Top 3

Ansem’s Newsletter: Quarter II 2022

**Beginner**

Ansem's quarterly newsletters are a must-read for those interested in digital assets. The 2Q22 posting highlights some of the biggest macro concerns, evolutions in the broader crypto space, and Ansem's top picks in the space: infrastructure (POKT, Genesys Go), Cosmos Ecosystem (OSMO, JUNO, LUNA, RUNE) & GameFi (DFK). I would recommend reading the entire piece. Highlighted PDF below.

Macro Concerns:

Russian-Ukraine situation escalates to other nearby countries that are a part of NATO

FED raises rates faster than the market expects them to

Putin decides it’s a good idea to use nuclear weapons

China enters the arena aggressively with their own personal imperialist pursuits

BTC

I believe that there are primarily two groups of people buying/trading BTC, those that trade with other risk-on assets and those that are accumulating it long-term for situations like the one we are living in currently. The latter group grows more everyday while the former group will continue to shrink in size, there are many better opportunities within the crypto space for those looking to put on more risk and as more money enters the space I think that new money will diversify their strategies accordingly.

ETH

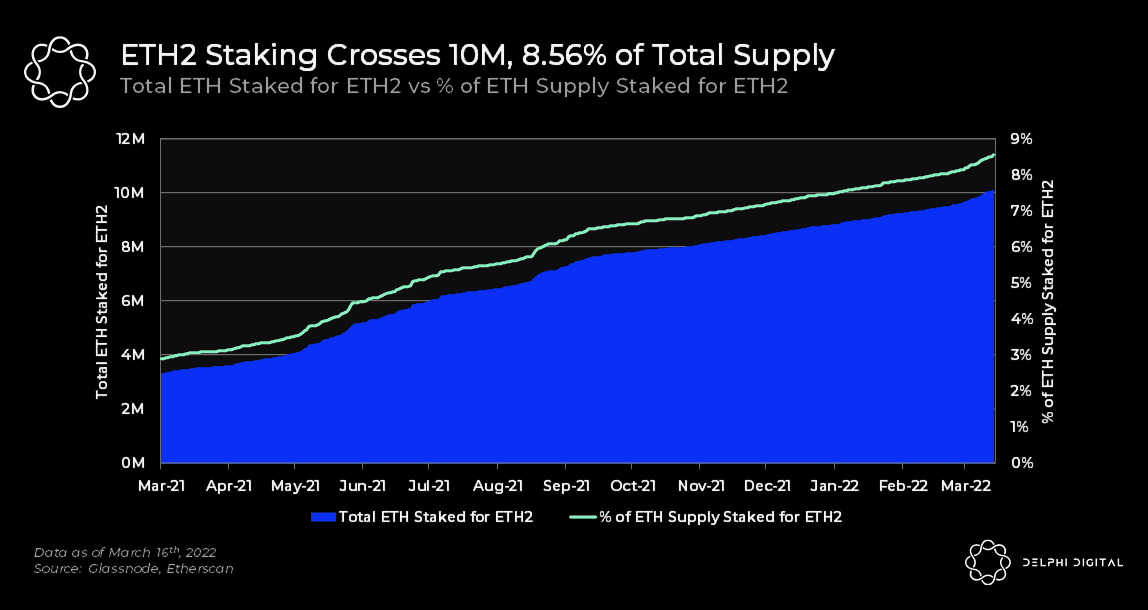

For the merge I think the strongest play is Lido, the liquid staking solution, as it benefits in a large way for users who want to participate in ETH staking but still want access to their funds to use in other parts of DeFi.

2Q22 & Crypto Broadly

As the crypto market matures, we are going to see less useless tokens just tacked onto applications that do not need them, and more tokens for which their demand is tightly connected to the overall protocol’s growth.

I’ve consolidated most of my infrastructure plays into POKT & Genesys Go, both are down significantly over the past few months but expecting them to do well if the market turns around.

For GameFi, am still bullish on DFK, development pace has not slowed down at all during the market downtrend and we’ve yet to see how the game will function once its’ in-game economy is fully flushed out with guilds, land, pvp, and its’ first cross-chain expansion onto an Avalanche subnet.

“Terra Luna is the only play in the crypto space where you can directly bet on the growth of stablecoins and the growth of layer 1 smart contract ecosystems at the same time. For this reason, LUNA is my favorite out of all of the largest layer 1s going into 2022 and I’m betting that their ecosystem growth, stablecoin growth, and also the growth of IBC in general will propel them above other competitors.”

Rune’s core focus is being a cross-chain dex that allows native swaps between different chains. Thorchain’s design requires bonding nodes to post 3x more Rune collateral than the other assets that are being added for liquidity, so as the TVL within Thorchain grows, demand for Rune grows with it. What’s most interesting to me about Rune’s community is the genuine interest from Bitcoiners, since they are typically not very interested in ETH or DeFi. If that target market of hodlers is able to be accessed, it’ll be extremely bullish for Thorchain and its’ future. There is a ton of BTC that is currently not getting any yield and for people who are very comfortable passively buying and holding low-risk yield should be one of the most attractive value props.

Conclusion

Q1 Reflections

be more cautious when aware of lack of edge [i.e. lack of knowledge on macro]

more concentrated bets, less diversification when no strong bias

be more diligent about using hedges, pair trades are much more important when market is overall bearish

appchains appear to be the current meta, have much stronger tokenomics than regular governance tokens

Favorite Pair Trades

long Luna / short Eth

long Rune / short Fantom

long BTC / short Doge

long Avax / short ONE

Some bold predictions for the quarter:

BTC trades @ ~60k again

ETHBTC trades lower than .055

Anchor flips AAVE in TVL

Astroport flips Pancake Swap in avg daily volumes

ETH gas fees stay low as people stay on alt L1s & more start using rollups

10+ AVAX subnets launch attracting new users

Solana becomes primary hub for on-chain perps & options

Arthur Hayes: Energy Cancelled

**Beginner**

Hopefully an interesting thought experiment versus an inevitability, but definitely worth reading in its entirety. Hayes analyzes how freezing Russian Central Bank assets could lead to a new norm for central bank reserves globally... leading nation-states to hold outside money, instruments that are not liabilities on another player’s balance sheet, like gold, other commodities, and bitcoin?, instead of inside money, monetary instruments that exist as liabilities on another player’s balance sheet... Not a comforting read, but it's important to understand as the implications could be massive. Shout out to JC for highlighting. Highlighted PDF below. This piece is related to Arthur's piece, Annihilation, and Zoltan Pozsar's Bretton Woods III, both below.

You cannot remove the world’s largest energy producer — and the collateral these commodity resources represent — from the financial system without serious unimagined and unintended consequences.

Regardless of the speed at which this war subsides, the monetary rules of engagement will not go back to the post-1971 Petro / Eurodollar system. A new neutral reserve asset, which I believe will be gold, will be used to facilitate global trade in energy and foodstuffs. From a philosophical standpoint, central banks and sovereigns appreciate the value of gold, but not that of Bitcoin. Human civilization is approximately 10,000 years old, and gold has always been valued as a monetary instrument. Bitcoin is less than two decades old. But don’t worry: as gold succeeds so will Bitcoin.

It All Balances

It’s a great privilege and ruinous cost to host the world’s reserve currency. The USD is the most used currency for global trade, FACT. Most hydrocarbons are priced in USD, FACT. As a result, the rest of the world uses USD to price any and all traded stuff on the global markets, FACT.

The US treasury market is the largest and deepest market globally. Therefore, excess global dollar savings flow in. If you want to be the global reserve currency, you must allow foreigners to invest as much as they like into your capital markets. In economics lingo, your capital account must be open.

This is great for a government in some circumstances. America essentially prints as much USD as it wishes … at zero cost, because it correctly assumes there will be a large foreign contingent of savers who MUST purchase this debt. While it’s great to get something for nothing, the cost is that your economy becomes financialised.

America exports finance, not goods, to the world on a macro scale. If your secret sauce is open, deep, and liquid capital markets, then you will prioritise the interests of financial services over manufacturing.

Readers should also ask why countries that produce things and earn dollars don’t invest those dollars back into their own countries?

The biggest “savers” are saving at the expense of their domestic wage earners. Those “savings” are essentially the difference between the wage level of a deficit country like America, and a surplus country like China. If China wanted to, it could exchange their trillions of dollars for Renminbi. That would push up the price of Renminbi, and hurt exporters. But it would make consumer products (imports) cheaper for workers.

Analog vs. Digital Money

This physical analog network is censorship resistant, anonymous, but very slow and limiting in a globalised economy. The mainframe computer, and most recently the internet, allowed society to digitise the network. We created digital forms of the most common units of accounts, paper money and gold, and began “sending” value electronically over centralised permissioned digital networks, like Society for Worldwide Interbank Financial Telecommunication (aka SWIFT).

