Blockchain, Cryptocurrencies & Digital Assets

Follow Up on Last Week’s Deep Dive: Crypto Insolvency Dominoes & Humans’ Irresponsible Risk Management

Here is a great thread from @ChainLinkGod on tokenizing real-world assets.

Quote of the week from ChainLinkGod:

I’m interested in crypto because this technology presents a viable path towards improving society by re-establishing trust between mutually-distrusting entities by executing agreements on a credibly neutral settlement layer that is viewable to all, and tamperable by none.

Updates on Crypto Insolvency Dominoes & the Fallout

The latest on the fallout from Terra/LUNA, 3AC, Celsius, Voyager, etc…

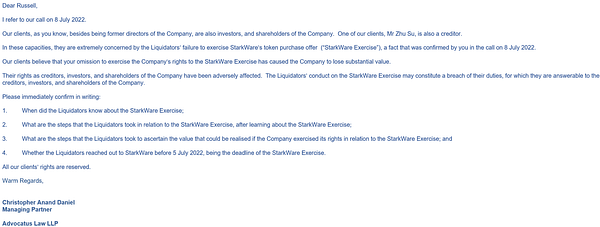

3AC (Three Arrows Capital)

Where are they? Three Arrows creditors get an emergency hearing as founders fail to “cooperate.” Lawyers acting on behalf of the creditors said the founders of the fund "have not yet begun to cooperate with the [proceeding] in any meaningful manner."

Concerns are mounting that assets belonging to Three Arrows could be easily transferred. Non-fungible tokens belonging to Three Arrows's NFT fund Starry Night have been transferred to a new wallet for unexplained reasons. -CoinDesk

Location of 3AC founders unknown 😬

To make matters worse, new court papers claim that the embattled founders of the bankrupt crypto hedge fund Three Arrows Capital are yet to cooperate with liquidation proceedings. A photograph taken by Bloomberg shows the firm's Singapore office empty and locked up, with unopened mail scattered on the floor. Court papers also suggest that the whereabouts of Kyle Davies and Zhu Su are unknown, but their lawyers have insisted they plan to cooperate. Liquidators are battling to ensure 3AC's remaining assets aren't "dissipated" — warning this risk is heightened because the fund owns crypto and NFTs that are "readily transferable. -CoinMarketCap

Blockchain.com

CryptoBriefing: Blockchain.com Loses $270M in 3AC Chaos

Blockchain.com has lost $270 million to Three Arrows Capital, according to a letter sent to shareholders two weeks ago.

Nevertheless the firm remains “liquid” and “solvent,” the CEO said before assuring customers would not be impacted by the loss.

Blockchain.com numbers among the entities wanting to hold Three Arrows Capital “fully accountable” for “defrauding” the crypto industry.

BlockFi

The Block: BlockFi will no longer accept GBTC as collateral

BlockFi has now unwound its positions in GBTC, a spokesperson for the firm said. Moving forward, it will not accept the product as collateral. The firm plans to announce this move later this week.

Celsius

Celsius Sued: KeyFi, a former asset manager for Celsius, has sued the troubled crypto lending firm for alleged crypto market manipulation and failure to put in place basic accounting controls to protect customer deposits. The roughed-up crypto lender froze withdrawals last month and later said it was exploring restructuring options. -CoinDesk

Celsius paid off its Maker loan.

TAKEAWAY: The crypto lender that halted withdrawals and downsized its staff reclaimed $440 million of its collateral on July 7 after fully paying back its loan on Maker. Celsius’ repayment released 21,962 wrapped bitcoins that were posted as collateral. The recent move is a big liquidity boost as the freed-up collateral “can be sold on centralized exchanges or via over-the-counter to meet creditor demands and customer withdrawals,” said Fundstrat analyst Walter Tend. Read more here. -CoinDesk

Genesis Global Trading

Genesis confirmed exposure to Three Arrows Capital.

TAKEAWAY: On July 6, Genesis Global Trading CEO Michael Moro said Three Arrows Capital was the large counterparty that failed to meet a large margin call in June, forcing liquidation of the related collateral. Digital Currency Group, parent company to both CoinDesk and Genesis, is not only helping Genesis isolate risk but is also assuming certain liabilities of Genesis related to Three Arrows Capital. Read more here. -CoinDesk

Terra/LUNA

New Home: More than 48 projects previously on the Terra network have begun migrating to Polygon almost two months after the Terra network collapsed following the implosion of terraUSD (UST). Over $20 million had been earmarked to help projects that are migrating.

Developers behind other blockchain networks also courted Terra projects, among them Kadena, Cosmos and Avalanche. -CoinDesk

Vauld

The Block: Vauld issues letter to its creditors, disclosing $70 million shortfall

The firm has also listed multiple other plans if its deal with Nexo doesn’t go through.

Voyager

Voyager Customer Update Email 7/11

How does the reorganization process impact my cash?

We are working to restore access to USD deposits. Customer USD belongs to customers and will return to those same customers, subject to a reconciliation and fraud prevention process.

Is the USD in my account FDIC insured?

Yes. USD in your Voyager cash account is held at Metropolitan Commercial Bank of New York (“MCB”) and is FDIC insured. That means you are covered in the event of MCB’s failure, up to a maximum of $250,000 per Voyager customer. FDIC insurance does not protect against the failure of Voyager, but to be clear: Voyager does not hold customer cash, that cash is held at MCB.

What will happen to the crypto in my account?

Voyager currently has approximately $1.3 billion of crypto assets on its platform, plus claims against Three Arrows Capital ("3AC") of more than $650 million (it fluctuates due to the exchange rate between Bitcoin and USD).

Under Voyager’s proposed reorganization plan, which is subject to change and requires Court approval, customers will receive a combination of the following, with the ability to select the proportion of crypto and common equity they receive, subject to certain maximum thresholds:

Pro-rata share of crypto;

Pro-rata share of proceeds from the 3AC recovery;

Pro-rata share of common shares in the newly reorganized Company; and

Pro-rata share of existing Voyager tokens. Can you tell me how much of my crypto I’ll get back?

At this stage, we are proposing that customers will receive their crypto as described above. However, the exact numbers will depend on what happens in the restructuring process and the recovery of 3AC assets. We understand how important this issue is and will provide updates as soon as possible.

What’s next?

Our next Court hearing is on August 4, 2022, where we will seek further relief to stabilize operations and further advance the restructuring.

“If you had 10 Bitcoins, or $10,000 of USDC stablecoins, in your Voyager account, you are, uh, you’re not getting those back. Voyager loaned 15,250 Bitcoins and $350 million of USDC to Three Arrows; those are gone.” -Matt Levine

A Thread on Real-World Utility Tokens

Bankless: How to Double Up on Airdrops 🪂

**Intermediate**

Look into token-less bridges, DeFi, and NFT projects on L2s for potential future airdrops.

🌉 Try token-less bridge projects on L2s

Bungee — supports Arbitrum, Optimism, and other L1 EVMs

deBridge — supports Arbitrum and other L1 EVMs

Mosaic by Composable Finance — supports Arbitrum and other L1 EVMs

Orbiter Finance — supports zkSync, Arbitrum, Optimism, and other L1 EVMs

transferto.xzy by LI.FI — supports Arbitrum, Optimism, and other L1 EVMs

⛹ Try token-less DeFi and NFT projects on L2s

Argent is a mobile social recovery wallet that supports Ethereum and the zkSync L2. On the zkSync side of things, Argent offers curated L2 DeFi investment opportunities across Aave, Lido, and Yearn.

Cozy Finance is an open-source, insurance-like protocol that allows people to create automated DeFi protection markets.

