Sneak Peak

Blockchain, Cryptocurrencies & Digital Assets

Nat Eliason Highlights Why Bitcoin Lightning is So Exciting

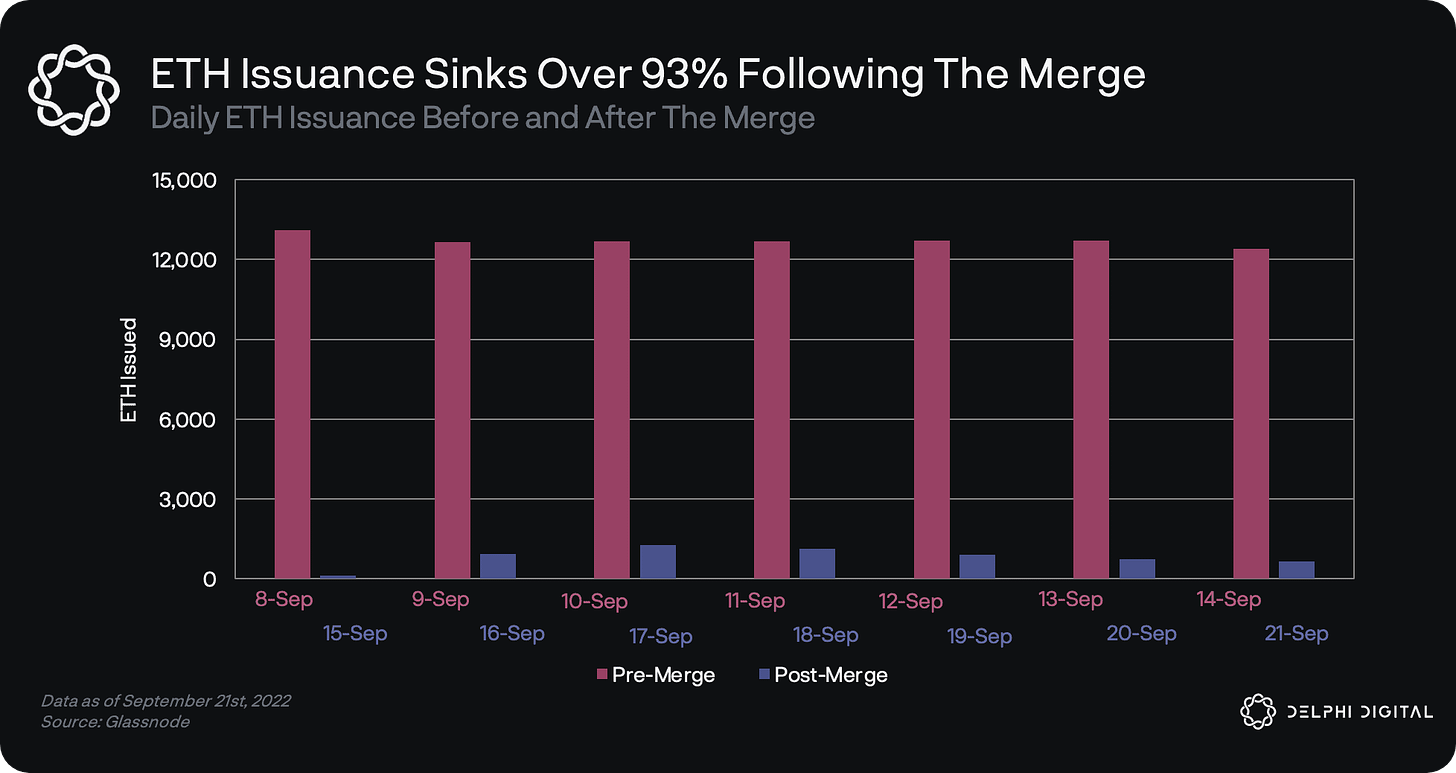

Bankless: The Merge isn’t Priced in Yet / Nothing Matters Except Macro Right Now

Blockworks’ Byron Gilliam on BTC Hodlers are Positive for Pricing, but Just Hodling Could Lead Network Security Issues

