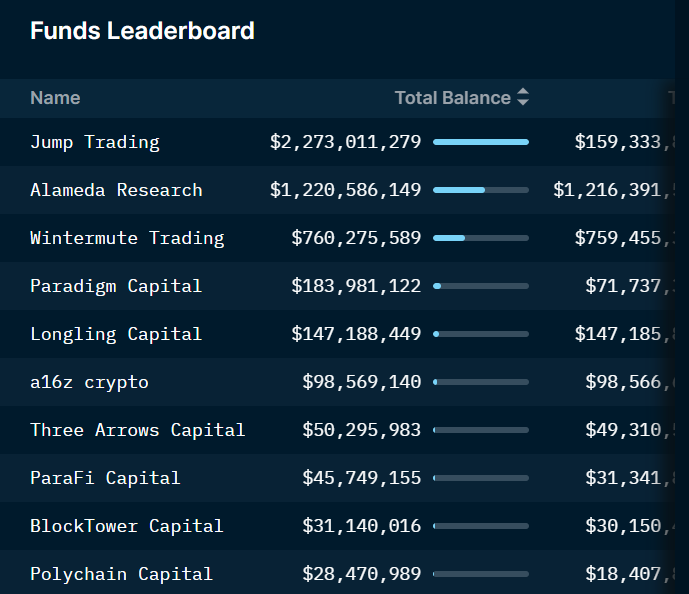

Nansen’s Fund leaderboard tracks the biggest hedge funds and venture capitalists in the industry such as Alameda Research, Wintermute, and Andreessen Horowitz.

Then, select the ‘Token Holdings’ tab and sort the list of ‘Top Holdings’ in a descending order for the last 30 days. This will help in identifying tokens that funds added in large amounts in the last month.

However, not all entries are buy orders. Many other sources can change a fund’s token balance, such as vesting early investment rounds, withdrawing from a liquidity provider (LP) pool, or receiving funds from a cross-chain bridge.

While the buying from exchanges adds value to the token, the unlocks from investment rounds may lead to a sell-off, and receiving funds from DEX pools and bridges may be non consequential because ownership doesn’t change.

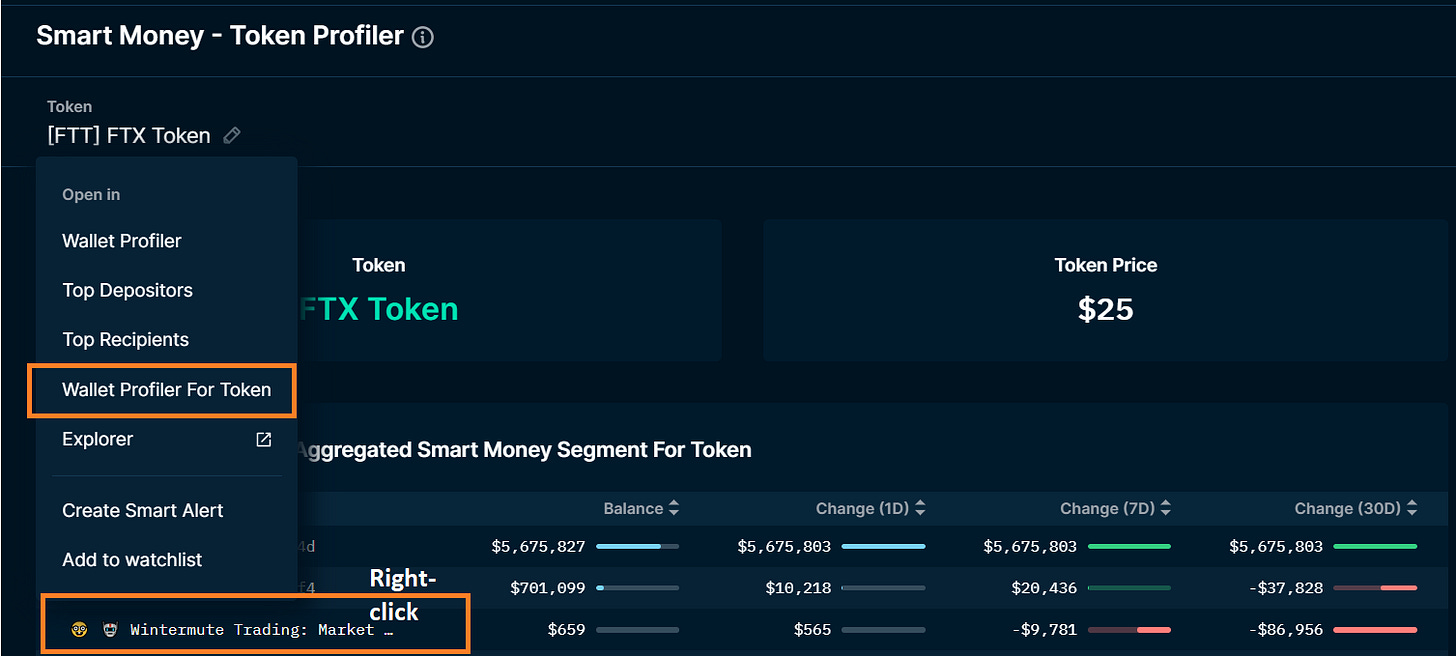

From the above list of tokens added in the last 30 days, let’s take a look at FTX (FTT). Apparently, top funds added around $5.7 million worth of FTT in the 24 hours, and around $8.3 million worth over the last 30 days.

To dig further, go to the ‘Smart Money - Token Profiler’ to identify the funds making the purchase.

For FTT, the top buyer is Alameda Research. Interestingly, in the last 30 days, Wintermute Trading’s FTT balance reduced by around $100,000.