All base fiat money derivatives like government bonds and shares of companies also ride on centralised, permissioned digital networks. These are the regulated domestic exchanges where such assets are traded. If you hold these assets, you merely rent them from the network, and the network can decide to remove you unilaterally at any time.

If you are a country that “saves” in the global reserve currency and any associated assets, you do not own your savings. You are allowed to own things at the mercy of the flag that operates the network. You trust that the ruling flag will not expropriate your “savings’’ and therefore you believe your net worth as a country is greater than zero in the nominal terms of the global reserve currency.

Twelve Trillion

If you save in dollars, America controls the network. If you save in Euros, the EU controls the network. If you save in renminbi, China controls the network.

On 26 February 2022, the West decided to confiscate the reserves of a sovereign nation held in a variety of G10 currencies. The Russian Central Bank lost access to $630 billion worth of reserves.

Russia is the largest country by landmass, exporting the most raw energy globally (mostly in the form of hydrocarbons — oil and natural gas — and it is one of the largest producers of foodstuffs). The West includes the wealthiest countries globally, who consume energy and food, and purchase it with their own fiat currencies. This arrangement is fini. Never before has it been possible, due to the digital nature of fiat currency payments, to shun a country like this.

Money is a medium of energy storage, and the most-used monetary instruments now lack the largest energy producer globally as a user.Why should any central bank “save” in any Western fiat currency, when their savings can be expropriated arbitrarily and unilaterally by the operators of the digital fiat monetary networks?

In the context of China and other surplus countries, that means do not let your fiat currency position grow as you earn income internationally.

Instead, what China will do is accept a fiat currency for their goods and immediately exchange it for a harder asset. Given gold is the hard money choice for humanity, China and others like it will begin to provide a sizable bid in the physical gold market.

For outside money to truly be outside, it must be in your physical possession. Even legal guarantees that you will receive your assets upon request are not enough if you can’t physically walk into the vault, or plug in the USB stick to access your savings whenever YOU desire. There should be no institution, person, or process stopping you from accessing your funds immediately. Any other arrangement renders your outside money, inside.

The reason why a central bank buys gold instead of Bitcoin is solely due to historical precedent. I am not a maximalist. Both are hard money, one is analog (gold) one is digital (Bitcoin). If a central bank begins saving exclusively in gold, and global trade imbalances are settled in gold terms, I am fully confident that over time some central banks may tire of shipping gold around the world to pay for things. They would rather conduct a small but rising amount of trade in a digital currency, which would naturally be Bitcoin.

The Generalist: Multicoin Capital: The Outsiders

**Beginner**

Terrific read on origins and performance of Multicoin Capital. Outsiders when starting in the crypto-realm in 2017, Kyla Samani and Tushar Jain built their fund by studying and writing about the nascent crypto space. Through their contrarian approach, concentrated bets, and founder-friendly attitude, Mulitcoin may be the highest-returning venture fund of all time. Long, but well worth the read... plus, parts 2 and 3 are yet to come. Highlighted PDF below.

Multicoin may be the highest-returning venture fund of all-time. Firms like Union Square Ventures and Lowercase Capital are legendary for funds with 14x and 76x returns, respectively. Multicoin’s first-ever venture vehicle appears to have them beat.

The firm has won by taking a contrarian approach. When Multicoin started, the investing landscape was dominated by funds focused on Bitcoin and Ethereum. Founders Kyle Samani and Tushar Jain saw opportunity elsewhere, making contrarian bets on Helium, The Graph, and Solana.

To drive outsized returns, make concentrated bets. Part of Multicoin’s genius is its willingness to back up its conviction with capital. Many of the firm’s best-performing investments were sized aggressively, contributing to the fund’s outperformance.

Investing in EOS was a flop…that led to Multicoin’s biggest winner. The firm’s outspoken support for alternative blockchain EOS rubbed some the wrong way. When that project floundered, critics celebrated Multicoin’s mistake. But it was by backing EOS that Multicoin recognized the potential for monster hit, Solana.

Multicoin has its critics, but founders are extremely positive. In the partisan world of crypto, Multicoin’s strident support of its investments can anger dissenters. Loathed by some as a result, the firm is loved by its entrepreneurs. Portfolio founders are exceptionally positive about Multicoin’s contributions.

Unpack what makes Multicoin special, touching on:

Unlikely origins. Kyle Samani’s first business involved building apps for the ill-fated Google Glass device. Tushar Jain also started a company that failed to pan out.

Thinking in public. Without an established investing track record, Samani and Jain built a reputation through their thoughtful writing on the crypto space.

LPs’ assessments. Those that invested in Multicoin’s early vehicles saw more than just two intelligent, hungry investors. They saw an idiosyncratic strategy with asymmetric upside.

Strategic shifts. Though Multicoin began as a US hedge fund, it has expanded its mandate over time.

Four bets. Multicoin’s personality as a fund can be best understood by looking at a quartet of investments, three of which were massive winners. One was a disaster.

Returns and reputation. Investors may be mostly judged by their financial returns, but reputation among founders may be the more important leading variable.

Kyle Samani and Tushar Jain are not successful in spite of being outsiders, but because of it. Arriving without preconceptions allowed Multicoin’s GPs to see opportunities where others didn’t, though that alone does not explain their performance. A ferocious desire to understand the space from the bottom-up, a willingness to take contrarian positions, and the nerve to make big bets have all been vital contributors to Multicoin’s success.

Blockchain, Cryptocurrencies & Digital Assets

Arthur Hayes: Annihilation

**Beginner**

A dark, but important read on the potential implications of the current economic climate and what a medium to large scale war could lead to. Arthur illustrates a few different options in the worst case, but between trying to tame inflation, "misdirection" from central banks and, the ever-popular solution of printing more money... it seems like we are a bit handcuffed. I would recommend reading the entire piece. Highlighted PDF below. Shout out to PH for highlighting!

Our currencies and assets are for the benefit of everyone, not just one particular imaginary construct that is a “nation”. There is no righteous war at a systemic level. Forget what the media on either side tells you about the justification for why this war is good for some nation state. Rather, consider that every life lost and structure damaged took energy to rear and construct. That energy is not inexhaustible, that is waste. The more we waste, the more negative consequences will be visited upon humanity as a whole.

The spectre of global conflict exists against a backdrop of the most accommodative monetary policy ever. I know that every major central bank talks about rising inflation and their commitment to dealing with it, but almost every major central bank is still printing money.

The politicians are now instructing their “independent” central banks to tame inflation. Central banks must now raise policy rates — that bit is not controversial. What is controversial is how much they decide to raise rates by and how quickly they want to accomplish it.

2.5% is not enough to combat the current levels of inflation, and that’s without factoring in various medium- or large-sized conflicts that will completely distort energy usage globally over the next 12 months.

6%, then 5%, then 2% — every decade, the level at which the financial markets buckle under positive and rising nominal rates declines. Given that systemic debt and leverage exploded globally after COVID due to low to negative rates and a need to generate yield, I don’t think the global financial markets can handle nominal rates even at 2%.

Short-end nominal rates rose, and gold still rose because real rates were still negative. As a result, gold’s historic tendency to hold value against a depreciating fiat regime has recently regained mindshare with investors. I expect Bitcoin will experience a similar narrative rediscovery eventually. Eventually is the key word, though.

Let’s look at some possible scenarios that could occur if the current situation in Eastern Europe expands into a medium- or large-scale global conflict.

Many countries decided to underinvest in the production of and exploration for hydrocarbons due to environmental concerns. That has led to society replacing cheap hydrocarbons with relatively expensive wind and solar (as measured by the energy each produces vs. the energy investment each requires). As a result, people are paying more for everything, because existing as a human in our current societal structure requires energy.

The world printed the most money in human history over the last 50 years. Now that populations are getting older on average in all major economies, there will be less productive people to service an ever-growing mountain of debt. But to keep the game going, central banks must print money so that, on a nominal fiat basis, the old debt can be honoured. A government never voluntarily defaults on its obligations in its own currency — it uses inflation instead.

Following past pandemics, inflation rises. Labour, which is scarcer, typically gains an upper hand over capital and demands a larger piece of the action. The post-COVID is no different. Costs are rising globally, as the productive workers who are left demand better wages and benefits.

Central banks in the most developed economies need to raise rates substantially just to get to positive real rates. However, the nominal interest rate level at which the financial system is likely to collapse is at an all-time low. Some sectors of the financial and possibly real economy may implode if rates rise another 1% to 2% from current levels.

Tame Inflation

To properly tame inflation, central banks must at a minimum get to 0% real rates. That would require policy rates in the 6%+ territory — which seems unfathomable given the current state of the financial markets. But, that is the minimum necessary rate level necessary to even put a dent in inflation and rectify all the imbalances over the last 50 years.

