Top Reads

The Generalist: Dune: The Data Must Flow

**Beginner**

Great history and overview of crypto analytics platform, Dune. By creating a powerful, yet accessible tool for crypto researchers to analyze and visualize blockchain activity, Dune allows data analysts, aka “wizards,” an opportunity to create dashboards, show off insights, and potentially make a living.

Actionable insights:

Run lean, and persevere. If Dune’s burn rate had been higher, the company almost certainly would have failed in the dead of crypto winter. Instead, founders Fredrik Haga and Mats Olsen spent conservatively, giving them the chance to flourish in better conditions.

Lean into what’s unique. Dune 1.0 offered paid dashboards of crypto data. Investors pushed back on that premise, given the availability of blockchain information at no cost. Rather than fighting, Haga and Olsen recognized the wisdom in this feedback. Dune 2.0 leaned into this characteristic.

Wizards make magic (and money). At the center of Dune’s “figure-eight flywheel” are the platform’s creators, better known as “wizards.” These data analysts create the dashboards that consumers view. In the process, they construct a resume of their skills, get paid via bounties, and discover professional opportunities.

Tokenize with caution. At first blush, Dune seems perfectly suited to a token. It has a thriving community doing meaningful work to benefit the ecosystem. Though they’re not opposed to the possibility of a native currency, Haga and Olsen are wary of doing so too soon.

Omnichain is the future. Or, perhaps, the present. The emergence of Solana has spawned a wave of chain-specific projects. Dune will need to support consumer desire to understand the data behind these initiatives better. The company’s upcoming “Dune Engine v2,” internally dubbed “Arrakis,” seeks to do just that.

In this piece, Mario discusses:

Certain failure. Dune courted collapse several times throughout its history, struggling to raise money, pivoting, and risking its customers. Its existence is a testament to the endurance of its founders and the value of an iterative approach.

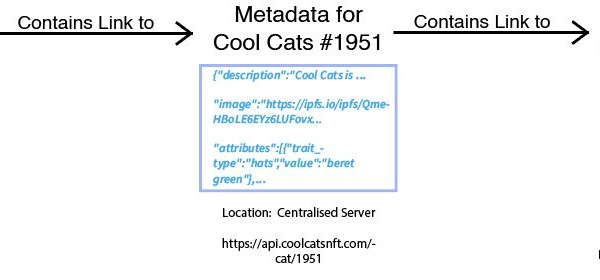

Crypto data. Financial data is typically reported quarterly. The blockchain changes this configuration, making mass amounts of information available instantaneously. Dune is built for this radical new reality.

Multi-sided platforms. Dune’s genius is how it orchestrates mutually-beneficial relationships between three stakeholders. It resembles Github, with an extra-dimensional twist.

Business model. How do you make money from free data? Dune seems to have found a way to create a consumer platform with the monetization motion that resembles large enterprises.

Vibrant culture. Near-death experiences are supposed to give survivors a new lease on life. Dune seems to be proof that the same goes for companies. Few startups seem so resolute in soaking up the joy of work.

Risks. Even the most invulnerable seeming of crypto companies can find their footing destabilized. Though Dune seems to be making sound strategic decisions, there is always the potential for disruption.

Future. Dune’s core platform is undergoing a significant renovation. “Dune Engine v2” will allow for cross-blockchain querying at scale. A new API may also help unlock another step-change in functionality and growth.

As crypto flamed back into life, it became more apparent than ever to him that “the information universe of blockchains was expanding exponentially.” Dune wouldn’t just support a few dozen protocols or projects but thousands.

There are four primary differences between traditional financial information and crypto data:

Availability

Crypto data is “available in real-time, 24/7.”

Actionability

Because data is continually available it is also more actionable. Consumers, investors, and builders can make decisions based on changes that occur from one moment to the next

Connectedness

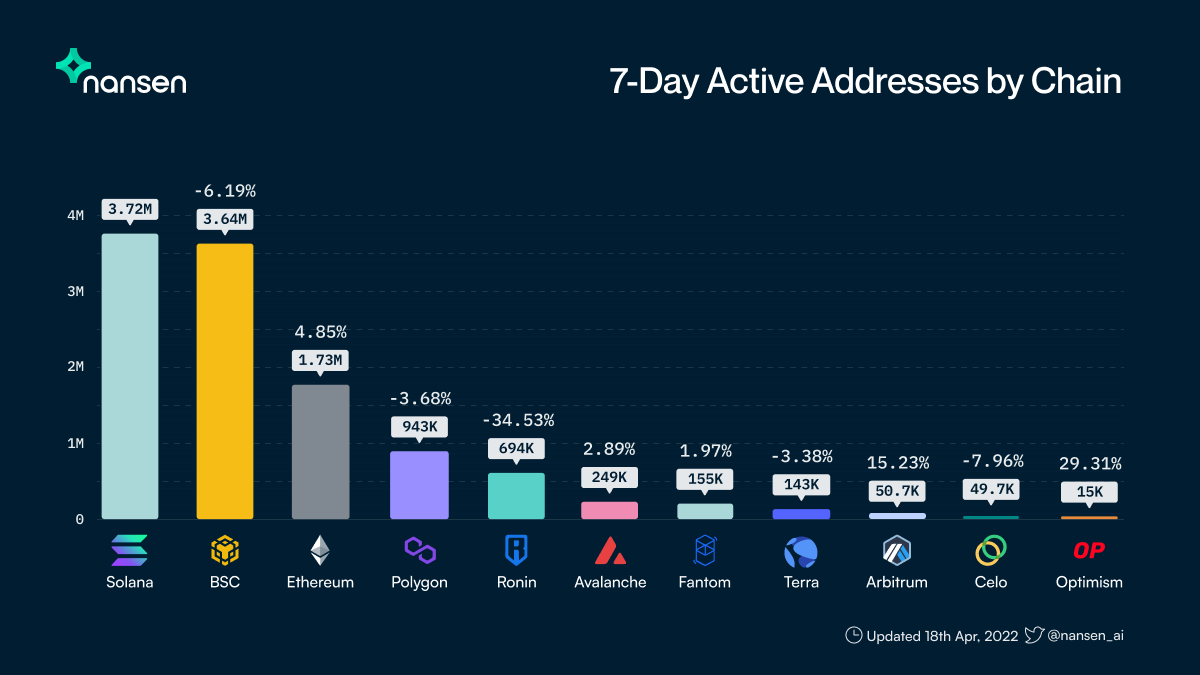

Because of the composability of Ethereum, Solana, and other protocols, crypto data is also fundamentally more connected. Actions in one part of the ecosystem have a direct impact elsewhere. Grossman described crypto data as something close to an “organism” for this reason, while a Dune blog post refers to it as the equivalent of a “living, breathing quarterly report.”

Scale

Finally, there’s a fundamental difference in scale at work – at least, when extrapolating out to a state of maturity. Today, most traditional business data is tied up in silos, accessible only to large enterprises. Crypto makes it almost entirely open. Suddenly, a top-down B2B industry becomes a bottom-up consumer one. The impact is a massive TAM expansion for providers of data tooling infrastructure as they manage many times more information and greater complexity.

Not Boring: The Invisible Hand's Visible Swarm Or, Why I'm Optimistic the Problems that Matter Will Get Solved

**Beginner**

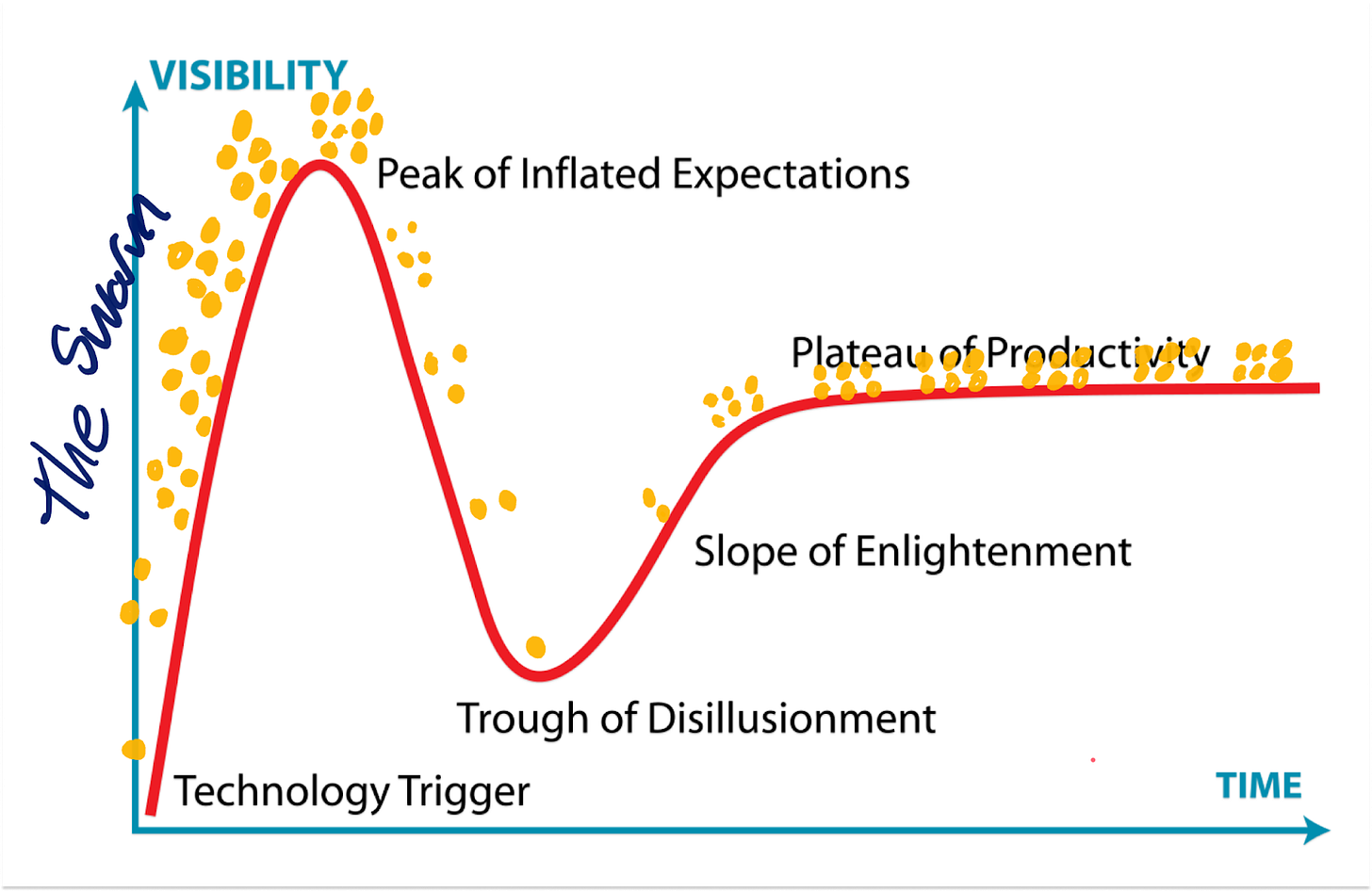

Excellent piece exploring how the “invisible hand” of capitalistic economies efficiently directs talent and capital, collectively known as the “swarm,” to the problems that matter. Sometimes its too many good solutions attacking the obvious problem(s), which Packy identifies as bubbles… and while bubbles are maligned for obvious reasons, they generally create excellent solutions over a longer timeline.

Individual actions matter deeply, but given enough time, the free market is shockingly good at directing those individuals’ actions and money at tackling the right really hard problems.

One way to think about entrepreneurship is as the invisible hand’s way of directing capital and talent towards solving problems, big and small, that move humanity forward. It’s the invisible hand’s visible swarm.

The swarm is an evolved and highly legible manifestation of Adam Smith’s invisible hand, operating a layer up from the pin factory version, orchestrating the search not for equilibrium but for progress.

The biggest challenges – disease, climate, space, inequality, and more – attract a swarm of talent and capital that grinds them down until they’re largely solved. Attract the swarm, solve the problem, with a lot of messiness, ts, starts, peaks, and of course, bubbles, in between.

Bubbles are usually maligned, but from a “how do we throw people and money at solving our biggest challenges?” perspective, they’re incredibly useful. When you see a bubble, you’re often seeing the swarm in action. The cumulative efforts of countless swarms are responsible for human progress, even if those swarms can look bubbly and choppy in the moment.