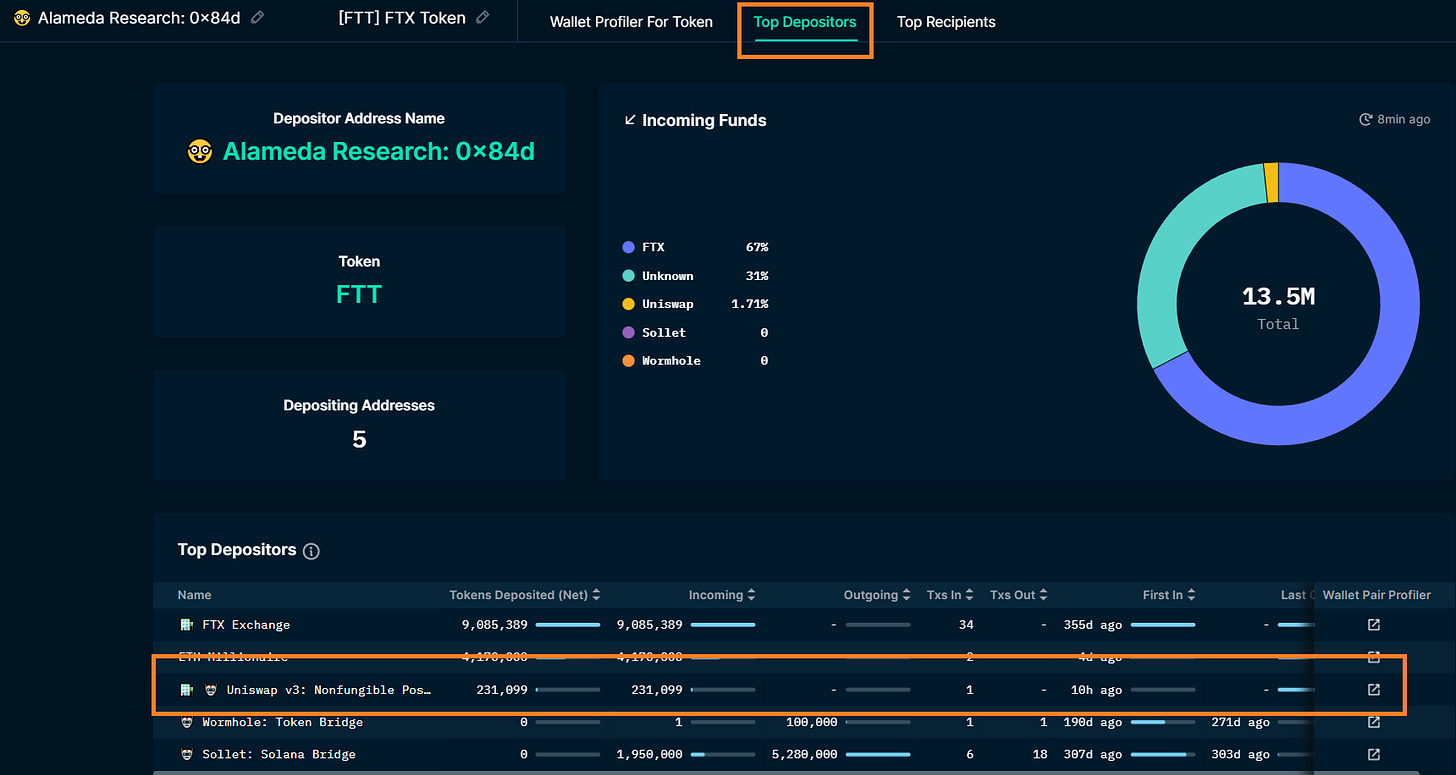

Now, let’s look at the source of funds added to Alameda’s wallet (we’ll later take a look at Wintermute’s wallet as well.) To track a fund’s transactions for a particular token, right click on the address and select ‘Wallet Profiler For Token.’

The top transactions include two 4.17 million FTT token transfers, one incoming and other outgoing sent to FTX exchange. This is a yellow flag as any tokens moved to exchanges are possibly sold.

To identify the source of the $5.7 million FTT token addition, we should look at the ‘Top Depositors’ to the Alameda Research’s wallet. Here we find that 231,099 FTT (worth ~$5.7 million) was unlocked from Uniswap V3: Nonfungible Position Manager. Alameda didn’t buy those.

The other notable FTT movement in the last month was around $100,000 worth FTT outflow from Wintermute's balance. Let's take a deeper look into that. Similar to the previous step with Alameda's wallet, we'll go back to the FTT token page for 'Smart Money - Token Profiler' and to Wintermute's 'Wallet Profiler for Token.'

The first thing I noticed was a massive decrease in Wintermute’s balance in mid-June, which coincides with the falling price of FTT.

If you notice Wintermute’s transactions top transactions, if you can find the exact date and sources of reduction in FTT balance. Looking at the ‘Tx’ for 1,000 FTT, we can see that Wintermute exchanged FTT for USDC on 0x Exchange.

Thus, a quick overview of the FTT token concerning Funds tells us that Alameda is unlocking its position on Uniswap, which is quite irrelevant, while Wintermute has reduced its FTT exposure significantly since June. These are not ideal signals of buying, in fact, quite the opposite.

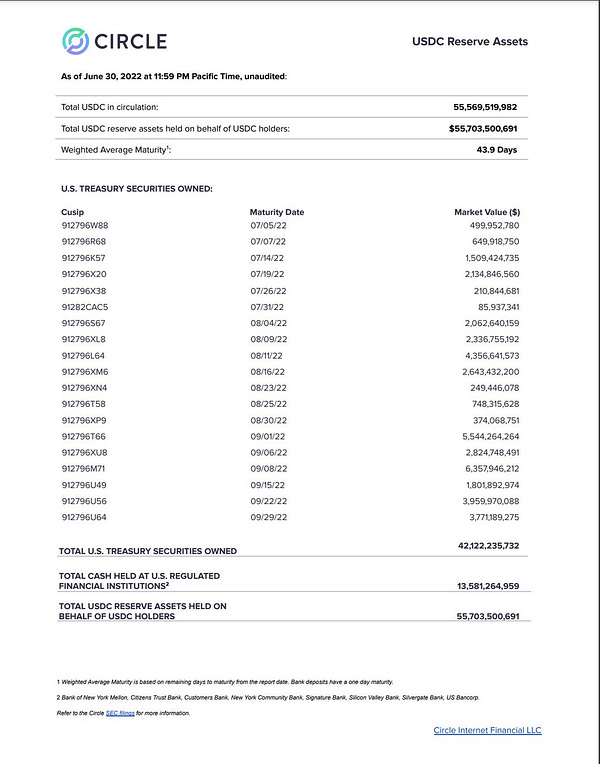

The Milk Road: CIRCLE RELEASES A BREAKDOWN FOR USDC RESERVE ASSETS

**Beginner**

Another positive step in transparency for collateral-backed stablcoin issuer, Circle. Expect most competitors to follow Circle’s lead.

Today - some good news came out. USDC, the 2nd biggest stablecoin in the world, with $55B in circulation, released data about the reserves backing their stablecoin.

So...what’s in the piggy bank?

$13.5B cash in banks (24.4%)

$42.1B in US treasuries (75.6%).

They have slightly more in reserves than the stablecoins in circulation (that’s good/expected)

This is important because we need a trusted stablecoin to be able to transact in crypto.

With USDC over 100% backed by cash + short-term treasuries, this should give people peace of mind.

It’s also one of the main ways USDC makes money - earning interest on their reserves. They’re projecting $351m in revenue for 2022.

Why this matters: When Terra crashed, it was a ~$18B stablecoin, that went to zero, and people lost trust. Circle showing that their stablecoin is fully backed by USD + short-term US Treasuries is good for trust.

VeradiVerdict: Brex for Crypto

**Beginner**

Overview of Rain, the company building the corporate card-esque spending rails for Web3 companies and DAOs.