DeFi Saver is an advanced DeFi management platform that’s like a personal on-chain command center.

Quixotic is currently the largest NFT marketplace on Optimism.

Yield Protocol is a fixed-rate borrowing and lending protocol that activated support for Arbitrum in March 2022.

Bankless: State of Ethereum Report — Q2, 2022

**Intermediate**

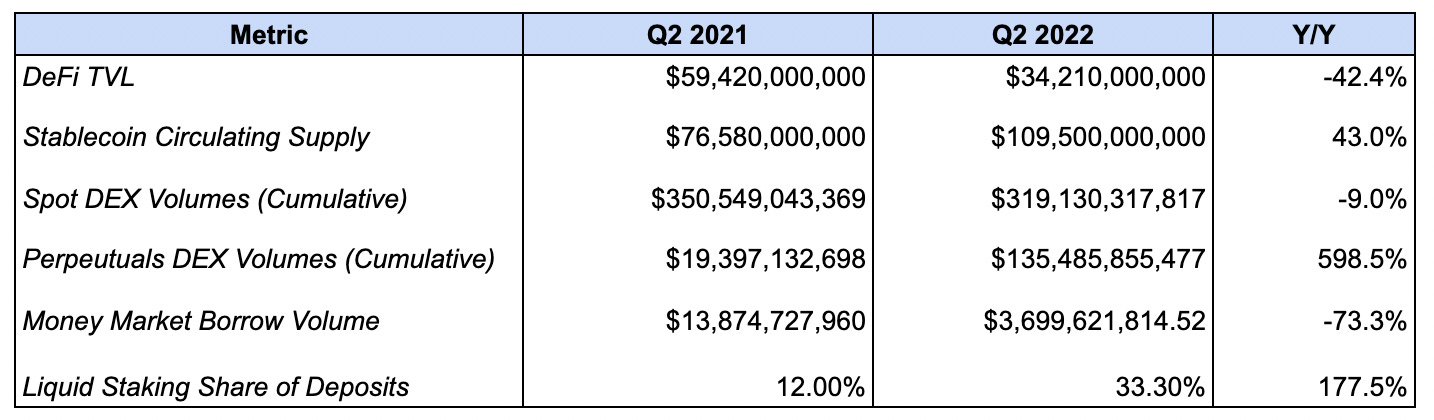

A look at 2Q21 vs 2Q22 metrics. Mixed results are expected with negative catalysts such as the market drawdown, more L1 competition, and less WFH employees. I highlighted some of the stats that surprised me.

Network Revenue fell 33.4% — from $1.91B to $1.28B.

ETH Inflation Rate decreased 37% from 1.12% to 0.71%.

Average Daily Active Addresses fell 20.6% — from 593,404 to 471,447.

Staked ETH increased 116% from 6.01M to 12.98M.

DeFi TVL fell 42.4% — from $59.42B to $34.21B.

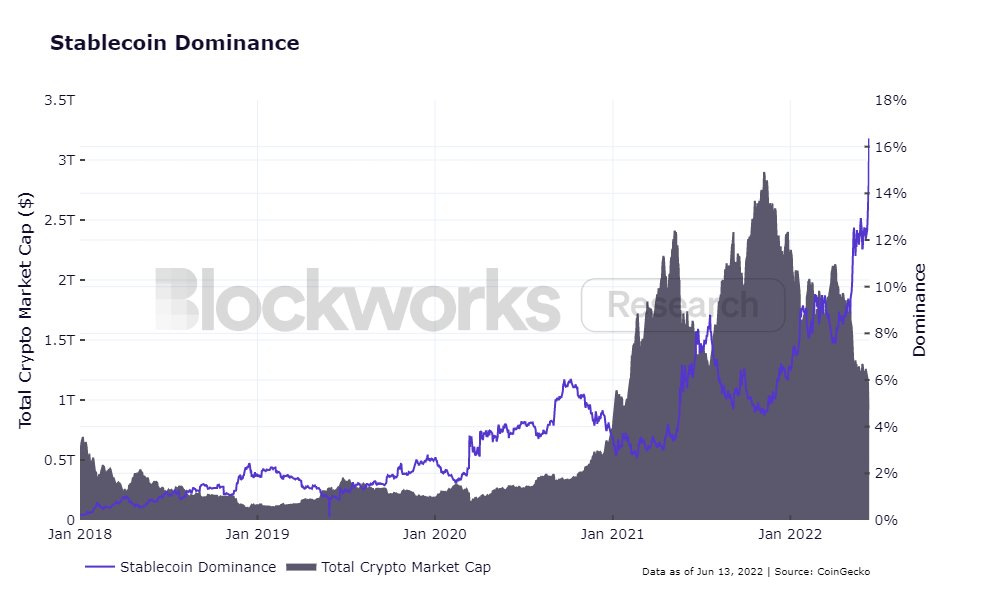

Stablecoin Circulating Supply increased 43.0% — from $76.58B to $109.50B.

Spot DEX volume fell 9.0% — from $350.54B to $319.13B.

Perpetuals DEX Volume increased 598.5% — from $19.39B to $135.48B.

Liquid Staking Share of Deposits increased 177.5% — from 12.0% to 33.3%.

NFT Marketplace Volumes erupted 2439.2% from $509.36M to $12.93B.

The Average number of Daily NFT Traders grew 1114.5% from 2412 to 29,289.

Bored Ape Yacht Club (BAYC) floor soared 3844% — from 2.50 ETH to 98.60 ETH.

TVL on L2s increased 896% from $374.17M to $3.72B.

Arbitrum Network revenue reached $8.20M. Optimism revenue was $5.58M.

Average Monthly Active Users on Optimism was 175,700.

Protocol

DeFi Ecosystem

NFT Ecosystem

L2 Ecosystem

Maclin Crypto: ETH Merge | A mega catalyst

**Intermediate**

Great piece by EM highlighting some of the most important implications of the upcoming ETH merge.

ETH is expected to switch from a structural supply asset to a structural demand asset. ETH will be reducing its energy usage by ~99.95%.

Supply / Demand TL;DR:

At a distinct moment in time (likely September / October ‘22) The Merge will forever shift the supply/demand dynamics for Ether…

Structural sell pressure (miners selling their ETH issuance) will be reduced by ~90%

Structural buy pressure (users buying back ETH spent to utilize the network) will likely remain steady / grow with the network

Recurring discretionary buy pressure (DCA investors/users making automated, indiscriminate purchases) will likely remain steady

Non-recurring discretionary buy pressure (new investors attracted by ETH staking rewards, institutions attracted by the improved ESG narrative, etc.) may increase while the bulk of discretionary sell pressure may be behind us after Q2’s wave of forced deleveraging (3AC, Celsius, Voyager, etc.).

Structural Supply: Pre vs Post Merge

Pre-Merge

ETH PoW miners are rewarded ~14k tokens/day (~$15m USD/day) for securing the network.

As IRL businesses, miners have to sell the majority of this ETH to cover their USD denominated expenses (ie. hardware, rent, energy, etc.). On average, it is estimated that miners sell 80-90% of the issuance that they receive.

PoW Miners = Structural Sellers

Post-Merge

ETH issuance will be reduced by ~90%. 100% of issuance will flow to stakers, who have significantly lower fiat-denominated expenses (motivation to sell) associated with each unit of network security that they provide relative to PoW miners.

Given that:

Stakers will likely sell closer to 10% of their rewards on average (vs 80% for PoW miners)

Staked ETH and all accrued ETH issuance will remain illiquid for another ~6 months after the merge

I believe it’s fair to anticipate a 90%+ reduction in structural sell pressure in the months following the merge

Structural Demand

ETH’s high fees can be thought of as a source of structural demand as users need to periodically buy back a comparable amount of ETH in order to continue using the network (Gaming, NFTs, DeFi, etc.) / maintain their ETH allocation.