A bubble – too many good solutions swarming the obvious problems – is far more likely than the problem not getting solved!

Bubbles can be directly beneficial, or at least lead to positive spillover effects: The telecom bubble in the ’90s created cheap ber, and when the world was ready for YouTube, that ber made it more viable.

The example Byrne provided – the Dot Com Bubble – is a canonical example. The swarm tried a million things, most of which failed, some of which (like Amazon and Google) became wildly successful. Even the failures contributed to bringing the world online in big and small ways. Today, connecting humans across the globe with each other, all of the world’s information, and an infinite inventory of things is a solved problem. That’s wild.

web3

To critics, web3 looks like the ultimate swarm hack: a product with money baked in, designed to attract talent and capital despite having no real impact. To critics, JPEGs of monkeys and incestuous DeFi protocols shouldn’t be able to hack the swarm’s attention like they have.

Scams and the other challenges of web3 – UX issues, mini-bubbles in categories like DAO tools, high transaction costs, and more – are classic cynic traps. They’re things that critics can point to as glaringly obvious shortcomings, but by pointing at them, they’re only directing the swarm to solve those problems, like those fun dancing tarmac traffic directors.

In fact, that might be the role of cynics in this whole thing: to uncover opportunities for the swarm and yell about them until they’re fixed.

Deep Dive Into The Headlines

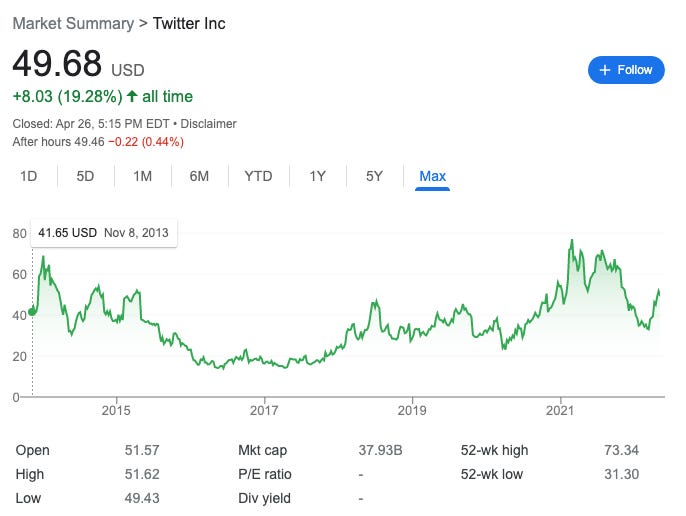

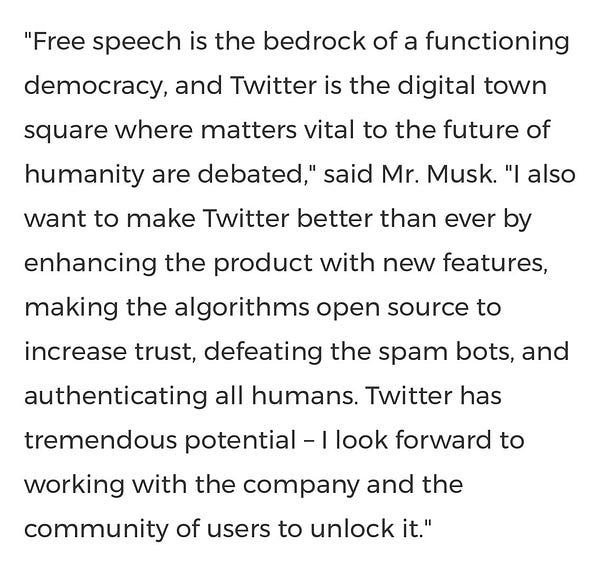

Elon’s (Probably) Buying Twitter

TDLR: After initially rejecting Elon’s offer to buy Twitter and adopting a poison pill to prevent a hostile takeover, Twitter’s board unanimously approved the transaction to sell the company to Musk. The deal is expected to close in 2022, subject to the approval of Twitter stockholders, the receipt of applicable regulatory approvals, and the satisfaction of other customary closing conditions.

PR Newswire: Elon Musk to Acquire Twitter

Bret Taylor, Twitter's Independent Board Chair, said, "The Twitter Board conducted a thoughtful and comprehensive process to assess Elon's proposal with a deliberate focus on value, certainty, and financing. The proposed transaction will deliver a substantial cash premium, and we believe it is the best path forward for Twitter's stockholders."

The transaction, which has been unanimously approved by the Twitter Board of Directors, is expected to close in 2022, subject to the approval of Twitter stockholders, the receipt of applicable regulatory approvals and the satisfaction of other customary closing conditions.

Mr. Musk has secured $25.5 billion of fully committed debt and margin loan financing and is providing an approximately $21.0 billion equity commitment. There are no financing conditions to the closing of the transaction.

WSJ: Twitter Accepts Elon Musk’s Offer to Buy Company in $44 Billion Deal

The takeover, if it goes through, would mark one of the biggest acquisitions of a tech company and will likely affect the direction of social media. Mr. Musk will bring a commitment to a more hands-off approach on speech moderation to a company that has struggled to reconcile freewheeling conversations with content that appeals to advertisers.

Mr. Musk said after the deal was announced that he wants to make Twitter a better user experience, in part by adding new features and fighting spam.

At an all-hands employee meeting on Monday afternoon, CEO Parag Agrawal said that there are no layoffs planned and that the company’s priorities aren’t changing before the deal closes, according to a person who heard the remarks. Mr. Agrawal said that once Mr. Musk takes over, “we don’t know what direction the company may go,” the person said.

Mr. Agrawal said Mr. Musk agreed to convert employee stockholdings to cash once the deal closes and pay them out on the existing vesting schedule, the person said.

Twitter changed its posture after Mr. Musk detailed elements of his financing plan for the takeover. On April 21, he said he had $46.5 billion in funding lined up. Twitter shares rose sharply, and company executives opened the door to negotiations.

Mr. Musk’s proposed changes for the platform include softening its stance on content moderation, creating an edit feature for tweets, making Twitter’s algorithm open source—which would allow people outside the company to view it and suggest changes—and relying less on advertising, among other ideas.

Mr. Musk has said he wants Twitter to rely less on advertising—which provided about 90% of its revenue in 2021—and shift its business model more toward subscriptions. The platform currently offers a subscription-based service called Twitter Blue, which gives customers premium features like “undo tweet” for $2.99 a month. He suggested removing all ads on Twitter as part of the subscription offerings.

His other proposed changes for Twitter include trying to stop spam and scam bots and allowing for longer tweets. The current limit is 280 characters.

Wall Street Breakfast: #TwitterTakeover

What changed? Musk has lined up $46B in financing to fund a buyout ($25B in debt coming from investment banks and $21B in personal equity). He is also rallying Twitter shareholders, like Thrivent Asset Management, to support the takeover following private meetings on Friday. A bigger fear for the board could be a tender offer, which could reveal Twitter shareholder support for Musk's bid. While the poison pill would prevent them from tendering their shares (and require multiple years to gain board control), the company's negotiating hand would weaken significantly if it was shown to be going against its investor base.

Wall Street Breakfast: It's official!

Elon Musk has reached a deal to buy Twitter (NYSE:TWTR) for $54.20 per share, or $44B in cash, pulling off one of the biggest leveraged buyouts in history to take the 16-year-old social network private. The transaction will shift control of the platform to the world's richest person, who plans to make Twitter a haven for free speech online after complaining about the service's heavy-handed moderation approach. Here's what some of the key players are saying:

White House: "No matter who owns or runs Twitter, the President has long been concerned about the power of large social media platforms [and] the power they have over our everyday lives," Press Secretary Jen Psaki said in a press briefing. "He has been a strong supporter of fundamental reforms to achieve that goal, including reforms to Section 230, enacting antitrust reforms, requiring more transparency, and more. And he’s encouraged that there's bipartisan interest in Congress. I still don’t have a specific comment on this specific transaction. And at this point, we don’t have any sense of what the policies will look like."

Former President Donald Trump: "I will be on Truth Social within the week. It's on schedule. We have a lot of people signed up. I like Elon Musk. I like him a lot. He's an excellent individual. We did a lot for Twitter when I was in the White House. I was disappointed by the way I was treated by Twitter. I won't be going back on Twitter."

Lawmakers in Washington: "Today is an encouraging day for freedom of speech. I am hopeful that Elon Musk will help rein in Big Tech's history of censoring users that have a different viewpoint," tweeted Senator Marsha Blackburn (R-TN). "This deal is dangerous for our democracy," responded Senator Elizabeth Warren (D-MA). "Billionaires like Elon Musk play by a different set of rules than everyone else, accumulating power for their own gain. We need a wealth tax and strong rules to hold Big Tech accountable."

Analysts: "Locking a deal up may sound pretty appealing for someone who knows they are in possession of bad news," Gordon Haskett said in a research note, referring to Twitter's Q1 results that are set to be published on Thursday. Wedbush also noted that advertising models are slowing and expanding the user base has been a challenge, while MoffettNathanson even told investors to "take their money and run."

Unanswered questions: Who will head Twitter going forward? Is Dorsey poised for a comeback? Makeup of the board? Terms of the transaction financing? How will the shareholder vote turn out? Subscriptions? Other product innovation to drive subscriber growth?

Benedict Evans: ‘Funding secured’

A week after announcing a bid, Elon Musk might have the funding to buy Twitter, and - STOP PRESS! - it looks like the company might accept. Other bidders may yet enter - but these are now M&A questions, not tech questions. Elon has not, so far, shown a very clear or convincing vision for what exactly he would do better, but that might not be the point - having someone who can actually run the company, make decisions and require excellence would be a big change. Twitter has been a badly run company for a very long time, and that’s reflected in the P&L but more importantly in the products and the experience. It's been the Craigslist of Web 2.0, coasting on network effects, building nothing much, and getting unbundled piece by piece. It deserves better.

USV’s Fred Wilson: Some Thoughts On Twitter

Twitter is too important to be owned and controlled by a single person. The opposite should be happening. Twitter should be decentralized as a protocol that powers an ecosystem of communication products and services. — Fred Wilson (@fredwilson) April 14, 2022

I continue to believe that decentralization is the right long-term answer for a core communications protocol of the Internet and hope that Elon will think about doing just that once he owns it and is not concerned with the stock price and meeting quarterly revenue targets.

My partner Albert wrote this yesterday:

1 – restore full API access – anyone should be able to write a full client, including their own timeline algorithm (this could require a monthly subscription)

— Albert Wenger 🌎🔥⌛ (@albertwenger) April 25, 2022

Albert’s suggestion would return Twitter to where it was a decade and a half ago when it first launched and that would be a fantastic first step towards full decentralization.

I continue to believe that a single person owning one of the most important communications protocols of the internet is a bad idea, but maybe it can be a bridge to something better.