Web3 is becoming natural in the modern workplace. We have seen the advent of Web3 protocols owning office space, hosting events, and even hiring interns. But even more importantly, companies have begun to integrate DAOs as a vehicle for making work more fulfilling.

DeFi makes it easy for companies to be transparent about their funds as well as add individual incentives. This, however, fundamentally changes how finances are managed. Large corporations can earn and raise money in crypto, hire fewer workers, and be community governed. Yet with all of this capital flowing in a DAO-based workforce, there has yet to be similar institutional adoption of cryptocurrency payments for goods and services. This bridge is essential in building the future of work.

Rain is betting on the future of these neo-corporations, allowing a seamless spending offramp for Web3 companies. Branded as a crypto corporate credit card, Rain provides a seamless way to spend directly from crypto treasuries.

Rain stands at the intersection of corporate credit cards like Ramp and Brex, along with crypto payment processing services such as Circle and CoinGate. Particularly, the solution attacks two of the major pain points: 1. Web3 companies have money locked away in treasuries 2. These funds need to be spent on goods and services.

Rain translates traditional financial rails to be compatible with tokens. Their vision is to build the fastest and most direct payment pipeline to connect Web3 companies to vendors. On the payment side, companies can acquire goods from Web2 services using corporate treasures without waiting for funds to settle. This allows protocols to use their treasury with instant liquidity whether it is for leasing office space, buying merchandise, or covering travel expenses. On the other hand, merchants paid by Rain get access to fiat without the regulatory risks of accepting crypto, and the underlying volatility associated with that crypto settlement. This means that you can purchase goods on Amazon, buy a Notion subscription, or rent a Zipcar all without the need for vendors to accept crypto.

Rain provides practical DeFi use at its core: unfreezing DAO treasuries. As this trillion-dollar asset class continues to expand, traditional corporate finances are headed to the blockchain, and the rails for these new processes are being established. Rain is providing a seamless spending offramp for Web3 companies, a groundbreaking service for the future of corporate finance. With several hundred customers on its waiting list, Rain has been onboarding customers since March.

Actions:

I removed a majority of my crypto assets from centralized platforms as insolvency dominoes play out in the market.

Airdrops

$STARK TOKEN CONFIRMED 🐺⚡️ Airdrop to StarkEx past users 🪂 @StarkWareLtd just published a Medium post: a token is coming for the ZK-Rollup solution! Zhu Su gave us a hint yesterday. 10B tokens have been minted, and an ERC-20 version is coming to Ethereum. Details 🧵👇

$STARK TOKEN CONFIRMED 🐺⚡️ Airdrop to StarkEx past users 🪂 @StarkWareLtd just published a Medium post: a token is coming for the ZK-Rollup solution! Zhu Su gave us a hint yesterday. 10B tokens have been minted, and an ERC-20 version is coming to Ethereum. Details 🧵👇Galaxy Digital: 🌟 Starknet Token Confirmed

StarkWare outlines decentralization path with new token & formation of StarkNet Foundation. As background, StarkWare is building a L2 on top of Ethereum in the form of a STARK-powered ZK rollup. StarkWare built StarkEx and StarkNet, which together are home to popular applications including dYdX, ImmutableX, DeversiFi, and Sorare.

StarkWare’s announcement outlines the roadmap towards the decentralization of StarkNet, which includes the creation of the StarkNet Foundation to oversee the development of the protocol and a new token to be used for governance and to pay for gas fees. The Foundation will be responsible for developing the community decision-making process around protocol upgrades, working on the protocol upgrades, creating a system for dispute resolution, and funding public goods on StarkNet.

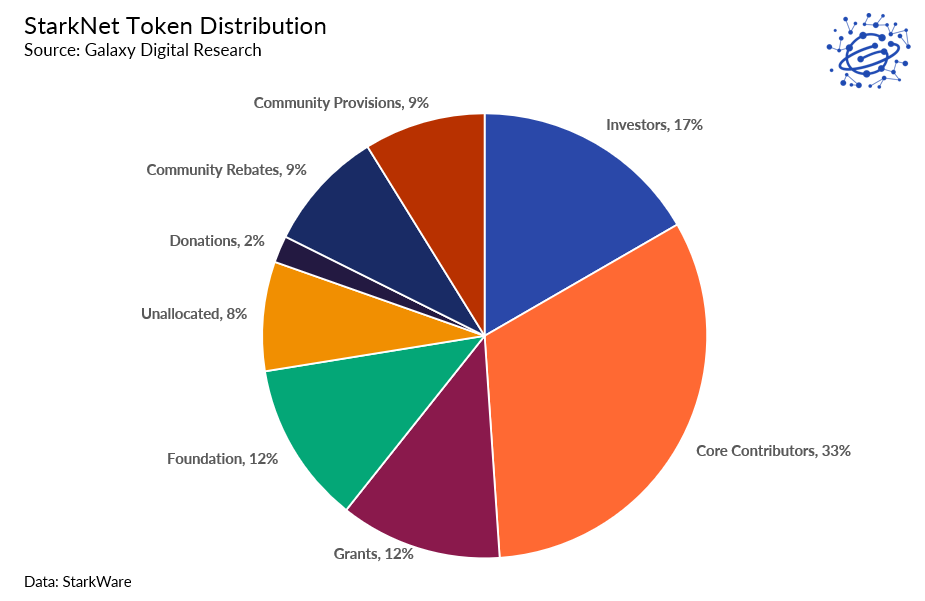

The token was minted with an initial supply of 10bn (not capped). The initial token allocation is split with 17% to StarkWare investors, 32.9% to core contributors, and 50.1% to the StarkNet Foundation—to be split among community provisions (9%), community rebates (9%), grants for research and development (12%), a strategic reserve (10%), donations to “highly regarded” institutions and NGOs (2%), with the remaining 8.1% left unallocated. Tokens allocated to investors and core contributors will be in a 4-year lockup with a one-year cliff and linear vesting.

OUR TAKE: 3AC's Su Zhu may have led StarkWare to disseminate information around its STARK token earlier than expected, but eventual plans to launch a token should not have come as a surprise. While token details are yet to be finalized, some critics took issue with the initial outline shared by the Starkware team including the amount allocated for Core Contributors and investors, the lack of an explicit airdrop for early users, and the intent to use the token to pay for gas fees (rather than sticking with ETH, which is currently used).