The Milk Road’s Top Four NFT Use Cases

Latest News

Safe Airdrop

More Adoption, Mostly Through NFTs

Crypto Execs Stepping Down

Reversible Transaction

Cosmos —> ATOM 2.0

Emerging Technology & Venture Capital

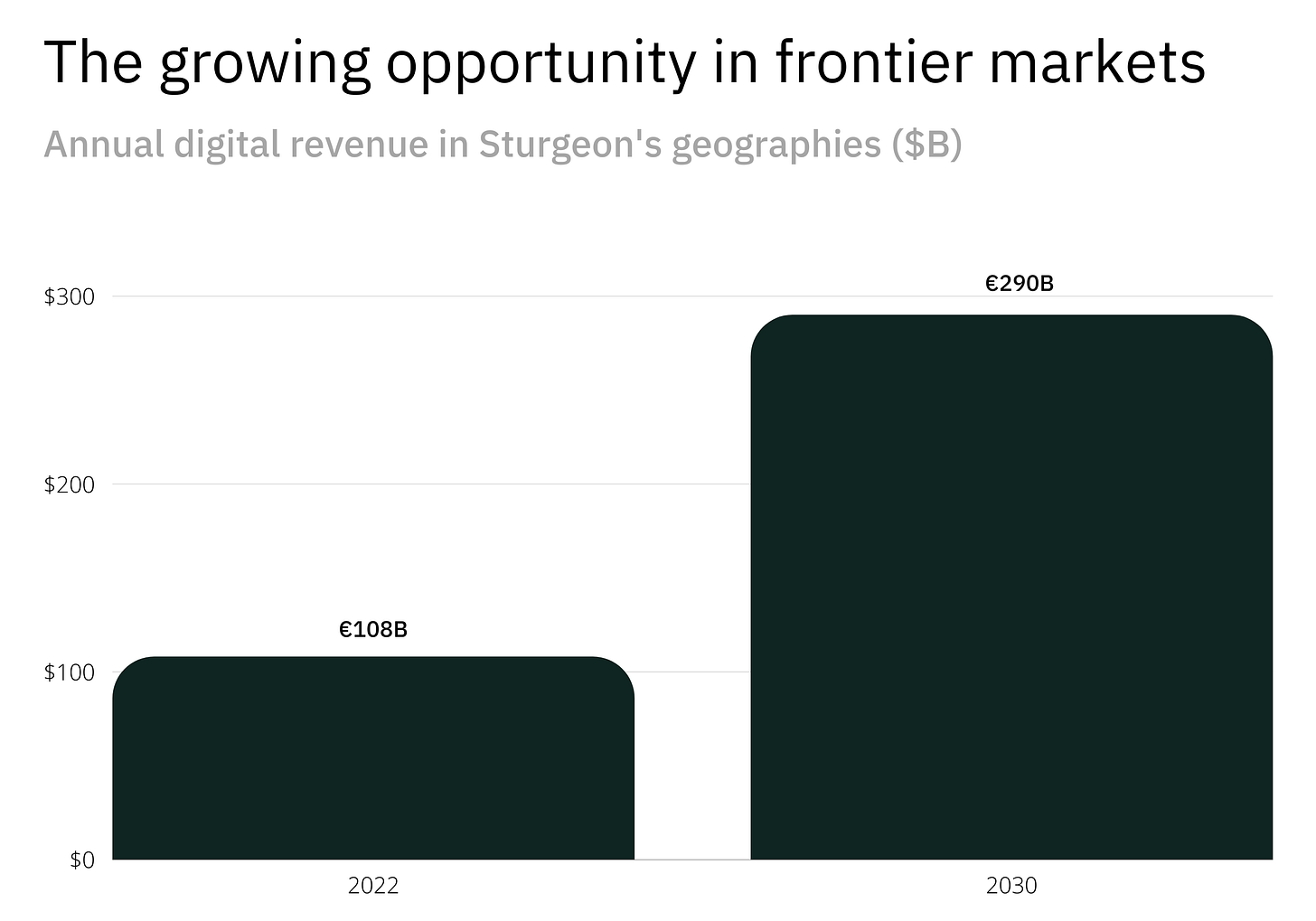

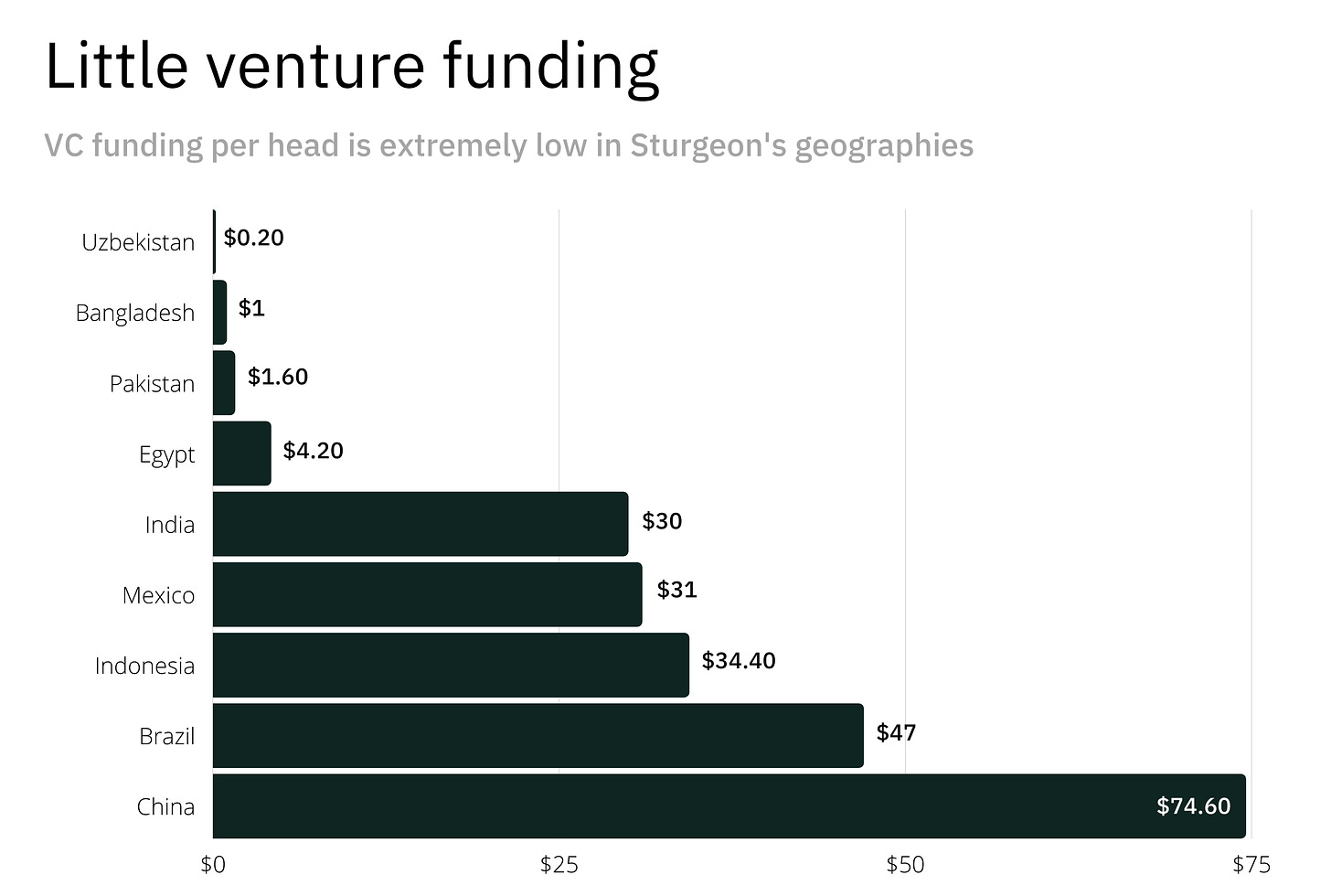

The Generalist: Sturgeon Capital is VC & PE x Frontier Markets

More Cuts at Klarna

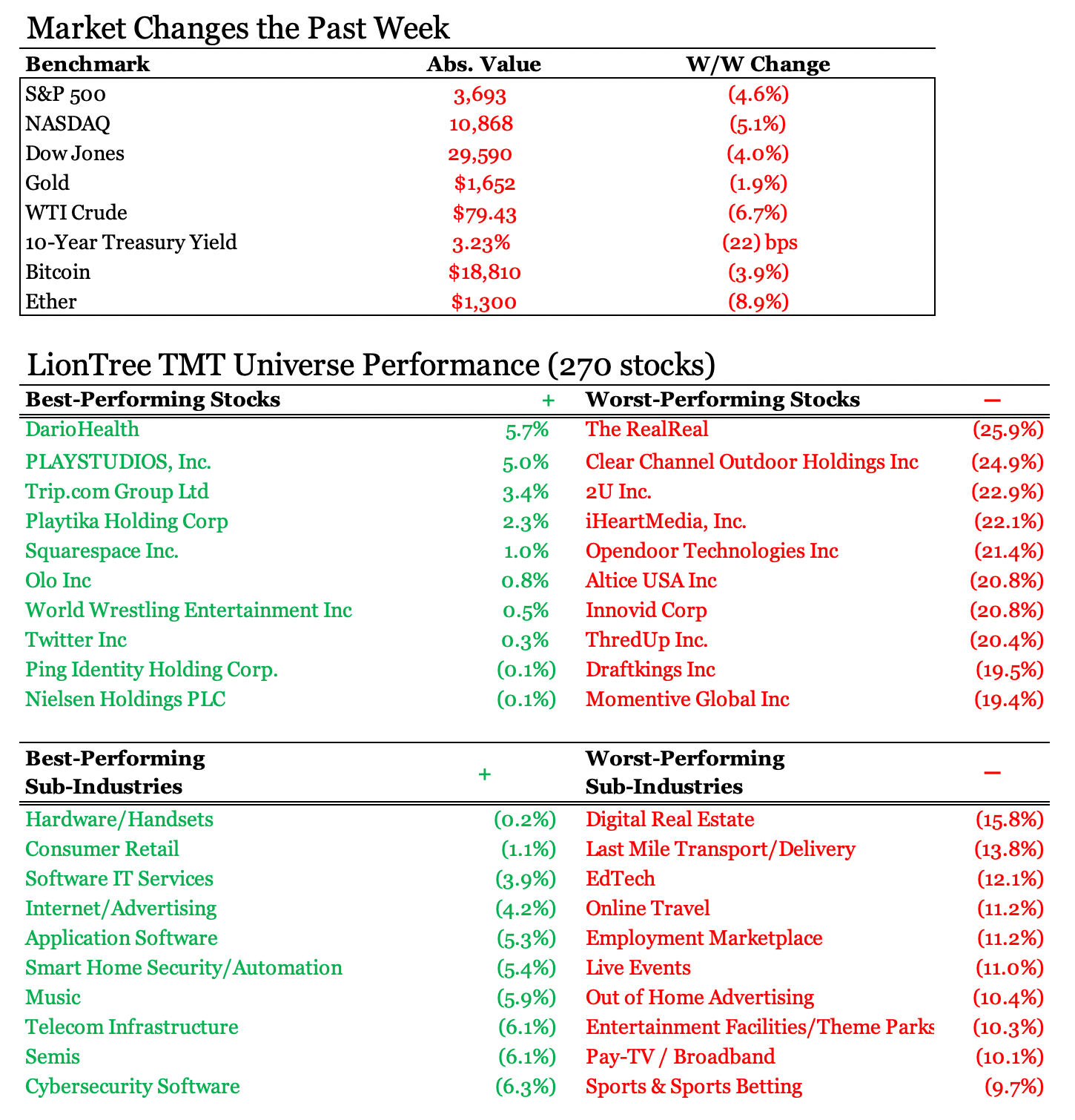

Macro & Markets

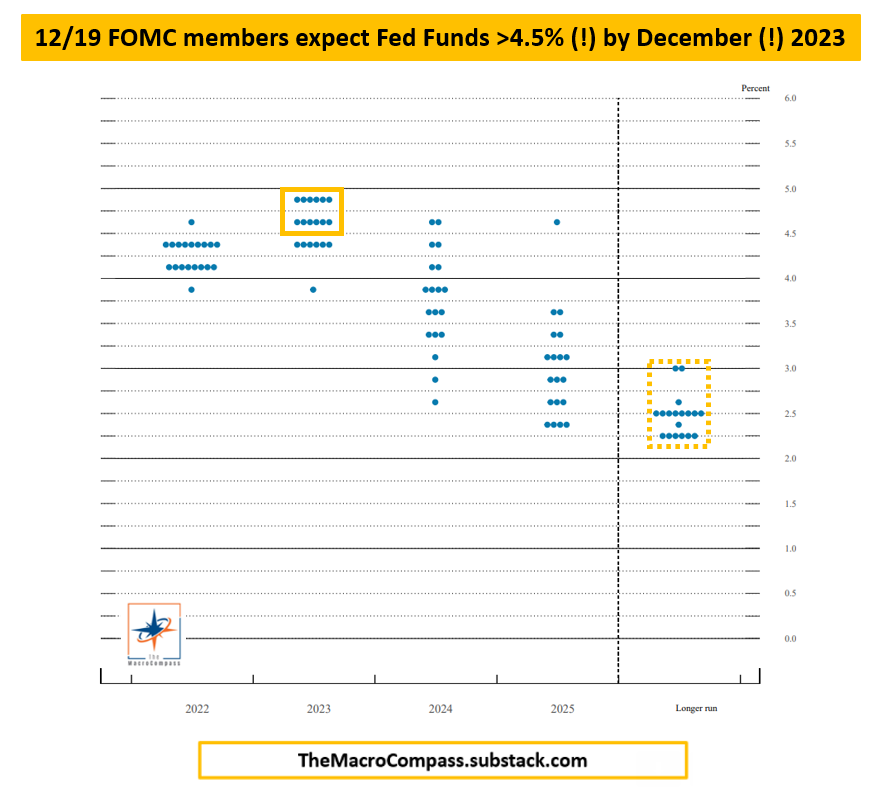

The Macro Compass: Tighter for Longer — Overview of the Recent Fed Minutes

Stronger Dollar Continues to Hit Risk Assets & Will Weigh on Earnings

Latest Corporate, Macro & Market News

Some Fun

Asleep Thinking: Golf and the 4 Stages of Mankind

Rolex Sea-Dweller After a Motorcycle Crash

Quote of the Week by @antoniogm: “Adulthood is when Zillow becomes your favorite porn site.”