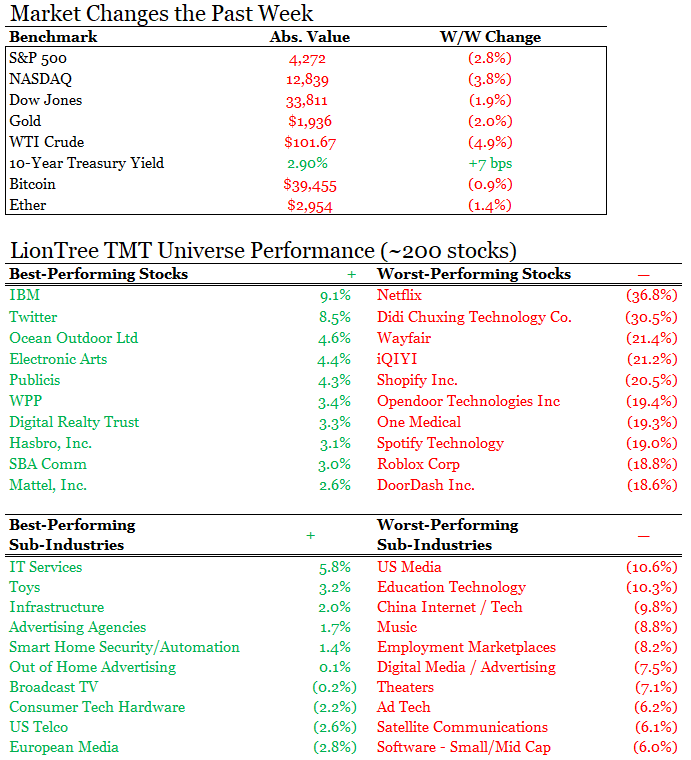

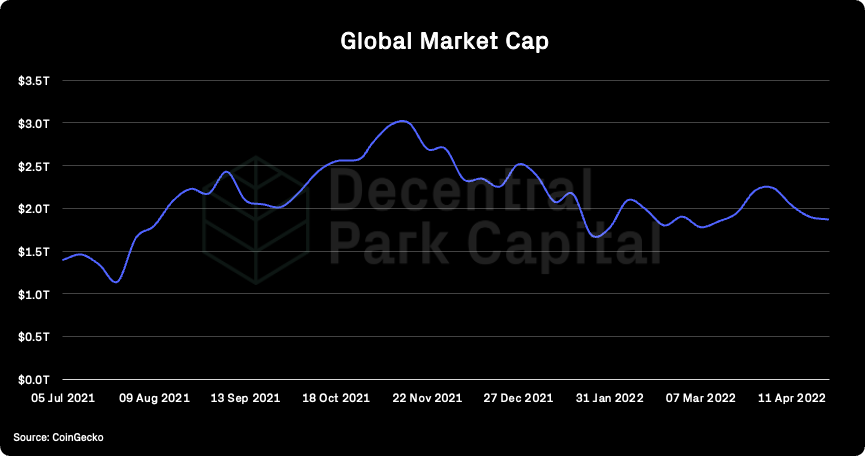

Market Volatility: Rate Hikes, Geopolitical Uncertainty & Potential Lockdowns in China

TLDR: The market is, and has been, choppy for a number of reasons: rates, potential lockdowns in China (again), and geopolitical uncertainty, particularly the Ukraine/Russia conflict and potential economic fallout (higher energy and food inflation, trade issues, etc). Will crypto save you? Probably not, it’s heavily correlated to broader risk assets in times of stress. Is it completely hopeless? Also, probably not, for a few reasons:

Companies, consumers, housing, and wages appear to be in a better spot than in a majority of previous tightening cycles.

The market is doing some of the Fed’s job already with borrowing costs notably higher and some key inflation inputs rolling over.

Tightening and easing are relative, and we seem to be on the aggressive tightening side at the moment. For better or worse, the Fed always tends to be late in tightening cycles (and early in easing cycles), which indicates we are closer to an easing cycle than most people think. More thoughts below.

Wall Street Breakfast: 75 basis points

Seventy-five basis points is the new 50 basis points. A relentlessly hawkish Federal Reserve is ramping up market expectations for big interest rate hikes that would have been considered unthinkable (and market crippling) just two months ago.

Nomura says that the FOMC will hike the fed funds rate by 75 basis points in June and July after a 50-basis point rise in May. That would bring the rate up to 2.25%, a phenomenal amount of tightening given that the Fed was still easing by buying assets as recently as March.

The shift in market expectations for even more tightening came after Fed Chairman Jerome Powell said at an IMF debate Thursday that a 50-basis-point hike in March was "on the table." Perhaps even more pertinent to the markets, he said there was some merit in front-loading tightening with the current upside risks to inflation and a historically tight labor market.

Traders quickly priced in more aggressive hiking as Powell spoke, with CME FedWatch now pricing in an 85% chance the benchmark rate will rise to a range of 1.5%-1.75% after the June meeting. That would mean a 75-basis point hike in June if May gets the expected half-point boost.

In fed funds futures, the market is now pricing in about 270 basis points of tightening for 2022, topping the 250 seen in 1994, with expectations now for the rate to hit 3% by March 2023, according to Deutsche Bank.

Deutsche Bank's chief economist said yesterday that the Fed could hike rates to as high as 5% by the time it's done tightening, a level not seen since 2006.

What this means for stocks and bonds: The selloff in Treasury bonds accelerated as expectations for even more hawkish policy rose.

The 10-year Treasury yield (TBT) (TLT) hit 2.95% at the high of the day Thursday. The 2s10s curve flattened.

Stocks started Thursday with a rally, but the big rise in rates (especially real rates) reversed the trend and the S&P (SP500) (SPY) fell 1.5%, while the Nasdaq 100 (NDX) (QQQ) lost 2%.

The Dow Jones average suffered its worst beating since October 2020 on Friday, capping a fourth straight weekly decline, as mostly positive earnings reports failed to ease worries about rising inflation or the near-certainty that the Federal Reserve will raise interest rates by at least a half point at its meeting next month. Friday's nearly 1,000 point drop in the Dow followed a speech by Fed Chairman Jerome Powell on Thursday that signaled support for a 50-basis point rate hike is very much on the table since taming inflation is "absolutely essential." Rates jumped on Powell's remarks before the benchmark 10-year yield eased slightly on Friday to about 2.9%. Next week will see earnings reports from the four biggest U.S. companies by market cap: Apple, Microsoft, Amazon and Google parent Alphabet. In the week just concluded, the Dow finished down 1.9% in its ninth losing week of the last 11, while the S&P 500 fell 2.8% and the Nasdaq sank 3.8%.

Wall Street Breakfast: Housing inflection point

Demand for homes is strong, with many properties for sale going for well above asking price. But with a hawkish Fed and the Treasury yields jumping, the 30-year fixed-rate mortgage just topped 5% for the first time in a decade.

"Rising rates are starting to show up in housing data," Schwab's Kathy Jones tweeted. That could further dent demand, although "housing starts have historically been unresponsive to changes in mortgage rates in a supply-constrained environment, likely because homebuilders are able to continue building with little fear that homes will sit vacant after completion,” Goldman Sachs said.

Yesterday, the NAHB Housing Market Index fell to a seven-month low of 77 for April. “The housing market faces an inflection point as an unexpectedly quick rise in interest rates, rising home prices and escalating material costs have significantly decreased housing affordability conditions, particularly in the crucial entry-level market,” NAHB Chief Economist Robert Dietz said.

Redfin reported last week that home sales fell 4% in March as buying costs shot up. “We expect the combination of surging mortgage rates and record-high home prices to cause more homebuyers to drop out of the market," Redfin chief economist Daryl Fairweather said.

The SPDR Homebuilders ETF (XHB) is down nearly 30% year to date and off 15% from its near-term peak in mid-March.

The World Bank predicted a “human catastrophe” because of surging food prices. They’re expected to jump 37% due to Russia’s invasion of Ukraine. Food giant Nestlé is already planning more price hikes.

Lockdown fears spooked markets. Chinese stocks had their worst selloff in more than two years while oil benchmarks dropped as covid restrictions in Shanghai stretched on, and Beijing residents prepared for similar measures.

The Federal Reserve waiting to raise interest rates because inflation was merely “transitory,” and then tightening monetary policy directly into a slowdown, is to McCullough a major policy mistake — and not surprising: “The Fed always screws up,” he says. “Their policy is too tight, too late.”

McCullough: When economies slow into what we call “Quad 4,” governments intervene. Quad 4 is when the year-over-year rate of change of growth and inflation start slowing at the same time. Our Quad 4 call this year is for a drastic slowdown in earnings growth, which is driven by growth and inflation slowing at the same time. One hundred percent of the time when the Federal Reserve tightens in Quad 4, the U.S. stock market goes down by 20% or more. We’re expecting that to happen in the S&P 500 SPX, 0.58% by the time this is done.

McCullough: At the peak of the inflation cycle, all everyone sees is inflation. We see inflation on a headline basis peaking between now and the end of the second quarter, and then rolling over. Not rolling over hard, but by the fourth quarter falling towards 6%. It doesn’t matter how fast it’s slowing but that it’s not accelerating.

The longer the Fed stays vigilant, tightening into a slowdown, the faster stock prices fall. You’re going to really deflate asset prices.

If the Fed stays with six or seven rate hikes, they’re going to invert the yield curve and real U.S. economic growth is going to be threatening a recession. I’m more concerned about the expectation of a recession and the effect on consumer spending behavior than actually making a big recession call.

We’re getting bullish on long-term Treasury bonds again. TLT TLT, -0.93% is the ETF for long-term Treasury bonds and SHY SHY, 0.02% for short-term. Where I think we get paid in the Treasury market is the Fed cutting back on these interest rate hikes. If I’m right on Quad 4 and recessionary probabilities are rising, the Fed can easily pull back two, three, four of these rate hikes.

I personally don’t think the Fed can get away with much more than two rate hikes.

McCullough: All of a sudden everybody thinks the Fed has a one-legged stool policy on inflation. It’s a three-legged stool. There’s the employment component, which I think will be deteriorating precipitously in the next three to six months, alongside corporate profits. Put two or three bad jobs numbers up, and then you have the third leg of the stool, which is, where’s the S&P 500? If it’s down 20% or more and the labor market is deteriorating, that makes the case. Corporate profits slowing precipitously and employment deteriorating give the Fed ample runway, especially if equity and credit markets are lower, to say “Done.”

McCullough: Conditions are always different but behavior is always the same. The stock market and the credit market go down, and the Fed goes dovish. We’re in the very late innings of the jobs market being strong and interest rates being high. That’s why it’s so critical to pay attention to the Fed going dovish or not. If they remain hawkish through the slowdown, then the market decline is going to be more protracted. If they pull back, quite often that ends up being the bottom.

I have similar thinking to McCullough. It’s like clockwork, Fed starts to raise too late, goes a little too far for the market, we get a notable equity drawdown, and then they are back to easing (at least relatively, by not tightening).

While this doesn’t bode well for risk assets shorter term, it could present a good opportunity to scoop up more crypto assets ahead of another, seemingly inevitable, easing cycle.

It works fine until it doesn’t. The question is, is this time different? Some more positive thoughts are below.

The inconvenient truth that haunts crypto at this current juncture is that crypto moves in lockstep with the debt-based, un-free risk asset markets like global developed market equities.

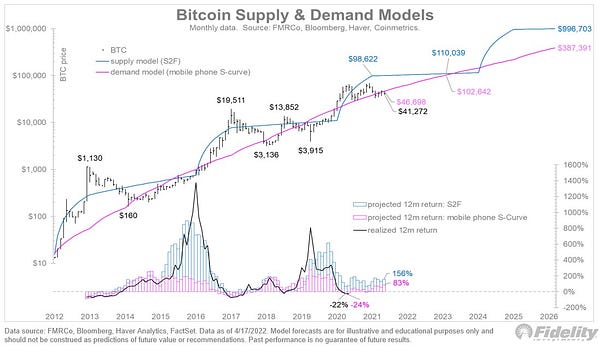

In “Energy Cancelled” [Noted & Highlighted in Wags Weekly 3/23], I argued that the Petro / Eurodollar global financial architecture ceased the day the West decided to confiscate the fiat reserve assets of the Russian Central Bank. This action ushered in an era in which it’s entirely reasonable for any sovereign that isn’t the US or an EU country (a.k.a., the Global South) to “save” in gold and ultimately Bitcoin. On a three- to five-year horizon, this eventuality will lead to Bitcoin reaching $1 million and gold reaching $10,000.

While that bullish prognosis is exciting, we live in the present — not the future. Many of us must make decisions right now on whether to sell fiat and buy crypto. I continue to argue for patience.

Roaul Pal makes a very convincing — and I believe, at least on a long-term basis, correct — argument that computers and the internet ushered humanity into an exponential age. In this age, valuation is based not on discounted future cash flows, but Metcalfe’s law (a principle that says when it comes to networks, users = value).

I have no issue with that, but when money is cheap (or nearly free), investors like to act like we are on the cusp of an amazing techno utopia that is actually many years away (see: the Metaverse).

China Can’t Save You: In the aftermath of the 2008 Global Financial Crisis, China stepped up to the plate and re-inflated the world. China embarked on one of humanity’s biggest quests to print money and build stuff, regardless of whether that stuff generated real economic value for its citizens.

As global growth wanes and enters outright decline in the face of rising energy costs, Beijing cannot be counted upon to save Western capital markets with more fiat wampum and economic “growth”.

The Fed is done caring about whether equity investors are up on the year. That game is over. It’s all about credit.

When this curve inverts– and I believe it will, due to softening global demand driven by commodity price inflation from the Russian / Ukraine conflict– how far down the hole will the NDX have fallen?