In an industry founded on the principles of decentralization, we typically take issue with large token allocations for "insiders" vs. the public. But StarkWare and other teams building out ZK rollups have been tackling one of the most difficult technical challenges of bringing scalability to Ethereum while also preserving privacy benefits. Their work will surely still be needed after the token launch (target Sept 2022) and there is an argument to be made that the teams deserve compensation. However, the allocation of the STARK token has raised eyebrows and some criticism for the lack of an explicit airdrop for early users. The initial 17% investor allocation is equal to that included in Optimism's OP, which didn’t generate as much criticism at the time. We wrote back in April that Optimism's OP token was relatively generous in rewarding early users and that having multiple rounds of airdrops was a great incentive to maintain engagement. For early StarkNet users, an airdrop has not been ruled out and can be included in the Community Provisions allocation or could come from the ecosystem project teams that are looking to provide an additional reward to their users.

Last, the intent to use STARK as the gas token of the platform may come as a disappointment to the ETH community since it removes a way for value to accrue to ETH. However, having a native token used to pay for gas provides application teams with significantly more operating flexibility, which ideally can be levered to deliver the best UX. StarkWare anticipates that fees will be paid exclusively with the STARK token, but that users will still have the option to pay fees in ETH - so value could still accrue to the ETH token depending on how this feature is implemented.

After dYdX announced several weeks ago that it would be migrating from StarkEx to Cosmos due to, among other reasons, a lack of decentralization (primarily with the role of the sequencer), a STARK token provides a path towards decentralizing the platform (first, in governance and then eventually with the sequencer for data availability provisioning and submission of validity proofs). Who's to say dYdX won't be incentivized to move back to a rollup then?

Buying Liquidations

Liquity (Disclaimer: I lend & stake on Liquity)

TLDR

Borrowing: Borrow against ETH to get Liquity’s stablecoin (LUSD), which you can swap to USDC and convert USD. The collateralization ratio minimum is 110%, meaning if you borrow against $11k worth of ETH, you can receive up to 10k worth of LUSD. If ETH’s price increases, your collateralization ratio increases (good). If ETH’s price decreases and your collateralization ratio drops below 110% (bad), your ETH will be liquidated and bought by stability pool lenders, but you keep your LUSD.

Lending: Lend Liquity’s stablecoin (LUSD) to the stability pool to earn an APY in Liquity’s native token (LQTY). Lending to the stability pool requires lenders to absorb and cancel debts that drop below 110% collateralization (ETH). This means your LUSD loan, will be converted into ETH on a pro rata basis.

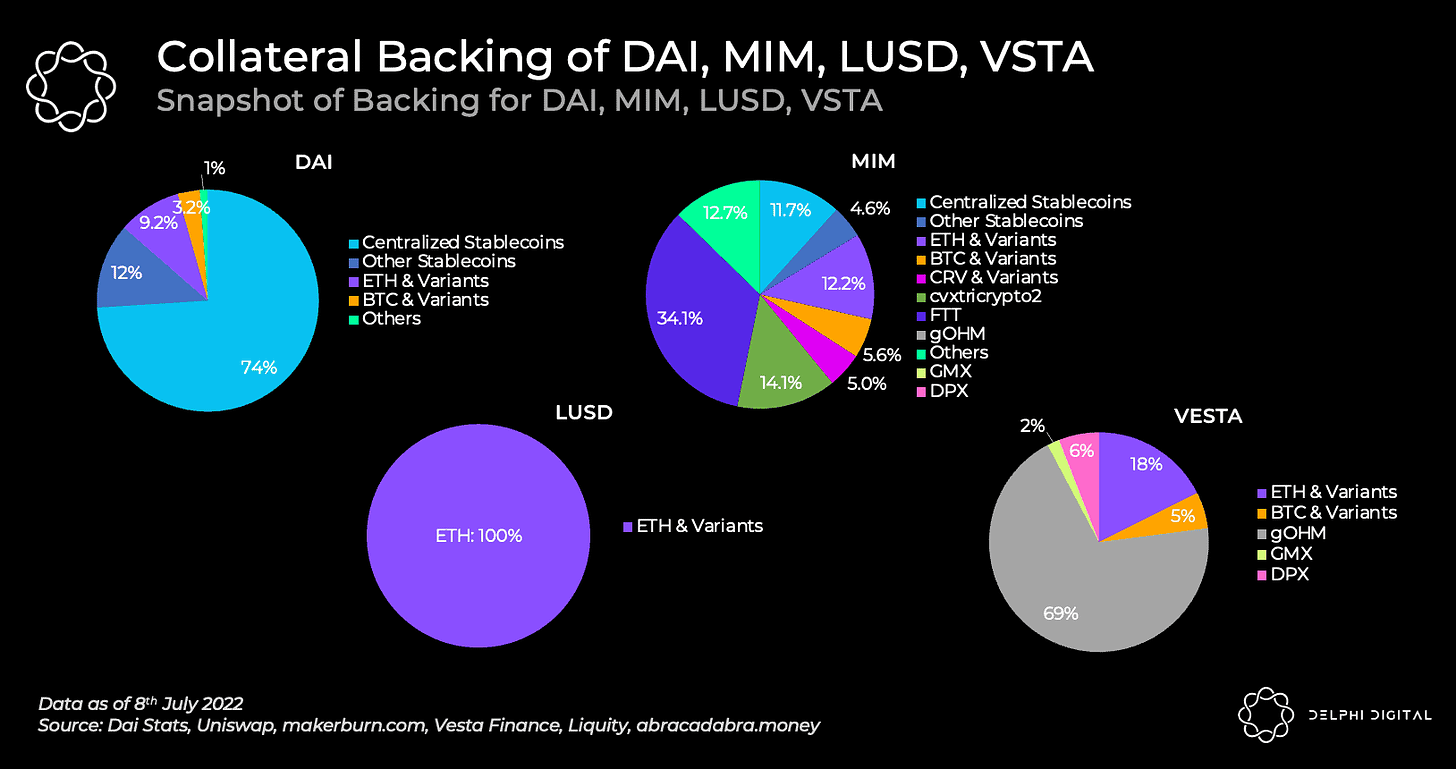

Delphi Digital on Liquity

Liquity is a decentralized borrowing protocol that allows users to draw interest-free loans against Ether used as collateral. Loans are paid out in LUSD (a USD pegged stablecoin) and need to maintain a minimum collateral ratio of 110%. In addition to the collateral, the loans are secured by a Stability Pool containing LUSD and by fellow borrowers collectively acting as guarantors of last resort. Liquity as a protocol is non-custodial, immutable and governance-free. Learn more about it here

Stability Pool:

The Stability Pool absorbs and cancels debt from liquidated Troves – similar to collateral auctions in MakerDAO

The Stability Pool replaces these auctions by allowing LUSD holders to commit capital upfront in order to “buy” liquidated ETH and offset the bad debt

In general, Stability Providers will receive more ETH (in $ terms) than LUSD burned which gives them discounted ETH

LQTY rewards are distributed pro rate to Stability Providers for the duration of their deposit:

The more LUSD a user has in the pool and the longer they keep it deposited, the more LQTY rewards they receive

Risks:

By committing capital upfront to “buy” liquidated ETH, users are also committing to buying ETH during price drops:

This means that it’s possible for the ETH that users receive to be worth less shortly after receiving it due to a quick price drop.