Due to EIP-1559, 70% of fees are burned and forever removed from the float (currently ~$3m/day) - this can be thought of as an automated stock buyback.

As use-cases for ETH continue to expand and adoption grows, so too will structural demand.

Real Vision: WHAT THE CURRENT MESS MEANS FOR THE FUTURE OF CRYPTO

**Intermdiate**

Really interesting to hear Raoul & SBF highlighting:

The parallels between the 1998 LTCM blow-up and the recent crypto insolvencies.

Their thoughts on establishing a “risk-free” rate through ETH 2.0 staking and the efficiency and transparency that could bring to the crypto space.

The biggest developments they are excited about: NFT ticketing, successful domestic and international crypto payment rails, equitable financial access, seamless mobile integration, and wallet experience.

The Milk Road: MT. GOX & THE RETURN OF LOST BITCOIN?

**Beginner**

Mt. Gox is a now-defunct Japanese crypto exchange that was hacked for 850k BTC back in 2014. 140k BTC has been recovered and, according to reports, will be repaid to Mt. Gox account holders in August. This could create additional sell pressure as BTC is up ~34x from 2014.

Check this out. This is a post from Satoshi Nakomoto (the creator of Bitcoin, before he disappeared) talking about what happens if people lose bitcoin.

It’s estimated that close to 4 MILLION Bitcoin has been lost. Mainly from people losing the keys to their wallets. That’s…

~20% of the entire supply

~$84B at today’s prices

But what if 140,000 bitcoin that were lost suddenly made a comeback?

That’s what’s happening with Mt. Gox.

Mt. Gox was a Japanese crypto exchange. Here are the 3 main things you need to know.

At its peak, it was handling over 70% of all Bitcoin

In 2014 - 850,000 BTC was stolen. The majority of it was customer funds. (~$18b at today’s price)

They were forced to suspend activity & filed for bankruptcy a few days later.

Mt. Gox eventually recovered ~140,000 BTC.

The funds are getting ready to be repaid by the end of August. That’s over $3b in BTC making a comeback!

There are two potential outcomes from this... It’s a Red Pill - Blue Pill decision.

Red Pill: Sell for a big profit. When Mt. Gox happened, BTC was worth ~$600. Today, BTC is ~$20.5k (a 34x return).

Some people fear that this sell pressure could bring the BTC price lower.

Blue Pill: HODL. They’ve been waiting 8 crazy long years, so some people might just hold it out now.

After seeing BTC at highs of $60k+ might as well hold, right?

It’ll be interesting to see what people choose….

Actions:

I removed a majority of my crypto assets from centralized platforms as insolvency dominoes play out in the market.

Buying Liquidations

Liquity (Disclaimer: I lend & stake on Liquity)

TLDR

Borrowing: Borrow against ETH to get Liquity’s stablecoin (LUSD), which you can swap to USDC and convert USD. The collateralization ratio minimum is 110%, meaning if you borrow against $11k worth of ETH, you can receive up to 10k worth of LUSD. If ETH’s price increases, your collateralization ratio increases (good). If ETH’s price decreases and your collateralization ratio drops below 110% (bad), your ETH will be liquidated and bought by stability pool lenders, but you keep your LUSD.

Lending: Lend Liquity’s stablecoin (LUSD) to the stability pool to earn an APY in Liquity’s native token (LQTY). Lending to the stability pool requires lenders to absorb and cancel debts that drop below 110% collateralization (ETH). This means your LUSD loan, will be converted into ETH on a pro rata basis.

Delphi Digital on Liquity

Liquity is a decentralized borrowing protocol that allows users to draw interest-free loans against Ether used as collateral. Loans are paid out in LUSD (a USD pegged stablecoin) and need to maintain a minimum collateral ratio of 110%. In addition to the collateral, the loans are secured by a Stability Pool containing LUSD and by fellow borrowers collectively acting as guarantors of last resort. Liquity as a protocol is non-custodial, immutable and governance-free. Learn more about it here

Stability Pool:

The Stability Pool absorbs and cancels debt from liquidated Troves – similar to collateral auctions in MakerDAO

The Stability Pool replaces these auctions by allowing LUSD holders to commit capital upfront in order to “buy” liquidated ETH and offset the bad debt

In general, Stability Providers will receive more ETH (in $ terms) than LUSD burned which gives them discounted ETH

LQTY rewards are distributed pro rate to Stability Providers for the duration of their deposit:

The more LUSD a user has in the pool and the longer they keep it deposited, the more LQTY rewards they receive

Risks:

By committing capital upfront to “buy” liquidated ETH, users are also committing to buying ETH during price drops:

This means that it’s possible for the ETH that users receive to be worth less shortly after receiving it due to a quick price drop.

DeFi

Governance

Resources

Security

Staking

CEXs:

CoinDesk: Binance Extends Zero-Fee Bitcoin Trading Globally

As of July 8th (Binance’s 5-year anniversary), the exchange cut bitcoin (BTC) trading fees to zero worldwide stepping up its competitive positioning against rival cryptocurrency exchanges.

Crypto Markets:

Decentral Park Capital’s Top 100 Movers as of 7/11 (7d %):

Quant (+38.5%)

Aave (+33.3%)

Internet Computer (+27.7%)

Uniswap (+25.8%)

Polygon (+20.8%)