Down 30%? ... Down 50%? ... your guess is as good as mine. But let’s be clear– the Fed isn’t planning to grow its balance sheet again any time soon, meaning equities ain’t going any higher.

Anti-inflation protests have broken out in Sri Lanka (cabinet resigned amid public pressure), Peru (army is being called into quell dissent), U.K., Spain, Belgium, Germany, Italy, Albania, Armenia, Bulgaria, Cyprus, Serbia, and Moldova (source 13D Research). How long before this inflation-driven unrest spreads to other countries? If you were a leader of such a country, and you cared about your life and your job as a politician, would you rather import cheaper Russian energy and food, or sanction it and watch your people overthrow you?

The takeaway from the above oversimplified analysis is that the war ain’t ending anytime soon. And if the war ends, it probably means some sort of partition of Ukraine into two sections — one Western and one Russian. If that happens, would the West reward Russia by immediately removing sanctions?

Given that Russia exports significant amounts of energy and food to the world, the trade disruptions that raise transportation costs and thus prices will continue with no abatement. Please read the last two truly epic Zoltan Pozar pieces about how difficult and expensive it is to re-route commodities to willing buyers in the Global South now that Europe has cancelled Russian exports. It will leave you convinced that higher prices are here to stay, and global growth — which is a derivative of the cost of energy– must slow. Therefore, slowing growth will take global equities down with it, unless buttressed by ample liquidity from central bankers who are supposed to be fighting inflation.

There are many crypto market pundits who believe the worst is over. I believe they ignore the inconvenient truth that the crypto capital markets are currently just a 24/7 Spooo’s and Qqq’s indicator and do not trade on the fundamentals of being peer-to- peer, decentralised, censorship-resistant digital networks designed for the transfer of money.

Bankless: The Stagflation Mega-Trade: Dan Morehead

Dan Morehead is the Founder & CEO of Pantera Capital, a blockchain investment firm that’s up nearly 65,900% since inception. Dan has spent decades successfully managing global macro funds throughout countless cycles.

We’ve said it before and we’ll say it again, macro plus crypto is a deadly combination. These two skills are some of the most important when it comes to navigating the remainder of this decade and beyond. Who better to share their expertise than Dan?

Tune in as Dan peels back the layers of inflation, the bond bubble, and other economic crises. How did they become so extreme? What’s the difference between today and the 70s? And most importantly, how can you prepare yourself to weather the storms of economic instability?

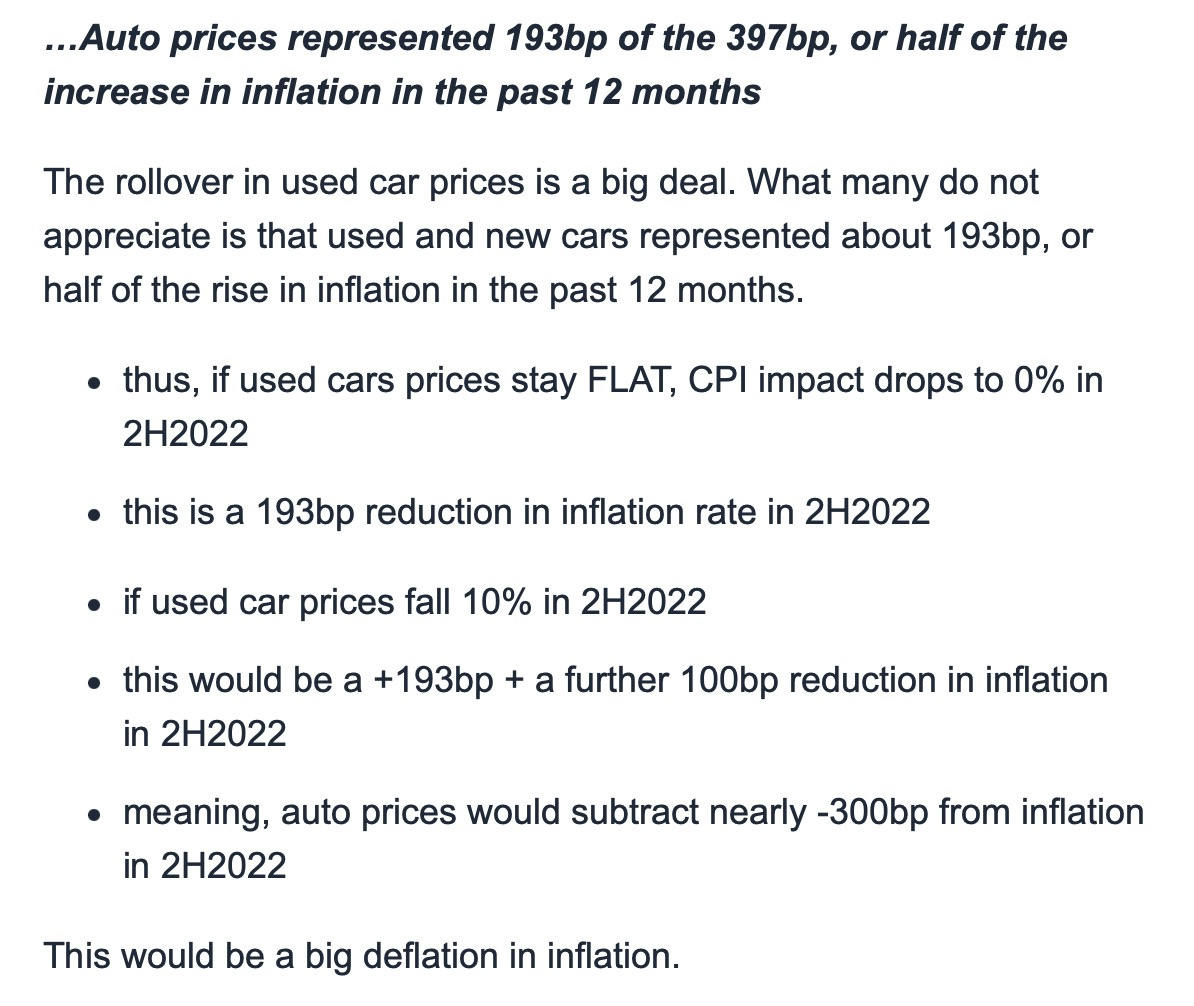

Let’s wrap up on some positives… the market is doing some of the Fed’s job:

Borrowing costs are up substantially…

A few larger inflation inputs appear to be rolling over…

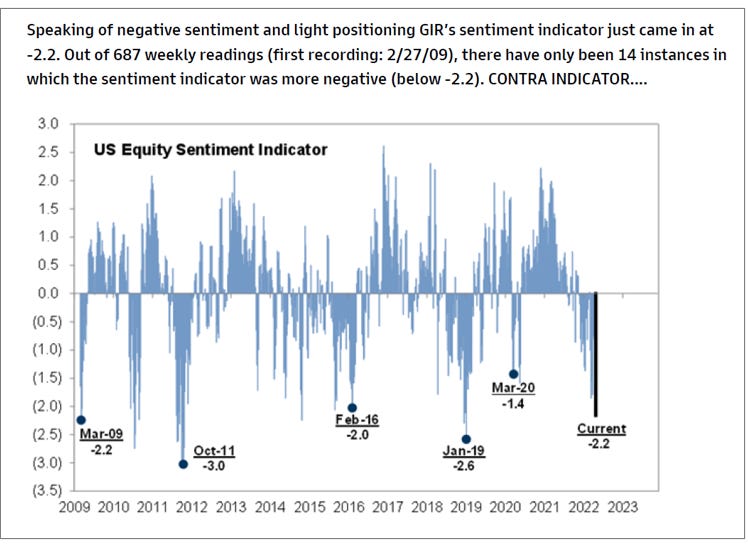

And market sentiment is close to an all-time low.

After a few conversations with smart friends, who also happen to be savvy investors…Shout out to RG, PH, CB, MW, MP! We digested a lot of the information above and found some silver linings.

Let’s examine what happens in a recession:

Companies slow down hiring/start firing

Consumers spend less

Housing drops

Wages drop

Currently:

Companies: remain in a notable labor deficit, and need to hire.

Consumers: close to the wealthiest, and savings as a percentage of income is close to the highest its ever been. This ties into housing, and while mortgage rates increasing will limit demand, supply in a lot of areas is still low.

Wages: tend to be more sticky, but like inflation, wage growth is calculated as a rate of change. It is very plausible for wage growth to slow, but wages stay, relatively, elevated. Keep in mind that today’s economy is different in many ways than historically. The economy is less a function of supply/demand in labor and more about specific industry growth. For example, when Amazon enters a city, it hires aggressively and lower-end wages go up toward $19/hr. Is e-commerce going anywhere? Is next-day delivery going anywhere? To facilitate that, Amazon needs to continue to build warehouses all over for fulfillment and will pay people $19/hr.

More broadly, and alluded to above, easing and tightening are relative. Currently, we seem to be at the far end of tightening expectations. Does that mean we won’t see more (potentially large) rate hikes and the Fed unwinding balance sheet near term? Absolutely not. Will we see the market correct if rhetoric moves further in the direction of tightening on the relative spectrum? 100%! What does that look like? Your guess is as good as mine. My gut points to -10-20% in equities.

One major point to keep in mind is if tightening expectations, or the pace of tightening expectations, changes toward the easing side of the spectrum… the market will celebrate.

Is that healthy? Some of it is, some of it isn’t…, particularly that the government is incentivized to keep rates artificially low. This is the first inflation test we have seen in the MMT era. It will be interesting to see how it shakes out.

RG expressed it in a funny, but accurate way: The world is healing. No more instant above-market offers on used cars from your cellphone.

Bitcoin in your 401(k)

TLDR: If you are interested in adding Bitcoin and other cryptocurrencies to your 401(k), Fidelity is leading the way in doing so. Expected to launch later this year, Fidelity will offer companies the ability to offer works Bitcoin exposure. There will be some restrictions put in place, such as caps, education requirements, etc, but this is another example of the increasing institutionalization of digital assets.

WSJ: Fidelity to Allow Retirement Savers to Put Bitcoin in 401(k) Accounts

Fidelity Investments plans to allow investors to put a bitcoin account in their 401(k)s, the first major retirement-plan provider to do so.

Employees won’t be able to start adding cryptocurrencies to their nest eggs right away, but later this year, the 23,000 companies that use Fidelity to administer their retirement plans will have the option to put bitcoin on the menu. The endorsement of the nation’s largest retirement-plan provider suggests crypto investing is moving further into the mainstream, but it remains to be seen whether employers will embrace it for their workers.

“There is a need for a diverse set of products and investment solutions for our investors,” said Dave Gray, head of workplace retirement offerings and platforms at the Boston-based company. “We fully expect that cryptocurrency is going to shape the way future generations think about investing for the near term and long term.”

Under the plan, Fidelity would let savers allocate as much as 20% of their nest eggs to bitcoin, though that threshold could be lowered by plan sponsors. Mr. Gray said it would be limited to bitcoin initially, but he expects other digital assets to be made available in the future.

Fidelity’s move comes at a time of heightened interest in digital currencies. Fidelity estimates that about 80 million U.S. individual investors own or have invested in digital currencies. Some institutional investors, including some U.S. university endowments, have reportedly invested in cryptocurrencies or funds that buy them, or took stakes in companies in the fast-growing industry.

Ali Khawar, acting assistant secretary of the Labor Department’s Employee Benefits Security Administration, wrote that “at this early stage in the history of cryptocurrencies,” the department “has serious concerns about plans’ decisions to expose participants to direct investments in cryptocurrencies or related products, such as NFTs, coins, and crypto assets.”

Companies have shown little interest in letting their employees rely on cryptocurrency for their retirement security. About 2% of the 63 employers in a recent Plan Sponsor Council of America poll said they would consider adding cryptocurrency to their 401(k) menu.

Participants who invest in bitcoin will encounter pop-up boxes with educational information on crypto when they log into their online accounts. When the balance in bitcoin holdings exceeds 20% of a portfolio’s value, the employee wouldn’t be able to transfer additional sums to the account from other investments in the 401(k) plan; the employee can continue to make payroll contributions. About 5% or less of the bitcoin account will be held in a short-term money-market fund to provide liquidity to facilitate daily transactions. Mr. Gray said the fees on the account will be between 0.75% and 0.9%, depending on the client, not counting trading costs.