DeFi

Governance

Resources

Security

Staking

Acala (ACA) Staking, if you participated in the Polkadot (DOT) crowdloan

Moonbeam (GLMR) Staking, if you participated in the Polkadot (DOT) crowdloan

Adoption:

Surge in Crypto Adoption in Saudi Arabia, 3 Million Saudis are Crypto Investors

Nearly 14% (or 3 Million) of the adult population in Saudi Arabia aged 18 to 60, are either crypto investors or have traded crypto over the last six months, the latest study by the cryptocurrency exchange Kucoin revealed. The study further added that around 17% (Approximately 3.6 Million) of the country’s adults are “crypto-curious and are likely to invest in cryptocurrencies over the coming six months.” -CoinCodeCap

How Big Three ratings agency S&P aims to ‘institutionalize’ DeFi

The fight to stabilize, legitimize and normalize cryptocurrency markets continues to rage — and ratings agency S&P Global is the latest giant of traditional finance to enter the ring.

S&P Global has launched a DeFi strategy group, led by chief DeFi officer Charles Mounts and head of DeFi strategy Charles Jensen. -The Block

74% of Latin Americans Prefer Businesses That Accept Crypto

50% of Latin American respondents said crypto will have a massive impact on finance and society

Asian consumers are up to three times more likely to purchase NFTs for emotional benefits -Blockworks

Most crypto-friendly countries revealed! 🌏

The U.S. has been named the world's most crypto-friendly country — but it's tied in joint first place with a rather surprising contender. Germany also holds the top spot, with researchers at Coincub praising the European nation's "progressive" laws and "favorable" tax regime. Bitcoin and Ether investors there can sell off their crypto without paying any capital gains — as long as they've held the coins for over a year. America was praised for having a high number of BTC nodes and ATMs, with high private demand for trading and mining. Singapore, Australia and Switzerland make up the rest of the top five, in a sign that actually adopting Bitcoin as legal tender isn't everything. Where did El Salvador rank, we hear you ask? 35th! -CoinMarketCap

U.K. to push ahead with official NFT 🇬🇧

The British government is vowing to push ahead with plans to create its very own non-fungible token — despite being thrown into disarray after the Prime Minister resigned. The Royal Mint, which issues coins in the U.K., is due to release the NFT later this summer. Even though the government is in turmoil, a spokesperson told London's Daily Telegraph: "We are firmly committed to putting the U.K. at the forefront of crypto-asset technology and innovation by capitalizing on the freedoms gained by leaving the European Union." The plans were initially unveiled by Rishi Sunak back in April, when he was Chancellor. Sunak's resignation helped lead to Boris Johnson's downfall, and he's now in the running to replace him. -CoinMarketCap

Centralized Crypto Entities:

OpenSea is cutting 20% of its workforce. The NFT marketplace said the drastic move was in response to "an unprecedented combination of a crypto winter and broader macroeconomic instability." CEO Devin Finzer says the company needs to prepare for a potentially prolonged downturn — and these changes will mean it can survive for several years if things don't improve. OpenSea's trading volumes have slumped in recent months. They hit a record high of $5 billion in January 2022, but dwindled to just $700 million last month. On top of that, the platform is facing increasing competition from new entrants into the space — Coinbase and Instagram among them. -CoinMarketCap

Coinbase approved to operate as crypto asset service provider in Italy. Coinbase has obtained a license to operate in Italy as a crypto asset service provider as the exchange expands in the region. According to a blog post on Monday, the publicly traded crypto exchange now meets the new requirements put in place by the Italian regulatory authority Organismo Agenti e Mediatori. It claims to be one of the first companies to meet these benchmarks. -Messari

CryptoBriefing: Binance Burns $444M in BNB Tokens

BNB Chain burned nearly 2 million BNB tokens in its 20th BNB auto-burn event.

Over $444 million worth of tokens were destroyed, bringing the total circulation supply to 161,337,261.09 BNB.

Still, BNB appears to have resumed its downtrend and could target $175.

Crypto Markets:

Decentral Park Capital’s Top 100 (7d %) as of 7/18:

LidoDAO (+153%)

Polygon (+56.2%)

Etheruem Classic (+50.1%)

Arweave(+45.6%)

Quant (+27.3%)

Total market cap back above $1 trillion 🔥

The total market cap of all cryptocurrencies has surged beyond $1 trillion for the first time in over a month, CoinMarketCap data shows. The return to this psychologically significant threshold comes after Bitcoin broke through $22,000. This price point has proven a stubborn level of resistance for BTC in recent weeks, with bulls given a boost after they successfully avoided a sustained fall below $20,000. But it's Ether that's by far the best performer on a seven-day timeframe. The world's second-largest cryptocurrency is now on the brink of cracking $1,500 after surging by 28.65% in one week. -CoinMarketCap

Bitcoin's smashed through stubborn resistance on Tuesday — hitting $23,500 for the first time since early June. The world's biggest cryptocurrency has cracked the 200-week moving average as a result, but analysts fear that the gains may be short-lived. On Twitter, Rekt Capital said BTC needs to secure a weekly close above $22,800 to prove that it's turned a corner — but a lot can happen between now and Sunday. Ether is now nearing $1,600 — up 50% in a week — and altcoins including Solana, Polygon and Avalanche are also performing strongly. Crypto investors have been desperately looking for a sign that the bear market may soon bottom out. -CoinMarketCap

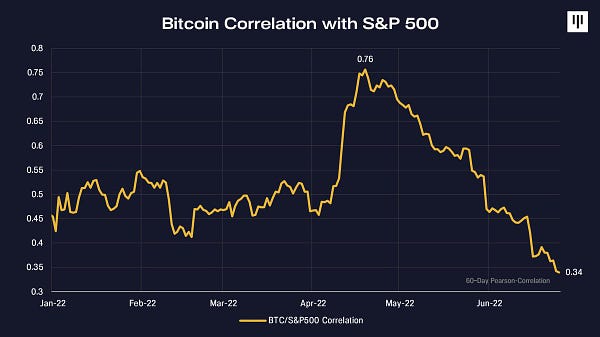

0.47

That is the 40-day correlation between Bitcoin and the Nasdaq 100, which is at its lowest point since January, according to Bloomberg. While Bitcoin hasn’t historically correlated with U.S. stocks — meaning its price hasn’t moved in tandem with the market — both crypto and tech stocks began trading in similar directions during the pandemic stimulus era, thanks to extra consumer cash. Now that fiscal tightening has caused both to fall significantly over the last six months, analysts are waiting to see if crypto will move more independently again. -Coinbase

Market Thoughts From Dan @ Proof of Work (7/17)

And while the Crypto price action over the weekend has been strong, the US trading session is the widow maker. If the current strength persists through tomorrow’s open, then it becomes increasingly likely that the lows are in for now and chatter around the ETH merge coming as soon as September 19th, could continue to propel us higher. The run in blue chip NFTs are also likely contributing to the ETH price acceleration.