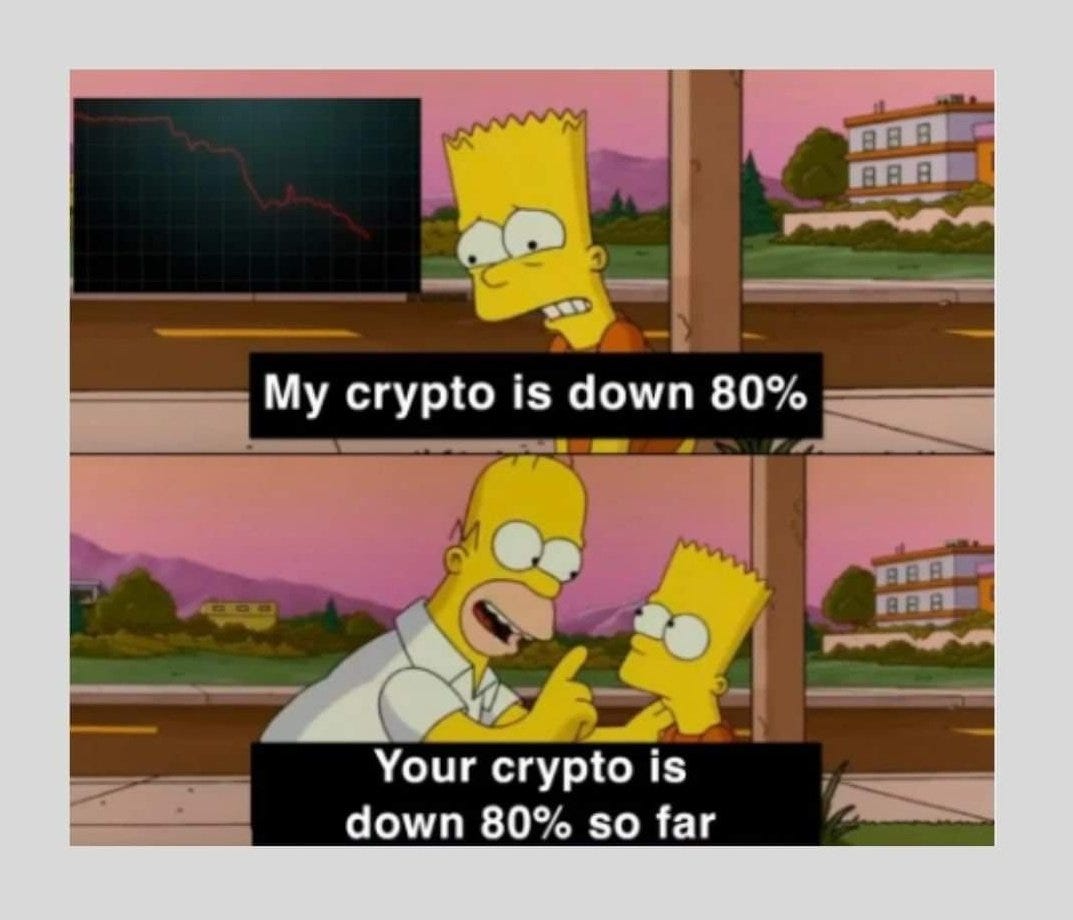

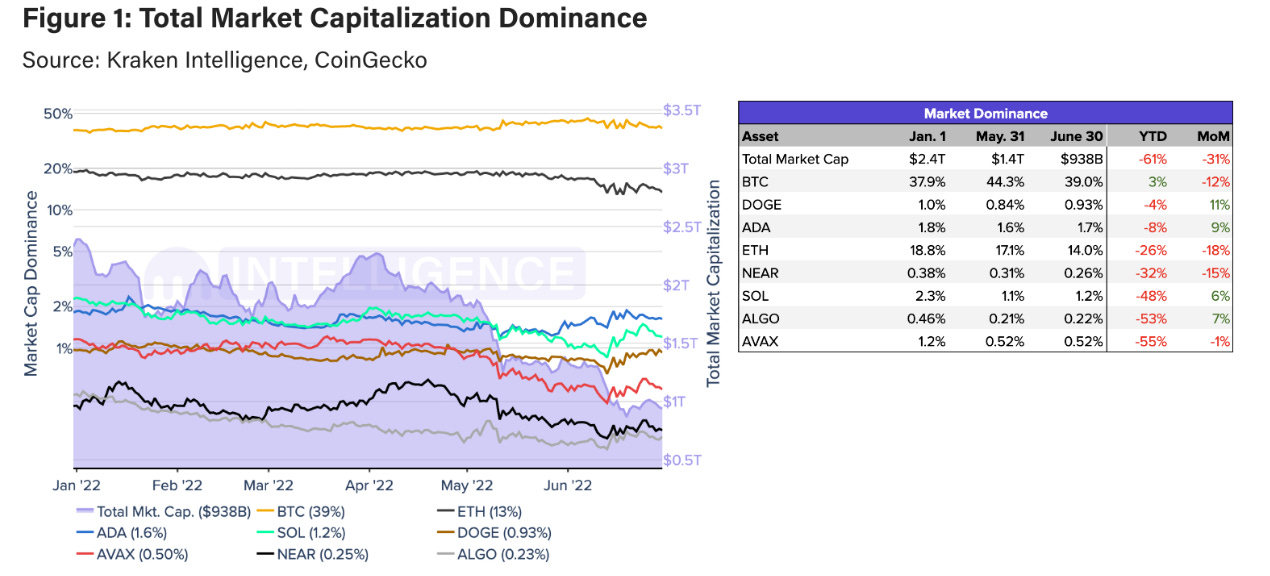

Investors gloomy about Bitcoin 😞

Bitcoin's more likely to tumble to $10,000 than accelerate to $30,000, according to a new poll. According to Bloomberg, 60% of those who responded to a MLIV Pulse poll believe BTC will tumble to new lows first. The remaining 40% think further downside is limited, and that the world's biggest cryptocurrency can regain lost ground in the months ahead. As Bloomberg's report notes, the industry "has been rocked by troubled lenders, collapsed currencies, and an end to the easy money policies of the pandemic." Retail investors were more likely to describe cryptocurrencies as "all garbage" than professional investors. -CoinMarketCap

Deals/Raises:

Animoca now worth $5.9 BILLION 💰

It's a difficult time for crypto companies hoping to raise capital right now, but some businesses are continuing to show strength. Animoca Brands has announced that it's secured another $75 million in funding. And while this is less than the $360 million raised back in January, Animoca's valuation has now gone up to $5.9 billion. Setting out its plans for the cash, the entertainment firm explained: "Animoca Brands will use the new capital to continue to fund strategic acquisitions, investments, and product development, secure licenses for popular intellectual properties, and advance the open metaverse, including through its efforts to promote digital property rights for online users." -CoinMarketCap

DeFi:

Decentral Park Capital’s DeFi Top 100 MCAPs Movers as of 7/11 (7d %):

Convex Finance (+41.6%)

GMX (+36.2%)

Aave (+33.3%)

Neutrino System Base (+28.2%)

Lido DAO (+26.1%)

Funds:

I was wondering when we would start to see crypto funds refilling coffers for more “distressed” opportunities.

Multicoin Capital announces its third crypto fund worth $430 million

The firm began raising for the fund in the fourth quarter of last year and closed it in January of this year, Kyle Samani, co-founder and managing partner at Multicoin Capital, told The Block in an interview. -The Block

Lightspeed raises over $7 billion across four funds, launches new 'crypto native' team

The announcement comes amid a general slowdown in venture capital dealmaking, as the turbulence in equity markets and rising inflation have had ramifications in the private market. As The Block reported previously, May was the slowest month for crypto venture capital deals in the last six months. -The Block

Protagonist raised a new $100m fund focused on early-stage crypto companies. It’ll also be an incubation lab. -The Milk Road

Shanghai's government is kicking off a new $1.5b fund for metaverse development. -The Milk Road

Magic Eden blue-balled everyone by announcing a new fund but not for how much. All they said is that it’s focused on web3 gaming. -The Milk Road

Hacks/Exploits:

$8 million stolen in phishing attack 💸

An estimated $8 million has been stolen after Uniswap liquidity providers fell for a phishing scam. The decentralized exchange says its infrastructure hasn't suffered an exploit, and that it remains secure to use. Offering further details about what happened, Uniswap said that the scammer had airdropped malicious tokens to certain wallets. This subsequently directed users to a fake interface where it was claimed these tokens could be swapped for UNI. But if unsuspecting victims ended up approving the transaction, the attacker would "have the ability to redeem all of the user's Uniswap v3 LP tokens for their full underlying value." -CoinMarketCap

Institutional Adoption:

The Block: MakerDAO approves $100 million stablecoin loan vault for 151-year-old US bank

MakerDAO has passed a vote to create a DAI vault for US-based Huntingdon Valley Bank.

At launch the vault will have a debt ceiling of $100 million, which will later be raised to $1 billion.

Crypto x Real Estate. Protocols and companies like Propy, Milo Credit, and Vesta Equity give real estate investors a unique opportunity to save money while engaging in real estate transactions by using blockchain technology. Although many of these players are relatively new to the crypto space, they are creating a more efficient real estate market. -Messari

Man City gets new crypto kit ⚽️

Big money sponsorship deals with sports teams have dried up as the bear market sets in — but not entirely. OKX has announced that its logo is going to be emblazoned on Manchester City's training kits during the 2022-23 season. It's going to be worn by the men and women first teams, and is set to make its debut later this month. The exchange says it sees a "strong parallel" between its users and training footballers, adding: "What else could embody the highest levels of preparation, perseverance and mental discipline better than Manchester City’s training camp? Now more than ever, in these choppy bear market conditions, it’s important to be as prepared as possible." -CoinMarketCap

Decrypt: Trio of JP Morgan Execs Leave For Crypto Jobs

Three JPM execs are joining: Digital Currency Group, Algorand Foundation & Pantera Capital.