Blockchain, Cryptocurrencies & Digital Assets

Almanack: Why Bitcoin Lightning is So Exciting

**Beginner**

Intro to Bitcoin Lightning and use cases: wallets, crypto Venmo, crypto social media, micropayment apps, & DeFi rails. Some highlights below.

The most promising and exciting of those on Bitcoin right now is Lightning: “a decentralized system for instant, high-volume micropayments,” which settles back to the Bitcoin network. Using Lightning, it’s possible to send fractions of a cent near instantaneously with negligible fees, providing the first glimpse of a true peer-to-peer electronic cash system...

Crypto Social Media & Messaging

Sphinx has taken a really interesting approach to a crypto-native chat and monetization platform.

First, it’s entirely Lightning native, including all the messaging, which is peer-to-peer encrypted so no one can access your messages. But then, on top of that, there’s a tiny transaction fee associated with each message to discourage spamming or botting from happening on the network. For normal human users, those costs get refunded.

Micropayment Apps

One that is particularly fun is a DALLE-2 Lightning Bot. You send it a DALLE-2 image generation prompt, it sends you a Lightning invoice for about $0.20, and then once you pay the invoice, you get your image.

Bankless: It's Not Priced In

**Beginner**

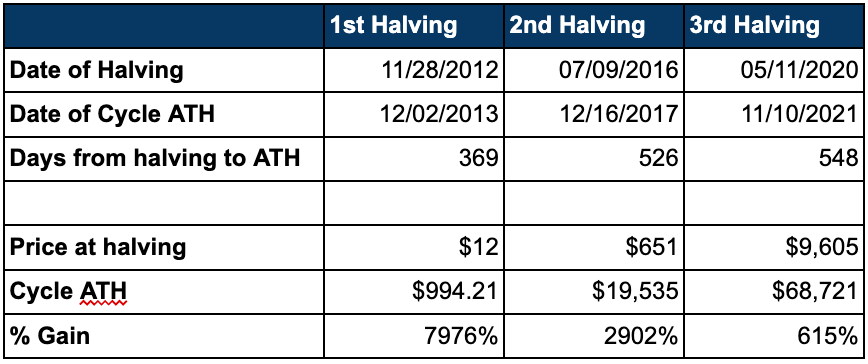

Bankless compares ETH’s Merge price action to BTC halving & how it takes time (~12-18mo) for these changes to be priced in. Additionally, other ETH improvements have taken time to price in… but nothing really matters but macro right now.

✅BTC hit ATHs almost exactly 18 months after the halving

✅The cycle was lengthened (barely)

✅Returns were diminishing

Blockworks: 🟪 The Great Bitcoin Migration

**Intermediate**

BTC owners are increasingly long-term hodlers as market conditions wash out speculators, but away from adding BTC, hodlers don’t transact enough to support the network security needed when block subsidies run out… so price, transactions, and/or transaction fees need to dramatically increase by before subsidies run out in ~2140.

The rising orange line above represents “the total amount of circulating supply held by long-term holders” of bitcoin, as calculated by Glassnode from on-chain data — holders of bitcoin are becoming increasingly laser-eyed and diamond-handed.

This is a feature of bitcoin sell-offs. But maybe also a flaw?

Feature: Speculators will come and go, but if bitcoin wins more true believers over time, the lows of each boom/bust cycle should be progressively less low.

Flaw? The current monetary policy of bitcoin becomes an article of faith that may not be able to adjust to new realities…

The ultimate bull case is that bitcoin becomes a risk-off monetary store-of-value — and that process may currently be underway: As coins move from sellers who see it as a risk-on, tech-correlated asset to buyers who see it as a risk-off monetary asset, we self-fullfillingly edge closer to that latter view becoming reality.

Satoshi’s white paper suggests rewards were meant as a boot-strapping mechanism: “Once a predetermined number of coins have entered circulation, the incentive can transition entirely to transaction fees and be completely inflation free.”

It appears increasingly evident that transaction fees alone will not be up to the task: The network is generating only about 15 BTC per day in fees, vs. 900 BTC in block subsidies.

15 BTC per day is not enough to secure the network.

This could solve itself through either higher activity or higher prices, but neither of those seems like something to hang our hat on: With bitcoin increasingly held by diamond-handed true believers, activity seems likely to stay low.

The Milk Road: 🥛I spent 200 hours researching NFTs. Here's my conclusion...

**Beginner**

The four best use cases for NFTs currently: rewarding super fans, digital collectibles, investing memberships & video game add-ons. You are probably familiar with most of these, but the concept of investing in memberships is a novel take.

USE CASE #1: REWARD FOR SUPER FANS

Have you ever heard of the concept of “1,000 true fans"? It’s a term created by Kevin Kelly (creator of Wired Magazine)

Kevin's idea is simple. 1000 true fans says that any creator (eg. a musician, or blogger) can "make it" if they find 1,000 true fans who are willing to pay $100/year.

1,000 fans x $100 = $100,000 per year…

NFTs are 'true fan' technology. It gives them:

A status symbol - Proof I was here early & I’m one of the top 1,000 fans

A membership card - You can offer exclusive perks/access to your NFT holders. It's like a digital back-stage pass to your top fans.

A way to “invest in your success” - The same way people buy "rookie cards" for athletes. Buying someone's NFT early on is an investment.

Here's a real-world example: The VeeFriends NFT collection.

Gary Vee’s NFT project serves as a membership card, which gives you access to his annual in-person conference.

It’s also a status symbol amongst his fans and can be resold as Gary’s fan base grows because the only way to join the club is to buy an NFT.

He apparently made $51M the first week selling them, and another $10M+ in royalties on secondary sales.

USE CASE #2: DIGITAL COLLECTIBLES

The collectibles market is a $400B+ market full of cards, stamps, coins, watches, and more. And it's projected to grow to $630B by 2031.

NFTs are a new type of collectible.

And it's already been happening in the real world today:

Anonymous digital artist Pak has sold more than $300mm in NFTs

19 year old Victor Langlois, aka Fewocious, has sold over $25mm in NFTs

Famous Japanese artist, Murakumi, created Murakami.Flowers which has sold over ~$25mm

USE CASE #3: MEMBERSHIP AS AN ASSET

I’ve always been fascinated by people who pay $20,000 to get into a country club, SoHo house, or private members club.

So I did it. I bought a $5,000 a year membership. I got access to an exclusive space. I met other interesting people… But after a year, I moved, and my membership card was useless…

But if this was an NFT membership, I could have sold it when I moved.

NFTs turn "memberships" into tradeable assets. NFTs lets you “invest” in a social group, rather than just paying fees for access.

USE CASE #4: VIDEO GAME ASSETS

There are billions of dollars spent on in-game items. In 2020 alone, there was $54b spent on digital clothes and virtual goods. But those items are owned by the game. They can kick you out of your account, and you can't take those items into other games.

In the future, games will issue items as NFTs. Those are things you OWN. You can sell them. You can bring them into new games. You can rent them out to other players.

Gaming giants like Ubisoft and Epic have already dipped their toes into NFTs.

Actions:

Airdrops

Safe (Previously Gnosis Safe) Airdrop

The Block: Safe token airdrop goes live with 43,000 users eligible for reward

The airdrop is part of the launch of SafeDAO, the decentralized autonomous organization that emerged following Gnosis Safe’s rebrand to Safe. Eligible users have until 12:00 AM CET on Dec. 27, 2022, to claim their SAFE tokens. Users can claim the tokens on both the Safe mobile and web app.

The airdrop amounts to about 18% of the SAFE token supply of one billion coins.

SAFE token holders will now have voting power on SafeDAO. Token holders can also delegate their voting power to guardians whose interests align with theirs on governance DAO governance issues.

Buying Liquidations

Liquity (Disclaimer: I lend & stake on Liquity)

Borrowing: Borrow against ETH to get Liquity’s stablecoin (LUSD), which you can swap to USDC and convert USD. The collateralization ratio minimum is 110%, meaning if you borrow against $11k worth of ETH, you can receive up to 10k worth of LUSD. If ETH’s price increases, your collateralization ratio increases (good). If ETH’s price decreases and your collateralization ratio drops below 110% (bad), your ETH will be liquidated and bought by stability pool lenders, but you keep your LUSD.