Wall Street Breakfast: 401(k) plans

Bitcoin (BTC-USD) slumped to a six-week low of $38,423 on Monday morning as investors pulled out of risk assets, but rebounded off its bottom following an intraday rally spearheaded by Elon Musk's deal for Twitter. More positive news saw the popular crypto rally 5.6% to $40,641 overnight as Fidelity Investments announced plans to allow investors to put Bitcoin in their 401(k)s. It's a big move for the industry, which to date has effectively limited crypto investing for company-sponsored retirement accounts.

Quote: "We have seen growing and organic interest from clients," especially those with younger employees, said Dave Gray, head of workplace retirement offerings and platforms at Fidelity. "We fully expect that cryptocurrency is going to shape the way future generations think about investing for the near term and long term."

Later this year, employees at companies that sign up for the new offering will be able to transfer up to 20% of their account balances into a digital assets account that holds Bitcoin, though employers can impose lower caps. About 5% or less of the Bitcoin account will be held in a money market fund to provide liquidity for daily transactions, while fees on the account will range from 0.75% and 0.9%. Although the investments will be limited to Bitcoin initially, other digital assets are expected to be made available in the future.

Not so fast: Last month, the U.S. Labor Department, which regulates 401(k)s, outlined "serious concerns about plans' decisions to expose participants to direct investments in cryptocurrencies or related products, such as NFTs, coins, and crypto assets." The guidance went on to flag valuation troubles, volatile prices, obstacles to making informed decisions and the evolving regulatory landscape. "Cryptocurrency has gained mainstream popularity and notoriety, but there is still great uncertainty about how the market will develop, and little agreement on investing fundamentals relating to cryptocurrency."

Blockchain, Cryptocurrencies & Digital Assets

$239B — Despite a series of high-profile hacks, institutional inflow into DeFi broke $239 billion in total value locked. This high marks a 40,000% increase since 2020.

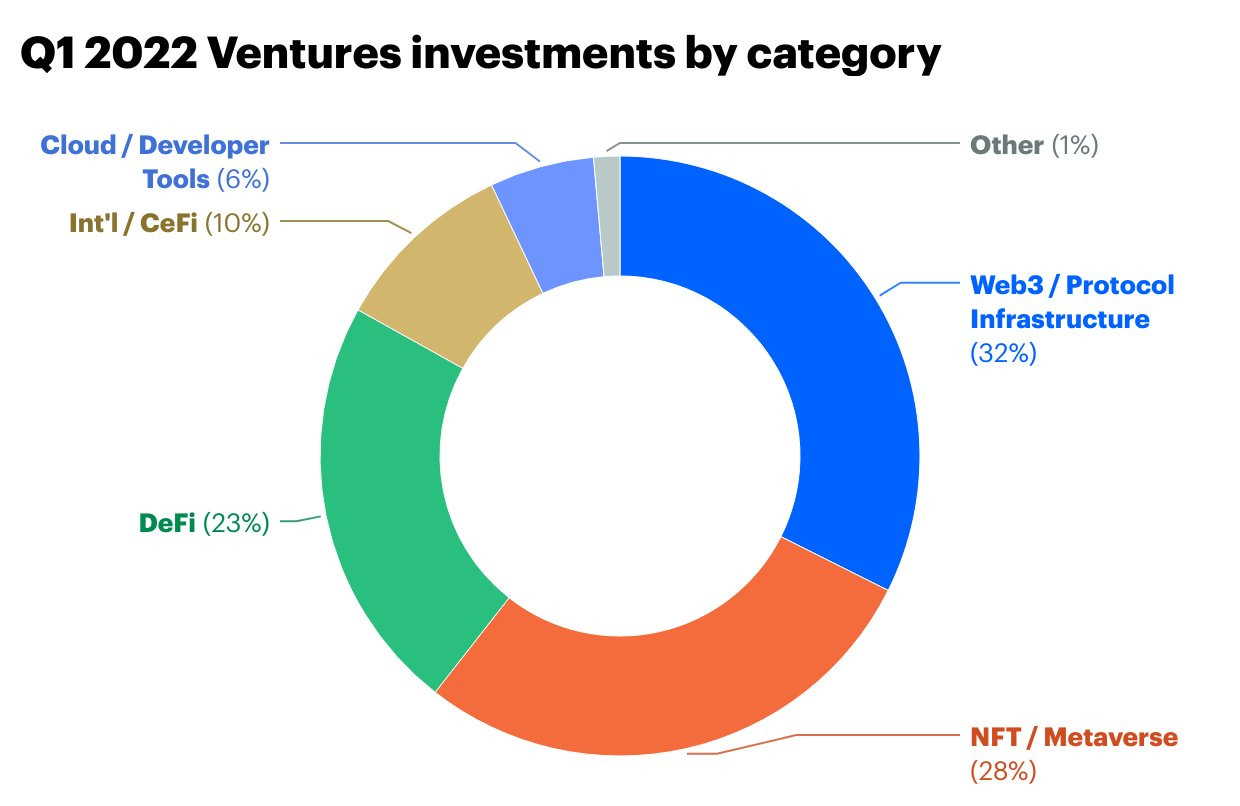

Coinbase Ventures 1Q22 Investments by Category

Sanction Evasion

According to the U.S. government, a North Korea-linked hacking group was behind last month’s $625 million Ronin bridge hack. In other words, a nation state was behind one of the largest crypto hacks. There's a growing story in North Korea’s actions here, but that actually isn’t the main point of interest for me.

North Korea appears to be hacking crypto exchanges and networks to seize funds for its own personal usage. And more immediately interestingly, adding an Ethereum address to the U.S. sanctions list does not appear to have halted the laundering of funds.

The U.S. Treasury Department’s Office of Foreign Asset Control added a single solitary Ethereum address to its Specially Designated Nationals list, otherwise known as its sanctions list. The address was tied to the hack of Axie Infinity’s Ronin Bridge, which saw some 173,000 ETH and 25.5 million USDC (worth around $625 million on March 29) stolen from the bridge network.

What’s really interesting is the wallet continued to send funds out after it was added to the sanctions list. Within 24 hours the controller of the wallet – said to be the North Korean hacker organization known as Lazarus – sent nearly 3,000 ETH to coin mixer Tornado Cash, repeating a pattern the hackers began after stealing the ether.

These transfers out continued through earlier this week. In many cases, the funds appear to have gone to an intermediary wallet before being sent to Tornado Cash.

In the past, helping sanctioned parties launder funds using crypto led parties being added to the sanctions list themselves. Anand Sithian, counsel at Crowell & Morning and a former trial attorney in the money laundering division at the U.S. Department of Justice, said crypto companies should watch for addresses and wallets tied to mixers, and in particular the fact that regulators like the Financial Crimes Enforcement Network have “highlighted the financial crimes risks associated with mixers, which obfuscate the source of transactions, and thereby prevent tracing transactions on the blockchain.”

“To the extent there are U.S. touchpoints, or U.S. persons involved in such transactions, crypto companies could face enforcement from FinCEN, OFAC, and/or the U.S. Department of Justice, depending on the activity at issue and whether any U.S. laws were violated,” he said. “Even without a violation, an investigation can be incredibly taxing on resources and distracting to leadership. As a result, crypto companies may wish to steer clear of mixers, to the extent possible.”

Tornado Cash’s executives have said that sanctions cannot be applied to the protocol itself, former CoinDesker and current Bloomberger Muyao Shen reported last month.

Regulators may not agree, but at least so far, the funds are continuing to move.

Meanwhile, on the North Korea front, the U.S. government is warning that the nation may continue to try and exploit crypto companies (and others) to raise funds.

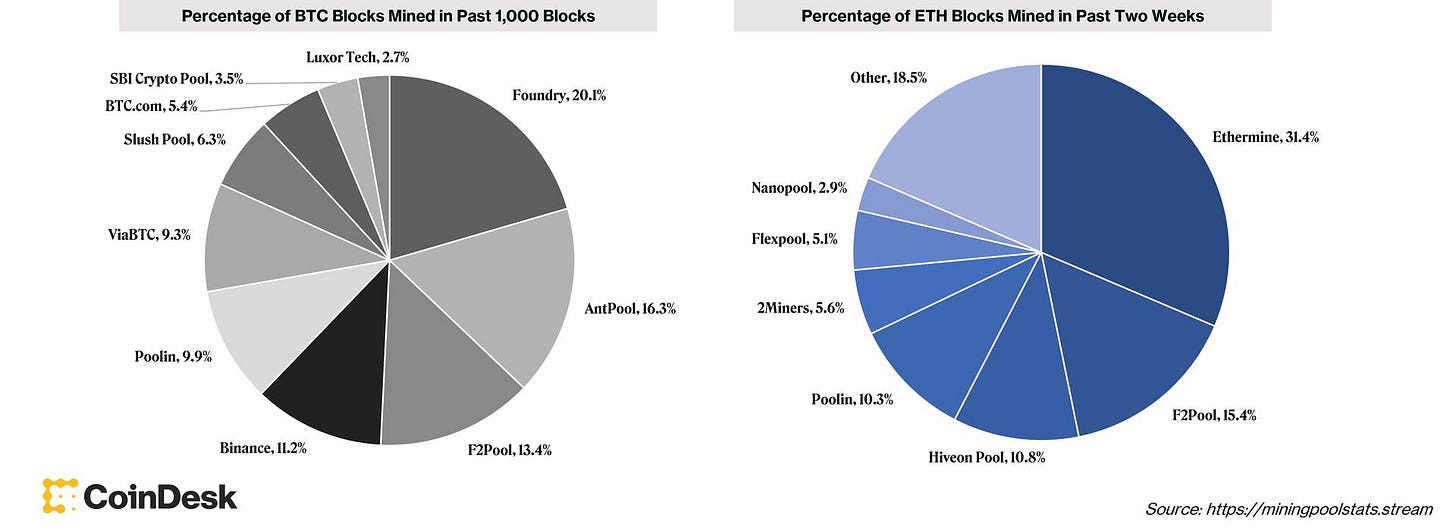

A majority of mining activity has fallen into the hands of a small number of pools – groups of miners who work together to mine blocks in exchange for a share of all the group’s aggregate rewards.

MINING MORATORIUM: New York Lawmakers will decide on a bill that would bar new permits for proof-of-working crypto mining operations in former power plants for two years.

The bill, which will be voted on by the state’s full Assembly this week, would not affect existing mining operations, but crypto advocates worry that if passed, could pave a way for more stringent crypto mining legislation in the future.

In the neighboring Green Mountain State, digital currency exchange Coinme is launching bitcoin ATMs across Vermont. The exchange is working with change sorting company Coinstar to add 23 kiosks to its roster, largely placed in grocery stores, according to Coinme CEO Neil Bergquist.

STRIKE, IN: Payments processor Stripe will use Ethereum scaling platform Polygon to allow its clients to make payments using USDC – potentially a boon for independent freelancers, content creators and service providers who want to be paid in crypto.

Social media behemoth Twitter (TWTR) will be the first company to try out the feature for its live, audio-only chats “Ticketed Spaces” and its “Super Follows” feature. In time, Stripe said it will add support for additional rails and payout currencies.

TRAPPED CRYPTO: Binance has recovered $5.8 million worth of stolen funds from the $625 million exploit on the play-to-earn Axie Infinity platform – the latest example of the world’s largest crypto exchange censoring transactions, perhaps for good, after one of the largest hacks in the crypto industry.

The funds were spread over 86 accounts, according to a tweet made by Binance founder Changpeng Zhao, who noted the hacking group started to move the stolen funds on Friday.

Meanwhile, Binance has asked a Texas federal judge to be removed from an $8 million lawsuit, which alleges the Cayman Islands-based company “aided and abetted” a romance scam, because it is not based in the U.S.

Finally, non-fungible token marketplace OpenSea has suspended “Gambling Apes” trading, an NFT series from the “Sand Vegas Casino Club,” after Texas and Alabama regulators stepped in and said the tokens looked like unregistered securities.

BANNING CRYPTO: The National Bank of Ukraine has banned the purchase of cryptocurrency using the Ukrainian hryvnia (the country’s local currency) under martial law.

In a move to “prevent the unproductive outflow of capital from the country,” individuals may only purchase crypto using foreign currency capped at roughly 100,000 Ukrainian hryvnia, or ~$3,400, per month.