And remember that a large part of current energy inflation is not a monetary phenomenon. It is due to chronic underinvestment in the cheapest forms of energy, and war. These are two problems the central bank cannot solve.

Misdirection

This is my base case for most of 2022.

Central bankers appear in the financial media and tell the politicians they are serious about fighting inflation. The bankers raise policy rates into the 1% to 2% range — the futures markets tell us to do this and nothing else. At these levels, real rates are still massively negative, which is very important in a war or near-war time. That is because the government needs to spend money to fight or prepare to fight, and citizens don’t take kindly to outright taxes to pay for a war effort. Governments always resort to the surreptitious tax of inflation.

By keeping real rates negative and nominal government bond rates below the nominal GDP growth, a government can finance itself affordably and reduce its debt/GDP ratio. Negative real rates are sneaky, stealthy wealth transfers from savers to governments.

The one issue is that, once again, the central banks are not in control of the cost of energy, which is likely to continue getting more expensive.

As it pertains to our portfolios, patience is key. If the Fed and other central banks raise rates, it will crush asset prices, but Bitcoin and crypto will emerge from the carnage first. The crypto markets are the only freely tradable markets in which all of humanity with an internet connection can participate. Therefore, crypto markets will go down and up first vs. the rest of the TradFi markets. Remember, real rates will still be negative. Once persistent negative real rates bites into the purchasing power of fiat, the stampede into scarce assets will be glorious. Wealth on USB sticks and pet shiny gold colour inert rocks sitting in a vault will feel beaucoup love.

Money Printer go Brrr

A hot kinetic global conflict is a complete game changer. Inflation becomes the name of the game, because the political necessity shifts from “let’s fight inflation so that the middle class preserves economic dignity” to “that flag over there is evil and must be defeated, so do your duty, citizens, by enduring this inflation to win the war”.

Price controls, rationing, and inflation will be the new normal in various countries so that all available resources are given to the military. Domestic currencies will be spent as quickly as they are earned. Gold, Bitcoin, and other cryptos will be hoarded. It will be Gresham’s law in action. Access to gold and crypto markets will become more difficult because capital controls will limit the ability of ordinary citizens to protect themselves against the theft of inflation.

Even though I’m hopeful that it’s only a remote possibility, if you believe this scenario is at all likely to occur, it behoves you to trade way ahead of it. That means taking spare financial assets and buying portable stores of wealth that are globally recognized. Domestic assets, e.g., real estate and equities, will not keep value in real terms. Gold, Bitcoin, and some other cryptos will retain global value vs. energy.

At some point the conflict ends, and hopefully your “savings” aren’t in a piece of fiction that had value pre- but not post-war. No portion of society ever escapes war unscathed financially — the best you can do is to protect what you can before you think it’s necessary. If you don’t believe that, watch Downton Abbey again. The great families of Britain had to hawk their family “birthrights” because the crushing inflation and economic costs of war left the country broke. The political response was taxes on those who had still had assets nailed to the ground.

But while we can all be idealistic and hope that the proliferation of information can change humanity’s proclivity for waging war on itself, we must prepare our finances to survive the scourge of inflation. That isn’t to say we should disregard the short-term price action, which I believe is negative for risk assets. The trick is to recognize when it’s time to pay the offer, at whatever the price — because he who sells fiat first, sells fiat best.

Bitcoin.com: Peter Thiel Says His ‘Biggest Mistake of the Decade Was Getting Too Late and Too Little Into Bitcoin’

**Beginner**

Short read, but another reminder from Thiel after statements made in October... Speaking at a cryptocurrency event in Miami last year, Thiel told participants that he felt like he was “underinvested in [bitcoin].” Speaking further on the benefits of bitcoin in Miami, Thiel stressed that bitcoin was “the canary in the coal mine — It’s the most honest market we have in the country.” The podcast this piece stems from is a conversation with some of the PayPal Mafia and author new book about Paypal, the Founders." The crypto conversation is brief, starting at 55:30. Shout out to BG for passing along!

Blockworks: How to build a currency

**Beginner**

A great thought experiment that leads the reader right into why Terra's UST and LUNA had, and will continue to have, success building a large, decentralized network with a thriving stablecoin. Shout out to PH for highlighting!

“If you wanted to create a decentralized, crypto reserve currency, how would you do it?”

Just like a reserve currency in the real world, a decentralized reserve currency needs two things:

Demand for your currency

Reserves that back it

In June of 2019, Terra announced its first partnership with South Korean mobile payments app CHAI. Soon, that turned into the Terra Alliance, with 15 Asian e-commerce giants doing $25 billion in annualized transaction volume spread across 45 million users.

At the time, thanks to their partnerships, Terra had the third-highest amount of transactions of any blockchain. Not a bad set-up in which to launch a stablecoin.

And finally, to secure demand, Terra launched Anchor, a savings protocol that offered 19.5% yield for depositors. Anchor has since become the single most important source of demand for UST.

Creating demand for UST helped tell a simple but powerful story: UST is currency.

LUNA is Terra’s native token. It’s used for staking, governance, and most importantly, collateralization of UST.

LUNA’s dynamic supply and native burn (read: swap) mechanism perform two key features:

LUNA acts as a source of reserves

The ability to maintain the peg through arbitrage

This was a good first step, but ultimately it’s not enough. LUNA has exploded in value over the last 12 months, but cryptoassets have been known to go down 90% and stay there.

Not exactly the ideal collateral to back your new decentralized currency. If only there was a completely decentralized, digital bearer asset that Terra could somehow leverage…

Enter the Luna Foundation Guard (LFG). LFG is many things, but to me, the most important way to view it is as a vehicle for raising BTC reserves to collateralize UST.

Back in February, LFG announced a $1 billion raise in BTC through an OTC sale of LUNA led by Three Arrows Capital, Jump Capital and many others.

That’s just the start though. Based on tweets from Do Kwon, it looks like LFG has bigger goals.

The way BTC is raised today primarily comes down to the most important pool of stables on Curve between UST, DAI and USDC. The pool’s ratio is consistently under pressure due to strong demand for UST on Ethereum.

LFG’s approach has been to burn (read: swap) massive amounts of LUNA for UST, sell UST into the pool for DAI and USDC, and use the proceeds to buy more bitcoin.

Besides being the most interesting conceptual thing happening in crypto right now (in my opinion), Do is publicly announcing multiple billion dollar bitcoin buys.

I think given the benefit of retrospect, it will be obvious that central banks won’t buy bitcoin. Instead, I think crypto will give us novel institutions and networks that replace our broken central banks.

Interestingly, if Terra is able to successfully collateralize UST with bitcoin, that construction looks strikingly similar to the gold-backed Bretton Woods monetary system.

Momentum 6: Modular Blockchains the Next Alpha? Celestia Overview

**Intermediate**

Self-explanatory... a good overview of Celestia and how its modular structure will help it grow independently, but also by other networks adopting some of Celestia's components for scaling. Shout out to PH for sending! I was on a call with Nick White, COO of Celestia Labs, this week... they are focused on solving for scalability (throughput while still allowing end-users to verify the chain) through zero-knowledge and optimistic roll-ups, as well as data sampling. Data sampling allows extremely light equipment to verify and secure the network... more users bring in more nodes (which can expand rapidly because of the light equipment threshold), the more secure the network. Data sampling stems from erasure coding "a method of data protection in which data is broken into fragments, expanded and encoded with redundant data pieces and stored across a set of different locations or storage media." The long-term vision is to make blockchains as easy to create as smart contracts are now, which allows communities to create their own digital sovereign space. This also makes it easy for independent and multiple communities to communicate across chains. Currently in Devnet phase with data sampling working and ~2,000 nodes. Testnet launch is scheduled for April, while Mainnet is expected year-end or early next year.

Celestia is a sort of cloud computing for Web 3. Celestia enables users to launch decentralized applications on app-specific chains that share a consensus layer.

There is a considerable overhead associated with creating a blockchain. Developers must create a consensus layer (typically proof of stake) and launch a token sale. Celestia saves builders from all this hassle.

Most of the blockchains today are monolithic. The core functions of a blockchain, execution and consensus, happen simultaneously and are enforced by the same set of validators. A monolithic architecture is hard to scale because every transaction has to be executed by the full node, causing a bottleneck.

Celestia applies modular architecture, which decouples a blockchain stack into specialized components. The core functions, consensus and execution, are separated into different layers.

NYT: The Latecomer's Guide to Crypto

**Beginner**

Quick guide to crypto for beginners. Kevin Roose does a good job answering some of the mainstream questions about crypto and digital assets. Also, he has some other guides on NFTs, web3, DAOs, and DeFi. Shout out to CG for sending! Highlighted PDF below.