Lending: Lend Liquity’s stablecoin (LUSD) to the stability pool to earn an APY in Liquity’s native token (LQTY). Lending to the stability pool requires lenders to absorb and cancel debts that drop below 110% collateralization (ETH). This means your LUSD loan, will be converted into ETH on a pro-rata basis.

DeFi

Governance

Jobs

VC Portfolio Company Jobs

Resources

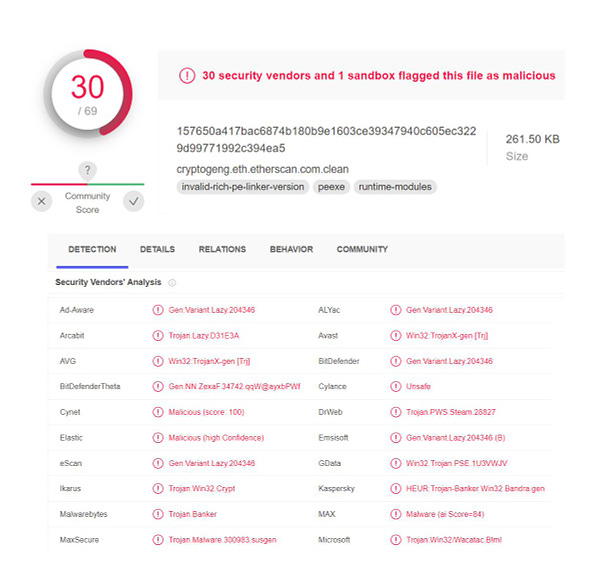

Security

Staking

Acala (ACA) Staking, if you participated in the Polkadot (DOT) crowdloan

Moonbeam (GLMR) Staking, if you participated in the Polkadot (DOT) crowdloan

Adoption:

CoinDesk's Best Universities for Blockchain 2022

CoinDesk announced their 2022 rankings of the 50 universities with the biggest impact on blockchain. They examined each of 240 schools based on metrics that include the number and influence of its research publications, the number of courses, degrees, conferences, clubs and industry partnerships, where graduates get jobs, reputation and many other measurements. In the U.S., UC Berkeley and Cornell made the top 5; The Hong Kong Polytechnic University took the top spot. -The Scenius Sync

The Block: Disney hiring transaction lawyer for 'aggressive' NFT and DeFi plans

"Assist in performing due diligence for NFT, blockchain, third party marketplace and cloud provider projects, and negotiating and drafting complex agreements for those projects," the job advert added.

Walmart Dives Into Metaverse With Launches in Roblox: Retail giant Walmart is allowing consumers to experience the metaverse through a partnership with gaming platform Roblox. The move comes after Walmart filed seven trademarks at the end of December that signaled its plans to make and sell virtual goods.

Separately, the Walt Disney Company posted a job listing for a principal counsel specializing in non-fungible tokens (NFT) and DeFi, hinting at its broader Web3 expansion. -CoinDesk

Mastercard: hi launches world’s first NFT Customizable Card with Mastercard

hi - the crypto & fiat financial app - today announces the world’s first debit card featuring NFT avatar customization, powered by Mastercard. Eligible cardholders will be able to personalize the face of their card with an NFT avatar they verifiably own, and spend at more than 90 million locations worldwide where Mastercard is accepted.

Stripe does crypto?

Stripe has added payouts in USDC, a reserve-based stable coin, aimed at people where the banking system is weak or very slow, and at people who are unbanked entirely. This has much more to do with the original proposed use-cases for blockchains (‘digital money’) than the subsequent waves of enthusiasm around DeFi or Web3 (though with consequent limits to the TAM). LINK -Benedict Evans

Christie's (the famous auction house) has launched a new NFT marketplace, Christie's 3.0. Christie's made ~$7b in sales in 2021. Now they're going Web3 -The Milk Road

Apple is making it possible for app developers to integrate NFTs into apps, possibly onboarding thousands. Their 30% cut still stands. (TWT) -The Drop

Centralized Entities:

CoinMarketCap: Why Kraken's CEO stepped down 🚨

Jesse Powell has revealed that he's resigning as Kraken's CEO because "there's a lot of stuff I don't enjoy doing." He told Protocol that he likes to think of his switch to chairman as a "nice promotion" — and says Dave Ripley is "better suited" to the challenges this exchange faces. Powell said he wants to focus on advocacy because "dangerous things" are happening in the U.S. when it comes to legislation — and maybe work 40 hours a week instead of 80.

CoinMarketCap: Is Celsius plotting IOU tokens? 😬

Celsius is considering turning its debt into so-called "IOU" tokens. An internal meeting that was leaked online shows the embattled crypto lender is weighing up wrapping the BTC, ETH and USDC that's owed to customers into a token. Customers would then have the option to redeem them, trade them on exchanges, or keep hold of them in the hope that Celsius Network recovers. All of this comes as the company grapples with a $1.2 billion black hole in its finances, and bankruptcy proceedings continue. Court filings have previously confirmed that 300,000 customers have a balance of more than $100.

Bankrupt Crypto Lender Celsius Network's CEO Resigned: Alex Mashinsky, the founder-CEO of Celsius Network resigned following months of failed attempts to save the once popular “neo-bank.” Users of the platform are still waiting to see if they’ll receive compensation or keys for crypto they deposited on the platform that once advertised higher yields than traditional savings accounts.

Mashinsky, who was found to have directed corporate funds for personal use, said he will remain active in the Celsius “community” and advocate for bankruptcy strategies to “provide the best outcome for all creditors.” -CoinDesk

California, New York Join Several States Ordering Crypto Lender Nexo to Halt Yield Product: California, New York and six other states are suing cryptocurrency lending platform Nexo for offering unregistered securities in the form of accounts that pay interest for cryptocurrency deposits. New York's action specifically accused Nexo of misrepresenting its registration status.

Meanwhile, U.S. Federal Reserve Chair Jerome Powell said regulation targeting decentralized finance (DeFi) ought to be “carefully and thoughtfully” enacted, given its limited impact on the real economy, at an event hosted by the French central bank on Tuesday. -CoinDesk

Messari: Red Oceans: Exploring the Unbundling OpenSea Thesis

Despite OpenSea’s astronomic growth in the last two years, Kim argues that horizontally integrated marketplaces like OpenSea will follow eBay’s path. Emerging NFT verticals like profile pics (PFPs), crypto gaming, art, and others will eventually be serviced by specialized marketplaces, rather than by generalized marketplaces like OpenSea.

Crypto Exchange Binance Eyes Return to Japan 4 Years After Exit: Report

The world’s largest crypto exchange Binance will apply for a license this time, as Japan looks set to adopt Web3-friendly policies. -The Scenius Sync

OpenSea to Auto Index Solana NFTs

FTX Wins Bid to Buy Crypto Lender Voyager Digital's Assets Out of Bankruptcy: Exchange giant FTX won the bidding war against Wave Financial, a digital-asset investment firm, to buy the assets of bankrupt Voyager Digital at an approximate price of $1.4 billion. Crypto lender Voyager Digital filed for bankruptcy in July, deepening this year’s industry crisis. -CoinDesk

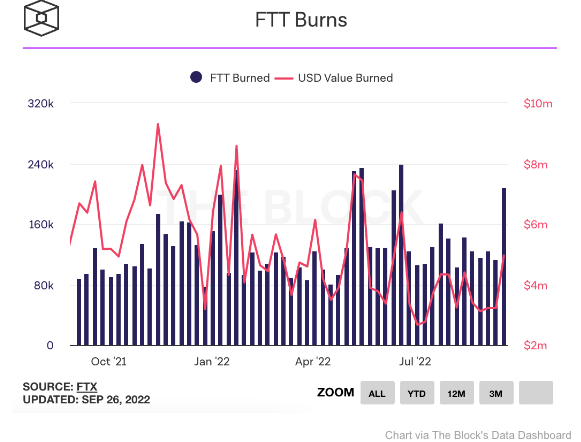

FTX burns over 200k FTT Tokens (~$5mm) After Increased ETH Merge Trading Activity

FTX US President, Brett Harrison, Stepping Down. Plans to Remain in Crypto.