However, I maintain my overall thesis that we’ll have time to accumulate in this range through the summer. Horribly researched stories like this one by english majors who don’t understand the first thing about crypto are good for helping establish the bear market but we need many more of them. We need Crypto to once again be terminally uncool, with no sign of use cases, for an extended period of time (and you know, GS to dissolve their crypto-derivatives desk). Only then will the bulls run once more.

Deals/Raises:

Mysten Labs, a startup building a new blockchain for gaming and social media networks, is in talks to raise at least $200 million in a Series B led by FTX Ventures at a valuation of $2 billion, The Information reported on Monday. -The Information

Gnosis Safe, a digital asset manager that is rebranding to Safe, raised a $100 million round led by early-stage crypto fund 1kx. The round also included Tiger Global, A&T Capital, Blockchain Capital and Digital Currency Group. -The Information

Merkle Manufactory, a startup building a decentralized protocol for social networks called Farcaster, raised a $30 million funding round led by Andreessen Horowitz. Other investors included Standard Crypto, Elad Gil and 1confirmation. -The Information

Magic Eden, a Solana-based NFT marketplace, launched a venture arm that will focus on investing in Web3 games. -The Information

Morpho Labs, a blockchain lending protocol, raised $18 million in a funding round co-led by Andreessen Horowitz and Variant. -The Information

Quadrata, a startup building identity verification tools with blockchain, raised $7.5 million in a funding round led by Dragonfly Capital. -The Information

LI.FI, a back-end blockchain services startup, raised $5.5 million in a funding round led by 1kx -The Information

DeFi:

Decentral Park Capital’s Top DeFi (7d %) as of 7/18:

Barnbridge (+204%)

Lido DAO (+153%)

Dopex (+97.7)

Rocket Pool (+47%)

Maple (+42.8%)

Funds:

Christie's launches venture fund, makes first investment in web3 company

Christie’s has launched a venture fund to make investments that “enable seamless art consumption.” The first investment will be in a blockchain interoperability startup called LayerZero Labs. -The Block

Hacks/Exploits:

U.S. fights North Korean hackers 🇺🇸

U.S. detectives have managed to recover over $500,000 in crypto that was paid to North Korean hackers following ransomware attacks. The FBI and Justice Department sprang to action after a medical center in Kansas was attacked. State-sponsored cyber criminals had encrypted hospital servers that were used to store critical data and operate key equipment. The crypto transaction was traced using blockchain analytics — and "breadcrumbs" led the FBI to China-based money launderers who help Pyongyang cash out ransom payments. It's believed North Korea uses these ill-gotten gains to fund its nuclear weapons program. -CoinMarketCap

Layer 1s:

The ETH Merge has a new target date: Sept 19th.

Here’s what the timeline is looking like:

Goerli Test Merge: week of August 11th (the final testnet!)

The Merge: week of September 19th

"It's quite realistic to merge in September, assuming... the Goerli fork doesn't completely blow up" - Tim Beiko, Protocol Support at ETH Foundation. -The Milk Road

The Block: NEAR partners with BitGo as it enters world of institutional investments

BitGo will support the NEAR Foundation protocol and its assets with qualified custody services.

Marieke Flament, CEO of the NEAR Foundation, said the partnership is proof of NEAR’s commitment to widening its ecosystem.

The NEAR Foundation will also custody its own treasury with BitGo.

Avalanche Ecosystem Overview. The umbrella network, the Primary Network, is composed of the C, P, and X chains. Today, the vast majority of Avalanche applications are deployed on the Contract Chain (C-Chain), Avalanche’s EVM-compatible smart contract platform. However, while Avalanche’s consensus brings speed and low fees, it doesn’t provide a long-term solution for scalability. To accomplish this, Avalanche enables projects to create custom blockchain networks (subnets) using the Platform Chain (P-Chain). Finally, the Exchange Chain (X-Chain) exists to create and move Avalanche-native digital smart assets. Like subnets, this design space is also fairly nascent and underexplored, but it has seen some unique projects (in use and under development) over the past year. -Messari

Layer 2s:

CoinTelegraph: Polygon selected to participate in Disney’s 2022 Accelerator Program

Ethereum scaling solution Polygon has been selected to participate in Disney’s Accelerator Program to further Polygon’s development of Web3 experiences.

Mining:

Bitcoin hash rate has now fallen 15% from ATH as evidence of coninued miner capitulation comes in. Rising BTCUSD will help miners cover overheads/capex. -Decentral Park Capital

Bear Market Mining: Crypto miner CleanSpark has bought 1,061 bitcoin mining rigs that are already in operation at the hosting firm Coinmint's facility in New York. In June, the Las Vegas-based miner signed contracts for another 1,800 mining rigs.

The cost to produce a bitcoin has fallen to about $13,000 from around $20,000 at the start of June as miners battle the bear market and efficiency in mining rises, according to analysts at JPMorgan. Declining production costs could be seen as a negative for bitcoin prices, since production cost is in theory a “lower bound” for the market, and $13,000 is well below the current $20,000 trading range. -CoinDesk

Miscellaneous:

The Milk Road: RIPPLE'S FOUNDER WALKS AWAY WITH $3B+

XRP is the 7th largest cryptocurrency with a market cap of $17b. It’s also widely mocked as a ‘sh*tcoin’ by most serious crypto folks.

Why?

They created 100B tokens on day 1 (no mining) and gave themselves 60%+ of it

They became paper billionaires, and some of the wealthiest people in the world when crypto took off, despite Ripple having ~no traction

One of the founders left the project, took 9 Billion XRP (18% of total supply) with him, and has been trying to sell as much as he can for the past 8 years.

His selling was putting too much pressure on the price. So they negotiated a gentleman’s agreement:

Jed could only sell a certain amount each week. The amount would be based on the daily volume for that week.

For the last 8 years, “tacostand” (the name of Jed's wallet) has slowly been selling off 9 billion tokens. And he just sold his last batch.

The saga is officially over. Jed makes $3B+, and XRP no longer has to deal with his massive sell pressure.