Virtu Financial is hiring a weekend crypto trader. The firm, one of the traditional finance world's most important market makers, is a later entrant to the crypto market and has ramped up its hiring efforts in the space this year. The aspiration to hire a crypto trader for the weekend indicates the extent to which crypto is a priority for Virtu, which trades across 200 venues in dozens of countries. The firm is known for making markets in crypto exchange-traded products and has been trying to carve out a niche as a wholesaler for crypto brokers. The potential hire also reflects the unique nature of crypto, which trades 24/7. Virtu is seeking a "dependable, trustworthy and highly self-motivated and self-disciplined individual," the job advert said. -The Block

TechCrunch: Reddit is Launching a New NFT Avatar Marketplace

The new NFT-based avatar marketplace allows users to purchase blockchain-based profile pictures for a fixed rate. The company said that you need not have a crypto wallet to buy them, so your credit or debit card should be enough, and you can use Reddit’s own wallet product to store them.

Layer 0s:

State of Polkadot Q2 2022. Despite a brutal macro-environment, Polkadot’s on-chain activity was consistent quarter over quarter. During Q2 2022, Polkadot had roughly 435,000 users, 878 million DOT tokens transferred, and a consistent staking rate of 54% to 56% of total DOT tokens staked. Concurrently, foundational KPIs held steady with a healthy validator distribution by total stake, strong developer activity, and seven additional parachains onboarded. -Messari

Layer 1s:

Mining:

Decentral Park Capital’s Bitcoin Hashrate Update as of 7/11:

Bitcoin hashrate has now dropped more than 11% from its ATH as miners start capitulating. Network difficulty has dropped 1.4% in response to falling commitment of hash power. The aggregate cost of minting 1 BTC has fallen to about $15k from $20k creating a new potential local floor in BTC price.

Hut 8 added 5,800 bitcoin mining rigs.

TAKEAWAY: The Canadian crypto miner has added 5,800 mining rigs to its fleet and remains committed to its HODL strategy of not selling any of their mined bitcoin to cover operating costs. Hut 8 CEO Jamie Leverton said, “We are confident that our HODL strategy, coupled with the uncorrelated recurring revenue from our high performance computing business, will allow us to continue to successfully navigate the current market.” The company mined 328 BTC in June, increasing its holdings to 7,406 BTC. Read more here. -CoinDesk

At that point, miners are paying more to mine than what they make from the actual mining.

This forces them to sell the BTC they have in their piggy bank (aka the reserves).

Just look at the recent numbers from a few publicly traded companies. It ain’t lookin’ pretty….

Core Scientific, one of the largest bitcoin miners in the world, sold $165M worth of BTC to pay for servers and settle some debt. This was over 75% of their total BTC holdings.

Bitfarms, a Canadian crypto mining farm, sold ~$62m worth of their BTC to pay off some debts & improve liquidity positions. This was ~50% of their total BTC holdings.

Argo Blockchain PLC sold $15.6m worth of BTC to fund operating expenses and pay off a loan with Galaxy Digital.

The silver lining? These sell-offs already happened last month, which means the market has absorbed them. But this is definitely a trend we're keeping an eye on.

Regulation:

CoinDesk: UK Court Allows Serving Legal Documents Via NFTs

The ruling will allow legal proceedings against otherwise anonymous persons through their wallet addresses.

Why Michelle Bond is running for Congress. The CEO of the Association for Digital Asset Markets (ADAM), a trade group focused on crypto policy, recently announced that she is running for New York’s 1st Congressional district. Bond calls herself “a strong supporter of President Trump’s America First mindset and policies” and says she can help the district by drawing on her experience working on economic policy. Aislinn Keely sat down with Bond to talk about how her crypto experience informs her policy stances. -The Block

Stablecoins:

Aave proposes GHO stablecoin

Aave’s latest governance proposal is taking DeFi by storm. The DeFi giant is proposing GHO, an overcollateralized USD-pegged stablecoin that lenders can mint against supplied collateral — similar to Maker’s DAI.

Why GHO? The business strategy is to capture stablecoin market share through “organic adoption via L2s.” Aave V3 is currently deployed across six chains, including Polygon and Ethereum L2s Arbitrum and Optimism. GHO will also serve as a revenue generator for Aave, as 100% of interest paid on GHO loans by borrowers will be sent to the DAO.

Obviously, this is huge. Aave is the second largest DeFi protocol by TVL after Maker. An Aave stablecoin would place both protocols in direct competition. For every one GHO in Aave means one less DAI in Aave.

Aave’s massive lending market across multiple chains gives its stablecoin a big advantage in getting off the ground, thanks to its many existing stakeholders and deep liquidity. Aave is tapping well on both of these strengths.

For example: GHO is designed to be highly incentive-compatible with existing AAVE token holders. Aave Safety Module stakers (stkAAVE) can mint GHO at a discounted rate, and sell them on other DeFi protocols for arbitrage profits, driving utility to the AAVE token. This means AAVE holders have a significant interest in seeing GHO passed. -Bankless

Web3/NFTs:

Analyzing Gaming Guilds: Merit Circle. Since the play-to-earn model emerged in the middle of 2021, crypto gaming guilds have received relatively little attention compared to the games they support. Gaming guilds are groups of investors, gamers, and advisors that help onboard prospective gamers to Web3 games. -Messari

Gaming guilds may uncover growth opportunities for different ecosystems during the current down market. In this report, we will analyze the Merit Circle guild to develop a framework for analyzing other gaming guilds and their potential impact. -Messari

State of Balancer Q2 2022. Balancer had no operational issues in the second quarter, and its usage measured by number of swaps or volume increased meaningfully. Balancer’s TVL fell as market participants withdrew liquidity across the board. The veBAL experiment is still in its early stages, paying out over $20 million in the quarter between revenue share with lockers and inflationary rewards to LPs. The DAO will continue to tweak the rules and management of veBAL incentives to best align gauge voters with the protocol. Balancer continues to lead the evolution of DAOs, implementing new frameworks and incorporating a foundation in the quarter.

State of Filecoin Q2 2022. Q2 2022 has been a strong quarter for Filecoin, as active storage deals grew 128% quarter-over-quarter. Should Filecoin continue to onboard demand, it stands a chance to be a prominent provider of decentralized storage and cloud services for Web3 and traditional apps. While decentralized storage is still in its early days, the Filecoin ecosystem continues to thrive, as over 450 projects are currently being built on Filecoin. Filecoin is being leveraged by several use cases, including NFTs, Web3, gaming, metaverse, and audio/video. -Messari

State of Sandbox Q2 2022. Despite far from ideal market conditions, The Sandbox continued to deliver on its promise to build a robust metaverse for its increasingly diverse community. It only takes a bit of “zooming out” to see the clear positives to Sandbox’s financial picture. Few platforms can survive secondary sales volume declining >90% and still tout 300% YoY growth on that very same metric. And, as is often the case, the mass exodus of speculators may ultimately be the healthiest thing for the platform. Bear markets are for building the next bull market. -Messari

Emerging Technology & Venture Capital

Marc Andreessen is an entrepreneur, investor, and software engineer. He is co-creator of the world's first widely used internet browser, Mosaic, co-founder of the social media network platform Ning, and co-founder and general partner of the venture capital firm Andreessen Horowitz.