Crypto Markets:

Decentral Park Captial’s Top 100 (7d %):

XRP (+31.4%) - speculation around SEC <> Ripple lawsuit resolve

Compound (+29.7%) - Compound III release

Tokenize Xchange (+27.1%) - new release

Algorand (+25.9%) - release of ‘State Proofs’ for decentralization push

IOTA (+19.3%) - partnership with Germany infrastructure project

Decentral Park Captial’s DeFi Top 100 MCAPs (7d %):

Reserve Rights (+50.3%)

TracerDAO (+49.7%)

Compound (+29.7%)

Ampleforth (+23.3%)

Injective (+21.8%)

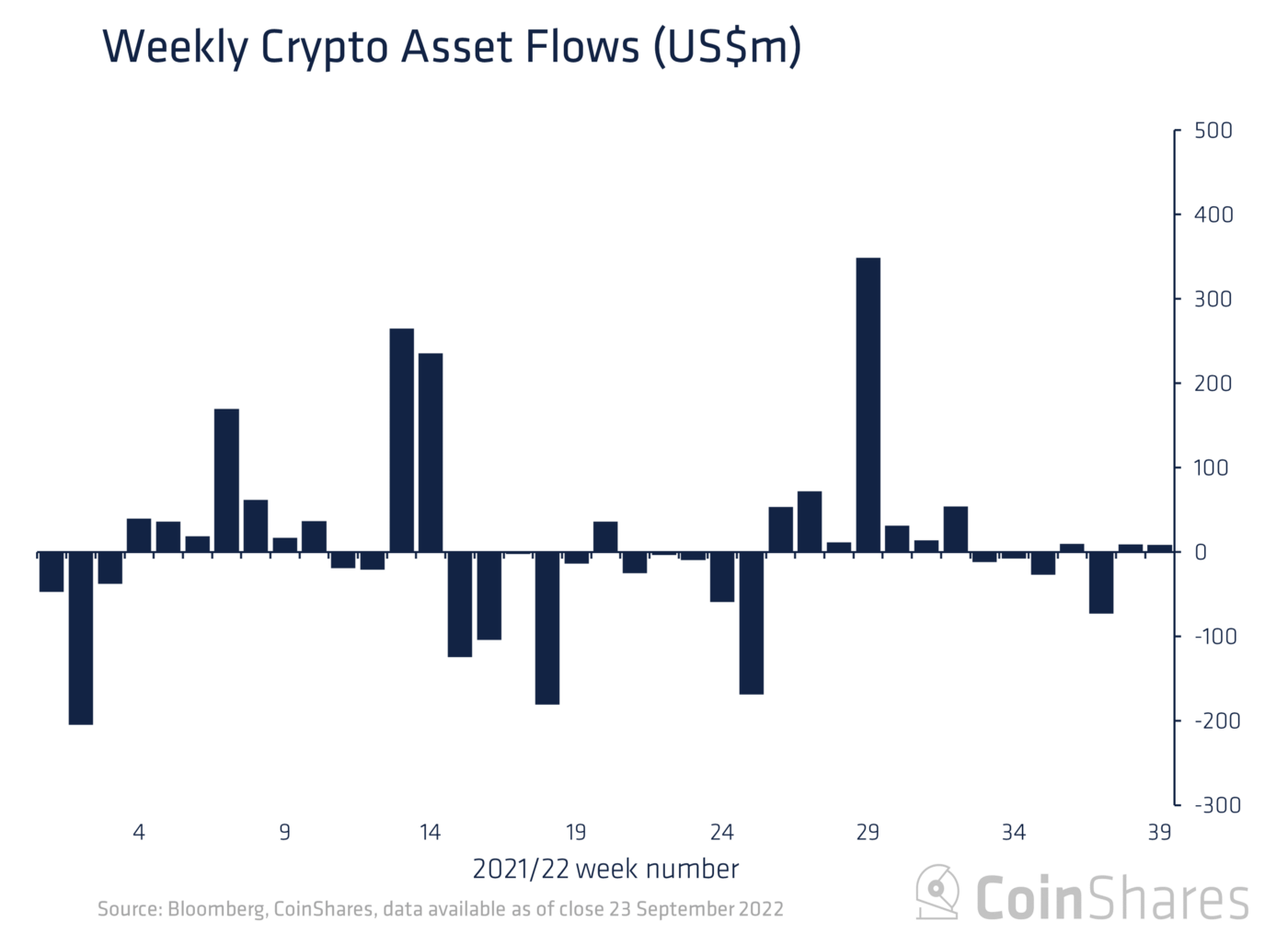

Blockworks’ Byron Gilliam: Q: Can crypto rally if rates are going to 4.5%?

Nasdaq was up nearly 600% in the second half of the 1990s. In 1995, Fed funds was 6%. In 2000, it was still 6%.

In the short run, tech stocks are interest-rate sensitive because higher discount rates mean lower valuations. Over time, though, tech is still a growth industry, and stock prices follow earnings and revenue growth.

If crypto is also a growth industry, we shouldn’t much care whether the discount rate is 1% or 5% — starting valuations should be lower, but gud tokens should still go up.

It doesn’t feel that way at the moment: Crypto natives talk about macro as if it’s affecting more than just prices and valuations — they make it sound like crypto itself cannot grow if the Fed doesn’t allow it.

It’s a little dog-ate-my-homework, in my opinion.

But maybe they’re right: Maybe price and utility are so intertwined in crypto that the industry cannot grow unless monetary policy is easy and getting easier.

Hopefully not, though. Crypto has a chance over the next year or so to show that it's a growth industry and not just a proxy for central-bank-driven liquidity.

Network activity remains in a dire condition as network adoption levels slump to levels last seen during the COVID crisis. However, one constructive observation would be the expulsion of retail participants from the network leaving just the HODLers class, career traders and everyday Bitcoin users remaining. This suggests the user-base is at its foundational level.

The HODLer class remain resolute with both mature coin USD wealth reaching ATHs, and a multitude of lifespan metrics fully resetting to historical lows, emphasizing the unwillingness to spend held coins. This suggests the majority of current market churn is associated with the Short-Term Holder class.

The Short-Term Holders find themselves at an equilibrium period where speculative market flows, and the STH cost basis are in-phase. With such a large concentration of supply in the current consolidation range, a risk remains of a levee break, should prices lose the June $17.5k lows.

DApps:

The Generalist: Aave: The Crypto Conglomerate

DeFi’s leading lender. Aave is the de-facto leader in decentralized lending. Its fully-diluted market cap is north of $1 billion. Aave has $5.6 billion in total value locked (TVL) and is on track to produce $147.6 million in annualized revenue.

Powered by community. One of Aave’s most noteworthy traits is its robust community. Founder Stani Kulechov has prioritized this since the beginning, investing considerable time in fostering grassroots support. This base has helped Aave distinguish itself from its rivals.

A relentless innovator. Since its founding in 2017, it has continually added new assets, ecosystems, and product lines. The result is a comprehensive financial platform with unparalleled range and flexibility.

Balancing expansion with focus. This year, Aave has announced two significant new initiatives in the social media and stablecoin spaces.

A Thread on Institutional Lending on DeFi using: Maple, Clearpool, Goldfinch, Atlendis, TrueFi, Teller, Zest

Crypto-Mixing Service Tornado Cash Code Is Back on GitHub: Code repositories for the Ethereum-based mixer Tornado Cash were relisted on GitHub on Thursday. The move by GitHub comes as Ethereum developers have called for platforms that host the mixer service to not ban Tornado Cash code. -CoinDesk

Deals/Raises:

FTX is in talks to raise $1 billion with investors at its January valuation of $32 billion, according to CNBC. -The Information

Deribit raises funds from existing investors at $400 million valuation: Sources. Deribit, the largest bitcoin options exchange by market share, has raised funds from existing investors at a $400 million valuation, four sources with knowledge of the matter told The Block. The Panama-based exchange raised around $40 million in the deal, said two of the four sources. Its existing shareholders include QCP Capital, Akuna Capital and Dan Tapiero's 10T Holdings. -Messari

Crypto Analytics Firm Messari Raises $35M in Funding Round Led by Brevan Howard Digital

The round reportedly values the firm at $300 million. Messari, which just hosted its annual Mainnet conference in New York this past week, will use the capital to hire more people and develop two new products – Protocol Metrics and Data Apps. -The Scenius Sync

Pantera Capital Reportedly Eyeing New $1.25B Blockchain Fund. Pantera Capital is reportedly seeking to launch a second blockchain fund, despite the ongoing bear market that has sent crypto prices spiraling in recent months. An institutional asset manager focused on the blockchain industry, Pantera currently offers five funds: venture, bitcoin, early-stage token, liquid-token and blockchain funds. Pantera’s blockchain fund, which launched in June 2021, is an actively managed offering that invests in a combination of venture equity, early-stage tokens and liquid tokens. -Messari

Hacks/Exploits:

CoinTelegraph: Reversible transactions could mitigate crypto theft — Researchers

The proposal puts forward an “opt-in” token standard that would enable victims to report theft to a governance contract, with algorithms helping to identify and freeze ill-gotten gains.

Under the proposed token standards, if someone has their funds stolen, they can submit a freeze request on the assets to a governance contract. This will then be followed up by a decentralized court of judges that need to quickly vote “within a day or two at most” to approve or reject the request.

Both sides of the transaction would also be able to provide evidence to the judges so that they have enough information, in theory, to come to a fair decision.