Elsewhere, the European Parliament is reportedly studying blockchain for tax collection while simultaneously looking to crack down on capital flight through crypto. Privacy advocates have also raised concerns that sharing information about foreign crypto holdings is unjustified.

STRANGE SCAM: The Federal Bureau of Investigation (FBI) arrested 37-year-old Chester “Chet” Stojanovich on Wednesday for allegedly defrauding over a dozen victims out of $1.8 million after posing as a dealer for crypto mining equipment.

He allegedly convinced would-be customers to fork over large chunks of money for mining machines and miner-hosting services, which he promised would be housed at a facility in Goose Bay, in Canada’s Newfoundland and Labrador province.

According to a complaint, Stojanovich never made good on his promises and stashed a majority of the money for himself, never purchasing the equipment but creating the illusion, sending customers photos of the miners he had bought including photos of himself near piled-up boxes.

The old-fashioned fraud alleges that he blew a majority of his customer’s cash on chartering flights on private jets, traveling in limousines, throwing lavish parties, passing some money to his wife and even paying off more than $80,000 in personal credit card debt.

BANKING ON CRYPTO: Morgan Stanley published a research note claiming that crypto – notably, bitcoin (BTC) – could become more widely used as currency. It cites recent partnerships payments company Strike announced with point-of-sales supplier NCR and payments firm Blackhawk Network, which may drive BTC use in physical stores rather than just online (over 85% of sales in the U.S. occur in shops rather than online).

Meanwhile, Germany’s Commerzbank has applied for a local crypto license. If accepted, it would make it the first major bank in the country authorized to offer exchange and crypto-asset services.

FUNDING METAVERSES: NFT cricket platform Rario has raised $120 million in a Series A funding round led by Dream Capital, the venture capital arm of fantasy sports platform Dream Sports. The investment will give the Singapore-based platform access to Dream Sports’ 140 million users, underscoring its efforts to launch both companies into Web 3. As part of the partnership, users will be offered fiat-only products in India.

Meanwhile, Limitless, the company behind the Next Earth metaverse project, is looking to raise $60 million for venture funding to build out its digital replica of the Earth and a new “metaverse-as-a-service” business-to-business line

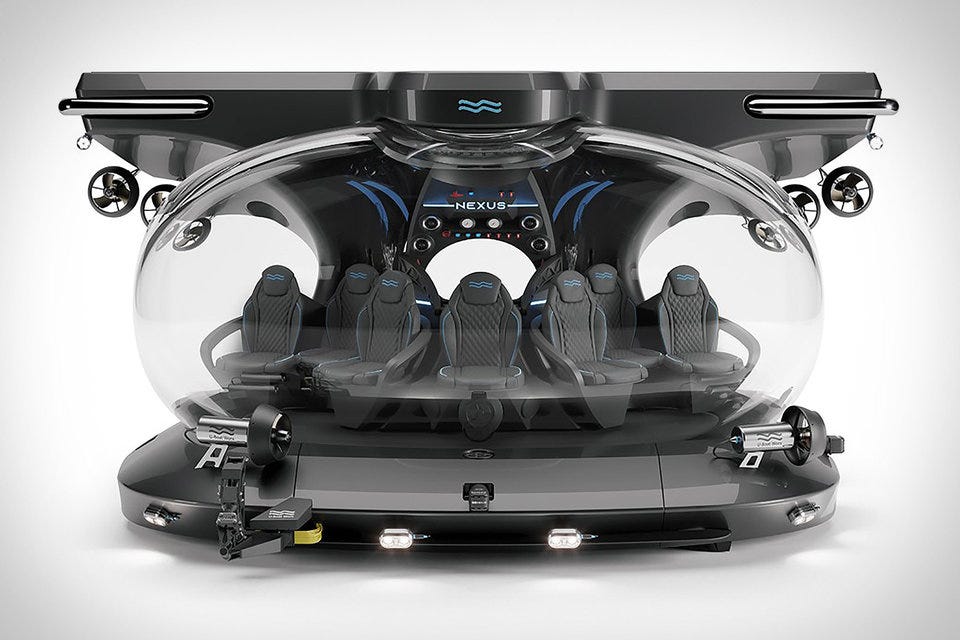

GOLDMAN GIANT: Goldman Sachs said virtual-reality (VR) platforms are projected to evolve rapidly in 2023, noting that tech titans like Apple and Meta will lead the race to develop metaverse technology.

That growth will depend on the sales of these products and the amount of utility consumers find within the ecosystems created, adding that VR may become a vital part of remote working, if issues, such as comfort, are resolved.

Meanwhile, Goldman is in the running to be FTX’s backer as the crypto exchange plans an initial public offering and future derivatives products, after the two companies’ CEOs Sam Bankman-Fried of FTX and Goldman CEO David Solomon met in the Caribbean.

Separately, venture fund Tower 26 has raised $50 million for virtual reality games. The fund led by veteran game investor Jon Goldman will focus on gaming, including the metaverse.

Singapore-based cryptocurrency trading platform KuCoin launched a $100 million Creators Fund.

WHY IT MATTERS: With roughly 10 million registered users and a daily trading volume of about $2.2 billion, KuCoin intends to support early-stage NFT projects. The fund will encompass several NFT categories of interest including art, sports, profile pictures, Asian culture celebrities and GameFi. Read more here.

Communication protocol Ethereum Push Notification Service (EPNS) raised $10.1 million in a Series A funding round at a $131 million valuation.

WHY IT MATTERS: With these funds, EPNS hopes to solve the lack of cross-blockchain communication. Already providing on-chain notifications for CoinDesk media alerts, Ethereum Naming Service (ENS) domain expirations, Snapshot governance updates and Oasis vault liquidations, the EPNS protocol permits on-chain communications by relying on a user’s on-chain identifier. This funding round aligns with EPNS founder Harsh Rajat’s comments on its “very aggressive plan to get a million users.” Read more here.

Some Indian Payment Processors Cut Off Local Crypto Exchanges: A handful of Indian crypto exchanges announced they were halting rupee deposits or withdrawals.

Attacker Drains $182M From Beanstalk Stablecoin Protocol: So my understanding is this wasn’t a hack or exploit, and can perhaps only technically be described as an attack. At any rate, the perpetrator here used a flash loan (a loan that is repaid almost instantaneously, perhaps within the same block) to borrow a hefty number of Beanstalk’s governance tokens, which the attacker used to vote in favor of a protocol change that sent all of Beanstalk’s funds to the attacker. All of this was “legal” in terms of the code’s setup.

Crypto Proponents Fear SEC 'Backdoor' Regulations on Exchanges, Dealers: CoinDesk’s Jesse Hamilton digs into a pair of SEC proposals that has the crypto industry up in arms: basically each proposal would appear to redefine the terms “exchange” and “dealer” (respectively) in such a way that they might encompass crypto protocols and decentralized platforms. However, it’s not clear – and this uncertainty has industry advocates worried.

Retail Interest in bitcoin is dwindling

Data from Google Trends shows search value for worldwide query bitcoin has dropped to 17, the lowest since mid-2020, having peaked above 70 a year ago.

OpenSea Acquires Gem to Invest in the Future of ‘Pro’ Community

OpenSea, touted as the largest Marketplace for NFTs, has acquired Gem, the leading NFT marketplace aggregator. OpenSea believes this new acquisition will help them invest more in building the future of the pro community. Keep Reading »

BAYC Instagram Hacked, Around $10M worth NFTs stolen

BAYC team has told in a Twitter thread that, after discovering the hack, they have alerted the community and removed links to the compromised IG account from our platforms and attempted to recover the account. Keep Reading »

Aid to Ukraine: Binance to Launch Refugee Crypto Card for Ukrainians

Russia’s invasion of Ukraine has led the world especially, Ukrainians to experience stagflation. In this chaos, several countries, big organizations, and charities are lending a helping hand to the refugees of Ukraine. Keep Reading »

The Bahamas Will Soon Allow Residents to Pay Taxes in Bitcoin

The government of the Bahamas has issued a ‘white paper’ named, “The Future of Digital Assets in the Bahamas”, that talks about the country’s digital asset strategy until 2026. It also includes information that the country is to allow its residents to use digital assets to pay taxes. Keep Reading »

Adidas’ Next Step Into Metaverse: The Brand to Release Products for NFT Holders

One of the largest sportswear manufacturers in the world, Adidas is all set to celebrate its partnership with NFT pioneers like money, PUNKS Comic, and Bored Ape Yacht Club by launching a limited edition digital collectible only for Metaverse users. The brand will be honoring the guidance provided by its partners and will offer NFT holders access to their exclusive physical merchandise collection and “ongoing digital utility” that will be available on their ‘Into the Metaverse’ website. Keep Reading »

Russia Monetizes its Natural Resources via Bitcoin Mining

Russia’s invasion of Ukraine is entering its third stage and has already taken a toll on the overall condition of the latter. The U.S. Department of Treasury is now issuing sanctions against the mining industry of Russia. Keep Reading »

MicroStrategy Quietly Selling Bitcoin

MicroStrategy is an American company. According to our sources, we could find out that MicroStrategy has been selling bitcoin without telling anyone. Keep Reading »

Top 100 (7d %):

ApeCoin (+48.2%)

STEPN (+30.6)

Terra (+14.8%)

Curve DAO Token (+14.8%)

Zcash (+7.9%)

DeFi (7d %):

Kava (+24.2%)

Kyber Network Crystal (+21.0%)

Curve DAO Token (+14.8%)

0x (+9.4%)

Ampleforth (+7.5%)

Galaxy Digital:

After months of anticipation, Coinbase released a beta version of its NFT marketplace on Wednesday. While only a select group of users can transact NFTs on the platform today, any visitor can still browse individual NFTs, NFT collections, and user profiles. The mere release of this platform, even in its limited functional state, is a milestone in and of itself given the 4+million people who signed up for its waitlist (compared to 1.5 million all-time users of OpenSea according to Dune Analytics). Coinbase built this OpenSea challenger with an eye towards integrating its existing retail-oriented product suite as much as possible. Not surprisingly, Coinbase Wallet features as the de-facto gateway to this web3 application (though Coinbase NFT is also compatible with other wallets like MetaMask). The platform will only support Ethereum-based NFTs initially, but they have plans of eventually being cross-chain. Fees on the platform are 0% for the time being, and they’re expected to rise to the low single digits seen in other marketplaces (such as OpenSea’s 2.5% and LooksRare’s 2%). The smart contract calls for exchanging NFTs on the Coinbase NFT platform are handled by 0x (whose token ZRX has seen a ~25% rise this past week on the news of their partnership).

Coinbase is looking to stand out from other NFT marketplaces by emphasizing its social features. On the Coinbase NFT platform, users can like, follow, and comment on NFTs and on other user profiles. This experience positions Coinbase NFT both as an NFT-oriented version of social media and as an NFT marketplace. Coinbase hopes that this added level of user engagement and interactivity will attract and retain users to its platform. Time will tell if the synergies between Coinbase NFT and Coinbase’s existing retail-heavy products will be insurmountable for current NFT juggernauts like OpenSea to compete against.

OUR TAKE: Coinbase is in a very strong position to capture market share from the likes of OpenSea and other competitors in the red-hot NFT marketplace landscape. For starters, Coinbase can offer its users a very simplified user journey starting with onboarding fiat all the way to acquiring and NFT. Coinbase can also reduce the number of hoops its users need to jump through to obtain liquidity for their NFTs. Coinbase NFT's approach also simplifies tax compliance for users who may otherwise have to manually reconcile taxable events for their NFT trades should they occur across multiple platforms.

More importantly, Coinbase will enjoy a strong relative position due to its data. There are two angles to this. First, Coinbase NFT will employ a discover page (much like what is seen on other platforms). However, because Coinbase has an existing userbase of 89 million individuals, it can leverage this treasure trove of data to recommend more relevant NFTs to its users in their personalized feed. This killer feature of accurate recommender systems anchored by massive datasets for ML algorithms to train on has led to the rapid rise of social media apps like TikTok. Because Coinbase has the best data of all current NFT marketplaces, they have the technical ability to recommend the most relevant content to their users compared to other players in this space.