Electronic Vehicle (EV) News:

Profile of BYD founder and CEO Wang Chuanfu (link). 'Rival carmakers have for several years been frustrated by logistics bottlenecks and shortages of key parts. BYD, meanwhile, has produced its own auto chips and sold its own batteries to rivals, including Tesla.' -Trucks FoT

Tesla will reportedly open up its charging network to other brand vehicles in the coming year (link). The news on this came through a somewhat opaque memo from the White House, which said that 'Later this year, Tesla will begin production of new Supercharger equipment that will enable non-Tesla EV drivers in North America to use Tesla Superchargers.' No details were included on how current Tesla owners will keep their priority at a station. -Trucks FoT

Just because it's an EV doesn't mean it's efficient (link). At 9000 lbs, the Hummer EV is responsible for 341 grams of CO2 per mile, whereas a gasoline-powered Chevy Malibu is responsible for only 320 grams. -Trucks FoT

36% of Americans plan to buy or lease an EV, while 14% would definitely buy one today -- up from just 4% in 2020 (link). Via Consumer Reports. -Trucks FoT

The average used ebike sells with only 252 miles of usage, or 'less than 10 charging cycles on the batteries' (link). Via Flywheel. Reasons include: too exp to return, wrong size, buyer didn't use. -Trucks FoT

A new bill in the works in North Carolina would allocate $50,000 to get rid of free public EV chargers unless free gas pumps are built alongside them (link). -Trucks FoT

Startups:

SpaceX's Starlink Maritime goes on sale for $5000/month (link). -Trucks FoT

What do successful European founders have in common? Universities? Degrees? Company backgrounds? My friends at Mosaic Ventures ran the numbers. LINK -Benedict Evans

As we embarked on the mission to find common traits and backgrounds of founding CEOs of European unicorns we found that they were most likely to have:

Prior experience as a founder (~65% were repeat founders)

No previous industry experience in the sector of their unicorn business (~55%)

A Master’s or PhD degree (~55%)

More than 10 years of work experience before founding the company (~35%)

Perhaps even more interesting is who and what European unicorn founders/CEOs tend not to be. They are:

Very unlikely to have worked for another unicorn (only ~10% had)

Very unlikely to have worked for a FAANG or Microsoft (~5%)

Unlikely to have skipped college, including dropping out (~10%)

Unlikely to have studied at a small set of highly represented universities. The top 5 alma maters accounted for only ~15% of founders in the sample

Unlikely to have a technical background (~35% of founding CEOs are technically oriented)

Venture Capital:

Andreessen Horowitz (NB I worked there a few years ago) has been buying public markets stocks. This is a very long way from the traditional venture model, but then, it does have ~$50bn under management and over 300 people. This has been a conversation for a while: why exactly is the IPO a binary cut-off, especially with public markets investors coming in the other direction? LINK -Benedict Evans

Macro & Markets

A Thread on a More Disciplined Approach to More Money Printing

**Beginner**

Interesting take on solving for more stimulus in an inflationary environment. I think we will have to deal with that situation in the next year or so. I understand what Jordi is getting at, but the logic seems circular…. with that said, don’t underestimate populist appeal.

Arthur Hayes has been alluding to EUR/USD flippening for a while…

**Intermediate**

The EU has been barely hanging on economically since the GFC… everyone saw this coming. I think the ECB’s next moves will be a directional preview of the Fed a year from now. It also is a nice lead-in to the Bankless x Lyn Alden piece below.

Bankless: Lyn Alden: 3 Models for the Macro Endgame

**Beginner**

Summary of the Bankless Podcast: Is This the End? Featuring Lyn Alden. Full episode & notes are below.

Long-Term Debt Cycles

Lyn Alden’s thinking is guided by Ray Dalio’s theories on long-term debt cycles and the macro endgame. These rhyming macroeconomic trends resurface every several decades and cause large-scale economic and social upheaval.

Decelerating growth and runaway inflation are flashing leading indicators of a deep downtrend, and by the time it hits the employment market — the final domestic indicator we’re waiting for — it’s already recession season. Consumer sentiment in the US is at its lowest in 70 years, and the pain is beginning to manifest in daily lives of the population everywhere you look.

Ray Dalio adherents see the next major US recession as a catalyst for transition from US-based dominance of the global economy towards a multi-polar world. Russia, China, and India have already begun detaching themselves from the dollar hegemony in the midst of their own emerging financial crises, all of which falls in lock step with Dalio’s ‘Endgame’ and ‘Great Reset’ models.

Opposing Milkshake Theory

The idea is that the global financial upheaval upon which we seem to be flirting will actually be good news for dollar strength as the American economy will ultimately drinks everyone else’s milkshake and re-assert global dominance.

With the DXY popping off towards all-time highs, it’s understandable that the milkshake theory has brought many economists to the yard. Alden thinks the theory is only true until it’s not: short term dollar strength may rather be an indicator of long-term dollar decline.

When there’s disruption in global cash flows, there’s effectively a short squeeze on the dollar. This makes it spike upwards. That’s not a sign of its strength, but rather the unfolding weakness of other currencies. The stronger the Dollar gets in comparison, the less tenable it becomes as a global reserve.

The Fed: Move Slow and Break Stuff

Alden says that the Fed now has to raise rates until it breaks something fundamental to the core economy like treasuries or credit markets.

With illiquidity in the treasury market already causing volatility and corporate bond markets distressed, there are signs that point may be only months away.

Alden thinks the Fed won’t be able to keep tightening into 2023, which means there’s no time for subtlety in the short-term. The Fed won’t pull the brakes on interest rates until the levee starts to break.

What this means for crypto

More significant interest rate hikes will likely be bad for the crypto market in the short-term.

Alden sees crypto as a ‘canary in the coal mine’ front-running what’s emerging on a more foundational macro level. She says what we’ve seen in crypto is just a precursor to what we’ll see in its legacy equivalent.

Decentral Park Capital: A Look at Consumer Financial Health

Personal saving has plummeted to 5.4% - the lowest level since 2009. Real Disposable Personal Income has dropped precipitously as well.

Blockworks’ Byron Gilliam: 🟪 Listening

Gilliam looks for some of the silver linings in macro themes.

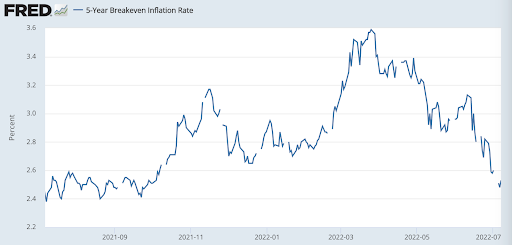

Every financial indicator suggests inflation is no longer the thing to worry about. But it’s not over until the Fed says it is: For risk assets to rally, we might have to wait for the Fed to give us the all-clear.

Expect the next inflation print to be ugly: The Cleveland Fed’s Inflation Nowcasting model has June CPI up nearly 1% month on month. But July is less than half of that!

Wholesale gasoline is down to $3.32, from a record high of about $4.30 a month ago.

Lower prices for lumber and wheat are helpful, but it’s Dr. Copper that makes headlines. $3.55 copper, to me, feels not-too-hot but not-too-cold.

Semiconductor shortages have been a big part of the supply-side portion of inflation. Inventories are now surging — thanks largely to the crypto crash — and that should ease the supply-chain issues in everything from autos to appliances.

This morning’s jobs data was strong, but job openings appear to have peaked.

Mortgage rates are similarly just off the highs:

The prospect of 6%+ mortgage rates felt recessionary. But 5.3%?