Layer 1s:

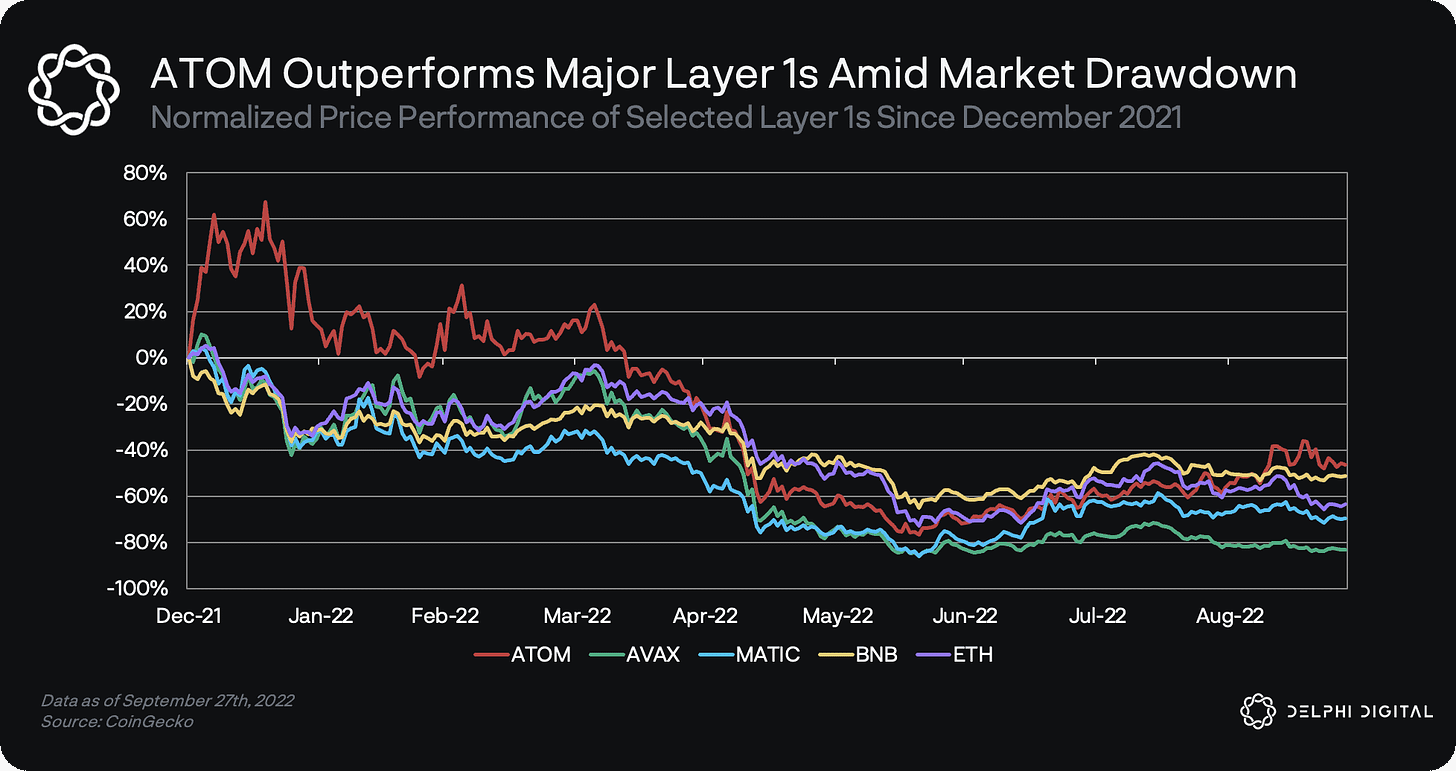

Non Cult Crypto News: Cosmos Hub Drops ATOM 2.0 Whitepaper to Bullish Fanfare

New Monetary Policy — 36mo Transition to Lower Inflation

The whitepaper proposes a new monetary policy for ATOM, in two steps. A 36-month-long transitional phase would first be introduced, at the beginning of which 10 million ATOM would be issued per month (briefly bumping up the inflation rate to 41.03%, if it were to launch today). The issuance rate would then steadily decrease until reaching emissions of 300,000 ATOM per month, effectively bringing ATOM’s inflation rate down to 0.1%.

Interchain Scheduler

The Cosmos Hub’s Interchain Scheduler intends to bring these negotiations on-chain and have the broader network benefit from them. A willing Cosmos blockchain could sell a portion of its block space to the Interchain Scheduler; the latter would subsequently issue NFTs representing block space “reservations.” These tokens would be auctioned off periodically and possibly even traded on secondary markets. The original blockchain would then receive a portion of the proceeds. According to the whitepaper, the Interchain Scheduler would complement (not replace) off-chain MEV relays, fostering competition and decentralizing the practice.

Interchain Allocator

The goal of the Interchain Allocator would be to streamline economic coordination across the Cosmos network. By establishing multilateral agreements between IBC blockchains and entities, the Allocator is expected to accelerate user and liquidity acquisition for Cosmos projects while securing ATOM’s position as the network’s reserve currency. Protocols may use the Allocator for mutual stakeholding, expanding ATOM’s liquid staking markets, rebalancing reserves, or participating in another blockchain’s governance. It would also open the possibility of creating Liquidity-as-a-Service providers, secure under-collateralized financing practices, and reduce the occurrence of insolvency due to extreme market events.

Governance Stack

The whitepaper advocated for creating a governance superstructure for the entire Cosmos network, called the Governance Stack. Not unlike the Allocator, the Governance Stack’s mission would be to streamline Cosmos-wide governance by giving each blockchain a shared infrastructure and vocabulary.

This would possibly entail the creation of a Cosmos Hub Assembly, which would work in tandem with Councils made of DAOs from the IBC network. The Assembly itself would be composed of representatives from each of these Councils, with their number of seats representing the project’s weight in the ecosystem—a system already adopted by political structures such as the United States Congress.

More Insights:

Helium Ditched Own Blockchain in Favor of Solana After Community Vote: Helium community members have voted to move the decentralized WiFi network from its blockchain, officially known as HIP 70, to the Solana blockchain. The move will transfer all tokens, applications and governance to the network, aiming to help scale the protocol through more efficient transactions as well as interoperability. -CoinDesk

Layer 2s:

Regulation:

Great Thread on the Importance of Digital Commodities Consumer Protection Act of 2022

CoinMarketCap: U.K. 'making it easier' to seize crypto 🇬🇧

The United Kingdom has a new law that will make it "easier and quicker" for law enforcement agencies to seize, freeze and recover cryptocurrencies. Announcing the measures, the Home Office warned that digital currency is "increasingly used by organized criminals to launder profits from fraud, drugs and cybercrime." Politicians point to figures from the Metropolitan Police, which has reported a big rise in crypto seizures over the past year. It's hoped that strengthening powers in the Proceeds of Crime Act will ensure law enforcement "can keep pace with rapid technological change and prevent assets from funding further criminality."

The Block: California Governor Newsom Vetoes Crypto Bill

The governor said the bill would have cost California “tens of millions” of dollars and the state would wait for federal policymakers to reach their own conclusions on crypto

Web3/NFTs:

VeradiVerdict: Global Entry for Web3 — Intro to Parallel Identity Tokens (PID)

Parallel Markets is launching the first-ever regulatorily compliant KYC/AML solution for web3: the Parallel Identity Token (PID). Maintaining the principles of decentralized anonymity, the PID token is a non-transferrable identity token that lives completely on-chain. It does not store or display any Personal Identifying Information (PII), but does supply necessary details to reassure market participants that their counterparties are not subject to sanctions or pose a risk of fraud…

PID token translates the necessary KYC/AML regulatory compliance and accreditation checks to allow users to interact with other compliant smart contracts. All participating parties must hold a valid PID Token, in the form of a soulbound NFT, to ensure proper accountability for interacting with honest parties. Protocol interactors can utilize their token to verify that the owner is a natural person or business entity and has submitted all information necessary for the KYC/AML review. Tokens may also indicate whether or not the owner is not currently sanctioned or if their address is currently being monitored and even asset 506(c) investor accreditation status. By incorporating the PID solution, protocols can be confident that no value is flowing to or from sanctioned parties without collecting any PII.

Emerging Technology & Venture Capital

The Generalist: Sturgeon Capital: Venture at the Frontier

**Beginner**

Mario’s deep dive into Sturgeon Capital highlights the firm’s focus on underpenetrated markets (Central Asia, Egypt, Pakistan), suite of financial backing (seed to PE) to better serve their portfolio companies, and positively impacting the regions they invest in. Below are a few highlights.

While many factors influence the fund’s focus, three are worth highlighting:

Size of population

Extent of digital opportunity

Levels of capital availability

Often, cross-border collaborations occur within Sturgeon’s portfolio. “The advantage we have is that by investing in multiple markets, we see similar companies at different stages, in different environments,” Head of Impact Robin Butler noted. “We can share those lessons across the portfolio and create partnerships.”