The Pomp Letter: 2021 Crypto Jobs

**Beginner**

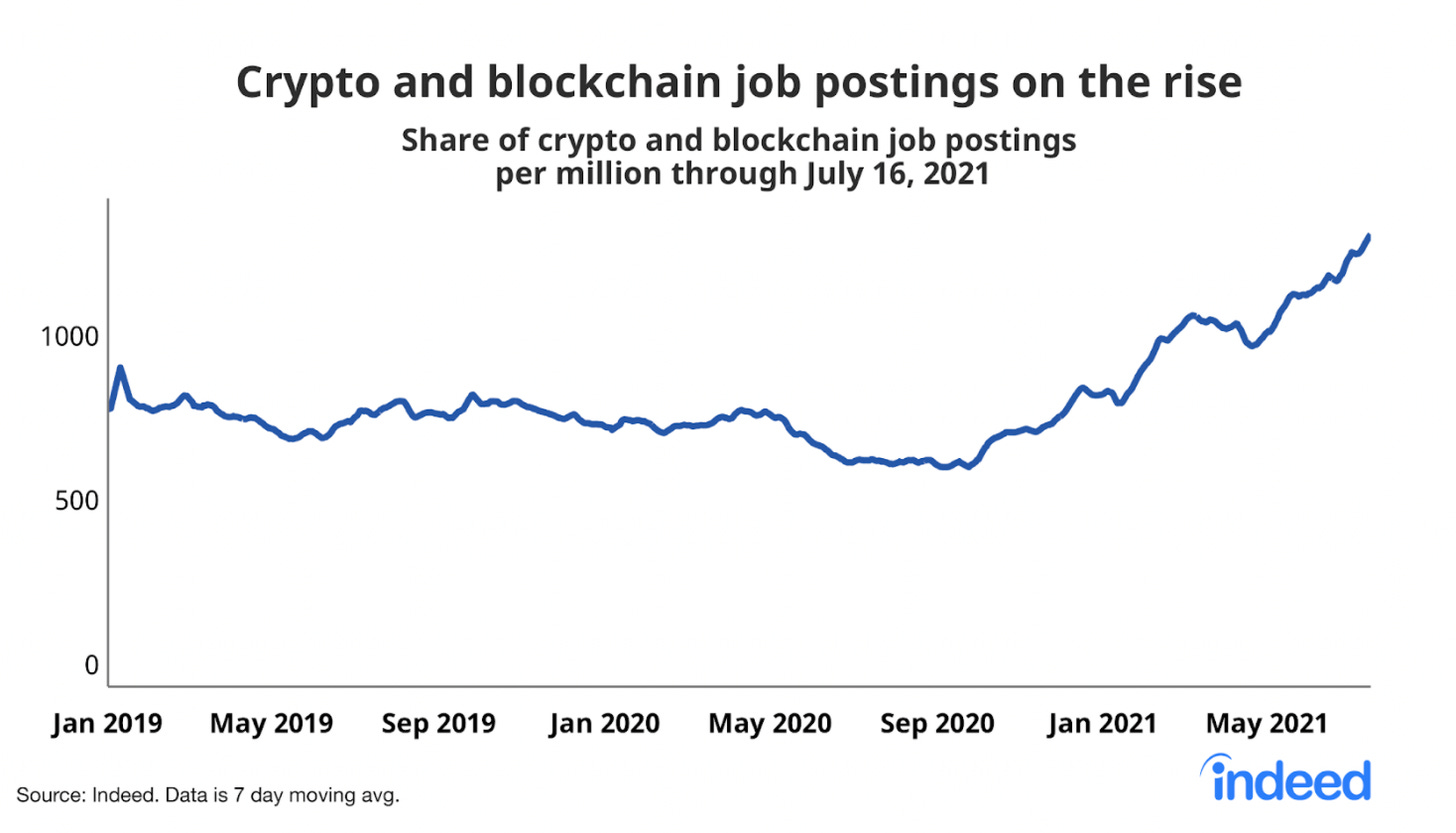

Recap of Crypto job growth in 2021... job postings are up ~4x, increasingly demand various specializations (away from just software development), and are 36% remote.

In 2021, thousands of the brightest minds around the world left their jobs to join the Bitcoin and crypto revolution. According to LinkedIn, Bitcoin and Crypto job postings grew 395% in 2021, representing more than 3x the growth of the broader tech industry.

36% of all crypto job postings allow for remote work, compared to just 7% for all other US job postings.

Venture funding in 2021 went parabolic in the crypto sector as VCs continue to place big bets on bitcoin and crypto companies. The crypto industry received more than $30B in funding across 1,700 deals in 2021, which represents a 709% year-over-year increase in total funding.

65+ companies in the crypto sector have reached unicorn status with a valuation of $1B or more

Time: The man behind Ethereum is worried about crypto's future

**Beginner**

Andrew Chow's profile of Ethereum founder, Vitalik Buterin, arguably the most influential person in crypto. Relating to The Atlantic piece, Cryptocurrency Might be a Path to Authoritarianism, which I highlighted in last week's Wags Weekly, the profile highlights Buterin's concerns about the direction cryptocurrency could go and his focus on keeping it on the right rails. Highlighted PDF attached.

Buterin hopes Ethereum will become the launchpad for all sorts of sociopolitical experimentation: fairer voting systems, urban planning, universal basic income, public-works projects. Above all, he wants the platform to be a counterweight to authoritarian governments and to upend Silicon Valley’s stranglehold over our digital lives. But he acknowledges that his vision for the transformative power of Ethereum is at risk of being overtaken by greed. And so he has reluctantly begun to take on a bigger public role in shaping its future. “If we don’t exercise our voice, the only things that get built are the things that are immediately profitable,” he says... “And those are often far from what’s actually the best for the world.”

The irony is that despite all of Buterin’s cachet, he may not have the ability to prevent Ethereum from veering off course. That’s because he designed it as a decentralized platform, responsive not only to his own vision but also to the will of its builders, investors, and ever sprawling community. Buterin is not the formal leader of Ethereum. And he fundamentally rejects the idea that anyone should hold unilateral power over its future.

Exploring the Theory of Money, MMT and how crypto is improving money, primarily through stablecoins.

Sen. Elizabeth Warren Rolls Out Bill Designed To Close Crypto Loopholes to Sanctions — Blockworks

Impossible for Russia To Evade Sanctions With Crypto, FinCEN Rep Says — Blockworks

Ukraine’s President Zelenskyy Signs Legal Framework for Crypto — Blockworks

ApeCoin in for Volatile Ride as Exchanges List Bored Ape Yacht Club-linked Crypto — Blockworks

FTX Ventures, Three Arrows Capital Lead $92M Raise for Mina Blockchain — Blockworks

ProShares Metaverse ETF Begins Trading — Blockworks

The Y Combinator of Web3 Attracts Record Number of DAO Startups — Blockworks

Russia’s Sberbank Receives License To Issue Digital Assets — Blockworks

EU’s Crypto Bill in Monday Vote Without Proof-of-work Ban — Blockworks

Binance.US Inches Closer to Approval in All 50 States — Blockworks

Fed Raises Interest Rates a Quarter Percentage Point — Blockworks

DraftKings Links NFTs to Betting Products in Web3 Push — Blockworks

Bretton Woods III, A Monetary New World Order — Credit Suisse

Who’s in Charge of What? Breaking Down the Crypto Executive Order — Blockworks

Crypto Job Report — TrueUp

Can New Launches from Aave and Sushi Usher in DeFi’s Comeback? — Blockworks

A proposal limiting proof-of-work was rejected in a European Union parliament committee vote.

TAKEAWAY: A proposed rule that could have, in effect, banned the popular cryptocurrency bitcoin across the EU was quashed on March 14. The vote on the provision was a part of the Markets in Crypto Assets (MiCA) framework, the EU’s sweeping crypto regulations package which promises to make it easier for crypto firms to expand throughout the EU by facilitating a "passportable" license that would be valid between countries.

Another crackdown in Kazakhstan forced another 106 crypto mines to close on March 15.

TAKEAWAY: Following investigations by the country’s financial monitoring agency, 55 mines closed voluntarily and 51 were forcibly shut down. The 51 are suspected of tax and customs evasion and placing equipment in special economic zones without permission, according to the statement. There were notable Kazakh political and business figures involved in the investigations. Kazakhstan has become an important hub for crypto miners since China banned mining last year.

Ethereum application and infrastructure builder ConsenSys closed a funding round that valued the company at $7 billion.

TAKEAWAY: The $450 million Series D round more than doubles ConsenSys’ valuation based on its previous $200 million fundraise in November 2021. The firm’s increased valuation coincides with its Ethereum wxallet and browser extension, MetaMask, reaching over 30 million monthly active users, while Infura, a widely used infrastructure tool created by ConsenSys, now boasts 430,000 developers.

Meta’s CEO Mark Zuckerberg said that NFTs are coming to Instagram soon.

TAKEAWAY: Zuckerberg said at a panel at Austin’s South by Southwest Festival that NFTs were coming to Instagram in the “near term” and that Instagram users would be able to mint their own NFTs within the app. His comments align with Meta’s ambitions to support NFTs within its own metaverse.