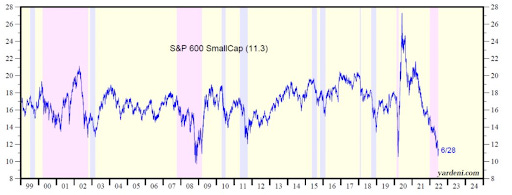

It might be: US small caps have derated all the way down to 11x forward earnings, which is about as cheap as they got in the Great Financial Crisis.

Elon x Twitter: The Saga Turns Ugly

Seeking Alpha: See you in court! 7/11

The Elon Musk-Twitter (NYSE:TWTR) saga kicked into high gear this weekend after the world's richest man decided to pull the plug on his $44B acquisition. Stepping away from the deal will not be easy, with both sides lining up their legal teams as they prepare for battle. Twitter (TWTR) has hired merger law firm heavyweight Wachtell, Lipton, Rosen & Katz, while Musk has brought in Quinn Emanuel Urquhart & Sullivan, which successfully led his defense against the "pedo guy" defamation suit in 2019 and is part of an ongoing shareholder case over his "go-private" tweet a year earlier.

Fine print: At issue is Elon's belief that Twitter (TWTR) hasn't done enough to address the matter of fake, spam or bot accounts on its platform. In a filing with the SEC, representatives for Musk said that despite what it claimed, Twitter (TWTR) "appears to have made false and misleading representations upon which Mr. Musk relied when entering into the merger agreement." With regards to Elon's requests for clarity around the bot issue, Twitter (TWTR) has "rejected them for reasons that appear to be unjustified, and sometimes claimed to comply while giving Mr. Musk incomplete or unusable information [that less than 5% of its total user accounts were spam]."

"This is a disaster scenario for Twitter and its board," noted Wedbush Securities analyst Dan Ives. "Now, the company will battle Musk in an elongated court battle to recoup the deal and/or the breakup fee of $1B, at a minimum." Twitter (TWTR) shares slumped another 7% in premarket trade on Monday to around $34, or 37% lower than the $54.20 per share price of Musk's original buyout agreement in April.

Questions remain: While things head to the courtroom, there is bound to be many settlement talks that take place in the background. Will Musk shoot to get a lower price for the deal based on a "material adverse effect"? Walk away by only paying a termination fee or damages? And how much hardball will Twitter be willing to play to uphold "specific-performance" clauses, which forces Musk to close the deal with every closing condition including financing of the transaction?

Twitter calls in the lawyers 🚨

Reports suggest Twitter's hired Wachtell, Lipton, Rosen & Katz to handle this upcoming legal battle — and early this week, a lawsuit will be filed with the Delaware Court of Chancery. Some analysts even say Musk's allegations are "unsubstantiated" — and his claims that Twitter's misleading investors over fake users is merely an attempt to abandon the acquisition without paying the fee. A major motivation for Musk likely relates to the fall in Twitter's stock price — far below the $54.20 a share he'd offered earlier this year. And the latest twist in this drama has caused even more carnage. In pre-market trading on Monday morning, Twitter's share price stood at $34.35 — a fall of 6.7%. -CoinMarketCap

Twitter hits back at Elon Musk 👀

Twitter has hit back at Elon Musk — and is accusing the world's richest man of "knowingly violating" an agreement to buy the social network. The law firm Wachtell, Lipton, Rosen & Katz — representing Twitter — says his termination is "invalid and wrongful." Lawyers also challenge an assertion that Twitter has suffered a "Company Material Adverse Effect," which would have enabled Musk to exit the deal without paying a $1 billion fee. Twitter went on to insist that the takeover deal has not been terminated, and that the company is demanding Musk and his partners "comply with their obligations under the agreement." The attorneys also warned they are willing to go through the courts unless Musk pushes ahead with the deal. -CoinMarketCap

USV’s Fred Wilson: Some Thoughts On Twitter (continued)

Shrug off Elon and focus on web3

I would like to see the Twitter Board and management team continue to press Musk to perform on the deal, and at the same time start working on a plan to decentralize Twitter and move it to the thing it has always wanted to be which is a core communications protocol for the Internet. A first step in that direction would to broadly re-open the API and allow third-party clients to be built on Twitter with a business model that covers the costs of operating the Twitter network. Longer-term, Twitter should move to a fully decentralized protocol, like Bitcoin or Ethereum, but that will take some time to do.

LionTree: Stock Market Update 7/8

The Milk Road: THE NEW INFLATION NUMBERS ARE OUT

U.S inflation hit 9.1% last month - the highest it's been in over 40 years.

Just look at the increase in prices across the board over the last 12 months:

Gas: +60.2%

Airline fares: +41.6%

Eggs: 33%

Chicken: +18.6%

Milk: +16.4%

Companies:

Uber (NYSE:UBER) is under fire following a massive trove of files that were leaked to The Guardian and shared with the International Consortium of Investigative Journalists. The stash consists of more than 124,000 records, including 83,000 emails and thousands of sensitive texts and documents that were exchanged between 2013 and 2017. According to the outlets, it shows how the ride-hailing app courted top politicians, and how far it went to avoid justice as it sought to establish itself in nearly 30 countries. -Quartz

Tesla (TSLA) is no longer the world's biggest clean vehicle maker as the EV pioneer takes a backseat to BYD (OTCPK:BYDDY). The Chinese automaker, which is backed by Warren Buffett, sold 641,350 new energy vehicles in the first six months of 2022, representing a 315% increase from the same period last year. Tesla, on the other hand, only delivered a total of 564,743 vehicles in H1 as it contended with supply chain problems, factory lockdowns and sales disruptions in China.

Fine print: BYD's figures included electric and plug-in hybrid vehicles, while Tesla's only include battery electric cars (it doesn't produce a hybrid). The numbers still highlight the trajectory of BYD's growth, compared to the Elon Musk-run company, which snapped a two-year streak as deliveries fell 18% last quarter. The developments have also been highlighted in their stock prices, with shares of BYD climbing 15% since the start of the year and Tesla tumbling 42% YTD.A $4 billion special purpose acquisition company (SPAC) is shutting down. Billionaire investor Bill Ackman said he’d be returning the money to investors after failing to identify a suitable candidate to take public through a merger. -Quartz

Gap CEO Sonia Syngal left the company. The retailer appointed executive chairman Bob Martin to serve as interim CEO and anticipated disappointing results for its second quarter. -Quartz

Apple’s iPhone hardening

Conversely, Apple and Google have been vocal for a while about a small number of (mostly Israeli) companies, most famously NSO, that sell very expensive and highly targeted intrusion tools to break into smartphones, generally based on finding and exploiting complex chains of obscure and unnoticed bugs. These are sold to companies and governments that want to hack into one particular person’s phone.

Now Apple has announced ‘lockdown mode’, which lets you turn off a whole range of features that can act as entry points for vulnerabilities. For example, FaceTime will reject anything inbound from anyone not already in your contacts (meaning that if NSO finds a vulnerability in FaceTime, it won’t be able to use it). Security is a trade-off, and at the extreme, your phone won’t be hacked if it never connects to the internet - but now Apple lets people who need that trade-off flip a switch. COVERAGE, APPLE -Benedict Evans

Amazon bundles Grubhub

Amazon is bundling free Grubhub restaurant delivery with Prime. Grubhub appears to be a very small player by share in the USA, and Just Eat has been trying to sell it; Amazon will get up to 15% of stock, but this might still get expensive. LINK -Benedict Evans

Amazon tries live streaming?