Companies:

Klarna is planning a second round of layoffs, four months after it cut 10% of its global workforce. In a live video message sent to employees on Monday afternoon, and reported by Swedish news site SvD, the company’s chief operating officer, Camilla Giesecke, announced that the organization needed to make further cuts to some of its departments “to reflect the more focused nature of today’s Klarna”. The message was sent to around 500 Klarna employees, across three departments including IT and recruiting, according to SvD. Klarna’s revised budget now has capacity for 6,000 employees, sources told the publication. Klarna confirmed the new round of job cuts to Sifted and said fewer than 100 employees would be affected globally. (TechCrunch) -LionTree

Macro & Markets

LionTree: Stock Market Check

The Macro Compass: Trust Me: It Will Be Enough & Related Thread on the Fed

**Intermediate**

Good overview of recent Fed minutes. Main takeaway: Tighter for longer — with a majority of Fed officials expecting >4.5% by 12/2023.

Companies:

Aerospace

Airbus won a $4.8 billion jet deal... The European firm will supply 40 jets to China Southern-owned Xiamen Airlines, beating out Boeing, which has historically been its supplier... while Boeing agreed to pay a $200 million settlement. The SEC had accused Boeing of making misleading statements about its 737 MAX model in the wake of two crashes of these jets. -Quartz

Consumer Staples

Seeking Alpha: A defensive consumer — Staples rally post-Fed

Nearly every sector suffered a downturn following the Fed meeting, but whatever strength there was left appeared in defensive consumer staple industry. In fact, twelve out of the top twenty gainers in the S&P 500 were part of the sector, including names like Kellogg (K), Campbell Soup (CPB), Kraft Heinz (KHC), Hormel Foods (HRL), Conagra Brands (CAG) and J.M. Smucker (SJM). The stocks tend to do better than the broader market during recessions or periods of high volatility.

Finance:

Wall Street banks paid a $1.8 billion fine over improper WhatsApp use. Regulators cracked down on bankers using private chats to discuss deals and trades. -Quartz

Banks are preparing for sanctions on China. Wall Street giants like JPMorgan Chase and UBS are reviewing contingency plans to manage their financial exposure to China, in case the US imposes sanctions over Taiwan. -Quartz

Gaming

EA and Marvel to create AAA Iron Man game. The initial discussion between the two Cos happened between Marvel’s Jay Ong as well as EA’s Patrick Klaus and Samantha Ryan. Leading the Iron Man team is executive producer Olivier Proulx. Proulx joined Motive straight from Eidos Montreal, where he had finished up working on another AAA Marvel game: Guardians of the Galaxy. From the creative side, it became clear EA Motive and Marvel matched in terms of values. (GamesIndustry.biz) -LionTree

Healthcare

Biogen agreed to a $900 million lawsuit settlement. The pharma giant was accused of paying physicians to prescribe its drugs over its rivals. Meanwhile, drugmaker Eli Lilly was sued for age discrimination in the hiring of sales representatives. -Quartz

Logistics

FedEx said it plans to raise shipping prices by an average of 6.9% across most of its services starting in January as the delivery Co deals with a global slowdown in business. The rate increase is higher than previous years and comes just days after the company lowered its profit and sales forecasts. (Investor's Business Daily) -LionTree

Media & Telecom

Verizon hopes to cover around 175mn people w/ its midband 5G network by the end of this yr, while AT&T hopes to cover around 100mn people w/ its own midband network. Both are working to catch up to T-Mobile, which expects to cover around 260mn people with its own midband 5G network by the end of 2022. Such networks promise to dramatically increase speeds for most US customers. -LionTree

Major League Baseball (MLB), the National Basketball Association (NBA), and the National Hockey League (NHL) are interested in acquiring US media company Sinclair’s regional sports networks (RSN), according to the New York Post. The report says that amid concerns about the viability of the business, the three major North American sports properties are expected to open talks with Sinclair’s Diamond Sports Group (DSG), which operates the 21 RSNs bought from Disney for $10.6bn back in 2019. (New York Post) -LionTree

Mobility

As part of its expanded selection, DoorDash announces new partnerships with Sprouts Farmers Market, EG America, Big Lots, Dick's Sporting Goods, and more / DoorDash -Movements

Harley-Davidson spun off its electric motorcycle unit in a $1.8 billion SPAC deal. LiveWire became the first publicly traded e-motorbike company in the US. -Quartz

Retail

Costco Wholesale topped fourth-quarter earnings estimates while reporting rev in line w/ expectations. With the bulk of Costco's profits coming from its membership model, the warehouse retailer seems better positioned than discount rivals to keep product costs down for consumers amid the current high inflation environment. (TechCrunch) -LionTree

A day after retail rival Walmart said it plans to hire 40,000 workers for the holiday season and beyond, Target annc'd its plans to hire 100,000 seasonal workers. Walmart last yr, however, hired 150,000 workers. The retailer said more than 30% of workers who start as seasonal employees and continue w/ the co after the holidays. (Winsight Grocery Business) -LionTree

Walmart will hire 110,000 fewer workers for this holiday season. Stores are better staffed this year, analysts said, but sales will also be hit by rising inflation and a difficult economy. -Quartz

Gap is cutting ~500 corporate jobs “amid declining sales and profits,” per WSJ, citing people familiar with the matter (link)

Job cuts across departments: The jobs are mainly at Gap’s main offices in San Francisco and New York, as well as in Asia -LionTree

Tech

Seeking Alpha: TNF [Thursday Night Football] — Amazon draws 13mm, in line with traditional TV

Amazon.com's (AMZN) initial exclusive Thursday Night Football broadcast - between the Los Angeles Chargers and Kansas City Chiefs - drew in 13M viewers last week, according to analytics firm Nielsen. While the data can be compared to several metrics (same week last year, similar matchups, season averages, etc.), the bottom line is that the online audience figures are roughly in line with those that compare to traditional TV. Amazon is the first streaming service to hold exclusive rights to an NFL game package, in a deal that will cost the tech giant about $1.2B per year through 2033.

Amazon announced 71 new renewable energy projects. The multinational e-commerce giant aims to run all operations on 100% renewable energy by 2025. -Quartz

Infinium and Amazon are partnering to test ultra-low carbon electrofuels for deliveries in 2023. The tests will be conducted in Southern California / Engadget -Movements

Hulu is the fourth most popular default source for TV viewing in America, Hub Says. Live traditional pay TV still ranks No. 1, w/ 28% of the 1,600 U.S. adult TV watchers polled by Hub in August reporting it as their default source. Netflix ranks second at 23%, but it has largely stagnated in that position. The digital video recorder still ranks third at 8%. Hulu ranks fourth at 6%, ahead of Amazon Prime Video, Disney Plus, and HBO Max. -LionTree

“Quiet layoffs” at Meta and Google (link/link)

Meta is reportedly planning to cut expenses by at least 10% in the coming months, in part through staff reductions, according to people familiar with the Co’s plans

The reductions are expected to be a prelude to deeper cuts, according to people informed of the company’s plans

In a similar move, Google alerts 50 employees to find new roles: Roughly half of the 100-plus staff at its Area 120 startup incubator were given 90 days to find other jobs within Google -LionTree

Twilio is laying off ~11% of its workforce as part of a major restructuring plan, according to an SEC filing published September 21st (link/link/link) -LionTree

TikTok is blocking politicians and political parties from fund-raising on its platform less than two months before the midterm elections. In a blog post, TikTok said it would prohibit solicitations for money by political campaigns. The Co said political accounts would immediately lose access to advertising features and monetization services, such as gift giving, tipping and e-commerce capabilities. (Fortune) -LionTree

International:

Central banks around the world raised interest rates. Following the Fed’s most recent hike, countries including the UK, Norway, Indonesia, and South Africa also bumped rates. Bucking the trend, Turkey cut rates and Japan kept them super low. -Quartz

Seeking Alpha: Yen intervention — BOJ to prop up Yen

Japan has intervened in the foreign exchange market for the first time since the late '90s, in an attempt to shore up the battered yen after it breached the key ¥145 level. The currency buying bumped the rate back to ¥140 per dollar, though many caution that the move will only provide a temporary reprieve and may be unsuccessful in the long term. Japanese Finance Minister Shunichi Suzuki also didn't disclose how much the government had spent buying the yen and whether other countries had consented to the intervention.