Regulation:

SEC Considers Waiving Some rules to Regulate Cryptocurrency

Gary Gensler, the chairman of the Securities and Exchange Commission, said on Thursday that the commission may use its power to exempt cryptocurrency companies from certain securities regulations in order to assist the sector in becoming compliant. -CoinCodeCap

The Central Bank of South Africa Now views Cryptocurrencies as Financial Assets

In a complete turnaround of its previous policy that left digital assets outside the purview of a legal framework, South Africa’s Central Bank [SARB] has opted to include cryptocurrencies into its regulatory jurisdiction. The top bank has changed its mind about regulating cryptocurrencies as financial assets and is evaluating doing so. -CoinCodeCap

Putin bans crypto payments in Russia ❌

Vladimir Putin has signed a law that bans crypto payments in Russia — amid claims they're behind a dramatic surge in pyramid schemes. The president's move means digital assets cannot be used to acquire goods, services and products across the country. It comes after a tug of war between governmental bodies on the best way to handle the rise of cryptocurrencies. While the Bank of Russia wanted all crypto-related activity to be banned outright, the country's Ministry of Finance advocated for regulation. Meanwhile, figures from the Bank of Russia suggest 954 pyramid schemes were identified in the first half of 2022 — 6.5 times higher than the same period a year earlier. Of those, 56% were said to have "raised funds in various cryptocurrencies." -CoinMarketCap

Crypto-friendly senators raised thousands from the industry in Q2. As The Block's Stephanie Murray reported this week, Senators Cynthia Lummis (R-WY) and Kirsten Gillibrand (D-NY) drew support from various quarters of the crypto space, especially from venture capitalists and senior executives from major firms. Notable names on Lummis’ filing included Multicoin Capital Managing Partner Kyle Samani, who has given Lummis $5,800 this cycle, along with Multicoin Capital Partner John Robert Reed and General Counsel Gregory Xethalis. Andreessen Horowitz co-founder Ben Horowitz and General Partner Chris Dixon have each given $5,800. For Gillibrand, notable names included FTX CEO Sam Bankman-Fried and Gemini’s Cameron and Tyler Winklevoss. -The Block

India's long-running crypto industry lobby group, the Blockchain and Crypto Assets Council, abruptly closed its doors this week. The impact of BACC's dissolution on India's crypto sector isn't immediately clear. But one crypto exchange executive, who declined to be named, described it as "a good thing" for the industry as the exchanges already led all major initiatives, raised funds and reached out to policymakers. In 2018, the IAMAI represented the Indian crypto industry against the Reserve Bank of India (RBI) after the central bank barred regulated financial institutions from dealing with crypto firms. Then in 2020, the IAMAI won the battle as India's Supreme Court struck down RBI's banking ban against crypto. -The Block

Stablecoins:

Web3/NFTs:

Think the days of NFTs selling for millions of dollars are long gone? Think again. A rare CryptoPunk has gone under the hammer — selling for a whopping $2.6 million… that's about 2,500 ETH. The transaction was completed on Tuesday, and in ETH terms, is tied in fifth place for the most-expensive sale since the collection launched. CryptoPunk #4464 is a particularly rare one — the 32nd rarest available, in fact. Out of the 10,000 NFTs in this collection, it's among just 24 that are apes. Accessories include an eye mask and a vape. Data from CryptoSlam reveals it's the biggest NFT transaction that's been seen over the past 30 days. -CoinMarketCap

The Milk Road: CONSENSYS DROPS A NEW NFT TO TOKENIZE SERVICES

ConsenSys is launching a new NFT. It’s called TURN.

This one is different. It has a special utility: holders can redeem their NFTs for a full week (40 hours) of security audits.

This is cool for 2 reasons:

It creates an open marketplace for time-bound services. Right now, it’s security audits. But in the future, it could be any time-bound service like consulting, marketing, designing, etc.

Buy the NFT and skip the line. Companies usually have to wait 6+ months to get an audit. Now they can buy the NFT and skip the line when needed.

Emerging Technology & Venture Capital

Confluence.VC Weekly: 50 brutally honest takeaways about my time in venture capital

**Beginner**

Interesting to scan through these takeaways if you are investigating the glorified world of Venture Capital. I highlighted some of my favorites below.

There are not enough good companies out there to justify the amount of venture funds in existence.

The best founders spend the least time fundraising. If you make your diligence process a burden on the founder, you’ll have to settle for bottom-tier deals.

The most interesting people have side projects and do not tie their identity to their job. If you want to be more interesting, do interesting stuff outside of work.

Having your money locked up for 7-10 years is not ideal, and a lot of LPs are starting to realize this.

It is way easier to 3x your money at a $10mm fund than it is at a $100mm fund.

Proprietary deal flow is a myth.

“Partner track” roles are not as popular as you’re led to believe. Most analyst / associate roles are two-year positions, then you're expected to find something else after that (preferably joining a portfolio company or starting your own company).

If you want to be rich, working as an employee in VC is one of the worst fields to do that.

If you want to work directly with founders, you’re better off joining an actual startup. Your involvement with the founding team will peak during the diligence process, and then it will wane off from there.

Venture capital rewards being solely focused on your job for long periods of time. If you have any plans of being multi-faceted and not obsessed with your work, there are better careers for you.

Most VCs are extremely lonely in their day-to-day. Small teams and saying “no” all day will do this to you.

Venture capital is an apprenticeship game. Because of this, you’ll be expected to be in the office to get facetime. It’s tough to find roles that are open to remote work.

There are very few contrarians left in VC because almost everybody is scared to say what they actually think.

The biggest asset an investor has is his / her network, but 90% will scoff at the chance to 10x their network overnight.

The best deals come from people you actually take the time to get to know and become friends with. If you view every interaction as transactional ("you send deals if I send deals"), why do you think anybody would send their best deals to you?

If you hate virtue signaling, you will hate venture capital.

There will always be an MBA that wants your job. If you’re a junior VC and think you’re indispensable, you’re not.

Venture teaches you to pattern match, but by definition, you are supposed to invest in companies that break patterns. Following the same mental heuristics as your peers will get you nowhere.

“The better the weather, the the better the network. The worse the weather, the better the worker.”

“Don’t talk politics” only applies if you have conservative values.

However many LP meetings you think you need to take in order to raise your first fund, double it.

Fundraising is 90% proving track record and ability to get allocation into competitive rounds.

If you haven’t built a Twitter audience by now, I’d argue that it’s not a great investment of your time. You’re competing for attention on the most-crowded platform, it’s not evergreen content, and good luck consistently saying something that hasn’t already been said.

The earlier you decide what you want out of your career, the better off you are. Some start a career in venture to increase their options in the future, but then they never leave. Nothing wrong with this, but if you have a plan, you can realize what actions you need to take if venture is not your final destination.

Venture is a branding game. You can only earn your brand through building a track record or being loud on the internet. Which of these options do you think LPs prefer?

USV’s Fred Wilson: Valuing a Venture Capital Portfolio

**Beginner**

Self-explanatory.

We have a few rules and I would like to share them:

Be conservative. The auditors try to get us to mark our portfolio up to reflect “market prices” but we prefer to keep our portfolio marked below market prices, particularly in times of market froth. This leads to a fair bit of haggling with our auditors that is mostly a waste of everyone’s time but we feel that it is important to maintain our conservative posture.