Live streaming ecommerce is a very big deal in China but nobody has been able to make it work anywhere else. Now Amazon (?!) is trying. LINK -Benedict Evans

Seeking Alpha: Motivation that moves you

In an effort to cut costs and simplify its operations, Peloton (PTON) is ending its in-house manufacturing. Instead, the firm will rely entirely on outsourcing production of its high-end bikes and treadmills to Taiwan-based Rexon Industrial and other manufacturing partners. The new strategy is one of the first big decisions pursued by new CEO Barry McCarthy, who came aboard in February to stabilize the company's finances and unwind some of the big bets co-founder John Foley made during his tenure.

Google’s parent company became the latest tech giant to slow down on hiring. Alphabet CEO Sundar Pichai told employees they need to be “more entrepreneurial.” -Quartz

International:

Seeking Alpha: Nord Stream goes offline 7/11

Energy concerns in Europe are getting grimmer by the day, with an emboldened Russia in a position to squeeze the bloc over its heavy sanctions and support for Ukraine. Moscow supplies the EU with 40% of the natural gas imports, and in countries like Germany, that figure is as high as 60%. Natural gas is used for heating and cooking for consumers, as well as electricity and power generation for heavy industry.

The latest: Russia has slashed capacity to Germany via Nord Stream 1 by 40% over the past week, just as the country was attempting to fill up its storage before wintertime. The cuts were caused by sanctions questions over a turbine that was being serviced in Canada, but another disruption will hit the important pipeline over the next 10 days (with annual maintenance work taking place from July 11 through July 21). Germany and other EU countries are fearful that the Kremlin could extend the shutdown due to the war in Ukraine, or might even turn off the taps for good.Following a call from key allies to step down, Boris Johnson resigned from his role as U.K. prime minister, but will stay on as caretaker until October. Sterling regained some lost ground on the news, with traders pricing in an end to the chaotic situation on Downing Street. It came after Johnson saw more resignations from his Conservative government in one day than any other prime minister in history, but was defiant and stressed his intention to stay on as leader as of late last night.

Seeking Alpha: Abe assassination

Japan's former prime minister, Shinzo Abe, died early Friday after being shot at a campaign event in the city of Nara. Abe was at the political gathering to give his support for his former party, the Liberal Democratic Party, with upper house elections in Japan due to take place this weekend. A 41-year-old man who lives in the Nara is in police custody following the assassination, and local media reports suggested he had disagreements with Abe's policies and decided to attack him.

China’s 1bn leak

First surfaced last week and now confirmed: a Chinese police database of a billion people (!) was left on an unsecured server, and someone downloaded it. It’s now in the hands of all sorts of researchers, both tech and other fields, such as demographics (how fast is the Chinese birth rate really declining?). This is now a cliché - data breaches on this scale are almost never Tom Cruise absailing into a building, but rather, someone who forgot to turn a switch. LINK -Benedict Evans

MI5 & FBI on China

Meanwhile, the FBI and MI5 (responsible for counter-espionage in the USA and UK respectively) issued a joint statement saying that Chinese industrial espionage, include ‘cyber’, is at unprecedented levels. LINK -Benedict Evans

Protests in Panama forced the government to reduce fuel prices. As demonstrations entered a second week, president Laurentino Cortizo announced measures to rein in prices of essential goods. -Quartz

London Heathrow Airport asked airlines to stop selling summer tickets. A daily cap of 100,000 passengers is needed until mid-September to cope with staff shortages. -Quartz

Macro/Markets:

Seeking Alpha: Market direction 7/11

Investors are strapping on their seatbelts as they prepare for some wild trading in the week ahead. Volatility is likely to reign high due to a confluence of economic indicators, which include retail sales and a consumer price index that may show a print greater than 9%. Earnings season for Q2 will also begin, with companies likely to show elevated input costs and slower consumer spending that could weigh on outlooks going into the second half of 2022.

Quote: "It's going to be a pretty bifurcated earnings season," said Keith Lerner, chief market strategist at Truist Advisory Services. "It's going to be a story of who doesn't have that pricing power, and there's going to be more differentiation."

A strong jobs report on Friday calmed some jitters that the economy might have already tipped into recession, but at the same time, it raised expectations that the Fed could press ahead with aggressive rate hikes to tame inflation. It's a circular methodology to gauge the coming economic landscape, meaning earnings season will likely play an outsized role in shaping investing sentiment. If traders see serious threats to corporate profits, it could lead to a further downturn for a market that has already slid into bear territory, though others say those estimates have already been taken into account - or at least make up some of the equation.

Stats, Themes & Trends:

Car dealers test Venmo, Zelle and other digital payment systems to purchase vehicles from customers (link). -Trucks FoT

Some Fun

NY Magazine: My Fares

1970s New York, seen by a cab driver

1957 FERRARI 500 TRC SPIDER

Ferrari made just 19 500 TRC Spiders between 1956 and 1957, with the inline-four powered car taking home trophies at several events in Europe, including a class win at the 1957 Le Mans. Designed specifically for privateer clients, this example, the 18th made, raced at Le Mans in 1957 but retired due to a water pump failure. Painted blue and white, the car would make its way to the US where win the SCCA E-Modified championship in 1958 and 1959. At some point in the '60s, the car's failing four-cylinder was replaced with a small-block Ford V8, later replaced by the correct unit directly from Ferrari. The car hasn't raced in decades, but instead has made appearances at various prestigious car shows throughout the US. An excellent example of the legendary Testa Rossa, the car goes to auction during Monterey Car Week in August 2022. -Uncrate

ULTIMATE CULINARY EXPERIENCE IN FRANCE BY DOMINIQUE CRENN

Dominique Crenn's whimsical take on French cuisine has wowed guests at her Atelier Crenn restaurant in San Francisco for a decade while earning her three Michelin stars. In collaboration with Satopia Travel, the visionary is taking her craft back to France for a one-of-a-kind culinary event. The five-day dining experience will whisk guests away to the French countryside of the Cognac region. Travelers will stay at the Domaine des Étangs, a former château, and indulge in Crenn's delicacies at a Versailles Masked Ball, Secret Forest Supper, an opulent golden dinner. Satopia Travel is offering early booking access for a limited time only with the promo code UNCRATE. ~$32k -Uncrate

Surprising Insights:

The world’s population will reach 8 billion on November 15. A new UN report on population growth forecast India overtaking China as the world’s most populous nation in 2023. -Quartz

US golf league PGA was hit with an antitrust investigation. According to The Wall Street Journal, the probe is linked to restrictions placed on golfers playing in a rival Saudi-backed event. -Quartz

More than 100 lions have taken up residence along beaches in India. Conservationists say territory wars between prides have pushed some to the Gujarat coasts. -Quartz

Welcome back, Spix macaw. The striking blue Brazilian parrot, once thought to be extinct, has been revived by a successful breeding program helped by the popularity of the Rio movies. -Quartz

Nanoparticles might be the future of teeth cleaning. A “robotic microswarm” could function as a mildly terrifying three-in-one brush, rinse, and floss mechanism. -Quartz

Britain’s gray squirrels will be put on birth control. The menace to UK woodlands will be given oral contraceptives hidden in hazelnut spread. -Quartz

The latest climate change gauge is fatty fish. Japanese fishermen fear katsuo are plumping up because of warming water temperatures. -Quartz

Government workers in the Philippines were told to smile more. The Mulanay municipality enacted a policy to stop people from grimacing while serving the public. -Quartz

A cobalt mine discovered intact after 200 years will be sealed again. Keeping oxygen out of the shaft is the only way to ensure its inside remains pristine. -Quartz

Sunlight boosts men’s appetite. Skin exposed to UV light was found to secrete more ghrelin, a hormone responsible for stimulating hunger—but only if no estrogen is present. -Quartz

Sponsorship

If any interest in sponsoring this newsletter, email me here.