The EU is planning new sanctions on Russia. Ministers will finalize a sanctions package during their mid-October meeting. Ukraine also called for the UN to strip Russia of its veto rights in the Security Council. -Quartz

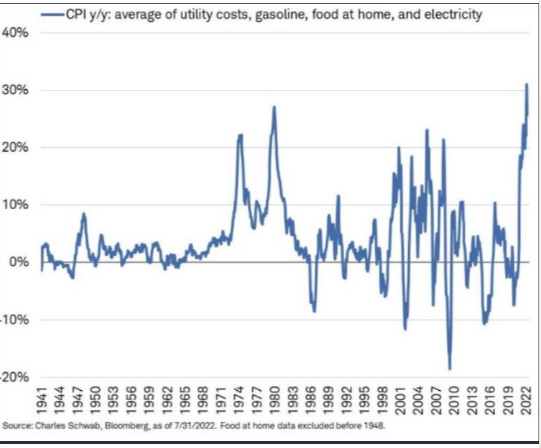

Macro/Markets:

The "recent move in the US dollar creates an untenable situation for risk assets that historically has ended in a financial or economic crisis, or both," equity strategist Mike Wilson said. "While hard to predict such 'events,' the conditions are in place for one, which would help accelerate the end to this bear market."

"In the meantime, we remain convicted in our eventual low for the S&P 500 (SP500) (SPY) coming later this year/early next between 3000-3400 (in line with our base and bear case tactical views, respectively)," Wilson said.

"On a year over year basis, the DXY is now up 21% and still rising," he added. "Based on our analysis that every 1% change in the DXY has around a -0.5% impact on S&P 500 earnings, 4Q S&P 500 earnings will face an approximate 10% headwind to growth all else equal."

"What's amazing is that this dollar strength is happening even as other major central banks are also tightening monetary policy at a historically hawkish pace," Wilson said. "If there was ever a time to be on the lookout for something to break, this would be it. Like our rates team, our currency team raised its forecast for the USD. On a DXY basis, they are now forecasting a year-end target of 118, which means no relief in sight, at least fundamentally speaking."Capitulation coming? "US rates are rising as the market reprices peak Fed Funds higher, and equities are being repriced lower," Societe Generale macro strategist Kit Juckes said. "This has all the hallmarks of the start of the final stage of the dollar’s rally (a stage which has the capacity to be violent and volatile)."

Sterling dropped to its lowest level against the U.S. dollar in history Monday before bouncing back off the lows of the session. The pound (FXB) fell to $1.0350, sliding below $1.04 for the first time ever, before buyers moved in. The cable cross rate is now around $1.07, still -1.3%. The pound is continuing its selloff from Friday after new Chancellor of the Exchequer Kwasi Kwarteng unveiled a budget of tax cuts and spending that worried traders.

The U.K. 2-year gilt yield is soaring 55 basis points to 4.47%. The 10-year yield topped 4% for the first time since 2010.Seeking Alpha: Another losing week [for markets post FOMC]

Echoes from the hawkish FOMC meeting are still reverberating through markets, after doubling down on a "whatever it takes" policy stance to get inflation under control…

Resetting expectations: "The forward paths of inflation, economic growth, interest rates, earnings, and valuations are all in flux more than usual with a wider distribution of potential outcomes," wrote Goldman Sachs strategist David Kostin. On that note, the bank slashed its year-end target for the S&P 500 to 3,600 from 4,300, and said the benchmark could even fall to as low as 3,150 in the event of a serious recession.The American housing market is paralyzed. Prices are beginning to fall, but prospective homebuyers have to contend with the US Federal Reserve’s aggressive rate hikes, which have driven mortgage rates to their highest level since 2008. -Quartz

The stock market downturn since the start of the year has caused the longest drought in US technology listings this century. The end of this week will mark 240 days without a tech IPO worth more than $50mn, surpassing the previous records set in the aftermath of the 2008 financial crisis and the early 2000s dotcom crash. (Wealth-X) -LionTree

Seeking Alpha: Strategic reserves — more SPR to be released in November

Crude sales from the U.S. Strategic Petroleum Reserve were only supposed to last through October, after the Biden administration authorized the release of 180M barrels - or 1M bpd over a six-month period - due to inflationary shocks from the war in Ukraine. Now, another 10M barrels of strategic stocks will be put on the market for delivery in November, adding to the recent bout of emergency sales to tame fuel prices. According to AAA, U.S. gasoline pump prices were averaging about $3.67 per gallon on Tuesday, down from a record of over $5.00 seen back in June, though the drop has been accompanied by recession fears, an aggressive Fed and heavy bearish sentiment.

Regulation:

Federal court upholds law banning tech companies from censoring viewpoints. For the past yr, Texas has been fighting in court to uphold a controversial law that would ban tech Cos from content moderation based on viewpoints. Now, the 5th Circuit Court of Appeals has overturned a lower Texas court's decision to block the law, ruling instead that the law be upheld. As a result, the ruling will likely lead to a Supreme Court showdown over the future of online speech. (Ars Technica) -LionTree

Amazon’s proposed acquisition of iRobot has drawn the attention of the US Federal Trade Commission (FTC), which has reportedly asked the two Cos for more information about the deal. iRobot said in a Sept. 20 filing with the Securities and Exchange Commission (SEC) that the FTC had requested more details on Sept. 19. About 20 organizations have urged regulators to halt the deal, saying they are concerned about privacy and about Amazon boosting its strength in the market for smart home devices, Reuters reported. (Ars Technica) -LionTree

Florida is calling on the highest US court to settle the dispute over social media speech regulation. The state's attorney general has petitioned the Supreme Court to determine whether or not states are violating First Amendment free speech rights by requiring that social media platforms host speech they would otherwise block, and whether they can require explanations when platforms remove posts. In making its case, Florida argued that the court needed to address contradictory rulings. (Engadget) -LionTree

An independent analysis found that President Biden’s student-debt relief plan could cost about $400 billion, or roughly 2 percent of the country’s annual economic output. -NY Times

The Fed:

Seeking Alpha: No blinking — Fed about as hawkish as can be

Things couldn't have been more hawkish with the Fed's "dot plot" showing a benchmark interest rate of 4.4% by the end of this year, as well as a terminal rate of 4.6% in 2023 (up from 3.25% and 3.8%, respectively). Lower growth forecasts and higher inflation estimates were also included in the projections, with the unemployment rate going up to 4.4% and leading to job losses of more than 1M (assuming no change in the size of the U.S. workforce).

Transcript highlights: "We have got to get inflation behind us. I wish there were a painless way to do that. There isn't," Fed Chair Jerome Powell declared. "Reducing inflation is likely to require a sustained period of below-trend growth and there will very likely be some softening of labor market conditions. Restoring price stability is essential to set the stage for achieving maximum employment and stable prices over the longer run. We will keep at it until we're confident the job is done."

Stats, Themes & Trends:

The US lost $45.6 billion to covid unemployment fraud. A federal watchdog identified criminals filing for unemployment benefits in several states or using the Social Security numbers of dead or imprisoned people. -Quartz

Americans can’t get enough of Mexican beer. Eight out of 10 imported beers in the US come from its southern neighbor. -Quartz

China is on track to sell about six million electric vehicles this year, more than every other country combined. -NY Times

Cargo bikes are the future of delivery trucks in cities. Researchers have found that biking packages to recipients is not only greener than using a van but also faster / Wired -Movements

Approximately $160 million will be available every year for the next five years for projects that use technology to improve the nation's transportation infrastructure and make communities safer, according to the U.S. Department of Transportation (USDOT) / Intelligent Transport -Movements

The Biden administration's $7.5 billion electric vehicle charging network will be led by Gabe Klein, who led transportation departments in Washington, DC, and Chicago / CNN Business -Movements

More on the benefits of bidirectional charging (link). If you think about this a different way, even if you accounted only for Ford's planned F-150 Lightning production targets, there would be more bidirectional Ford decentralized power stations by the end of one year than all the gas stations in America. -Trucks FoT

Young people are driving a rise in mental health spending. While older people represent the lion's share of overall health care costs, people under 25 are propelling a slow and steady rise in mental health and addiction spending. EBRI's seven-yr survey of employer-sponsored health plans found that spending on mental health and addiction has been rising, from 6.8% of total costs in 2013 to 8.2% in 2020. (AXIOS) -LionTree

Some Fun

Asleep Thinking: Golf and the 4 Stages of Mankind

Fun & short read exploring how golf is our modern day substitue for a Neolithic hunting experience.

We can’t go back to Neolithic times, but we can create fake savannah pastures that give us a faux-hunting experience that even a fat middle-aged accountant can be good it.

Mass Damper of Taipei 101 Skyscraper During a Recent Earthquake

Trucks FoT Highlight: Rolex Sea-Dweller After a Motorcycle Crash

Surprising Insights:

Blimp cruises may soon take to the skies. But unless you can cough up $200,000, you’re stuck on the ground, buddy. -Quartz

People are opening unofficial Shein stores - actual real physical stores. LINK -Benedict Evans

NASA successfully crashed a spacecraft into an asteroid. The 14,000-mile-per-hour collision was a test of a technique to protect Earth. -NY Times

The music you listen to as a teen shapes your taste for life. Personality traits might also play a role in what you like to jam out to. -Quartz

Sponsorship

If any interest in sponsoring this newsletter, email me here.