Additionally, Coinbase NFT’s social features enable brand-new sources of user-generated data to help the platform cultivate a custom experience for each of its users. This is especially crucial in a world increasingly cluttered by new NFT projects that emerge on a daily basis. Users will appreciate the ability for a platform to filter the signal from the noise. With that being said, integrating social features is a double-edged sword because content moderation is extremely tough and it is not a core competency of Coinbase’s existing business. To the extent that hate speech, vulgar language, and unpleasant user-user exchanges happen on its platform, Coinbase may struggle with filtering out this bad content and may do more harm than good from a UI/UX point-of-view. Time will tell if Coinbase can pull this off, but to the extent that they do, they will be well-positioned to slice-off a chunk of NFT trading market share in this highly competitive space.

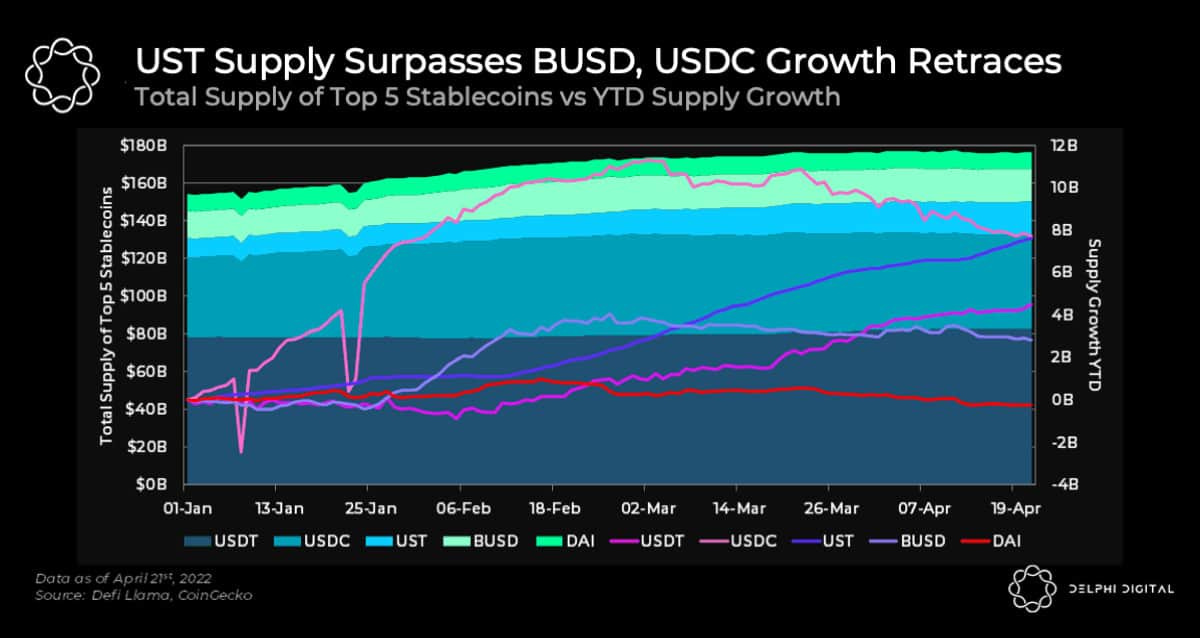

TRON to launch its own platform stablecoin USDD. TRON founder Justin Sun announced plans to launch a decentralized algorithmic native stablecoin on Tron called USDD (Decentralized USD). USDD will employ a market module similar to Terra's UST to maintain its peg to the dollar: USDD will be minted by burning a portion of Tron's native platform token $TRX. As demand for USDD increases, burning more TRX will have a diluting effect so that the price of USDD doesn't rise above $1. Similarly, when demand for USDD decreases, USDD can be redeemed for TRX at a 1:1 dollar ratio, which reduces USDD supply puts upward pressure on price whenever USDD is below $1.

Blockchain.com is interviewing banks for an initial public offering that could take place as soon as this year. An IPO might not happen until next year and the company’s plans could change, said the people, who asked not to be identified because the discussions were private. A representative for the company declined to comment. (YAHOO)

Crypto investors made $163 billion in gains in 2021: Chainalysis. Crypto investors took home about $162.7 billion in realized gains in 2021, according to a blog post by blockchain analytics firm Chainalysis, showing it was a stellar year after $32.5 billion in 2020. Out of this, US investors took the lion’s share of the profits, netting some $47 billion — around 29% of the total amount. These investors were followed by those in the UK, Germany, Japan and then China, which banned bitcoin mining and poured cold water on investing in crypto early in the year.

Investors Poured $2.5B Into Crypto Games in Q1 2022: Report. A new report by DappRadar and the Blockchain Game Alliance (BGA) suggests that 2022 will be a benchmark year for crypto games developers. The report reveals that $2.5 billion in investments was raised in Q1 alone this year, adding that developers could see this figure balloon to $10 billion by the end of the year. Compared to previous years, these figures also suggest the niche has become a key sector for investors. In 2021, for example, just $4 billion was raised throughout the whole year. The investment trend is also supported by growing interest from crypto enthusiasts. Blockchain gaming attracted 1.22 million unique active wallets (UAW) last month and currently accounts for 52% of the blockchain industry’s activity.

Kadena announces $100 million grant program for web3 developers. Kadena, a proof of work (POW) blockchain, today announced a $100 million grant program funded by its treasury to support web3 development. The program will be administered by Kadena Eco, the blockchain’s innovation network, and used to attract talented developers to contribute to the Layer 1 network’s codebase. According to a company news release, the grant will focus on supporting builders in areas including NFTs, DeFi, gaming, metaverse and DAOs among others.

a16z Crypto is launching an academic research lab focused on web3

Dubbed a16z Crypto Research, the new unit will be led by Tim Roughgarden, a prominent academic expert in game theory who has been a professor at both Stanford and Columbia. He joined a16z as a research advisor last year and will now take the title of head of research.

Australian authorities lay out guidelines and roadmaps for crypto industry regulation

In a letter from APRA Chair Wayne Byres, the authority, which supervises banking, insurance and pension institutions in Australia, emphasized the need for due diligence and risk assessments when dealing with crypto assets.

Flare gas-powered Bitcoin miner Crusoe Energy Systems raises $505 million

The Denver-based company got $350 million in equity financing from G2 Venture Partners and an additional $155 million in credit facilities from SVB Capital, Sparkfund and Generate Capital, according to an announcement on Thursday.

Julian Assange’s brother: AssangeDAO helps Wikileaks founder take legal fight to US

A DAO set up to provide funds for Julian Assange to fight American espionage charges is helping him take "aggressive" legal action in the US, according to Assange’s brother, Gabriel Shipton.

Dining With Apes: A Field Trip to the World’s First NFT-Themed Restaurant

Those not entrenched in the crypto-sphere might be surprised to learn that there is now a pop-up restaurant based on Bored Ape Yacht Club and Mutant Ape Yacht Club, the two biggest NFT collections currently in circulation. They might be even more shocked to learn that the food there is actually pretty good! Brandon reports from Bored & Hungry, a burger joint in Long Beach, Calif. with a vision that’s much bigger than burgers.

Betterment, an early pioneer among startups offering automated investment advice that was valued at $1.3 billion in September, bought crypto robo-adviser Makara earlier this year. Getting into crypto was a natural extension for the fintech company. Betterment CEO Sarah Levy said that crypto’s $2 trillion market cap was too hard to ignore—and an obvious way to lure more customers. Plus, the sheer variety of crypto options means there’s a huge need for investment advice.

Betterment’s solution, via Makara, is to bring a similar approach to crypto investing that already exists for the stock market via ETFs and index funds. Because those investment vehicles don’t yet exist for tokens, Makara has put together “baskets” of crypto investments, ranging from metaverse-focused tokens to inflation hedge-focused tokens, and more. Levy said Makara's offering will be rolled out on Betterment's core platform this summer.

Tweets & Threads:

Emerging Technology, Startups & Venture Capital

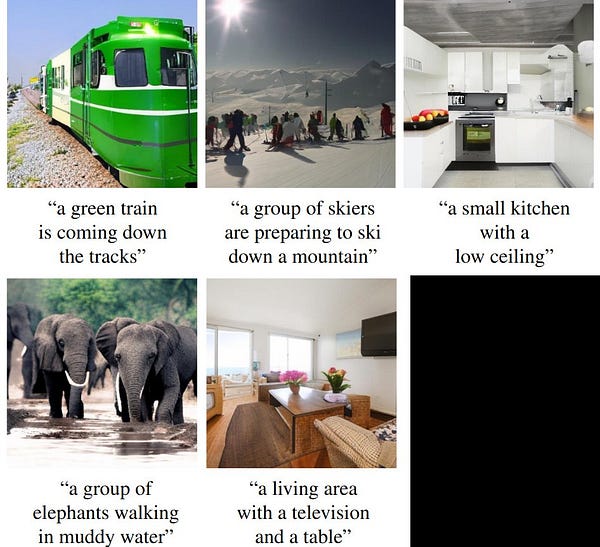

OpenAI’s DALL·E 2

A new AI system that can create realistic images and art from a description in natural language.

DALL·E 2 can:

Create original, realistic images and art from a

text description. It can combine concepts, attributes, and styles.Make realistic edits to existing images from a natural language caption. It can add and remove elements while taking shadows, reflections, and textures into account.

Take an image and create different variations of it inspired by the original.

DALL·E 2 has learned the relationship between images and the text used to describe them. It uses a process called “diffusion,” which starts with a pattern of random dots and gradually alters that pattern towards an image when it recognizes specific aspects of that image.

When in a hole...

Meanwhile, Elon's tunnelling company raised $675m at a $5.7bn valuation. Civil engineers are divided on this one - he's using the same tunnelling tech as everyone else (it's a second-hand TMB!), but with some arguably more efficient processes, and then of course the idea that using cars instead of carriages could be more efficient is a maths question. One could look at Elon as a machine for generating billion dollar frontier-tech companies, some of which work (remember Hyperloop?). LINK

Scaling venture

This is not a venture newsletter, but it’s fascinating to watch my old shop Andreessen Horowitz evolve as it scales. The team page now lists over 350 people, with another 70 open roles (archive.org says there were 80 people in total when I joined in 2014). Reportedly, it now has over $50bn under management, which per the NVCA is roughly the same as all venture partnerships in the USA combined when Marc Andreessen co-founded Netscape in 1994. Now it’s launched its own in-house crypto research lab, with a bunch of blue-chip computer scientists building open code. Of course, like the rest of the model, this is a way to win deals (reinvesting that 2&20), but it’s a long way from the artisanal craft of old-school VC - BenMarc has, what, 50x more people than Benchmark? LINK

Parents are increasingly using electric cargo bikes to transport their children to school and playdates around New York City / NY Times

It is time for America to pull back from car-focused road designs / NY Times

Tesla is no longer including mobile connections in all of its vehicles / The Verge

Experts in European logistics agree that sustainable modes of transportation will soon dominate last-mile logistics / Transinfo

GM's Cruise has expanded its pilot program for autonomous delivery with Walmart in Arizona / TechCrunch

The Startup That Gives Product Manufacturers X-Ray Vision

Ever consider cracking open your Airpods or Bose speakers to peek inside? Now there’s a non-invasive way to see the internal workings of complex consumer gadgets. Lumafield, a startup just out of stealth mode, built a compact CT scanner for use by engineers who develop products from sneakers to shampoo bottles. To test the product, The Weekend brought a mini-massager and a pair of Beats headphones to Lumafield’s San Francisco office to get the full 3D x-ray treatment.

Trucks Venture Capital's Reilly Brennan:

Bike sharing company PBSC acquired by Lyft for an undisclosed amount (link). 'The PBSC acquisition will bring to Lyft’s repertoire the company’s 7,500 stations and 95,000 bikes that are scattered throughout 45 markets in 15 countries.'

What factors influence bike share ridership? (link). 'Ridership is influenced by weather conditions, temporal factors (eg daylight hours, university terms, weekdays, holidays), employment, and proximity to important destinations. Ridership is not influenced by population and most transportation infrastructure variables.'

Accredited investors can now invest with us in the Trucks Growth Fund (link).

Macro, Markets, Hedge Funds & Private Equity

A Wealth of Common Sense: How Series I Savings Bonds Work

**Beginner**

A good introduction to inflation-protected Series I Savings Bonds. More details at Treasury Direct.

According to the Wall Street Journal, yields on I Bonds are fast-approaching 10% and the money is pouring in:

U.S. Treasury Series I Bonds, or I Bonds, will offer annual interest payments of 9.6%, based on the bond’s latest inflation rate calculation, which is tied to March’s consumer-price index.