CRYPTO SCAMS: Meta Platforms (the former Facebook) and its Meta Platforms Ireland are being sued by the Australian Competition and Consumer Commission for engaging in false, misleading and deceptive conduct. The commission says Facebook and Instagram knowingly published scam ads featuring prominent Australian celebrities, but failed to address the issue even after those celebrities complained. The consumer watchdog is seeking declarations, injunctions, penalties, costs and other orders

Web 3 Gaming Platform on Terra Blockchain Raises $25M in Token Sale

Curve Might Introduce the Newly Developed Fundraising Gauge

The Curve community initiated a vote. The vote is on a proposal to introduce a new “FundRaising Gauge”. At the time of writing, 95% were for the support and 5% were against it. It will enable a more efficient financing model. Keep Reading »

Digital Treasures Center Gets In-Principle Approval for Digital Payment Token Services

The Monetary Authority of Singapore (MAS) has conceded an in-principle approval to Digital Treasures Center (DTC) along with Coinhako, Hodlnaut, and Paxos. The company will now be able to provide fiat-to-crypto pairing. It was possible as Digital Treasures Center has been offered a license under the Payment Services Act. Keep Reading »

Digital Identity for Bitcoin: Can Governments Track Down Your Private Wallets?

Blockchain has progressed tremendously from its inception as a distributed ledger system for tracking bitcoin holdings. This technology can potentially replace existing identity management systems with a highly reliable mechanism. Keep Reading »

Blockfi user data leaked in a Hubspot Security Breach

After Coinbase was alleged to sell unregulated securities, crypto users have been alarmed. In addition, scams and security breaches have been causing trouble to the market almost every day. For example, on March 18, BlockFi reported that they had been informed about a “data incident” at one of their third-party vendors called Hubspot. Keep Reading »

Market Notes

The total implied network value (market cap) of the digital assets market stands at $1.79tn, up 6.5% from last week (when it stood at $1.68tn). Bitcoin’s network value is 6.03% of gold’s market cap. Over the last 7 days, BTC is up 3.85%, ETH is up 8.03%, and LUNA is down 14.33%. Bitcoin dominance is 42.9%, down 2 percentage points from last week.

That Bitcoin and Ether are holding up during rate hikes, geopolitical uncertainty, and increasing regulatory and legislative activity speaks volumes about the resiliency of the asset class. Shifting narratives around the global monetary order favor Bitcoin in the long run, and Ethereum’s forthcoming switch to Proof of Stake (expected sometime this summer) should galvanize further interest. Funding in private markets continues at a breakneck pace, although we’ve heard some rumblings that valuations are starting to recede from Q4 2021 highs, which were truly outsized (I wrote about this in our EOY 2021 VC report). Institutional interest in cryptoassets remains strong and many are taking time during this uncertainty to get their ducks in a row. We’ve not seen a decline in institutional interest in digital assets – to the contrary, investors are more educated and interested in the asset class than ever before.

EU Rejects Regulation Amendment Banning Proof-of-Work Coins

Environmental sustainability is at the forefront of debate in the European Parliament. It has become the lens through which many EU policymakers legislate. However, the narrative is frequently weaponized to stifle innovation and blur the facts, as exemplified by the S&D and Green MEP parties, who launched a two-front attack on Bitcoin and the underlying consensus mechanism (PoW). Recently, S&D treasurer Eero Heinaluoma stated, “The Carbon Footprint of a single Bitcoin Transaction equals a…flight from London to New York.” Not only is this factually untrue, but it is also subtly misleading. Carbon footprint represents the energy source utilized, not a measure of the energy needed. Fossil fuels and coal are sources of high carbon intensity, but renewable energies have low to zero-carbon intensity. Proof of work does use a significant amount of electricity, but it is estimated that more than 55% of bitcoin mining is done with sustainable energy, which makes bitcoin mining the industry with the smallest carbon footprint worldwide.

In Mr. Heinaluomas’s backyard, Europe’s largest PoW mining operation utilizes 100% carbon-neutral energy. Northern Data is a pioneer in green mining and data centers, with sites in Norway, Sweden, Netherlands, and Germany. The fate of proof work firms like Northern Data is not sealed yet, due to the approval of the European Union taxonomy amendment, and proof of work is likely to fall under data centers as an economic activity, with EU data center regulation expected in the next two years.

🦍Bored Apes Yacht Club Creators Launche $APE Token Days After Acquiring CryptoPunks and Meebits

Yuga Labs, creator of the Bored Apes Yacht Club (BAYC) NFT collection, cements its status as the lone NFT juggernaut. For the longest time, CryptoPunks and BAYC were Coke and Pepsi — two dominant forces in the NFT landscape that were viewed both as OGs and as the gold-standard for profile picture (PFP) NFTs. Many copycats have emerged from these collections as they sought to mimic both the artistic style (Punk copies have popped up on every other Layer 1 blockchain) and the community engagement these collections embodied (BAYC popularized airdropping NFTs to existing holders).

Punks and Apes are perhaps the only NFT collections with true “evergreen” brand appeal, an especially crucial consideration in an industry constantly evolving with new trends in the marketplace. The impact of unifying these two hallmark NFT collections (and to a lesser extent Meebits) is massive. Yuga Labs now owns three of the most valuable NFT collections on the planet, with the longest collective track records to boot. This is best evidenced by the respective volumes of these collections: CryptoPunks has done $2.2 billion in volume, BAYC has done $1 billion in volume, and Meetbits has done $227 million in volume (according to OpenSea).

Yuga Labs’ primary goal with this acquisition is to emancipate owners of CryptoPunks and Meebits from the onerous restrictions of the NFT License. Under Yuga Labs’ ownership, licensing rights for CryptoPunks and Meebits will be transferred fully to the NFT owners at the NFT-level. In other words, CryptoPunks and Meebits owners will be able to monetize their respective NFTs with little-to-no restrictions. We will soon see (an, in-fact, already have!) CryptoPunk and Meebit merchandise, artwork, and branded products in a manner similar to what has been possible with BAYC owners for some time now.

Aside from broadening licensing rights, Larva Labs’ co-founders Matt Hall and John Watkinson were comfortable with transferring ownership of these culturally-important NFT collections because of Yuga Labs’ track record for continually pushing the NFT landscape forward. This has not been a strong suit for Larva Labs historically as John Watkinson had previously come under fire for publicly criticizing V1 CryptoPunks days after selling all of his V1 punks to the public (V1 Punks were the original version of CryptoPunks that launched with a bug in the smart contract. Functionally, they look and behave the same as CryptoPunks, but there are only 1,000 of them total and they are not considered part of the “official” CryptoPunks collection). Regardless, Watkinson’s remarks, days after he sold all of his V1 Punk holdings, caused the price of these V1 punks to plummet. This understandably infuriated the community that had purchased the 40 V1 Punks from him for a tidy sum of 200 ETH. Conversely, Yuga Labs is much more adept at creating a continually-evolving ecosystem that benefits all stakeholders involved. One of the manners in which Yuga has once-again pushed-the-envelope in this regard is with their newly-launched $APE token.

Although the $APE token was originally announced last October, it finally made its debut today as an airdrop available for current BAYC NFT holders. In a tweet from the official $APE account, the purpose of the $APE token is to “promote culture gaming and commerce and empower decentralized community building at the forefront web3”. The $APE token is managed by ApeCoinDAO, which is a separate entity from Yuga Labs and Bored Apes Yacht Club. The ApeCoinDAO allows its token holders to vote on the allocations of its treasury while also giving them a say in future partnerships and governance. The only requirement to be considered a member of ApeCoinDAO is having the affiliated $APE tokens.

One added layer of complexity here is that there is also an Ape Foundation. This entity can be seen as a foundational layer upon which both token holders and the associated DAO can build. The foundation is financed by a separate ecosystem fund managed by the ApeCoinDAO. In addition, the Ape Foundation will be incubated with a board that will serve to create new DAO proposals and draft an initial vision for what the ApeCoinDAO should focus on. Board members will start with a six-month term and ApeCoinDAO token holders will vote-in new members on an annual basis. The council currently consists of: Dean Steinbeck (president/general counsel, Horizen Labs), Amy Wu (head of ventures/gaming, FTX) Alexis Ohanian (co-founder, Reddit; general partner, Seven Seven Six), Yat Siu (executive chairman, Animoca Brands), and Maaria Bajwa (principal, Sound Ventures)

The $APE token itself has a total supply of 1bn with 15% of which going to BAYC and MAYC NFT owners and 47% going to the DAO's ecosystem fund - the remaining 38% is then allocated to the Yuga Labs team (16%), the BAYC project founders (separate from Yuga Labs; 8%), and launch partners and investors (14%). $APE was listed across many of the largest exchanges and as much as 30% of supply may be in circulation on launch day. Airdrop amounts are based on the rarity of the NFT and the 15k eligible addresses have 90 days to claim, though over half of had quickly claimed their airdrops within 3 hours of launch. On its first day of trading, the token has been very volatile, falling 80% from a high of $39.40 to a low of $6.48. It has since settled into the ~$9 range.