Get Ahead of Market Pullbacks. We like to move quickly to take our marks down when we see the market environment changing. Public stocks often lead private valuations by several quarters so we like to look to public market comparables and mark down quickly.

Never Mark Higher Than Potential Sale Value. Every time we have a significant M&A exit in our portfolio, I like to check that the proceeds to USV exceed our current mark.

Take Total or Partial Write-Downs In Advance of Problems. When a company is having real issues, we like to take total or partial write downs. We sometimes reverse them if the company recovers. If you might lose money on an investment, it is always best to signal that ahead of time.

Have Multiple Sets Of Eyes On The Marks. We debate and discuss the marks with each other. This is all about getting multiple sets of eyes on the marks. While the partner closest to the company will always have the best sense of value, debating and discussing often leads to a better answer.

EV Updates:

EV startup Canoo receives massive order from Walmart for 4500 vehicles (link). -Trucks FoT

Penetration of EV sales in the US market doubled in Q2 from the same period last year, up to 5.6% (link). Via NYT / Cox Automotive. -Trucks FoT

Macro & Markets

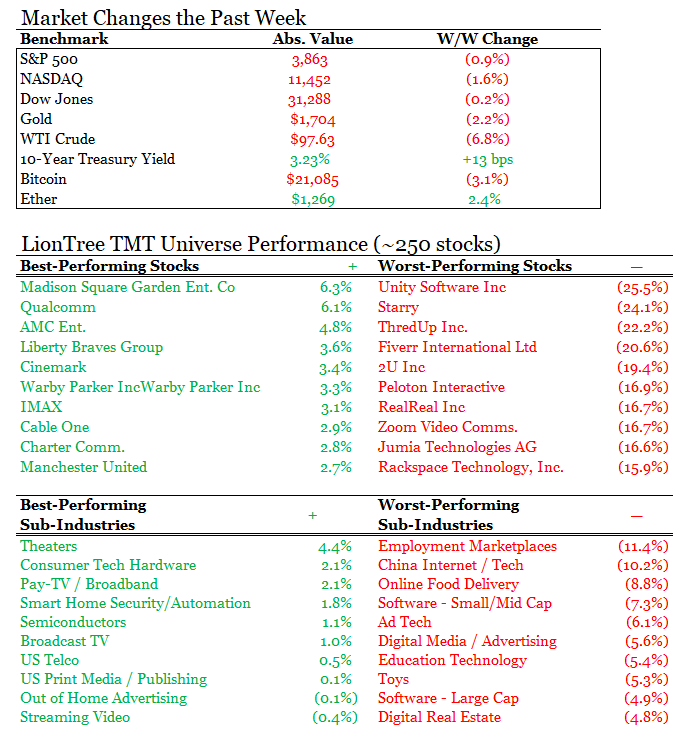

LionTree: Stock Market Check 7/15

Companies:

Seeking Alpha: Earnings evaluation

The second-quarter earnings season is officially underway as investors prepare for a slew of results that could define market direction over the course of the summer.

While many analysts have been lowering their Q2 estimates in recent months, earnings among S&P 500 companies are still expected to have risen 4.3% Y/Y (though it would mark the slowest pace of growth since the fourth quarter of 2020). According to FactSet, the S&P 500's expected net profit margin for Q2 is also expected to come in at 12.4%, which is above the five-year average and slightly higher than the previous quarter. "I'm absolutely gobsmacked that margins are expected to be as high as they are," declared Hans Olsen, chief investment officer at Fiduciary Trust. "It's just this notion of hope over reality."Q2 results from JPMorgan Chase (JPM) and Morgan Stanley (MS) on Thursday did not set a good tone for earnings season. Both stocks slid following lower-than-expected earnings, triggering pain for bank shares across the board.

Financial bellwether: JPMorgan posted a worse-than-expected 28% fall in quarterly profit as global investment banking fees slid in a "challenging macro environment." The division is coming off the SPAC boom, as well as IPOs and other dealmaking that rocketed higher in 2021. The bank additionally set aside another $428M to cover possible future loan losses, playing some defense in case things go sour.

On the upside, JPMorgan reported its best earnings from lending in over a decade, benefiting from the rising interest rate environment. It also sounded positive on the U.S. consumer and commercial landscape, with cash balances and defaults holding up well, and spending on Chase credit cards even rising 21% from a year ago. The bank even raised its net interest income guidance for 2022 despite "waning consumer confidence and high inflation. "Seeking Alpha: Autopilot departure

It's hard for Elon Musk to stay out of the headlines, but his AI leader at Tesla (TSLA) just left the company. Andrej Karpathy, who was instrumental in developing the Autopilot driver-assistance feature, had been on sabbatical since March, when Musk stated he would be taking an approximately four-month break for unspecified reasons. It's set to be a big loss for the Autopilot team, which already experienced 229 layoffs after the recent shuttering of Tesla's office in San Mateo, California.

Amazon (AMZN) is reducing the number of items it sells under its own brands by well over half, and the company has discussed the possibility of exiting the private-label business entirely. Disappointing sales for many of the items has led the online retail behemoth to scale back certain household brands, but the broader move is aimed at alleviating regulatory pressure, according to the WSJ. In recent years, U.S. lawmakers and the European Commission have blamed Amazon for giving advantages to its own brands at the expense of products sold by millions of other vendors on its site.

The latest report also comes after the retail giant announced that members purchased more than 300M items worldwide during Prime Day 2022, making it the single biggest event in its history.Amazon and competition regulators

In the USA, Amazon has apparently been pulling back from its private label business in the face of regulatory pressure - apparently they discussed reducing the selection by half. I have always seen this complaint as entirely irrational. Private label has been a basic part of retail since the 19th century: it’s 2-3% of Amazon revenue, but 20-30% of revenue at most big US retailers, and Amazon is doing nothing meaningfully new or different. On the other hand, the fact that it’s so small might make it easy to give up to make regulators happy. LINK

Conversely, in the EU, Amazon is negotiating with regulators over Marketplace (which is over half of GMV), and has offered to limit its use of sales data, apply equal treatment to the ‘Buy box’ and move Prime shipping to FRAND terms. LINK -Benedict Evans

Amazon sued more than 10,000 Facebook group administrators. The e-commerce giant is fighting against fake product reviews. -Quartz

There was a lot of positive momentum going into yesterday's quarterly report from Netflix (NFLX), as stocks soared in a broad-based rally with earnings season not as worrisome as initially feared. Netflix benefited from the sentiment by climbing 5.6% during the session, and tacked on another 7% AH to firmly trade above the $200 level. There had also been some alarm about a saturated streaming market and price hikes during a period of inflation, but Netflix was able to assuage those concerns with an upbeat outlook of an imminent comeback.