Over the past six months, nearly $11 billion in I Bonds have been issued, compared with around $1.2 billion during the same period in 2020 and 2021, according to Treasury Department records.

That’s 9.6% annualized for bonds backed by the full faith of the U.S. government.

Here’s the rundown:

You buy these bonds straight from the government at Treasury Direct.

The yield is computed every 6 months (in May and November) and compounds semi-annually.

There is a fixed component (which is currently 0%) and an inflation-indexed component tied to CPI that resets semi-annually.

There is a $10,000 limit per person (you can buy them for your kids too) annually.1

If you send your tax refund directly to Treasury Direct you can buy an extra $5,000 per year.

You don’t pay any state taxes and federal income tax can be deferred until redemption.

If you use these bonds to pay for education expenses they are tax-free.

You cannot cash in these bonds in the first 12 months.

If you cash in before 5 years is up, you pay a penalty of 3 months’ worth of interest.

After 5 years you can redeem penalty-free.

The only real downsides are as follows:

The Treasury Direct website looks like it was created in 1997 and is not the greatest user experience.

It’s not easy to rebalance these bonds.

You can’t buy the bonds in a tax-deferred account like an IRA or 401(k).

You cannot do joint accounts so both you and your spouse would need to create their own account.

You can earn 2-3% in relatively “safe” U.S. government bonds right now.

I don’t know if these rates will endure and it’s probable the near-10% Series I Savings Bond yields won’t last either. But the beauty of dollar cost averaging is you can spread out your starting yields so you’re not tied to an arbitrary starting point.

Netflix is not a tech company

Like Sky before it, Netflix is a television company using tech as a crowbar for market entry. The tech has to be good, but it’s still fundamentally a commodity, and all of the questions that matter are TV questions. The same applies to Tesla, and indeed to many other companies using software to enter other industries, especially D2C - what are the questions that matter? LINK ♻️

Netflix 💩🛏

Netflix subscribers fell for the first time, the shares crashed, and it's going to clamp down on password-sharing, rationalise spending and explore an ads model. See my column below. LINK

CNN+ killed after a month

As leaked last week, the new CNN+ subscription streaming service is dead, just a month after launch. There is some debate as to how far this is due to a slow launch (though a month is not a long time to look for product-market-fit), a questionable strategy (it was mostly new content and didn’t give you the core CNN content), or change of management - Jason Kilar took it live just before handing over control to the new Discovery owners. This is a footnote to the Netflix miss (except for the staff, given 90 days days notice, which is longer than the actual operations) but seems equally symbolic of the first phase of TV unbundling - just because you want a direct relationship with your users, that doesn’t mean they think about you at all. LINK

Pay with Amazon

Amazon how offers a ‘Pay with Prime’ button for ecommerce retailers, leveraging the existing use base and taking on Shop Pay (and Apple Pay etc). Lots of interesting moving parts here. Shopify is trying hard to build network effects to keep merchants on the platform and Shop Pay is a big part of that; for Amazon adding its own button is both a spoiler (“we have a bigger network!”) and a way to extend the reach and value of Prime. Maybe there’s a pivot point within this - how do you combine the network effects of an aggregator with control of your own site? LINK

Amazon AR

No surprise at all that Amazon is (apparently) working on its own AR product. If AR/VR/‘metaverse’ is indeed the next big platform after smartphones, then it’s a huge opportunity for any consumer tech company, and perhaps a chance to reset the platform gatekeeping currently controlled by Apple and Google - this is why Facebook has already invested so much. Option value and platform risk. LINK

Facebook payments

Facebook’s cryptocurrency may have been quietly forgotten, but WhatsApp is building a lot in emerging markets payments, with approval to expand to 100m users in India. Meanwhile, a project in Brazil keeps getting into regulatory and partnership difficulties. INDIA, BRAZIL

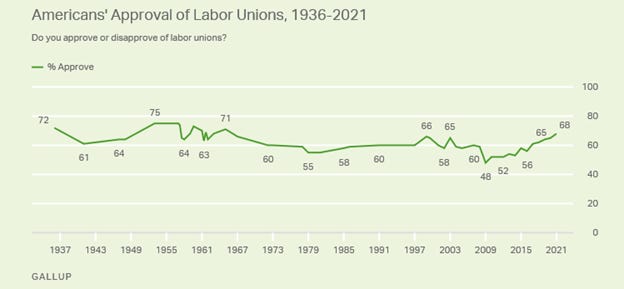

Labor union approval ratings in 2021 were the highest since 1965 in the U.S., Rates were relatively elevated among young adults aged 18-34 (77%) and those with annual household incomes under $40,000 (72%)

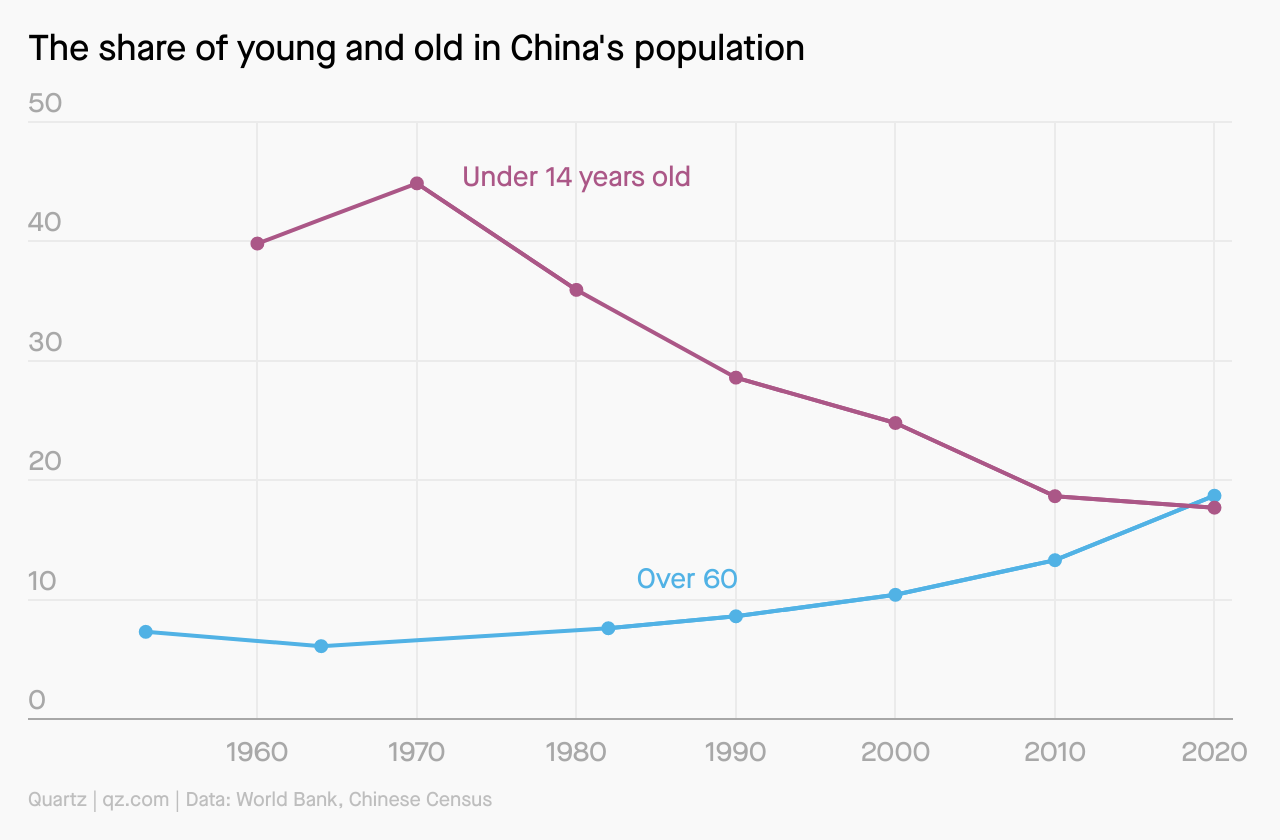

China has some of the youngest retirement ages in the world. But it’s becoming a big problem for a country that is steadily aging. For one, China’s pension system is drastically underfunded for the growing number of people who are approaching retirement.

Parts of Beijing are facing lockdown. With mass testing under way, there are fears that restrictions could become as severe as Shanghai’s, where residents have been confined to their homes and have faced food shortages because of China’s covid-zero policy.

China ratified treaties on forced labor. Despite growing international rebuke over its Xinjiang camps and treatment of the Uyghur ethnic minority.Sri Lanka requested an emergency bailout from the IMF. The country owes more than $35 billion in foreign debt. More tough economic times in general are ahead, the IMF said, as it cut its global GDP growth forecast to 3.6%

China doubled down on its friendship with Russia. The two nations would increase “strategic coordination,” China’s vice foreign minister said, despite the ongoing war in Ukraine.

Joe Biden released $1.3 billion more in assistance to Ukraine. “Putin is banking on us losing interest,” the US president said, with money going toward weapons and economic aid.

Russia said it had gained control of Mariupol. Russian president Vladimir Putin said that the southern Ukrainian city, which has been under constant attack, is now under Russian control—though that still doesn’t include the steelworks where Ukrainian fighters have been holding out.

Russia also tested a nuclear-capable missile to rattle its detractors. The Sarnat is an intercontinental ballistic weapon that will make people “think twice,” Putin said.

The ruble continued its rise. The Russian currency climbed to more than 73 rubles against the dollar, recovering to pre-war levels, thanks to tax payments companies are expected to make this week.

Shares in Cnooc soared on its IPO. China National Offshore Oil Corporation shares leapt 44% after it listed on the Shanghai exchange, raising $436 billion. The company was forced to delist from the New York Stock Exchange last year as part of a lingering post-Trump crackdown.

CNN+ is no more. The $300 million bet on streaming services lasted less than a month.

Just Eat may sell Grubhub, less than a year after buying it. Europe’s largest meal delivery company is looking to drop US-based Grubhub under pressure from investors as orders decline.

Coca-Cola’s earnings rebounded. The company posted higher sales last quarter even as the cost of ingredients such as corn syrup rose.

Trucks Venture Capital's Reilly Brennan:

GM confirmed it would build an 'electrified', all-wheel drive Corvette in 2023 (link). The language seems to suggest the first variant will be a hybrid, followed by a full BEV in years following.

Inside Lucid's mad dash to ramp up production (link). 'Sources also said Lucid resorted to buying parts off Amazon amid supplier mishaps, deploying corporate workers to help on the factory floor, scrambling for final assembly quality, and sending developers to customer homes to deal with software glitches.' If you build a new EV company, may you be so fortunate as to experience Production Hell -- and emerge on the other side.

Tesla hinted at a dedicated robo taxi prototype, but why? (link). In this piece I also learned a new term - robezium - which describes the design of a 'typical AV symmetrical box with a roughly trapezium-style shape.' All AV concepts seem to look the same, which is to say most are both forgettable and unobtainable.

'What I found when I crawled under Rivian's Amazon van' (link). This is a fascinating look by a few guys who are literally crawling underneath Rivian prototypes. Of course, we need more on-the-ground reportage like this.

A list of the top 100 used-vehicle retailers shows how used vehicles are further dominating new sales (link). Via Automotive News. 'In 2021, the average company on the list sold 1.52 used vehicles for every new vehicle they sold. That ratio has steadily increased during the 10 years Automotive News has tracked the numbers, up from 0.88 in 2012.'

75% of surveyed auto consumers dislike software subscriptions for in-vehicle features (link). Via Cox Automotive. 'Specifically, 92% said heated and cooling seats should be part of the purchase price; 89% said remote start should be as well. Both items have been discussed by some automakers as subscription features. As for safety features, the response was almost as overwhelming; 89% said lane-keeping assist should be part of the price and 87% said automatic emergency braking should be too.'

The newly found FAANG family, now called MAMAA by Mad Money's Jim Cramer (he coined the first phrase in 2013), includes Meta (FB), Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Google parent Alphabet (GOOGL). The quintet will report earnings over the next several sessions, with many eager to see how the quarterly results will impact market direction given their heavy weighting in the S&P 500. Combined revenue of the group is expected to have surpassed $340B in Q1 of 2022, up by 7% compared with the same period last year.