OUR TAKE: Yuga Labs’ acquisition of CryptoPunks and Meebits is a prominent example of consolidation in the NFT space at the collection-level. With this proverbial domino falling, we wouldn’t be surprised to see consolidation accelerate as NFT creators vie for market share over an increasingly crowded, competitive, and mainstream landscape.

However, the most interesting takeaway from this acquisition is the unlocking of IP for CryptoPunks and Meebits owners. The obvious conclusion here is that the floor price of CryptoPunks will go up since the IP gap that once existed between BAYC and CryptoPunks has finally been closed. We are already seeing this play out in a number of ways as prominent NFT influencer Gmoney published a game that leverages his Punk 8219 likeness in a remake of Brick Breaker. It will only be a matter of time before more CryptoPunk games and branded merchandise gets released by individual owners of these digital assets. Importantly, many of these owners are simultaneously wealthy enough to bootstrap entrepreneurial ventures by virtue of being able to afford these expensive NFTs in the first place. We are also seeing creative use-cases of BAYC’s IP play out. One Ape owner is opening a BAYC-themed restaurant using his Ape’s likeness. While it is unclear if either of these early attempts at monetizing NFT IP will be successful, it is abundantly clear that NFTs are unlocking a brand-new relationship between digital asset ownership and capitalism. As popularity and brand awareness for CryptoPunks and BAYC continues to grow, the individual holders of these NFTs will accrue most of the economic benefits for themselves (if they choose to do so). Said differently, IP itself is becoming decentralized. This is BIG, and it is perhaps the best definition of what NFTs truly embody and why they matter.

As for the $APE token, it's rare to see a token having this much success at launch. The success was partly due to the existing traction of the BAYC collection and the prominent council members of the ApeCoin DAO, which may have been helpful in getting listed at most major exchanges at launch—including Coinbase, Gemini, FTX, Binance, Huobi, OKX, and more. This is basically unheard of for a new token project and it made the token accessible to many users. That said, $APE saw large price volatility that may have harmed some new users who bought as the high value of the airdrop (averaging ~6 figures for eligible addresses) led to some quick profit taking along with the lack of a staking program to incentivize airdrop receivers to hold (but a proposal for one is in the works with AIP-4). Airdrops, which are essentially free tokens for those users who qualify, have a tendency to decline in value sharply during in initial trading sessions when early liquidity is low and only sophisticated airdrop claimers are holding.

TLDR: What's ApeCoin? Bored Ape Yacht Club (BAYC) has taken the crypto world by storm. Since minting at a price of 0.08 ETH in April 2021, BAYC has reached a floor price of 89 ETH at the time of writing. They recently passed CryptoPunks to become the world’s most valuable NFT collection. Now, on March 17th ApeCoin ($APE) was officially launched. ApeCoin is an ERC-20 governance token that will be operated by the ApeCoin DAO.

LUNA Integration. Terra will be launched on THORChain this week following the upcoming hardfork. The node launcher for terra-daemon has been merged on chaosnet and node operators should begin syncing their chain daemons now in anticipation for chaosnet launch. No hard date has been set as of this time, but the THORchain team has confirmed in multiple tweets that the integration will occur this week, sometime after the hardfork scheduled to occur today, Mar. 21, 2022

FTX Ventures Invests $100 Million in Money App Dave. Dave, a financial services app, announced today a new partnership with crypto exchange FTX US and an investment of $100 million from FTX Ventures. The deal will enable the platform to begin offering cryptocurrency services. Founded in 2018 by MIT graduate Sam Bankman-Fried, FTX launched the $2 billion FTX Ventures fund in January of this year.

Bored Apes head for the metaverse. Yuga Labs, the creator of the Bored Ape Yacht Club NFT collection, dropped a teaser trailer for a new project called Otherside. The teaser itself doesn't explicitly state what Otherside is, but recent hints -- as well as details contained in a report by The Block's Ryan Weeks -- strongly suggest that Otherside will focus on the "culture, gaming, and commerce" invoked during this week's announcement of ApeCoin. The teaser tweet indicates that the project will feature the use of ApeCoin. The company had previously explored its gaming-related ambitions in a pitch deck scooped by The Block's Ryan Weeks.

Elizabeth Warren and a group of Democrat senators dropped some long-awaited legislation this week that, as expected, has drawn opposition from the crypto industry. As noted by The Block's Aislinn Keely: "The broad language of the bill has drawn outcry from the industry since it could encompass unexpected entities like technologists or those deploying open-source code." It's an open question whether the legislation will pass given the environment in Congress today; industry commentators have largely taken the position that it's too early to panic. Stay tuned on this one.

The future of (NFT) finance. Tim Copeland has become fascinated with the idea that NFTs could be used in new kinds of financial applications. Now he reports that it’s already starting — with NFT-backed loans. In the first part of a series, Tim confirms that demand these loans is exploding. In the second part, he explains how one of the biggest challenges that lenders face in this context is the pesky challenge of pricing the NFTs.

Coinbooks raises $3.2 million to build accounting software for DAOs

Coinbooks, an accounting software startup based in San Francisco, is 3 months old. But in that time, the company has raised a total of $3.2 million from investors including Y Combinator, Multicoin Capital, Lattice Capital, Polygon’s founders, Seed Club Ventures, and Orange DAO.

Taiwan's largest crypto exchange eyes $400 million valuation and potential IPO: report

Taiwan's largest cryptocurrency exchange, MaiCoin, is reportedly raising a Series C funding round that could value it at $400 million. A report by Bloomberg on Friday indicated that the company is considering joining fellow exchange Coinbase in going public on the Nasdaq stock exchange in the US within two years.

Someone borrowed 5 Bored Apes to claim $1.1 million of APE tokens

A bill moving through the New Jersey General Assembly would prevent public officials from accepting NFTs as gifts.

GameStop said it will launch an NFT platform by the end of the second quarter.

Ethereum scaling startup Optimism raises $150 million at $1.65 billion valuation.

The Mina Ecosystem has raised $92 million in a token sale co-led by Three Arrows Capital and FTX Ventures.

Gaming startup Lava Labs’ valuation tops $100 million in Series A raise.

Former Meta employees raise $200 million for blockchain startup Aptos.

FTX announced that tennis star Naomi Osaka will be a global ambassador for the crypto exchange. Osaka also took an equity stake in FTX and will be compensated in crypto.

Aura Fat Projects Acquisition Corp., a special purpose acquisition company that is seeking to merge with a web3 startup, filed for a $100 million initial public offering.

“It’s so nice to have a concierge in life in anything, and now to have it for NFTs, it’s perfect,” Paris Hilton told my colleague Margaux about startup MoonPay’s concierge service that helps “high net worth” individuals get access to non-fungible tokens... The startup, last valued at $3.4 billion after raising a $555 million Series A round in November, launched its concierge service last year, but the service grew in popularity after Hilton and Jimmy Fallon shared images of their Bored Ape NFTs on an episode of the Tonight Show.

Tweets & Threads:

Some implications of the ETH merge, expected to occur in ~3mo

Some stats on AVAX

Starting to see more of this...

Common pitfalls for Web3 founders

Thoughts on $APE

Thoughts on $LUNA

Macro, Markets, Hedge Funds & Private Equity

BBC: Ukraine war: Putin has redrawn the world - but not the way he wanted

**Beginner**

Interesting piece examining some of the more pivotal moments in European history to give us some historical context on the Ukraine/Russia conflict.

Quentin Sommerville, one of the BBC's most experienced war reporters walked through the wreckage in Kharkiv recently and said of the Russian bombardment: "If these tactics are unfamiliar to you, then you haven't been paying attention."

He should know, he spent enough time under Russian rockets in Syria to be paying very close attention. But the governments of the democratic world - how much attention have they been paying to the nature of the Putin regime?

The evidence has been building for years.

Two decades have passed since he sent troops into Georgia claiming he was supporting breakaway regions.

Later, he sent spies into British cities armed with nerve agents to murder exiled Russians.

In 2014, he invaded Eastern Ukraine and annexed Crimea.

Russia is highly integrated into the global economy. But now it has been expelled from the system the world uses to exchange payment for goods and services. Its industries, including oil and gas, depend on imported goods and components. Soon production will grind to a halt. Employers will have to lay off their workers. Unemployment will rise.

No-one expected the West to sanction the Russian Central Bank. Already, the rouble has collapsed and interest rates have doubled. No other major economy has ever been subjected to a package of sanctions this punitive. It amounts to the expulsion of Russia from the global economy. More workers will be laid off. Major industries will find it hard to carry on. Unemployment will rise further. Soaring inflation will erode life savings.

We will all be affected. Potentially, this is the rolling back of the globalised economy that emerged after the end of the Cold War.

The US and the EU have, in effect, divided the world up. Those states and companies that continue to trade with Russia will find themselves punished - also frozen out of trade with the rich world.

It amounts to a new economic iron curtain separating Russia from the West.

Much will depend on how China negotiates this new landscape. China and Russia are bonded by their shared antipathy to American power, and their conviction that the greatest threat is from a resurgent, more unified democratic world.

China does not want Putin weakened, or the West strengthened. Yet that is exactly what the effect the war in Ukraine has had.

Credit Suisse's Zoltan Pozsar: Bretton Wood III

**Intermediate**

This four pager from CS's Zoltan Pozsar illustrates the West's difficult situation as a result of sanctions and freezing the Russian Central Bank's "inside money" (monetary instruments that exist as liabilities on another player's balance sheet). While likely necessary given the current conflict, governments have never been good at recognizing unintended consequences, particularly as it pertains to an increasingly complex and globalized financial system. Zoltan examines how creating an environment with "good" (Non-Russian) and "bad" (Russian) commodities increases stress and pricing discrepancies in commodities where no one, other than the People Bank of China, can arbitrage the commodities basis. Additionally, and I think, more importantly, freezing assets has caused nation-states to reevaluate the value of foreign assets they hold, likely moving toward an environment where nation-states will be holding notably more "outside money" (instruments that are not liabilities on another play's balance sheet: gold, other commodities, bitcoin?), which could exacerbate inflation.

We are witnessing the birth of Bretton Woods III – a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West. A crisis is unfolding. A crisis of commodities. Commodities are collateral, and collateral is money, and this crisis is about the rising allure of outside money over inside money. Bretton Woods II was built on inside money, and its foundations crumbled a week ago when the G7 seized Russia’s FX reserves…

Recall our conversation in Friday’s Dispatch about the parallels between the currently unfolding crisis and the crises of 1997, 1998, 2008, and 2020, and the conclusions that we drew from the review of these crises. These were that every crisis occurs at the intersection of funding and collateral markets and that, in the presently unfolding crisis, commodities are collateral, and more precisely, Russian commodities are like subprime collateral and all other stuff is prime. Now, back to the four prices of money and how they link up with these themes:

(1) Par – this is what broke in 2008 when money funds broke the buck and funding markets froze from fearing subprime mortgage collateral.

(2) Interest – this is what broke in 2020 when bond RV trades crashed as the drawdown of credit lines pulled funding away from good collateral.

(3) Exchange rate – this is what broke in 1997 when collateral (FX reserves) went missing and U.S. dollar funding staged a sudden stop in Asia.

(4) Price level – this is what’s in play as we speak…

Commodities no longer trade at par. There are Russian commodities that are collapsing in price and there are non-Russian commodities that are rallying

Russian commodities today are like subprime CDOs were in 2008. Conversely, non-Russian commodities are like U.S. Treasury securities were back in 2008. One collapsing in price, and the other one surging in price, with margin calls on both regardless of which side you are on.

From the 1997, 2008, and 2020 crises, we also learned that… …every crisis is about the core vs. the periphery (large New York banks refusing to roll U.S. dollar funding in Southeast Asia in 1997; secured funding against subprime collateral to SIVs, Bear Stearns, and Lehman Brothers in 2008; and secured funding against good collateral to RV hedge funds during 2020).

And from these crises we also learned that… …someone, somehow must always provide a backstop – or as Perry Mehrling would say, an “outside spread” (the IMF in Southeast Asia in 1997 in exchange for Washington consensus-type structural reforms; the Fed backstopping the shadow banking system with a range of facilities in 2008 in exchange for Basel III; and the Fed backstopping RV funds with QE and the SRF in March 2020, in exchange for “we don’t yet know what,” but history says there will be a price).

Who will provide the backstop? We see but only one entity: the PBoC!

Western central banks cannot close the gaping “commodities basis” because their respective sovereigns are the ones driving the sanctions. They will have to deal with the inflationary impacts of the “commodities basis” and try to cool them with rate hikes, but they will not be able to provide the outside spreads and won’t be able to provide balance sheet to close “Russia-non-Russia” spreads.

Commodity traders won’t be able to either. Remember that Glencore rose from the ashes of Marc Rich + Co, and with Switzerland along with the sanctions, Swiss-based commodity traders will think twice about arbitraging the spreads.

But the PBoC can… …as it banks for a sovereign who can dance to its own tune. To make things more complicated, China is probably thinking deep and hard about the value of the inside money claims in its FX reserves, now that the G7 seized Russia’s.

The true problem here is not liquidity per se. Liquidity is just a manifestation of a larger problem, which is the Russian-non-Russian commodities basis, which only China will be able to close.

When this crisis (and war) is over, the U.S. dollar should be much weaker and, on the flipside, the renminbi much stronger, backed by a basket of commodities.

From the Bretton Woods era backed by gold bullion, to Bretton Woods II backed by inside money (Treasuries with un-hedgeable confiscation risks), to Bretton Woods III backed by outside money (gold bullion and other commodities).

After this war is over, “money” will never be the same again… …and Bitcoin (if it still exists then) will probably benefit from all this.

Fabrice Grinda: The Great Unknown

**Beginner**

A refreshingly honest piece on the uncertain times we are in from French entrepreneur and "super angel" investor, Fabrice Grinda.

The Optimistic Case

To prevent runaway inflation, the Fed is expected to raise rates 5 times this year by at least 1.5% cumulatively. Historically, most rapid increases in rates by the Fed have led to a recession.

COVID finally becomes endemic. While it may be with us for a long time, we learn to live with it and states end all restrictions, following the lead set by Denmark and the UK. Consumers revert to their ex-ante consumption patterns. This should allow supply chains to unclog and have a deflationary effect on the economy as logistics costs decrease significantly.

If this happens quickly enough such that inflation expectations are not entrenched and asking for 7% pay raises annually does not become the norm, the inflation bump should prove temporary, allowing the Fed to increase rates slower than anticipated by the markets.

Should inflation and geopolitical tensions abate, the economy would be well positioned to continue to do well and for markets to recover. Companies are in good financial shape relative to other periods when a recession was brewing in terms of cash positions and indebtedness. We are at full employment with US unemployment at 3.8%. The fiscal deficit is dropping sharply as Congress is not considering further relief packages, and the additional infrastructure and social packages will be much smaller than the recent relief packages.

Technology is deflationary and provides better user experiences at lower costs.

In Q4 of last year I would have ascribed a 50% probability to the optimistic scenario playing out. Right now, I would say it’s about 33%, but unfortunately declining by the day.

The Stagnation Case

The issue is that the longer inflation stays above trend (say 2 – 2.5%), the more likely it is that inflation expectations get entrenched. The private-sector average hourly earnings, seasonally adjusted, rose by 5.1% in February year-over-year. While this is still lower than inflation, if workers start to get an automatic 7% bump in pay every year to combat inflation, this will entrench inflation at 7%.

Permanently higher inflation would have many costs: lower purchasing power, lower investments, misallocation of capital, destruction of the value of savings. However, in the short term negative real rates would also erode the value of the debt.

In times of war, states have tolerated higher inflation rates for reasonably long periods of time as you can see in the chart below for WWI, WWII and the Vietnam War.

Interest rates rise, but not enough to counter increased inflation expectations. Politicians and the Fed choose to accept above trend inflation. When combined with geopolitical uncertainty, we would set ourselves up for low real growth.

This scenario may very well be the most likely one at this point.

The Pessimistic Case

A 1.5% increase in interest rates may not be enough to contain inflation.

Even a 5% rate, a level last seen in 2007, would tremendously slow down the economy and lower valuations, especially of risk assets.

Italy, Greece, Spain, and Portugal all saw significant increases in their public debt over the last few years

A crisis of confidence on Italian debt could threaten the entire Euro project with collapse. The Greek debt crisis triggered a massive global financial crisis.

Officially, Swiss banking system assets are ~ 4.7x GDP but this excludes off balance sheet assets. Including these suggests a ratio of ~9.5x 10x is more accurate.

Switzerland has long been regarded as a safe haven with a prosperous and stable economy and a homogeneous population. I suspect that in the next crisis Swiss banks may prove too big to bail instead of too big to fail and could bring the entire Swiss economy down with them.

In the postwar era in the U.S., every instance in which oil has spiked above $100 per barrel in real terms has been followed by a recession. This pattern has played out in 1973, 1979, 1990, and 2007.

Geopolitical tensions could also escalate. It’s no longer inconceivable that Russia would use a tactical nuke in Ukraine. The conflict could easily engulf other countries. It’s not clear where our red line is and what would happen if Russia launched cyber-attacks on the infrastructure of our NATO allies for instance. It’s also possible that Xi Jinping makes a play for Taiwan while we are distracted in Ukraine further threatening global stability.

Conclusion

For both investors and founders, the takeaway is simple: raise a war chest now. For founders, this means raising enough cash to survive and indeed to press competitors during tough times. For investors, this means raising liquidity in anticipation of chances to buy attractive assets at dimes or pennies on the dollar.

Individuals should try to lock in long term fixed mortgages at today’s low rates while they still can. I would also recommend maxing out the amount of non-recourse loans you can borrow against your home at a low 30-year fixed rate. Inflation will ebb away at your debt load.

Despite high inflation, I would keep a fair amount of cash on hand. While its value is being deflated it gives you optionality to buy assets cheaply should there be a large correction.

My current asset allocation is as follows: 60% early-stage illiquid startups, 10% public tech startups (the companies from the portfolio that IPOed that I have not yet sold to reinvest), 10% crypto, 10% real estate, and 10% cash.

We are still at the beginning of the technology revolution and software continues to eat the world. I am optimistic that we are going to see a re-acceleration of technology driven growth. We will use technology to address the challenges of our time: climate change, inequality of opportunity, social injustice and the physical and mental health crisis.

WSJ: California, Love It and Leave It

**Beginner**

Joe Lonsdale, GP at 8VC, writes about why he moved his family and business from California to Texas. Leaving high-tax and extremely restrictive COVID states has been a popular move over the last few years, but with things starting to normalize, will people move back? I think the growth of remote work and the SALT deduction cap here to stay, at least for a while, it's unlikely. With that said, younger folks still seem to gravitate toward major cities like NYC, LA, SF, CHI, at least for a while. Shout out to BG for passing along!

Biden said Putin’s “back is against the wall.” As Russia uses increasingly deadly military force in Ukraine, the US president warned of the possible deployment of chemical weapons.

The US Federal Reserve is considering a half-point rate increase. Fed chair Jerome Powell said the aggressive monetary tactic is a possible weapon in the fight against inflation

Companies

Ahead of its annual shareholder meeting today, Starbucks (SBUX) laid out some steps it could take on the sustainability front. One of those included plans to establish an electric-vehicle charging network with partner Volvo at Starbucks (SBUX) stores nationwide. The other centered around reducing its disposable cup use, which is not only a crucial utensil for coffee giant, but features its iconic green-and-white colors.

Starbucks is embarking on 20 different types of tests - across eight markets - to figure out the best way to ditch the single-use cup. One will test financial incentives for reusable mugs or deterrents for disposables, while another will explore washing stations, where customers will be able to have their personal cups cleaned before ordering a beverage. A borrow-a-cup program is also in the works, where a deposit is paid for a reusable cup until they are returned to stores (plastic straws will additionally be replaced with compostable options). Starbucks' environmental commitments have made the stock popular among ESG investors, but shares have slipped 35% from highs notched in July as the company battles costs and economic uncertainty.

Inflation & The Fed

A bond selloff is deepening after yesterday's comments from Jerome Powell, which said the Fed is prepared to act even more aggressively to tackle inflation. The yield on the 10-year Treasury has soared 20 basis points to 2.32% since the remarks, leading to the worst month for the asset class since 2016. Meanwhile, the 2-year Treasury yield broke above 2%, jumping almost 24 bps over the past 24 hours to reach 2.19%, as the yield curve hurtles towards an inversion (or one of the best indicators of a coming recession). Stocks are hanging in there despite the latest comments - closing in positive territory yesterday - while futures linked to the major averages are up another 0.4% this morning.

Quote: "If we determine that we need to tighten beyond common measures of neutral (i.e. an interest rate that neither hinders nor fuels economic growth) and into a more restrictive stance, we will do that," Jerome Powell announced during a speech at the National Association for Business Economics. He even went as far to say that the central bank is prepared to raise interest rates by 50 basis points at the next policy meeting. Consumer prices took a turn for the worse in February as CPI growth rose by 7.9%, representing the largest 12-month increase since January 1982.

The Federal Reserve kicked off its tightening cycle with an expected quarter-point hike and the stock and bond markets had different reactions. The FOMC hiked rates by a quarter point. That was expected, but the summary of economic projections took what many saw as a hawkish tilt, with the median forecast for rates to end 2022 at 1.9%, up from 0.9% in December, and the majority of Fed officials looking for seven hikes this year. Officials see rates at 2.8% at the end of 2023, up from 1.6% at the previous Fed meeting.

Stocks sold off right after the release of the statement and dot plot, with the S&P 500 (SPY) dipping into negative territory. But they quickly resumed rally mode as Fed Chairman Jay Powell spoke, seemingly taking heart at him downplaying the possibility of recession.

"Powell’s mention that the balance-sheet drawdown may be worth an extra hike and a comment on the easing of goods price inflation (however small) may have calmed market fears a bit." "We think the Fed is probably pleased with this reaction," he said. "Equity markets closed higher, suggesting that investors saw the Fed stance as threading the needle between tolerating inflation and threatening a major downturn. But this looks like a vote of confidence from the equity market that, after admitting it is behind the curve, the Fed won't overreact and slam the brakes too hard.

The Treasury market doesn't look too convinced that a soft landing is on the cards. Bonds followed a similar path as stocks yesterday afternoon, with prices plunging and yields spiking on the release of the statement, especially on the short end, then changing direction as Powell spoke. There was further flattening of the Treasury yield curve and an inverted 2s-10s curve is generally considered a warning of an impending recession. The 5s-10s curve inverted for the first time since March 2020. On average, "it takes around three years from the first Fed hike to recession," Deutsche Bank's Jim Reid said. "However the bad news is that all but one of the recessions inside 37 months (essentially three years) occurred when the 2s10s curve inverted before the hiking cycle ended." On average it takes 12-18 months from inversion to recession. The problem is that all but one of the hiking cycles in the last 70 years have seen a flatter 2s10s curve in the first year of hikes. The exception saw a very small steepening. So these are the risks."

Supply Chain

COVID restrictions have come to an end in many parts of the world as governments establish "live with the virus" policies, but one nation stands out in this regard: China. The country has continued to pursue a "zero-COVID" strategy, imposing strict lockdowns and containment measures to prevent viral transmission among its population. However, a growing wave of local cases is seeing authorities double down on the policy and that's getting investors nervous about the economy

China just placed the 17.5M residents of Shenzhen into lockdown for at least a week, which will be accompanied by three rounds of city-wide testing. All bus and subway systems were closed, while businesses, barring those that provide essential services, have been shuttered. The decision resulted in Foxconn (FXCOF), a key Apple (AAPL) supplier, to halt production as the virus spreads across the technology hub. Shenzhen also features the headquarters of tech giants Huawei, BYD (BYDDY) and Tencent (TCEHY).

Similar measures are impacting Hong Kong, Shanghai and other regions as a spike in coronavirus infections leads to a worsening outbreak. The Hang Seng Index (HSI) plunged 5% on Monday, shares in Shanghai dropped more than 2%, while the bad news keeps piling up as U.S. officials said Russia asked China for military assistance for its war in Ukraine. The developments could also compound supply chain disruptions that have contributed to a rise in global inflation

"The COVID situation in China has deteriorated at an alarming pace over the past week, but abandoning zero-COVID now could be perceived as conceding that the strategy did not work in the first place," said Ting Lu, chief China economist at Nomura. "With the much worsening pandemic and Beijing's resolution in maintaining its [zero-COVID strategy], we believe China's 'around 5.5%' GDP growth target this year is becoming increasingly unrealistic." China sets 2022 GDP growth at 5.5%, lowest since 1991.

Miscellaneous, Notes & Headlines

Intel, Europe and chip sovereignty

After announcing a $20bn investment in Ohio in January, Intel has now announced another $33bn in Germany. Intel has a competitive imperative to catch up with TSMC, but the rest of the world now feels a geopolitical imperative to expand production of leading-generation semiconductors away from one company on one island that China might invade. (Russia, of course, will be cut out on both sides, even as it needs all kinds of high-tech components to restock munitions and replace its combat losses.) LINK

Supply chain censorship

The FT reports that UK publishers are self-censoring content in books that they have printed in China, even when those books are being made for non-Chinese audiences, so that they can use cheap Chinese suppliers. This isn’t specifically a tech story, but it points to the unforeseen consequences of interconnected global supply chains. LINK

China’s crackdown

Apparently, Tencent is cutting up to 20% of headcount, while Alibaba might be cutting 30%. As the man said, ‘it’s too early to say’. LINK

AR’s slow build

Google bought another small hardware company working on AR optics. As I’ve written too many times, the dream of a pair of glasses that can place stuff into the world seems very compelling, but we don't really know how close we are to optics can do that. LINK

Amazon closes MGM